60 Day Move Out Notice Withholding Tax

Description

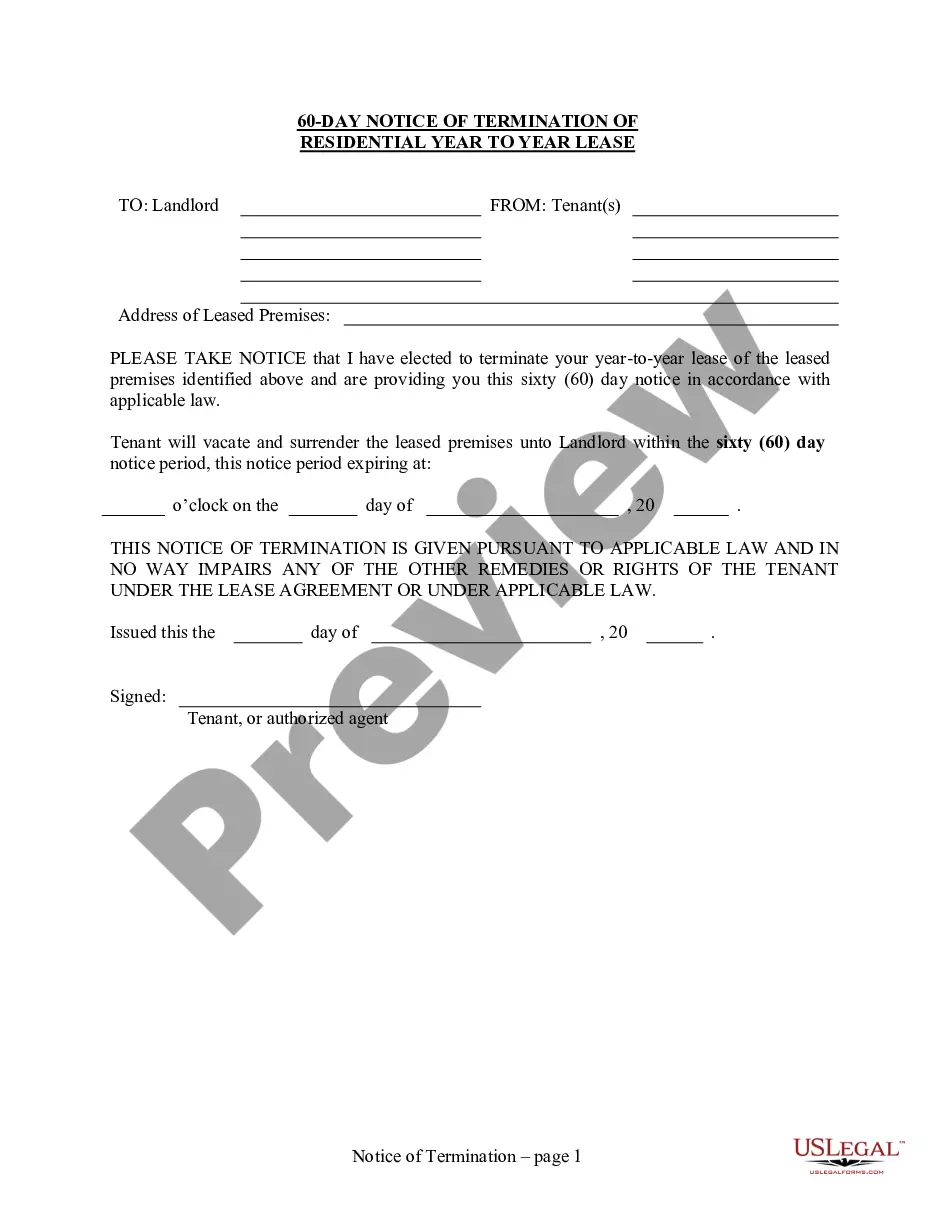

How to fill out Virginia 60 Day Notice To Terminate Year-to-Year Lease - Residential From Tenant To Landlord?

The 60 Day Move Out Notice Withholding Tax displayed on this page is a reusable official template crafted by expert attorneys in adherence with federal and state regulations.

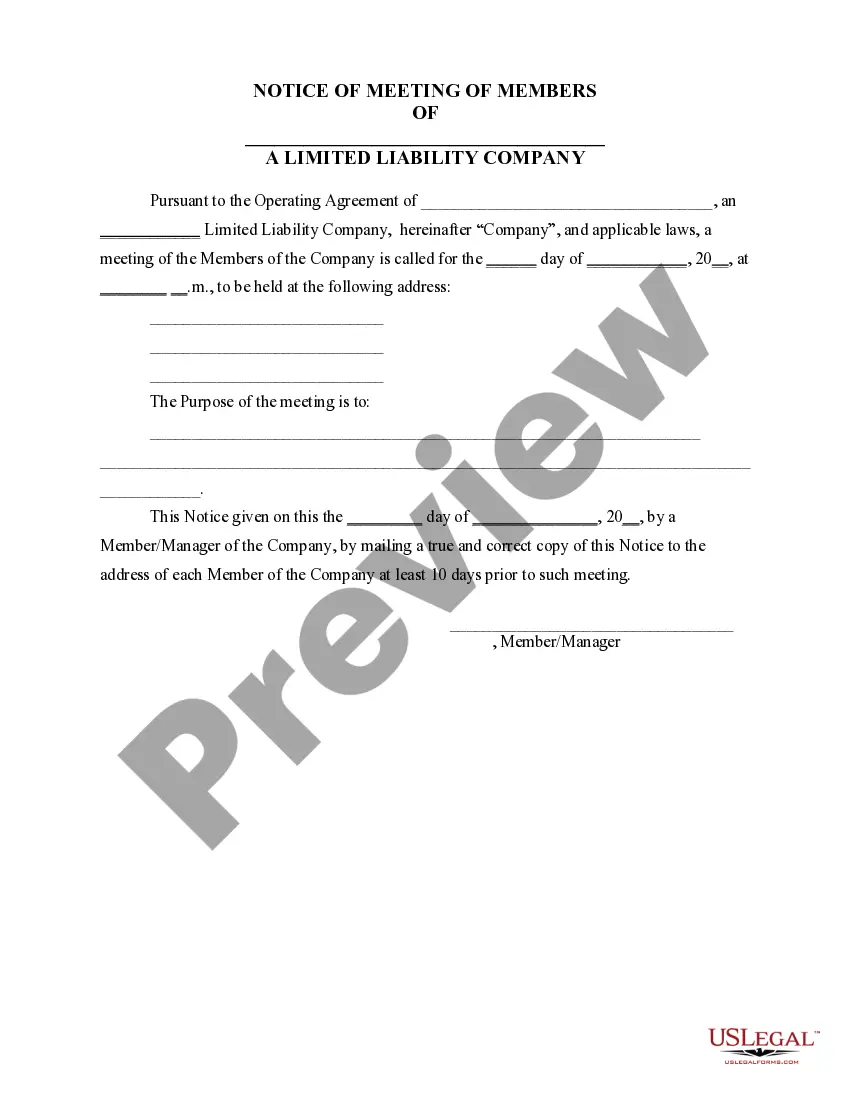

For over 25 years, US Legal Forms has offered individuals, entities, and legal practitioners more than 85,000 authentic, state-specific documents for any business and personal circumstance. It is the quickest, easiest, and most dependable method to acquire the forms you require, as the service ensures bank-level data security and anti-malware safeguards.

Re-download your document whenever necessary. Access the My documents section of your profile to retrieve any previously acquired forms.

- Examine the document you require and verify it.

- Look through the example you searched and preview it or review the form description to ensure it meets your requirements. If it doesn’t, utilize the search feature to locate the correct one. Click Buy Now after identifying the template you need.

- Register and Log In.

- Select the pricing package that works for you and create an account. Use PayPal or a credit card to complete payment promptly. If you already possess an account, Log In and review your subscription to continue.

- Acquire the editable template.

- Choose the format you prefer for your 60 Day Move Out Notice Withholding Tax (PDF, DOCX, RTF) and save the document to your device.

- Fill out and sign the document.

- Print the template to fill it out manually. Alternatively, employ an online versatile PDF editor to quickly and accurately complete and sign your form electronically.

Form popularity

FAQ

When filling out a tax withholding form for a new job, start by providing personal details like your name, address, and Social Security number. Next, use the W-4 form to declare the number of exemptions you wish to claim. Consider how your choices may influence the 60 day move out notice withholding tax, ensuring you align with your financial goals.

You may qualify for exemption from withholding if you had no tax liability last year and expect none this year. Additionally, certain income thresholds and types of income, such as certain Social Security benefits, can affect your exemption status. Understanding these qualifications can help you navigate the complexities of the 60 day move out notice withholding tax.

To change your tax withholding, you typically need to fill out a new W-4 form. This form allows you to adjust your exemptions or indicate any additional withholding you want. Make sure to submit it to your employer promptly to ensure they apply the changes to your paychecks, especially in relation to the 60 day move out notice withholding tax.

When asked if you are exempt from withholding, you should assess your tax situation first. If your income for the year is below the taxable threshold or if you meet other criteria, you may qualify for exemption. Otherwise, you should indicate that you are not exempt, as misrepresenting your status can lead to complications with the 60 day move out notice withholding tax.

Filing rental withholding tax involves reporting the income you earn from rental properties. You need to complete the appropriate tax forms, such as Schedule E, to detail your rental income and expenses. Additionally, ensure that you account for the 60 day move out notice withholding tax if applicable, as it may influence your tax obligations.

To fill out a withholding exemption, start by gathering your personal information, such as your Social Security number and filing status. Next, locate the appropriate form, usually the W-4 for employees. Follow the instructions carefully to ensure you accurately declare your exemptions, which can impact your 60 day move out notice withholding tax.

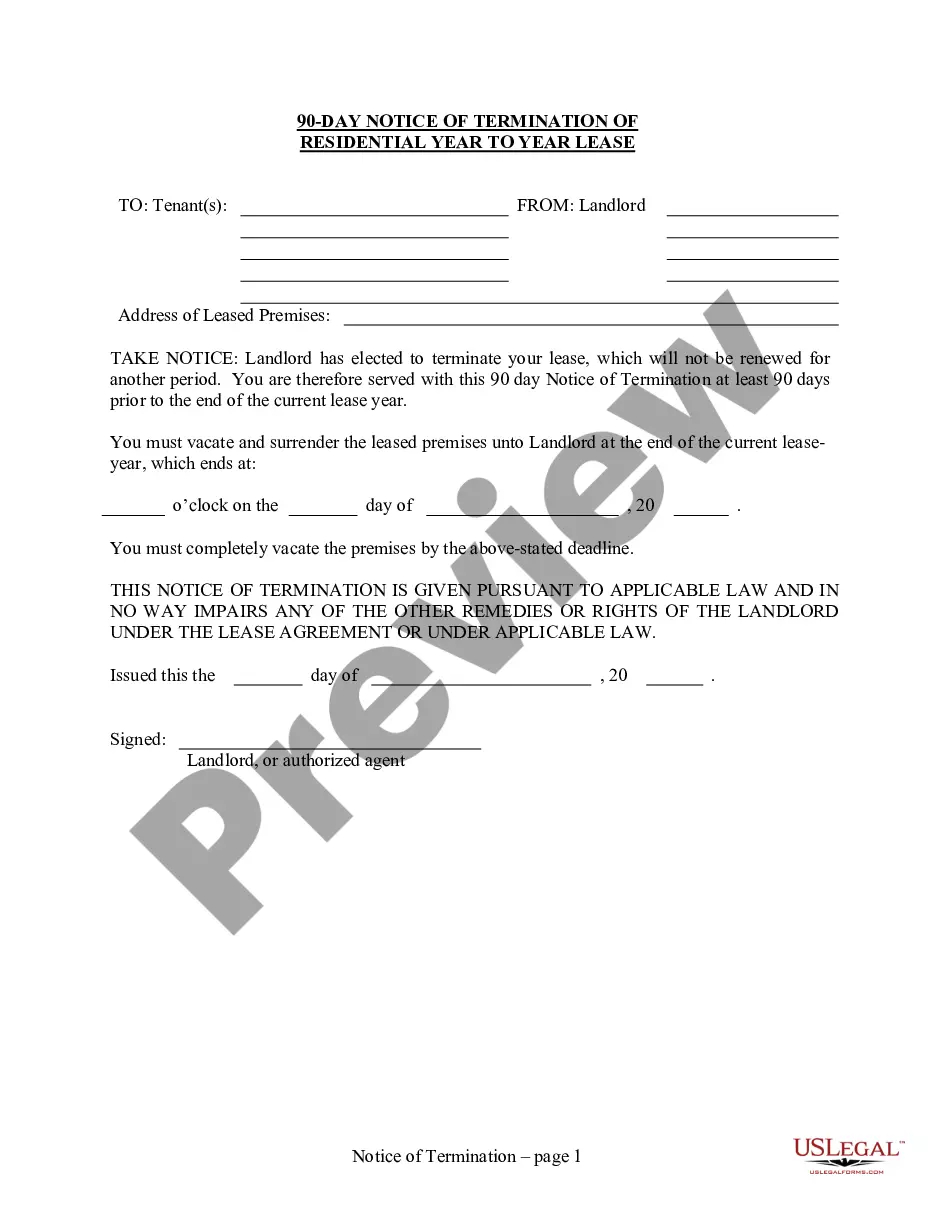

The 60-day notice rule requires tenants to inform their landlords at least 60 days before moving out. This rule helps landlords manage their rental properties effectively and find new tenants in a timely manner. Understanding this rule can save you from unexpected costs or complications, and utilizing services like uslegalforms can help you draft the appropriate notice.

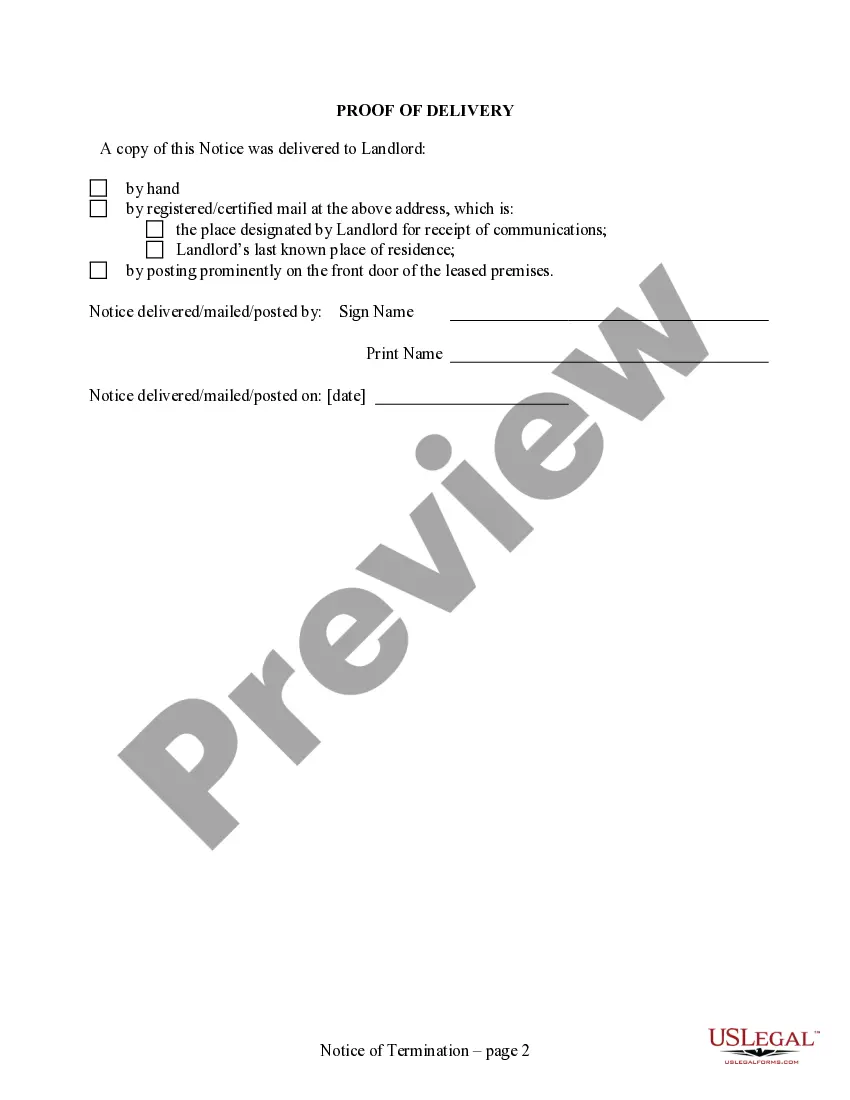

A 60-day notice serves as a formal communication that you intend to vacate the rental property. This notice typically must be delivered in writing and specifies the last day you plan to stay. Following the notice, your landlord will begin preparations for your move-out, including inspections and potential advertising for new tenants.

If a tenant does not give a 60-day notice, they may face penalties as outlined in their lease agreement. This could include losing part or all of their security deposit or being responsible for rent until a new tenant is found. It's important to familiarize yourself with the terms of your lease to understand the potential consequences of failing to provide adequate notice.

In Oklahoma, you can terminate your lease early, but it often depends on the lease terms and state laws. If you provide a proper 60-day move out notice, you can minimize potential penalties. However, you should check your lease agreement and consider discussing your plans with your landlord to find the best solution for both parties.