Estate Planning Checklist With 529 Plans

Description

How to fill out Estate Planning Questionnaire?

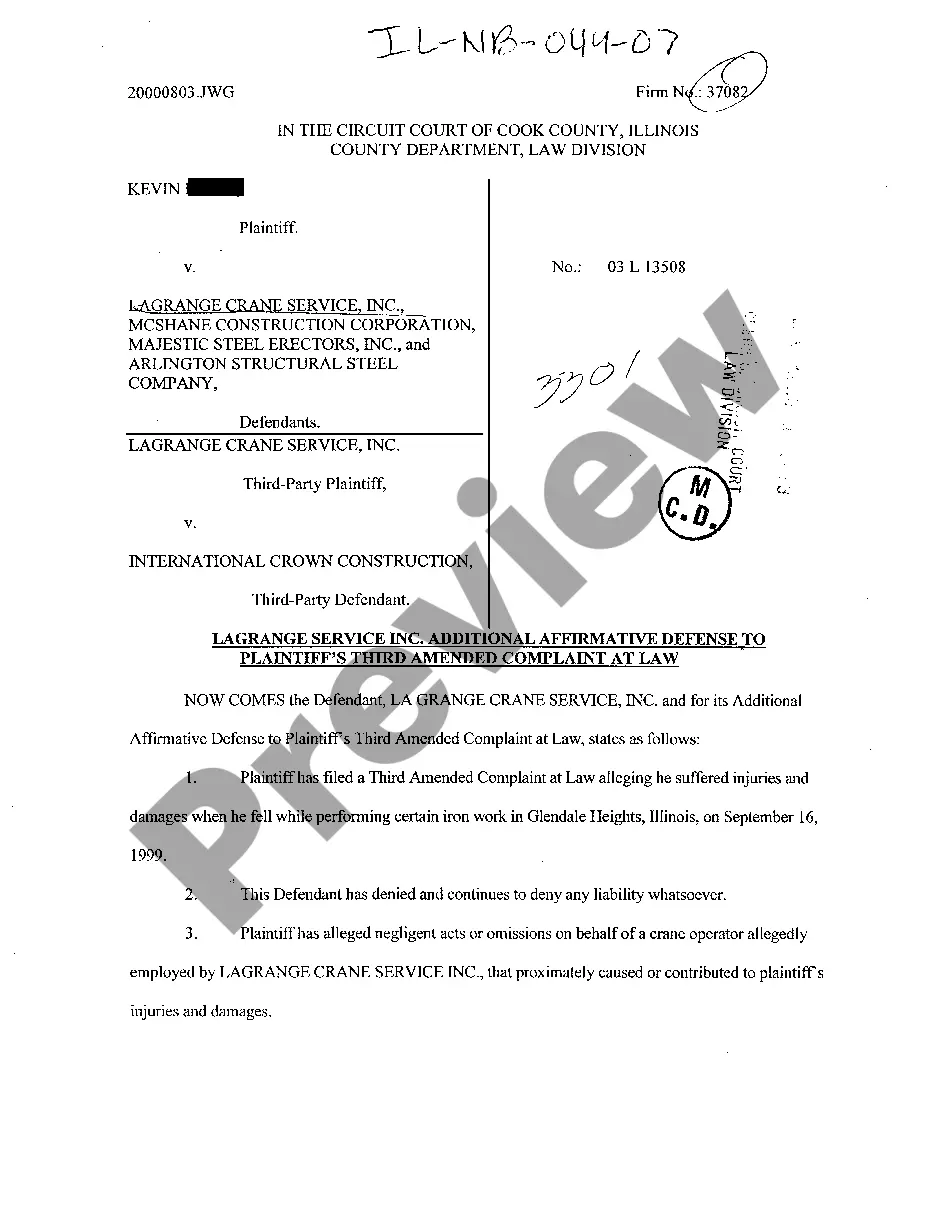

When you need to finalize Estate Planning Checklist With 529 Plans that adheres to your local state's laws and regulations, there can be various options to choose from.

There's no necessity to review every document to ensure it meets all the legal criteria if you are a US Legal Forms subscriber.

It is a trustworthy service that can assist you in obtaining a reusable and current template on any subject.

Acquire the appropriately drafted official documents with ease using US Legal Forms. Moreover, Premium users can also benefit from the powerful integrated tools for online document editing and signing. Give it a try today!

- US Legal Forms is the most comprehensive online catalog with an archive of over 85k ready-to-use documents for business and personal legal scenarios.

- All templates are confirmed to comply with each state's regulations.

- Consequently, when downloading Estate Planning Checklist With 529 Plans from our platform, you can be assured that you retain a valid and updated document.

- Acquiring the necessary sample from our system is very straightforward.

- If you already possess an account, simply Log In to the system, verify your subscription is active, and save the chosen file.

- In the future, you can access the My documents tab in your profile and maintain access to the Estate Planning Checklist With 529 Plans at any time.

- If this is your first experience with our website, please follow the instructions below.

- Review the suggested page and check it for alignment with your requirements.

Form popularity

FAQ

When the owner of a 529 plan passes away, the assets typically remain in the account and can be transferred to a designated beneficiary. This ensures that the funds are still available for educational expenses, aligning with the goals outlined in your estate planning checklist with 529 plans. It's important to review the beneficiary designations and update them regularly to reflect your wishes. For comprehensive guidance, consider utilizing resources like USLegalForms, which can help you navigate these important decisions in your estate planning.

The recent rule changes clarify that contributions made by grandparents to a 529 plan can affect financial aid eligibility in subsequent years. However, their contributions do not count in the year they are made, which allows for strategic planning. By updating your estate planning checklist with 529 plans to reflect these changes, you can optimize how and when contributions are made. This knowledge will help you ensure that your financial support continues to benefit your grandchildren effectively.

The grandparent loophole 529 refers to how contributions made by grandparents to a 529 plan do not affect the grandchild's financial aid eligibility immediately. This loophole enables grandparents to support their grandchildren's education while keeping financial aid options open. Including this strategy in your estate planning checklist with 529 plans allows you to make informed decisions about funding education without jeopardizing future aid. It’s a smart way to assist loved ones while managing financial responsibilities.

Generally, 529 plans are not included in your estate for tax purposes. However, if you maintain control over the account, it may be considered part of your taxable estate. To incorporate this knowledge into your estate planning checklist with 529 plans, ensure you strategize around account ownership and control when considering your overall estate plan. This planning helps minimize tax implications and maximize benefits for your beneficiaries.

The grandparent 529 loophole allows grandparents to contribute to a grandchild's 529 plan without impacting financial aid eligibility. This feature can provide substantial financial benefits when planning for education expenses. By understanding this loophole, you can effectively incorporate it into your estate planning checklist with 529 plans. Doing so maximizes the financial advantages for your grandchild while preserving estate benefits.

Contributions to a 529 plan can have favorable treatment when it comes to estate tax. Generally, these contributions are considered a gift, but they qualify for the annual gift tax exclusion. This means you can contribute a significant amount without incurring gift tax, making it an important factor to include in your estate planning checklist with 529 plans.

Depending on your financial goals, alternatives to a 529 plan may work better for you. For instance, a Coverdell Education Savings Account allows for more investment flexibility and can be used for expenses beyond just college. Therefore, as you develop your estate planning checklist with 529 plans, consider including these alternatives to find the best fit for your needs.

Generally, a 529 plan does not go through probate. Since these plans are considered a form of a designated beneficiary account, the funds typically transfer directly to the named beneficiary upon the account owner’s death. This means that your estate planning checklist with 529 plans can help simplify the transfer of these assets while avoiding the lengthy probate process.

While a 529 plan has its benefits, it also has some drawbacks to consider. One key negative is the limited investment options; you're typically confined to the plan's selections. Additionally, if the funds are not used for qualified education expenses, you may face penalties and taxes on the earnings. Therefore, it’s important to include a thorough estate planning checklist with 529 plans to ensure you understand these limitations.

Yes, 529 plans can be structured to potentially remove certain assets from your gross estate, which is beneficial for estate planning. By including them in your estate planning checklist with 529 plans, you can effectively lower your taxable estate size. This strategy not only helps in educational funding but also can lead to more favorable tax outcomes when the estate is settled.