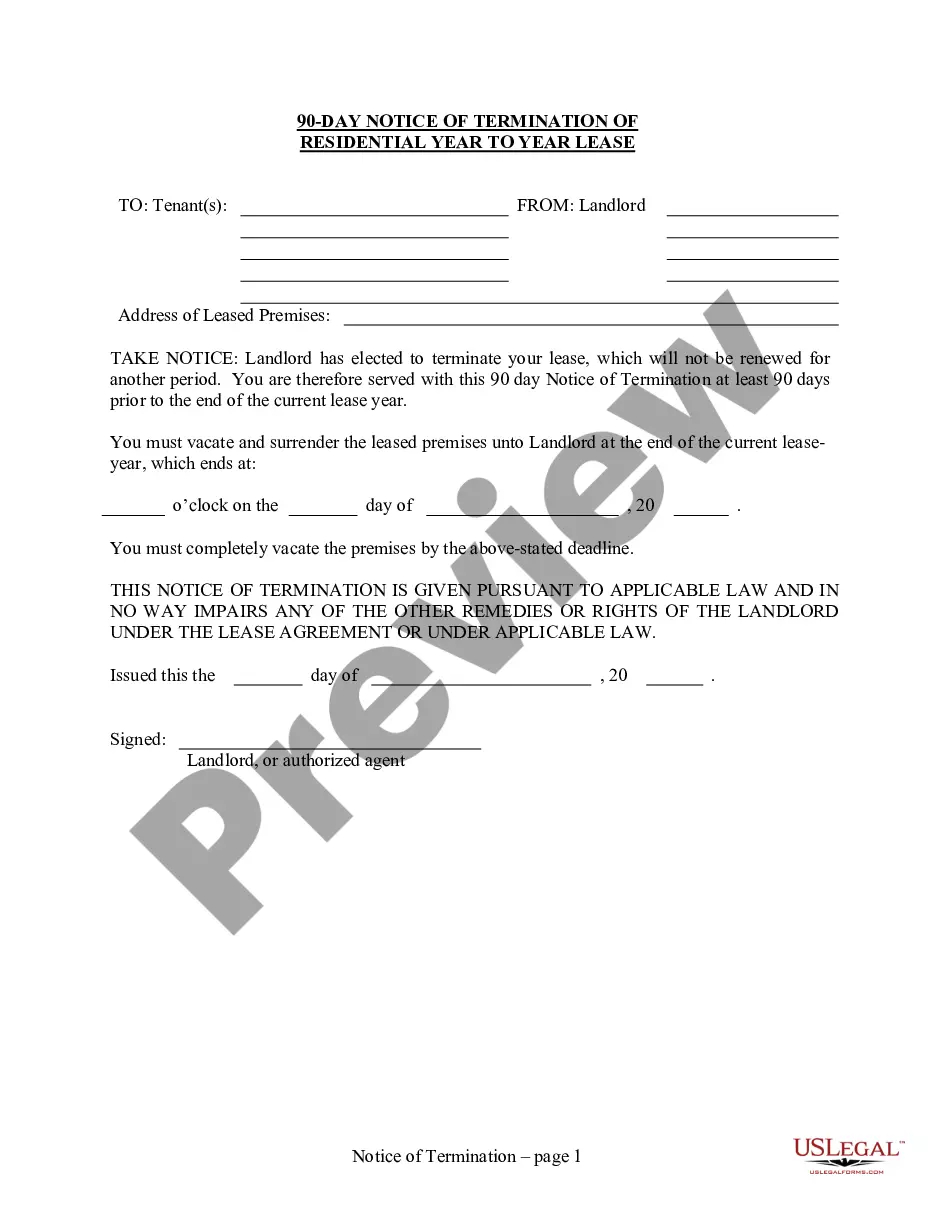

Notice 90 Day Period Form

Description

How to fill out Virginia Notice To Terminate Year To Year Lease - 90 Day Period To End Of Term - Residential?

Individuals commonly connect legal documentation with something intricate that solely an expert can handle.

In a certain sense, this is valid, as creating the Notice 90 Day Period Form requires significant knowledge of subject criteria, including regional and local statutes.

However, with US Legal Forms, the process has become more user-friendly: pre-prepared legal documents for various personal and business scenarios specific to state laws are compiled in a single online directory and are now accessible to everyone.

All templates in our catalog are reusable: once purchased, they remain stored in your profile. You can access them whenever required via the My documents section. Discover all the benefits of utilizing the US Legal Forms platform. Subscribe now!

- US Legal Forms provides over 85,000 current documents categorized by state and type of use, so searching for the Notice 90 Day Period Form or any specific example takes just a few minutes.

- Users who have previously registered and hold an active subscription must Log In to their account and click Download to retrieve the form.

- New users to the platform will first have to create an account and subscribe before they can save any files.

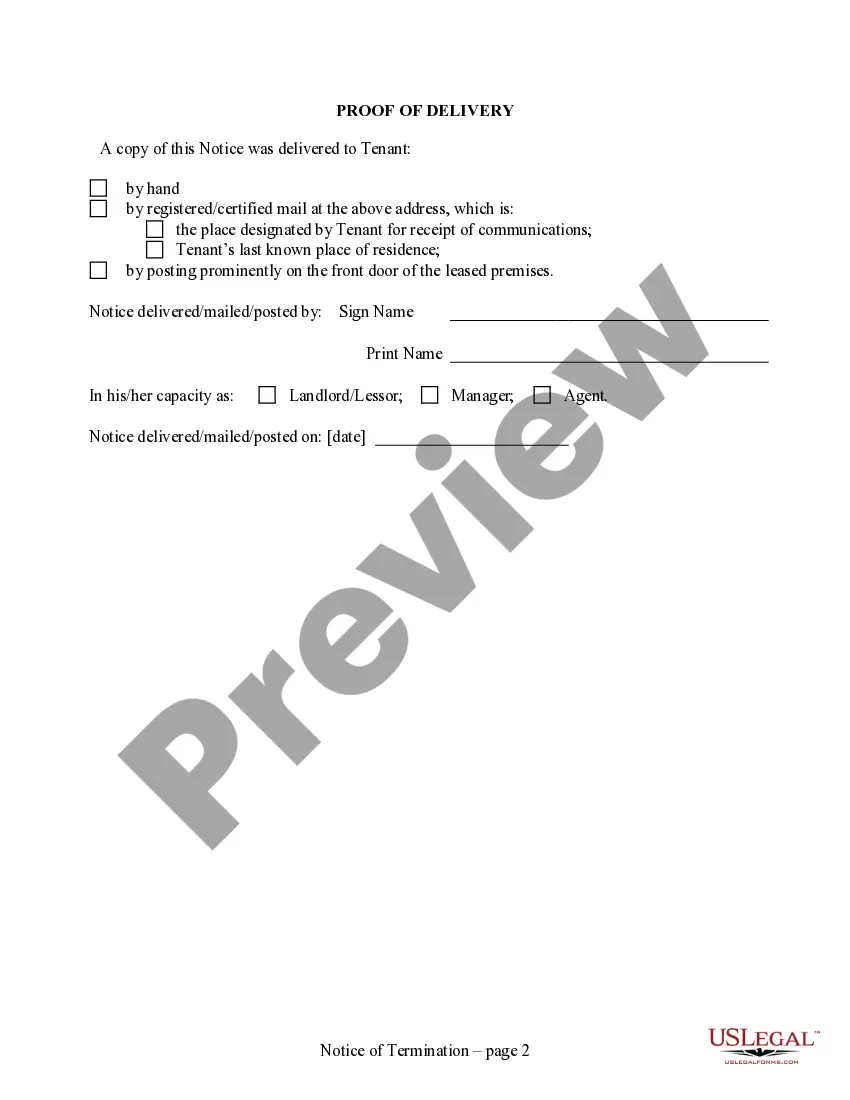

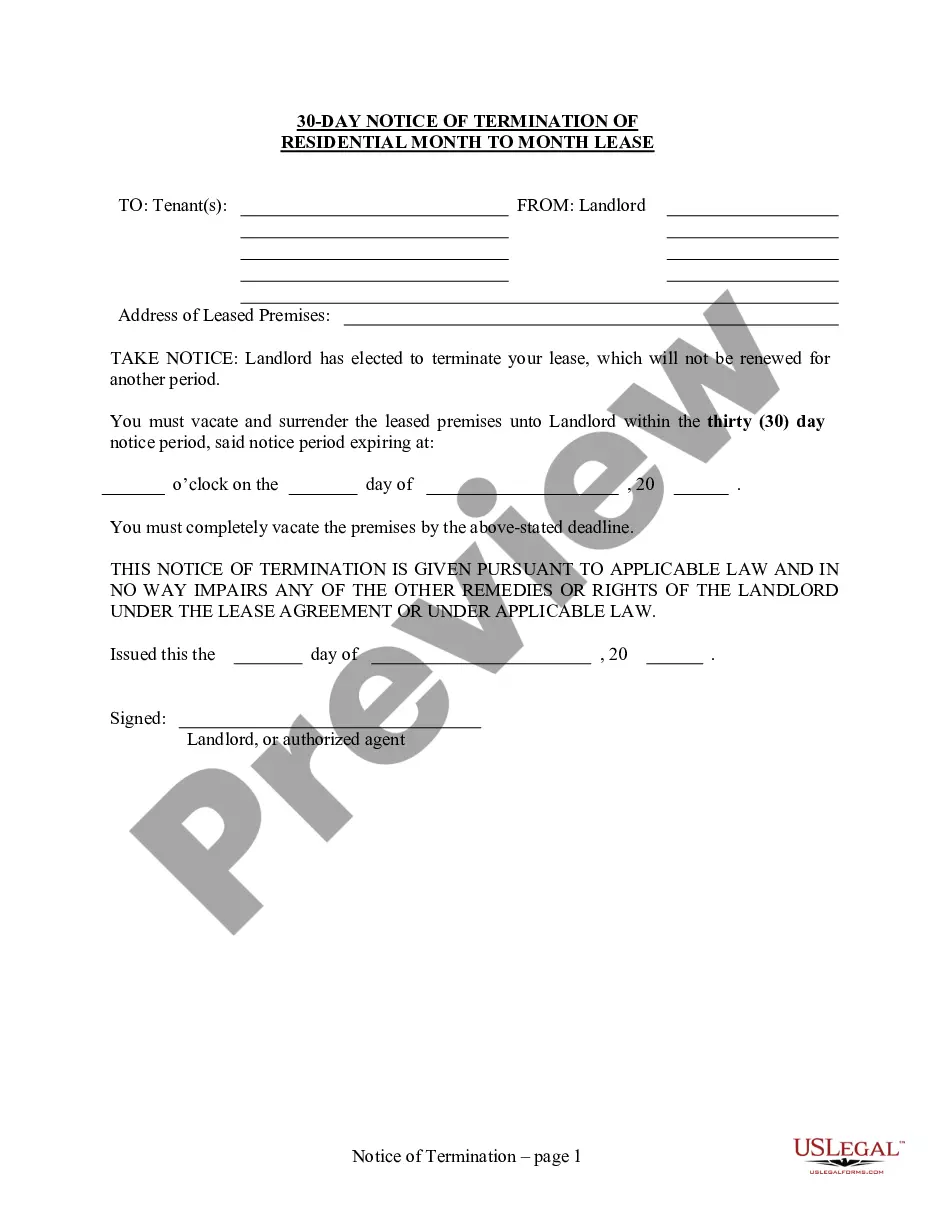

- Here’s the detailed guide on how to acquire the Notice 90 Day Period Form.

- Examine the page content thoroughly to ensure it meets your requirements.

- Review the form description or view it using the Preview feature.

- If the earlier option does not meet your needs, search for another template using the Search bar above.

- Click Buy Now when you locate the appropriate Notice 90 Day Period Form.

- Select a subscription plan that fits your needs and financial plan.

- Create an account or Log In to advance to the payment page.

- Complete your subscription payment using PayPal or a credit card.

- Choose the format for your document and click Download.

- Print your document or upload it to an online editor for quicker completion.

Form popularity

FAQ

The term '90 days notice' typically refers to the timeframe given by the IRS for taxpayers to respond to certain notices, such as a Notice of Deficiency or CP2000. This notice period is critical for making necessary adjustments or appealing IRS decisions. Understanding and adhering to this timeframe can save you from additional penalties or complications. Our Notice 90 day period form can assist you in preparing a comprehensive response during this critical period.

The notice CP3219A is the IRS's way of informing taxpayers about adjustments related to their income tax returns, typically after assessing discrepancies. This notice provides a timeline for appeal and outlines how to respond. It's important to act within the designated timeframe to protect your rights. Use our Notice 90 day period form to help structure your response and ensure compliance.

While a CP2000 notice can cause concern, it is essential to view it as an opportunity to clarify discrepancies. The best approach is to review the notice thoroughly and gather any necessary documents. By taking prompt and informed action, you can address any issues before they escalate. Our platform offers resources, including the Notice 90 day period form, to help you respond effectively.

The CP2501 notice is used by the IRS to notify taxpayers of potential additional tax due based on discrepancies in reported income. This notice serves as an initial alert, providing taxpayers a chance to review their information before formal proceedings begin. Addressing this notice quickly can help clear up any misunderstandings. Utilize our Notice 90 day period form to respond appropriately and ensure compliance.

Receiving a CP2000 notice does not automatically stop your tax refund; however, it may delay it. The IRS places specific holds on accounts if discrepancies aren't resolved in time. Taking prompt action and providing clear documentation can help prevent any further delays. Use our Notice 90 day period form for a structured response to avoid complications.

IRS notice 1462 is a communication sent to inform taxpayers that their tax return has been selected for review, often relating to earned income tax credit claims. This notice requests specific documents or information to verify your eligibility for certain credits. If you receive this notice, stay organized and act quickly. Our platform provides tools like the Notice 90 day period form, making it easier to compile the necessary information and respond.

The IRS 90-day letter, often referred to as the Notice of Deficiency, is a critical communication that provides taxpayers with 90 days to respond before the IRS assesses additional taxes. This notice usually follows a CP2000 notice if you fail to resolve the issues identified. Taking timely action on this notice is vital to avoid further complications. You can find guidance on how to respond using our Notice 90 day period form.

The CP2000, CP2501, and CP3219A notices are forms from the IRS that inform taxpayers of discrepancies or issues with their tax returns. These notices provide essential information about potential adjustments, underreported income, or missing documents. Understanding these forms is crucial for maintaining compliance with tax regulations. You can navigate these notices by using our Notice 90 day period form to respond effectively.

The 90-day review for the IRS involves the examination of any disputes or claims made by taxpayers after receiving notices. This allows you to present your case before the IRS makes a final decision. Understanding this review process is essential for effectively communicating your situation. Utilizing the Notice 90 day period form can significantly aid your review preparation.

Filling out form 9423 involves providing personal information, a detailed explanation of your circumstances, and attaching necessary documentation. Include any relevant details regarding the Notice 90 day period form, as it can strengthen your case. Once you've completed the form, review it carefully to ensure all information is accurate. Finally, submit it to the IRS, following their guidelines.