Liability Company Online Fort

Description

How to fill out Professional Limited Liability Company - PLLC - Formation Questionnaire?

Whether for business purposes or for individual matters, everybody has to manage legal situations sooner or later in their life. Filling out legal documents needs careful attention, beginning from choosing the correct form sample. For example, when you choose a wrong edition of the Liability Company Online Fort, it will be rejected once you submit it. It is therefore essential to have a trustworthy source of legal papers like US Legal Forms.

If you have to obtain a Liability Company Online Fort sample, stick to these easy steps:

- Get the sample you need using the search field or catalog navigation.

- Examine the form’s description to make sure it fits your situation, state, and region.

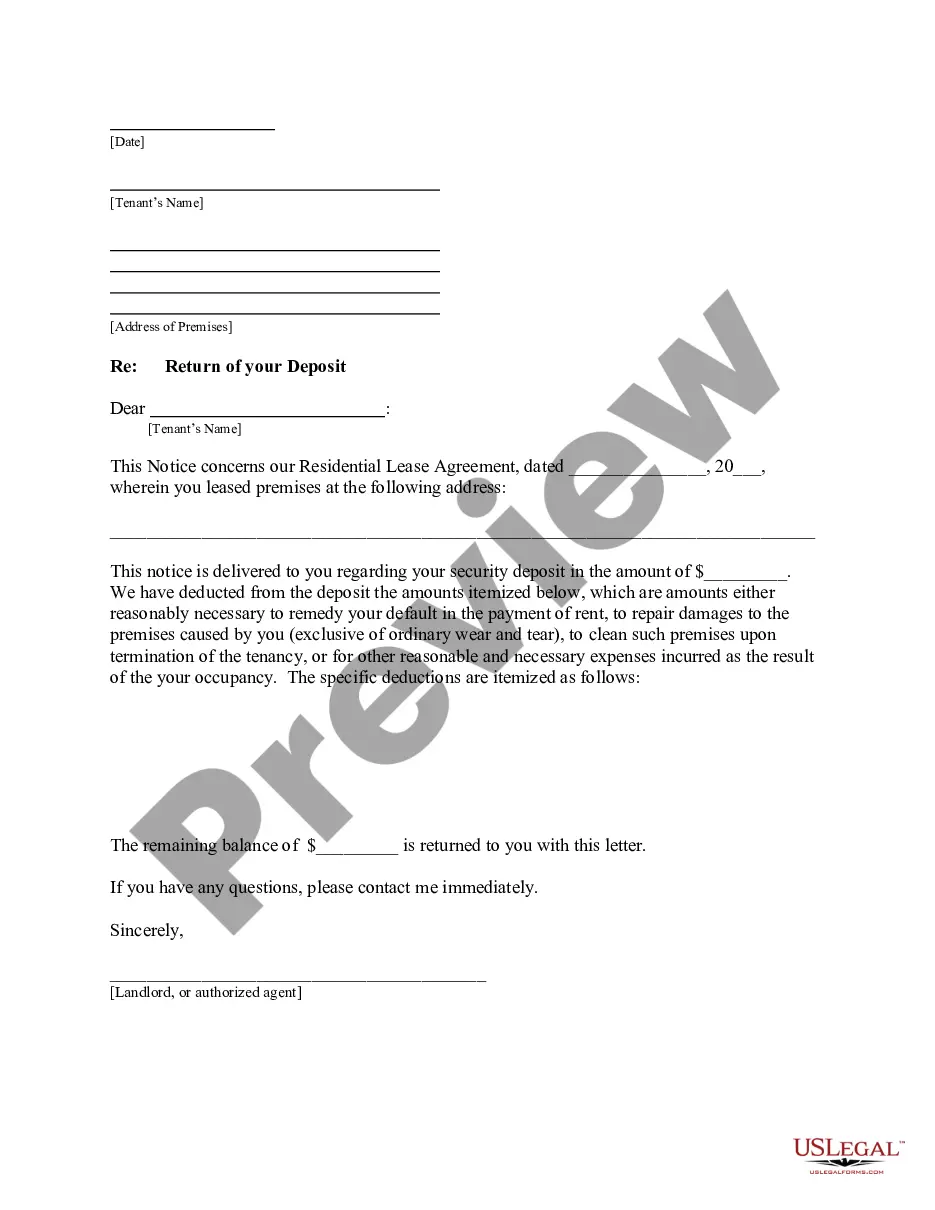

- Click on the form’s preview to examine it.

- If it is the incorrect form, return to the search function to find the Liability Company Online Fort sample you need.

- Download the file if it meets your needs.

- If you have a US Legal Forms profile, just click Log in to access previously saved templates in My Forms.

- In the event you do not have an account yet, you can download the form by clicking Buy now.

- Select the appropriate pricing option.

- Complete the profile registration form.

- Select your transaction method: you can use a bank card or PayPal account.

- Select the file format you want and download the Liability Company Online Fort.

- After it is downloaded, you can fill out the form with the help of editing software or print it and finish it manually.

With a large US Legal Forms catalog at hand, you do not have to spend time seeking for the appropriate sample across the web. Make use of the library’s straightforward navigation to find the proper template for any situation.

Form popularity

FAQ

Create Your Texas LLC in Five Steps Step 1: Choose a Name for Your LLC. ... Step 2: Appoint a Registered Agent. ... Step 3: File the Certificate of Formation. ... Step 4: Create Your Operating Agreement. ... Step 5: Obtain an Employer Identification Number.

Start-up costs for a Texas LLC A new LLC that is being formed in Texas needs to file a Certificate of Formation?Limited Liability Company (Form 205) with the Texas Secretary of State, and pay a $300 filing fee. If you need a certified copy of the Certificate of Formation, there is a $30 fee.

The state filing fee for a Florida LLC is $125. This fee is required to file the LLC's Articles of Organization with the state of Florida. IncNow's ?Basic LLC? package costs $189 and includes: The Florida state filing fee of $125, and.

How to form an LLC Step 1: Choose a state in which to form your LLC. ... Step 2: Choose a name for your LLC. ... Step 3: Choose a registered agent. ... Step 4: Prepare an LLC operating agreement. ... Step 5: File your LLC with your state. Step 6: Obtain an EIN. ... Step 7: Open a business bank account.

Disadvantages of creating an LLC Cost: An LLC usually costs more to form and maintain than a sole proprietorship or general partnership. States charge an initial formation fee. ... Transferable ownership. Ownership in an LLC is often harder to transfer than with a corporation.