Checklist For Starting A Homestead

Description

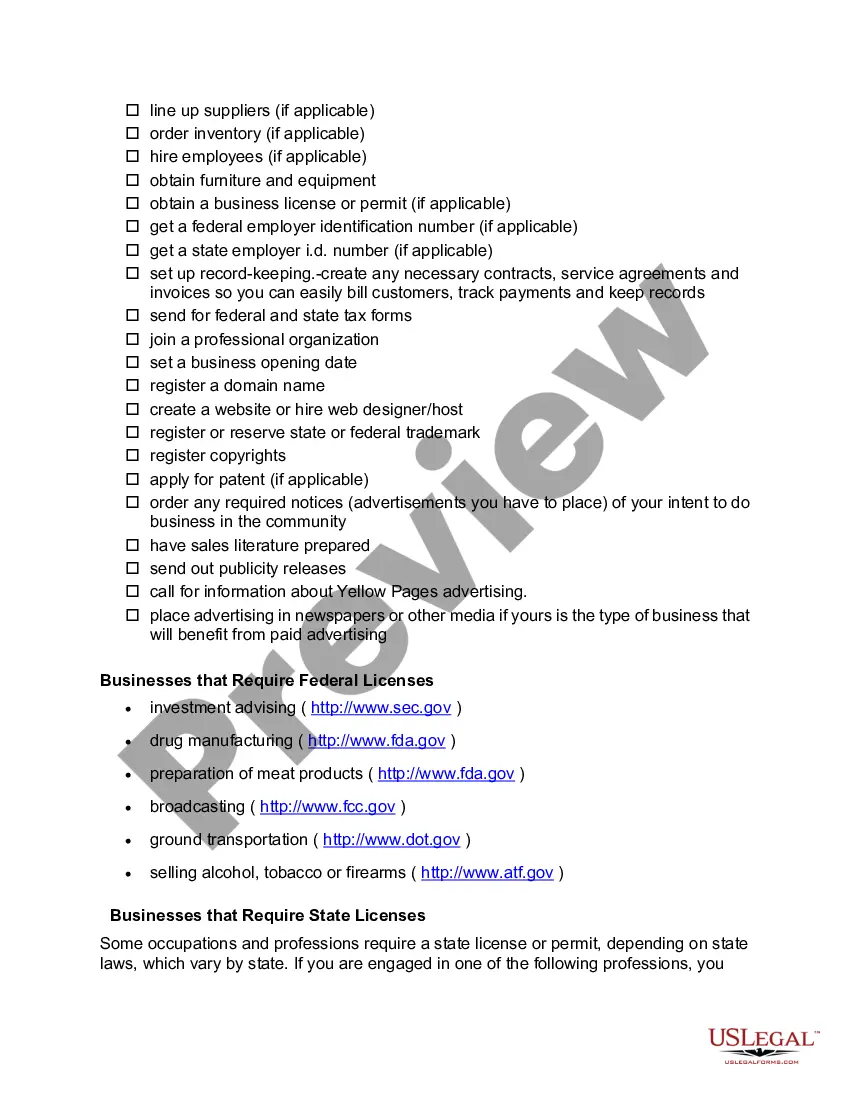

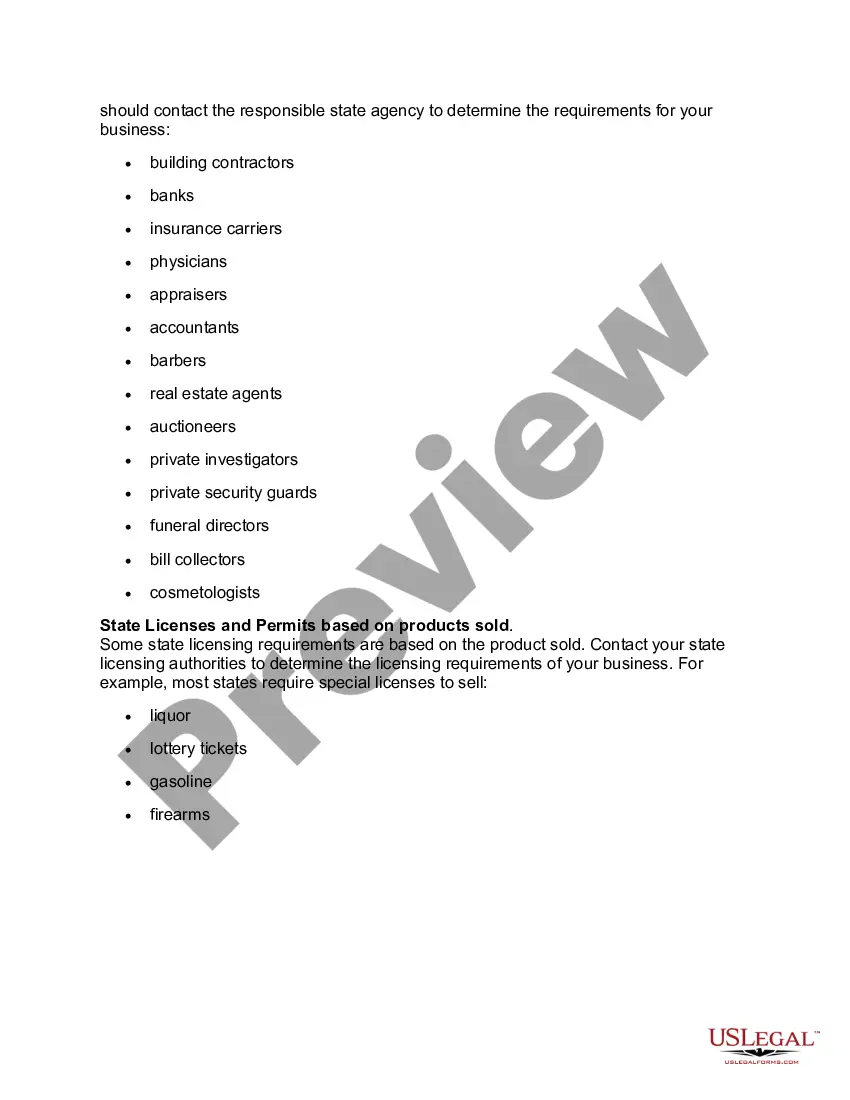

How to fill out Checklist For Starting Up A New Business?

It’s clear that you cannot instantly become a legal specialist, nor can you easily learn how to promptly draft a Checklist For Starting A Homestead without possessing a specific skill set.

Compiling legal documents is an extensive task that necessitates particular training and expertise. So why not entrust the creation of the Checklist For Starting A Homestead to the professionals.

With US Legal Forms, one of the most extensive legal document repositories, you can locate anything from judicial forms to templates for internal business communication. We recognize the significance of compliance and adherence to federal and state laws and regulations. Therefore, on our platform, all templates are location-specific and current.

You can revisit your documents from the My documents section at any time. If you’re an existing client, you can simply Log In, and locate and download the template from the same section.

Regardless of the purpose of your documents—whether financial, legal, or personal—our website has you covered. Try US Legal Forms today!

- Find the document you require by utilizing the search box at the top of the webpage.

- View it (if this option is available) and read the accompanying description to ascertain if the Checklist For Starting A Homestead meets your needs.

- Start your search afresh if you need a different document.

- Create a complimentary account and choose a subscription plan to purchase the document.

- Select Buy now. Once the payment is processed, you can download the Checklist For Starting A Homestead, complete it, print it, and deliver or send it to the specified individuals or organizations.

Form popularity

FAQ

You have a right to see and copy records of public bodies. A record cannot be withheld and a meeting cannot be closed unless a specific exemption applies. The FOIA ? also known as the Sunshine Law because it shines light on government meetings and records ? is essential to our democratic form of government.

The fair market value is then assessed at rates established in the State Constitution. For manufacturers, real and personal property are both assessed at 10.5%. The assessment ratio for all other businesses is 6% for real property and 10.5% for personal property. (For homeowners, primary residences are assessed at 4%.)

SECTION 30-4-70. Meetings which may be closed; procedure; circumvention of chapter; disruption of meeting; executive sessions of General Assembly.

All South Carolina businesses must file a form PT-100 annually detailing all personal property involved in their operations. The form can be found on the website of the South Carolina Department of Revenue. A separate form must be filed for every business location.

Ing to South Carolina Instructions for Form SC 1040, you must file a South Carolina income tax return if: You are a RESIDENT and: You filed a federal return with income that was taxable by South Carolina. You had South Carolina income taxes withheld from your wages.

Give us a call at 1-844-898-8542 or email forms@dor.sc.gov so we can direct you to the proper form, or discuss the online filing option that best fits your needs. Filing online using MyDORWAY makes finding the right form easy!

LLC taxes and fees The following are taxation requirements and ongoing fees for South Carolina LLCs: Annual report. South Carolina does not require LLCs to file an annual report.

Personal Property PT-100 If you owned a property in Horry County on December 31st of the prior year and this was not your legal residence, you are required to complete and submit a Personal Property Return. You may complete the form online by choosing the correct link below.