Estate Planning Forms Printable For Attorneys

Description

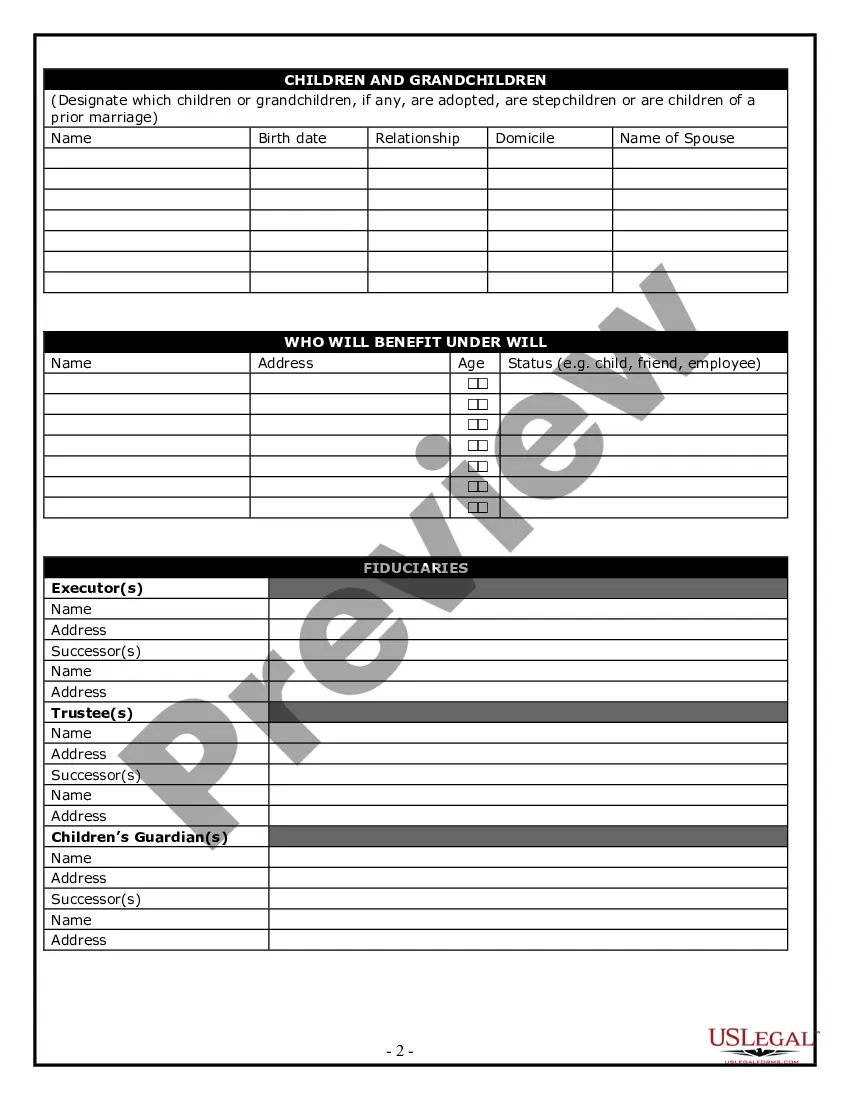

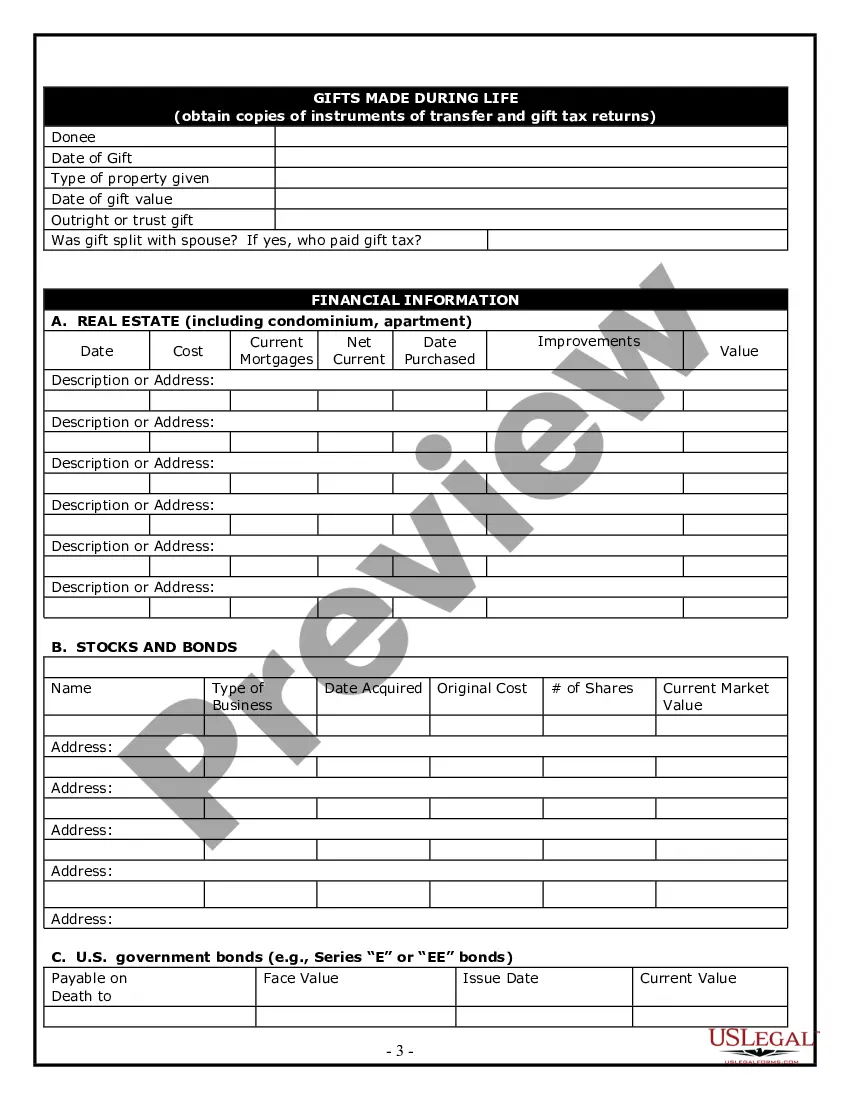

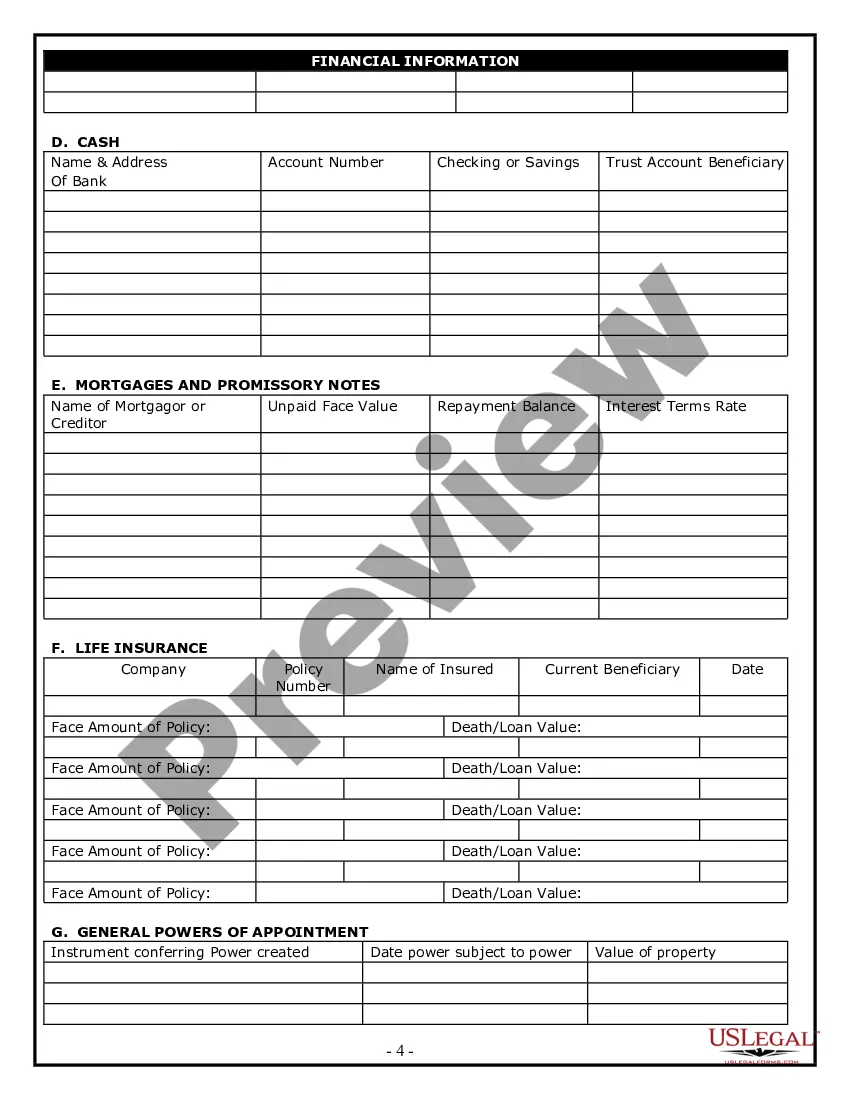

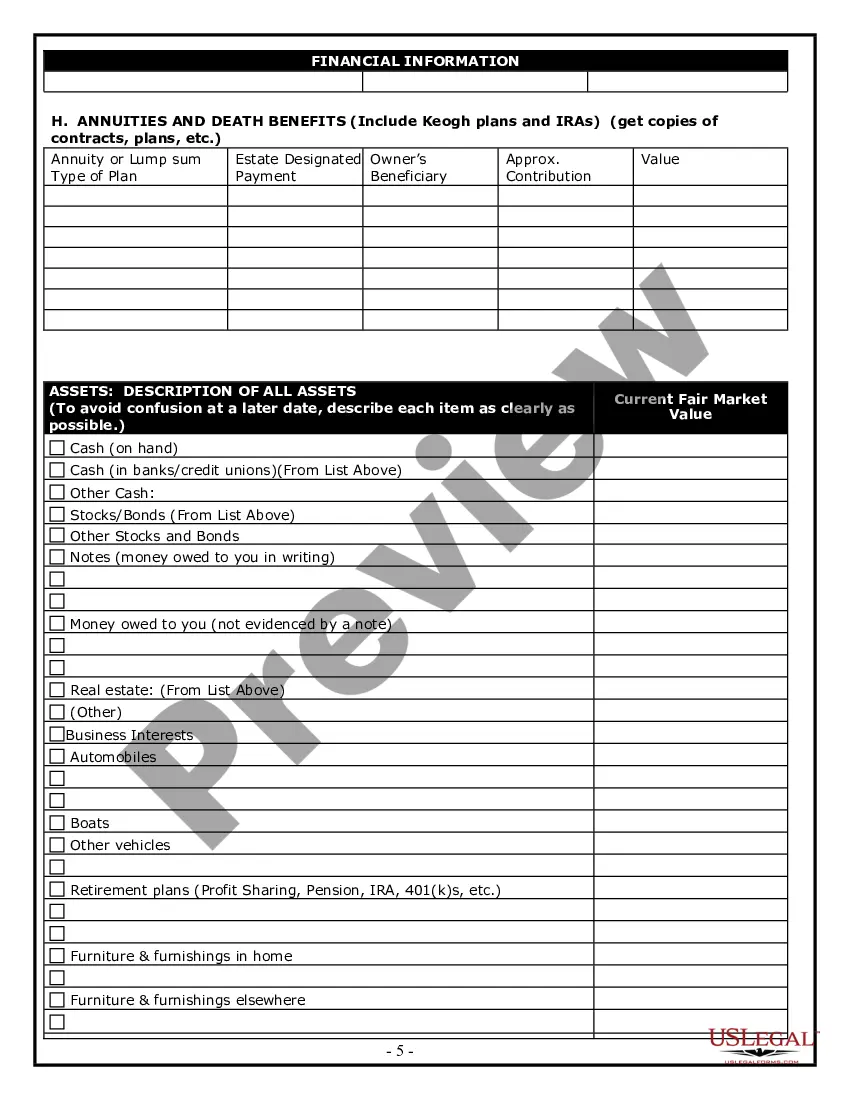

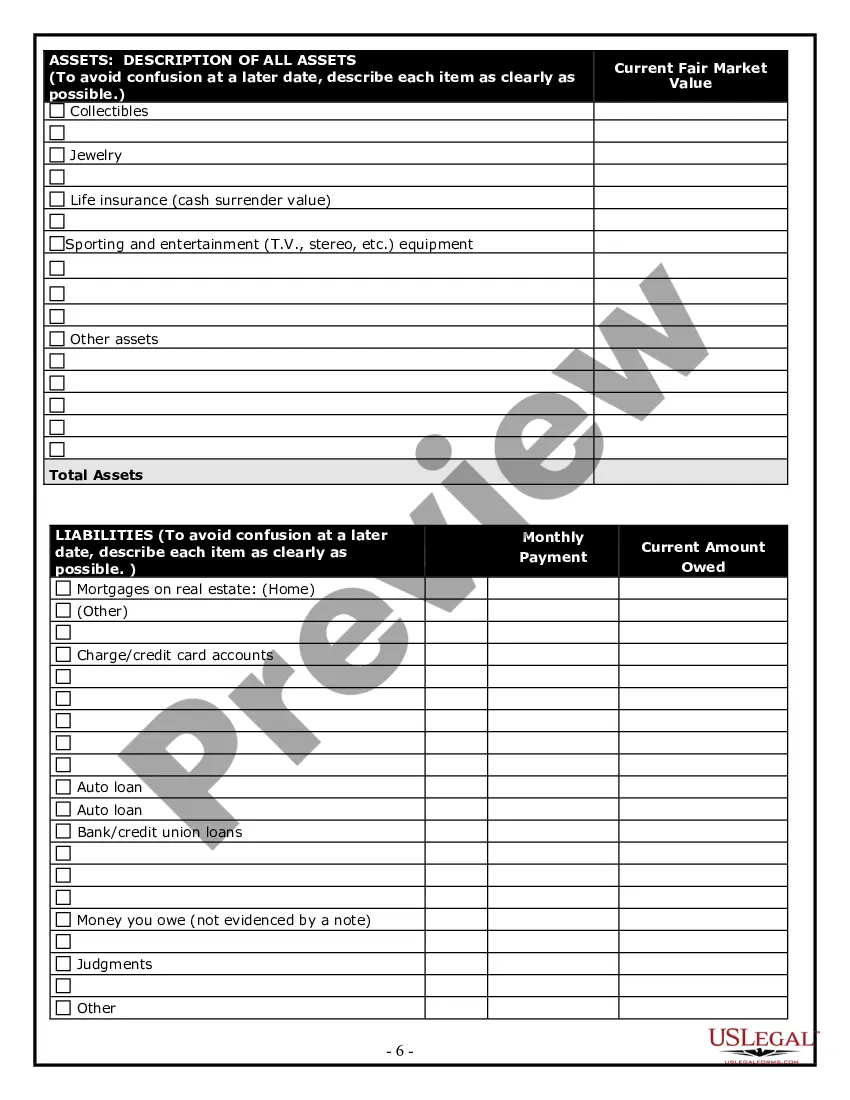

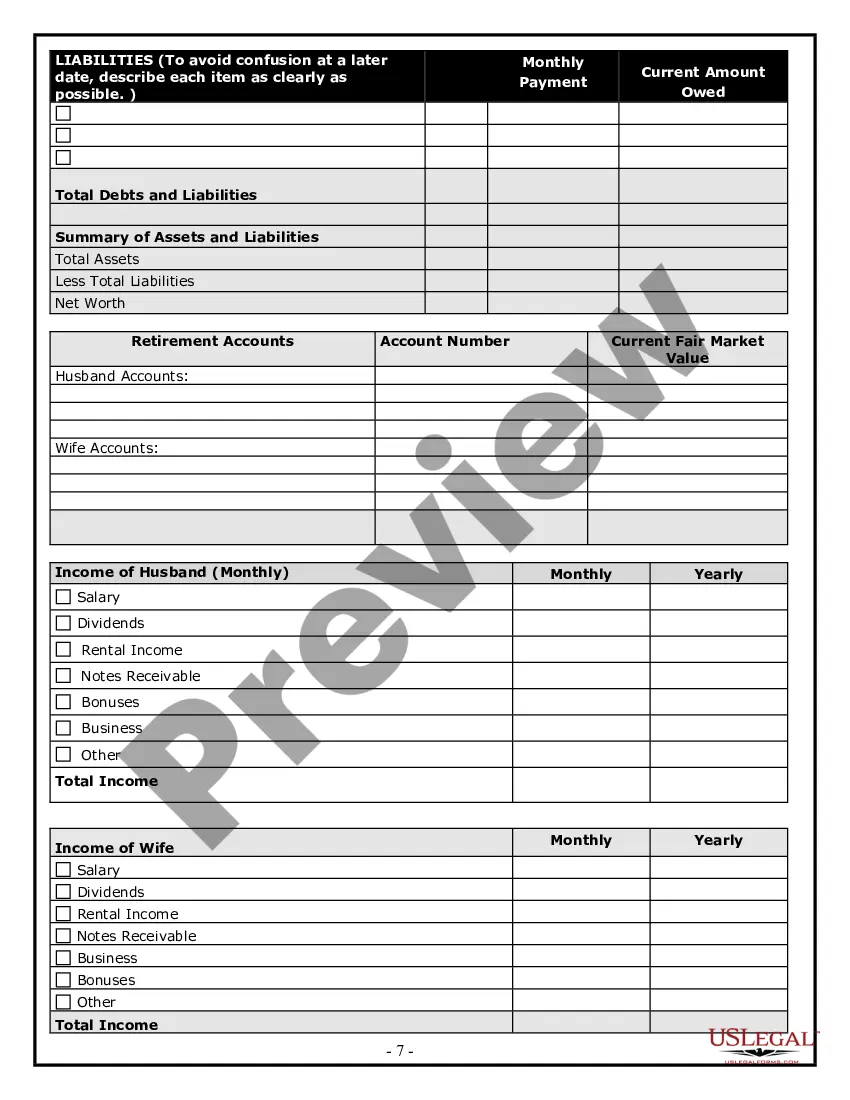

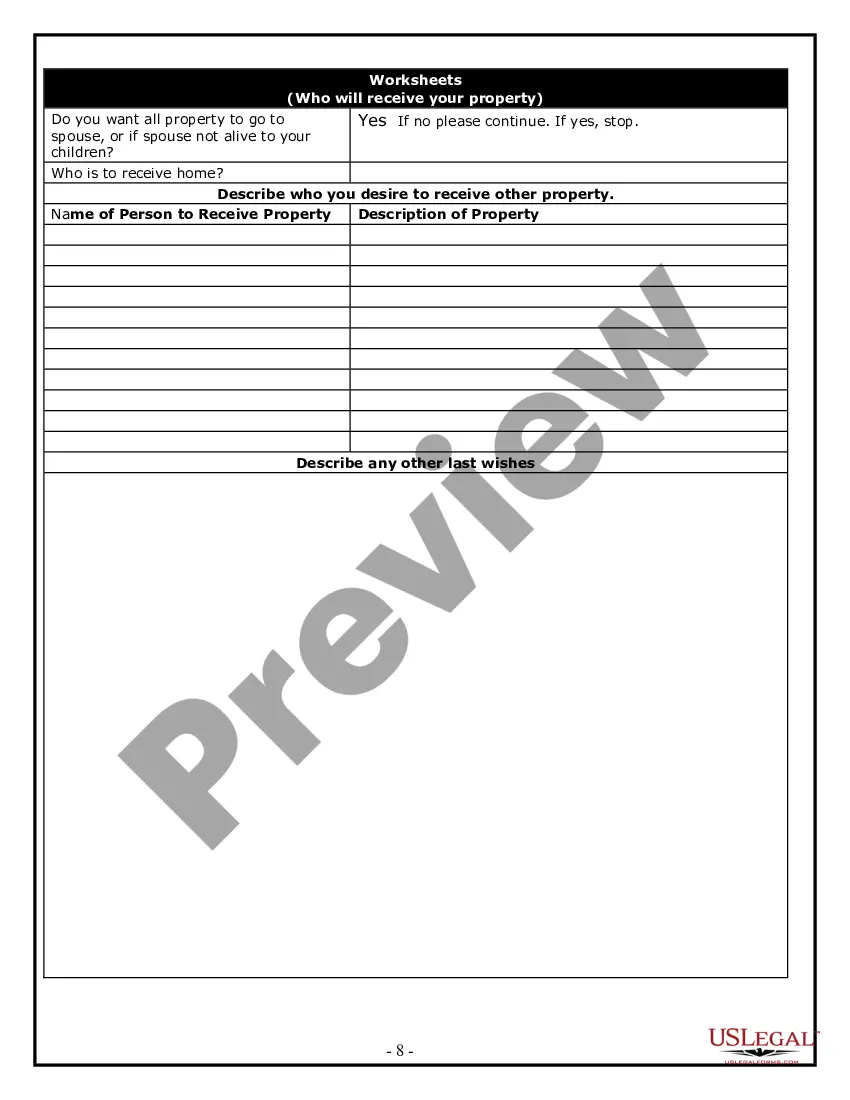

How to fill out Estate Planning Questionnaire?

Gaining access to legal templates that adhere to federal and regional regulations is essential, and the internet provides numerous choices to select from.

However, what’s the benefit of spending time searching for the suitable Estate Planning Forms Printable For Attorneys example online when the US Legal Forms online library has already compiled such templates in one location.

US Legal Forms is the largest online legal repository with more than 85,000 fillable templates created by attorneys for any business and personal situation.

Review the template using the Preview option or through the text description to ensure it fulfills your requirements.

- They are easy to navigate with all documents categorized by state and intended use.

- Our specialists keep up with legislative changes, so you can always be assured your documents are current and compliant when obtaining a Estate Planning Forms Printable For Attorneys from our platform.

- Acquiring a Estate Planning Forms Printable For Attorneys is straightforward and quick for both existing and new users.

- If you already possess an account with a valid subscription, Log In and store the document sample you require in the appropriate format.

- If you are a new user, follow the instructions below.

Form popularity

FAQ

Walmart does not typically sell specific power of attorney forms. Instead, you might want to consider using online resources that offer estate planning forms printable for attorneys. These forms can provide you with customizable options that meet your unique needs. Websites like US Legal Forms specialize in providing comprehensive legal documents, including power of attorney forms, ensuring you have the proper paperwork for your estate planning.

In general, the terms of a trust take precedence over a beneficiary designation. This means that if a trust specifies how assets should be distributed, those instructions are followed first. To ensure clarity and avoid disputes, utilizing estate planning forms printable for attorneys can help clearly outline the roles of beneficiaries in relation to your trust.

While a trust can help manage your estate and potentially reduce inheritance tax, it does not outright eliminate it. Certain types of trusts, like irrevocable trusts, may help shield assets from taxes. To navigate these complexities effectively, consider using estate planning forms printable for attorneys that can guide you in establishing a trust that aligns with tax benefits.

The 5 by 5 rule, often confused with the 5 and 5 rule, refers to the provision allowing a beneficiary to withdraw up to 5% of the trust's value annually without tax consequences. This rule helps provide flexibility for beneficiaries while still protecting the trust's assets. Using estate planning forms printable for attorneys can facilitate the effective implementation of this rule in your trust agreements.

The estate planning process typically involves seven key steps: assessing your assets, setting your goals, choosing an executor, selecting beneficiaries, creating a will or trust, reviewing tax implications, and regularly updating your plan. By following these steps, you can create comprehensive estate planning forms printable for attorneys that align with your objectives and provide peace of mind.

The 5 and 5 rule allows a beneficiary to withdraw a certain amount from a trust without triggering gift tax. Specifically, it permits a withdrawal of the greater of $5,000 or 5% of the trust's value each year. Understanding this rule can help you create effective estate planning forms printable for attorneys that maximize benefits for your beneficiaries.

One of the biggest mistakes parents often make when setting up a trust fund is not clearly defining the terms and conditions of the trust. Without clear guidelines, beneficiaries may misunderstand their roles or expectations. Utilizing estate planning forms printable for attorneys can help ensure that your trust fund is structured correctly and meets your family’s unique needs.