Deed Of Gift Form For Property

Description

How to fill out Virginia Deed Of Gift - Husband And Wife Or Two Individuals To Indvidual?

Regardless of whether it is for professional reasons or personal issues, everyone must confront legal matters at some point in their lives. Completing legal documents necessitates meticulous attention, beginning with selecting the appropriate form sample.

For example, if you select an incorrect version of a Deed Of Gift Form For Property, it will be declined upon submission. Thus, it is essential to have a reliable source of legal documents such as US Legal Forms.

- Obtain the template you require by using the search bar or browsing the catalog.

- Review the form’s details to ensure it aligns with your situation, state, and locality.

- Click on the form’s preview to assess it.

- If it is not the correct document, return to the search tool to find the Deed Of Gift Form For Property sample you need.

- Acquire the file when it meets your requirements.

- If you possess a US Legal Forms account, simply click Log in to access previously saved templates in My documents.

- If you do not have an account yet, you may download the form by clicking Buy now.

- Select the suitable pricing option.

- Fill out the profile registration form.

- Choose your payment method: use a credit card or PayPal account.

- Select the file format you desire and download the Deed Of Gift Form For Property.

- Once it is saved, you can fill out the form using editing software or print it and complete it manually.

- With an extensive US Legal Forms catalog available, you do not need to waste time searching for the suitable template online. Use the library’s user-friendly navigation to find the correct form for any circumstance.

Form popularity

FAQ

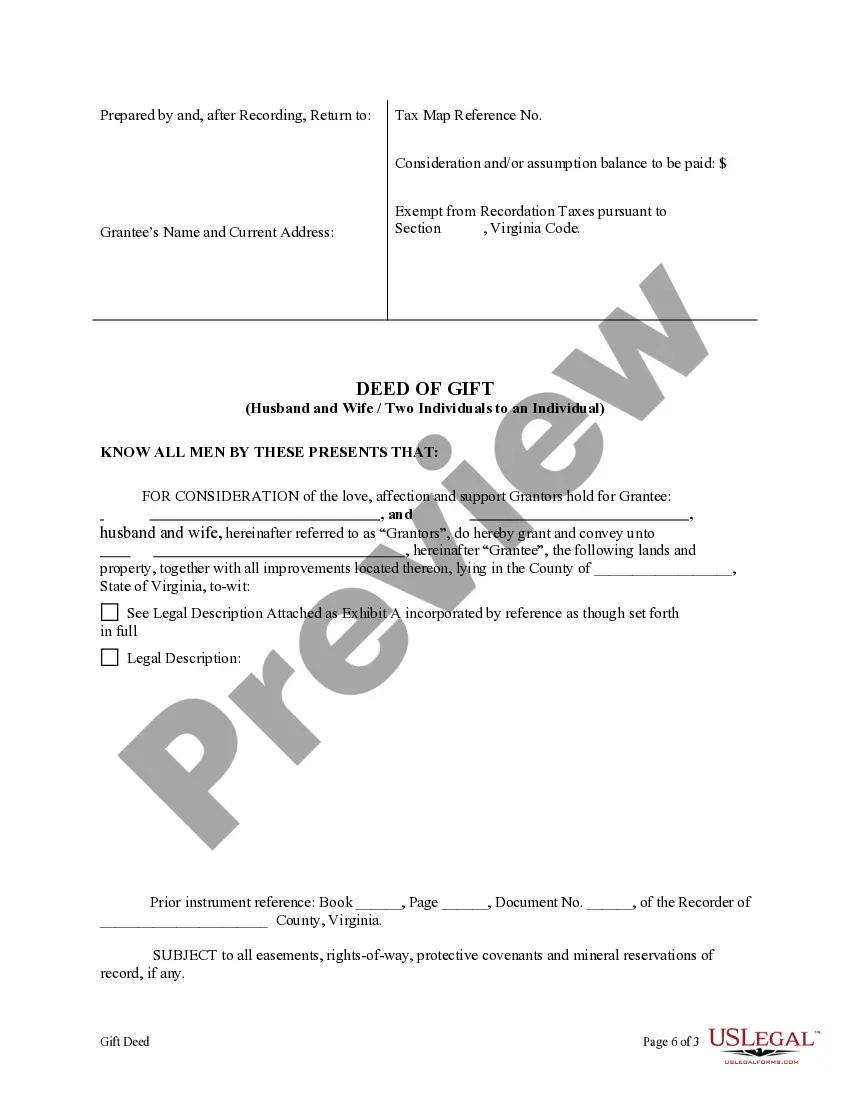

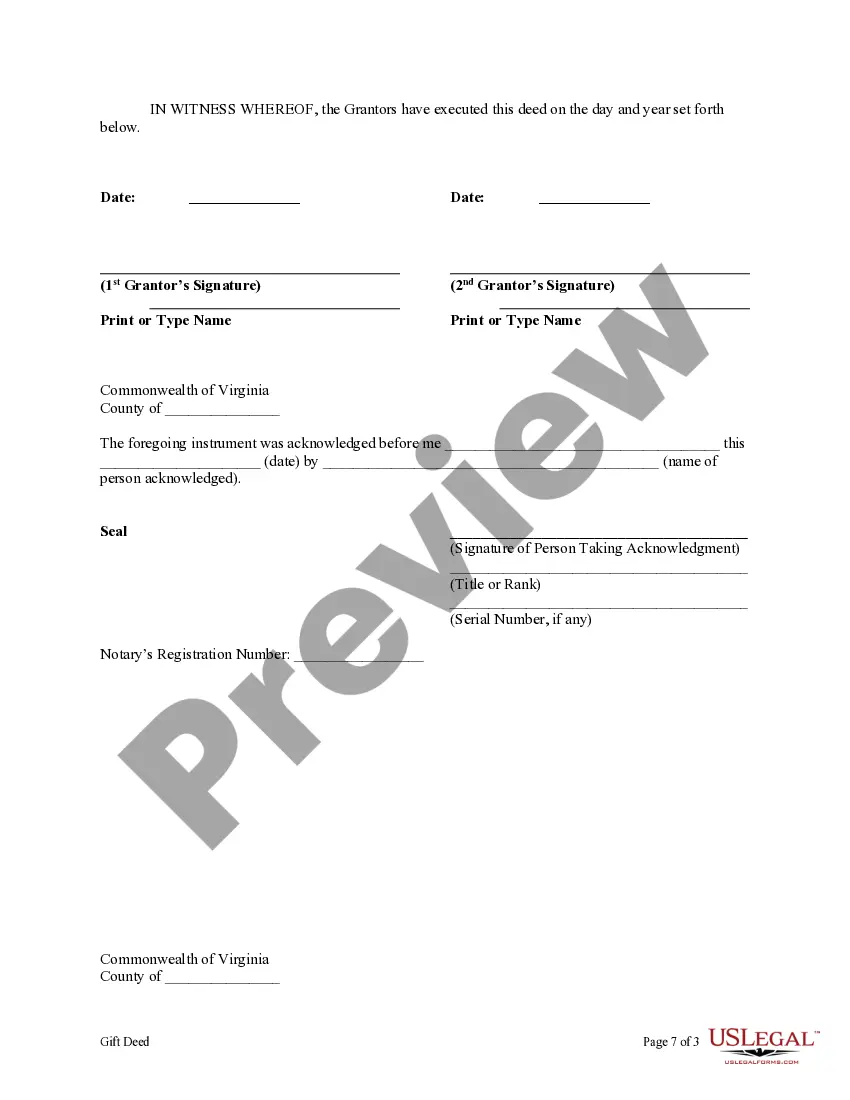

To complete a deed of gift, start by obtaining a deed of gift form for property that meets your state's requirements. Fill in the necessary information, including details about the property and the parties involved. Both the donor and recipient must sign the document in front of a notary public. Finally, record the deed with your local government office to finalize the transfer.

Common mistakes in gift deeds include not using a proper deed of gift form for property, failing to include essential details, and neglecting to record the deed. Lack of clarity about the donor's intent can also lead to disputes in the future. To avoid these issues, ensure that you follow all legal guidelines and consider using templates from US Legal Forms.

To qualify as a gift, three requirements must be met: there must be a clear intention to give, the gift must be delivered to the recipient, and the recipient must accept it. When using a deed of gift form for property, ensure that these elements are explicitly addressed to avoid complications. This clarity protects both parties and solidifies the transfer.

Using a deed of gift form for property is often the best method for transferring property between family members. This approach allows for a straightforward transfer without the complexities of a sale. It is essential to ensure that all legal requirements are met, including possible tax implications. Utilizing resources like US Legal Forms can help you navigate this process smoothly.

The process of creating a gift deed begins with drafting the deed using a deed of gift form for property. Next, both the donor and recipient must sign the document in front of a notary. After that, you should record the deed with the appropriate local authority to ensure legal recognition. This process helps formalize the gift and establishes clear ownership.

Yes, recording a deed of gift is generally recommended to protect the interests of both the giver and the recipient. By filing the deed with the local government office, you establish a public record of the property transfer. This can prevent future disputes and clarify ownership. Using a deed of gift form for property from a reliable source, like US Legal Forms, can streamline this process.

Gift Deed ? A gift deed is a special type of grant deed that ?gifts? ownership of real property interest to another person or entity. This deed is different from a standard grant deed because it specifically designates that the transfer was not subject to a sale, and the grantor received no monetary compensation.

These deeds need to be in writing and signed by the person giving the property in front of any notary. Once it has been properly prepared and signed, the deed needs to be filed with the county clerk for the county in which the property is located. The county will charge a filing fee of about $30 to $40.

A deed of gift must be signed by all parties, notarized by a Virginia notary, and witnessed by two or more parties who have no ownership interest in the property.

In Virginia, gifting a home involves transferring ownership of the property from the current owner (the parent) to their child or children as a gift. This transfer can be made during the parent's lifetime or after their death. Gifting a home can be done through a quitclaim deed or other legal instrument.