Death Transferring With Trust

Description

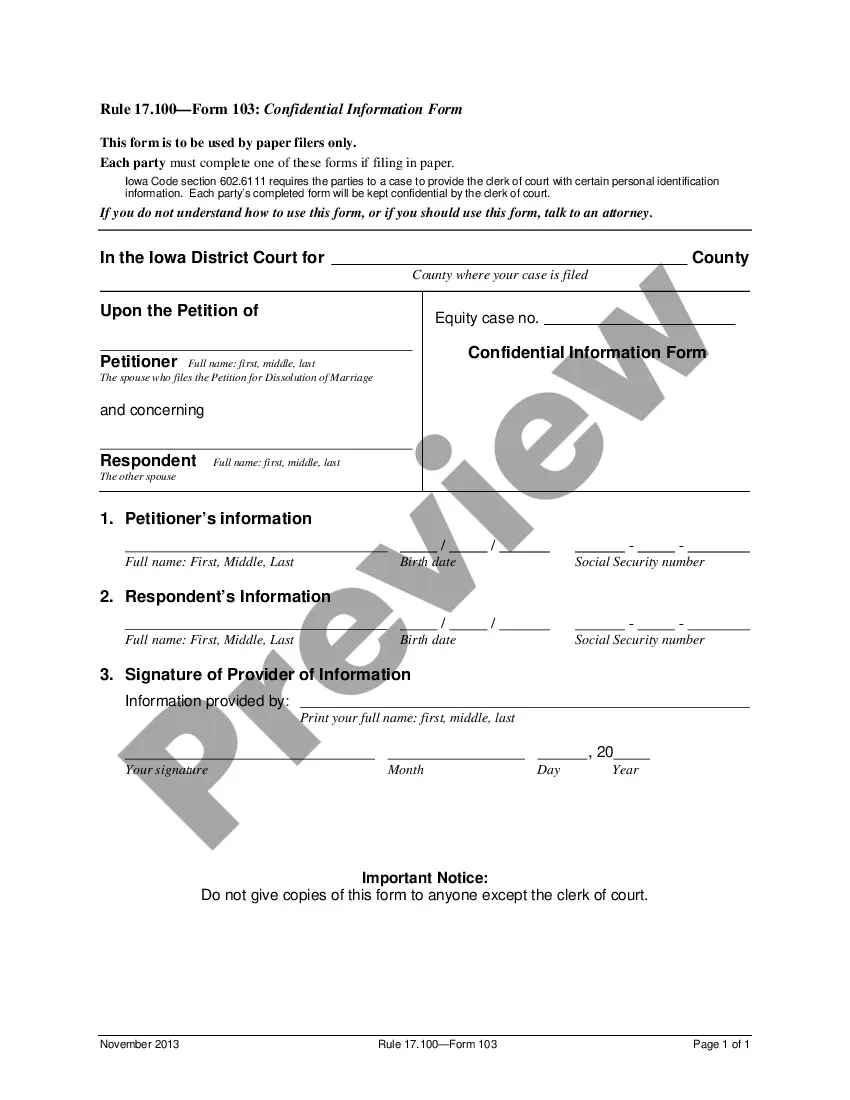

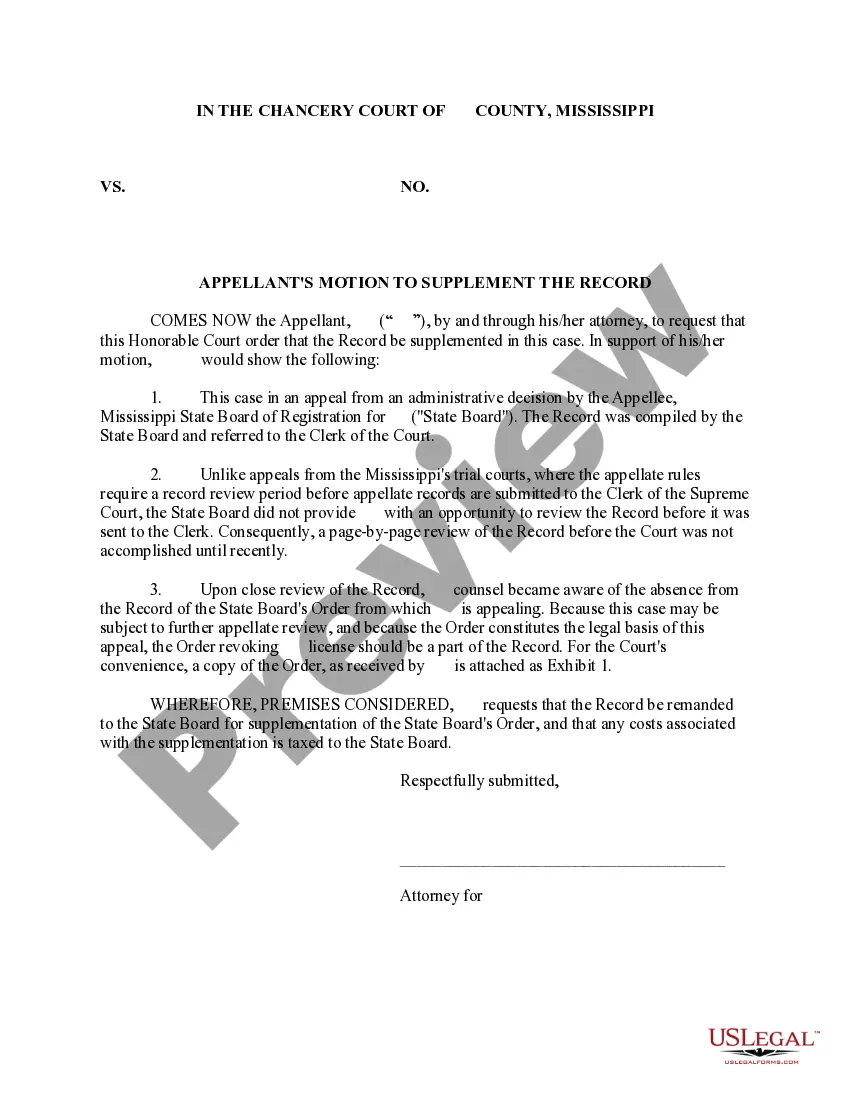

How to fill out Affidavit For Transferring Property After Death In Joint Tenancy With Right Of Survivorship By Surviving Tenant When One Tenant Is Deceased?

Finding a go-to place to access the most recent and relevant legal samples is half the struggle of working with bureaucracy. Choosing the right legal papers needs accuracy and attention to detail, which explains why it is important to take samples of Death Transferring With Trust only from trustworthy sources, like US Legal Forms. An improper template will waste your time and delay the situation you are in. With US Legal Forms, you have very little to worry about. You can access and check all the information about the document’s use and relevance for your situation and in your state or county.

Consider the following steps to finish your Death Transferring With Trust:

- Make use of the catalog navigation or search field to find your sample.

- Open the form’s information to ascertain if it matches the requirements of your state and area.

- Open the form preview, if there is one, to ensure the template is definitely the one you are searching for.

- Resume the search and look for the appropriate document if the Death Transferring With Trust does not match your needs.

- When you are positive regarding the form’s relevance, download it.

- If you are an authorized customer, click Log in to authenticate and access your selected forms in My Forms.

- If you do not have a profile yet, click Buy now to obtain the template.

- Pick the pricing plan that fits your requirements.

- Go on to the registration to finalize your purchase.

- Complete your purchase by choosing a payment method (bank card or PayPal).

- Pick the document format for downloading Death Transferring With Trust.

- When you have the form on your device, you can modify it using the editor or print it and finish it manually.

Eliminate the hassle that comes with your legal documentation. Explore the extensive US Legal Forms library where you can find legal samples, check their relevance to your situation, and download them on the spot.

Form popularity

FAQ

The way it differs from a TOD deed is that a living trust can be used for any type of asset, not just real estate. So if you have stocks, savings accounts, valuable belongings, or other assets that you want to transfer to someone after your death, a living trust is a way to do it.

A transfer on death deed can be a useful addition to your estate plan, but it may not address other concerns, like minimizing estate tax or creditor protection, for which you need a trust. In addition to a will or trust, you can also transfer property by making someone else a joint owner, or using a life estate deed.

If you suddenly become incapacitated and unable to manage your own affairs, a transfer-on-death clause will do nothing to help you. Your beneficiary will not be able to access the money to pay your bills because they only get the money once you have died.

Once the grantor passes away, the trust needs its own tax number, as the grantor's Social Security number is no longer sufficient. Therefore, while a revocable trust does not initially need an EIN, it's an excellent idea to apply for one just as you would for an irrevocable trust to avoid difficulties managing it.

The grantor can opt to have the beneficiaries receive trust property directly without any restrictions. The trustee can write the beneficiary a check, give them cash, and transfer real estate by drawing up a new deed or selling the house and giving them the proceeds.