Business Startup Sole With Bad Credit

Description

How to fill out Small Business Startup Package For Sole Proprietorship?

Whether for business purposes or for personal affairs, everyone has to deal with legal situations sooner or later in their life. Filling out legal papers needs careful attention, beginning from picking the appropriate form sample. For instance, when you choose a wrong edition of a Business Startup Sole With Bad Credit, it will be declined when you submit it. It is therefore crucial to get a dependable source of legal papers like US Legal Forms.

If you need to obtain a Business Startup Sole With Bad Credit sample, stick to these easy steps:

- Get the template you need by utilizing the search field or catalog navigation.

- Check out the form’s description to make sure it matches your situation, state, and region.

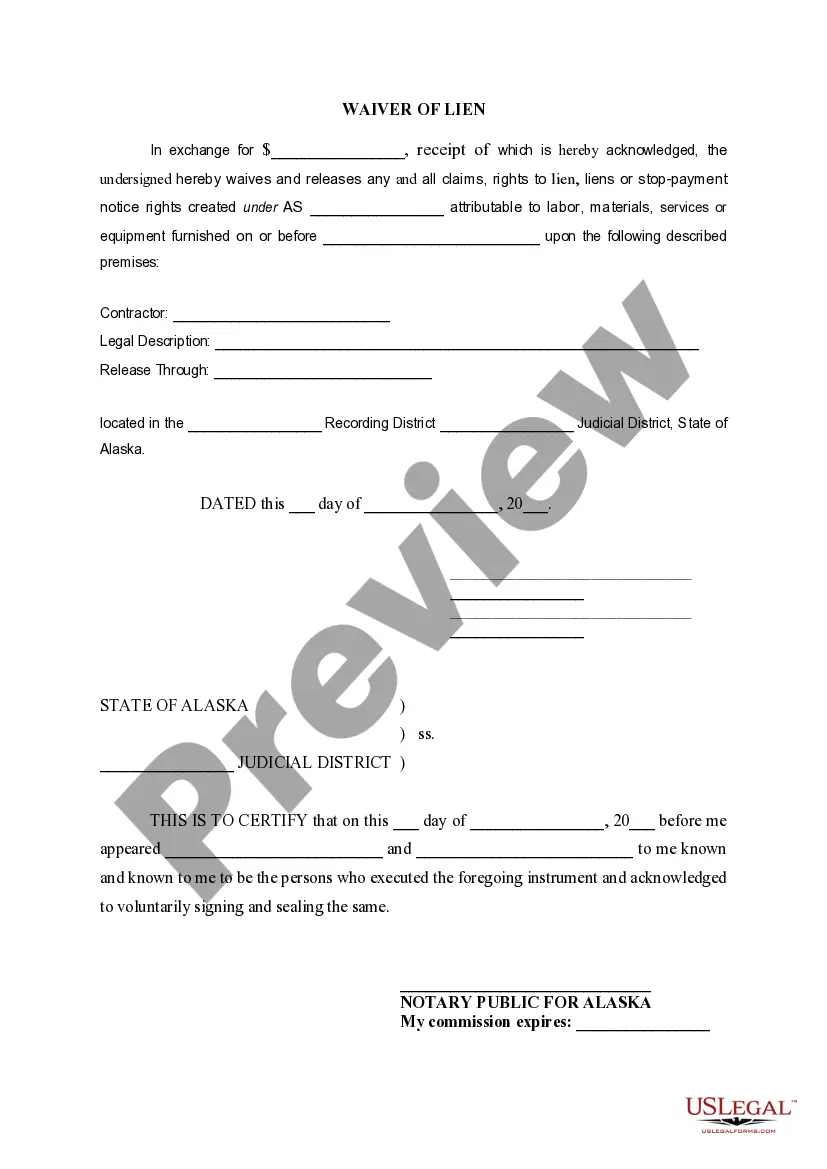

- Click on the form’s preview to view it.

- If it is the incorrect document, go back to the search function to find the Business Startup Sole With Bad Credit sample you need.

- Get the template when it matches your needs.

- If you already have a US Legal Forms profile, simply click Log in to gain access to previously saved documents in My Forms.

- If you do not have an account yet, you can obtain the form by clicking Buy now.

- Pick the appropriate pricing option.

- Finish the profile registration form.

- Select your transaction method: you can use a credit card or PayPal account.

- Pick the file format you want and download the Business Startup Sole With Bad Credit.

- After it is downloaded, you are able to complete the form with the help of editing applications or print it and finish it manually.

With a large US Legal Forms catalog at hand, you don’t have to spend time searching for the appropriate template across the web. Utilize the library’s easy navigation to get the right template for any situation.

Form popularity

FAQ

Yes, startup business loans offer lenient credit requirements as low as the 500s, but your options will be limited. Most startup loans have a minimum FICO score of 600 or higher and require at least six months in business.

Getting a business loan is more challenging for startups than for established businesses?but it's still possible. New business owners can improve their approval odds by choosing the right type of financing, familiarizing themselves with their credit scores and identifying the most competitive lending options available.

You can apply for a business loan with your EIN if you're a new business owner without established credit. However, you may also need to include your SSN and details about your personal finances because you'll likely have to provide a personal guarantee.

You have several options for EIN-only loans: Invoice Factoring. Accounts Receivable Financing. Merchant Cash Advances. Other types of loans.

For example, a lender may offer business loans with a minimum 600 personal credit score while accepting businesses with six months' experience. Some lenders do offer startup business loans for a 500 credit score.