Transfer Mortgage Lender Withdraw Offer

Description

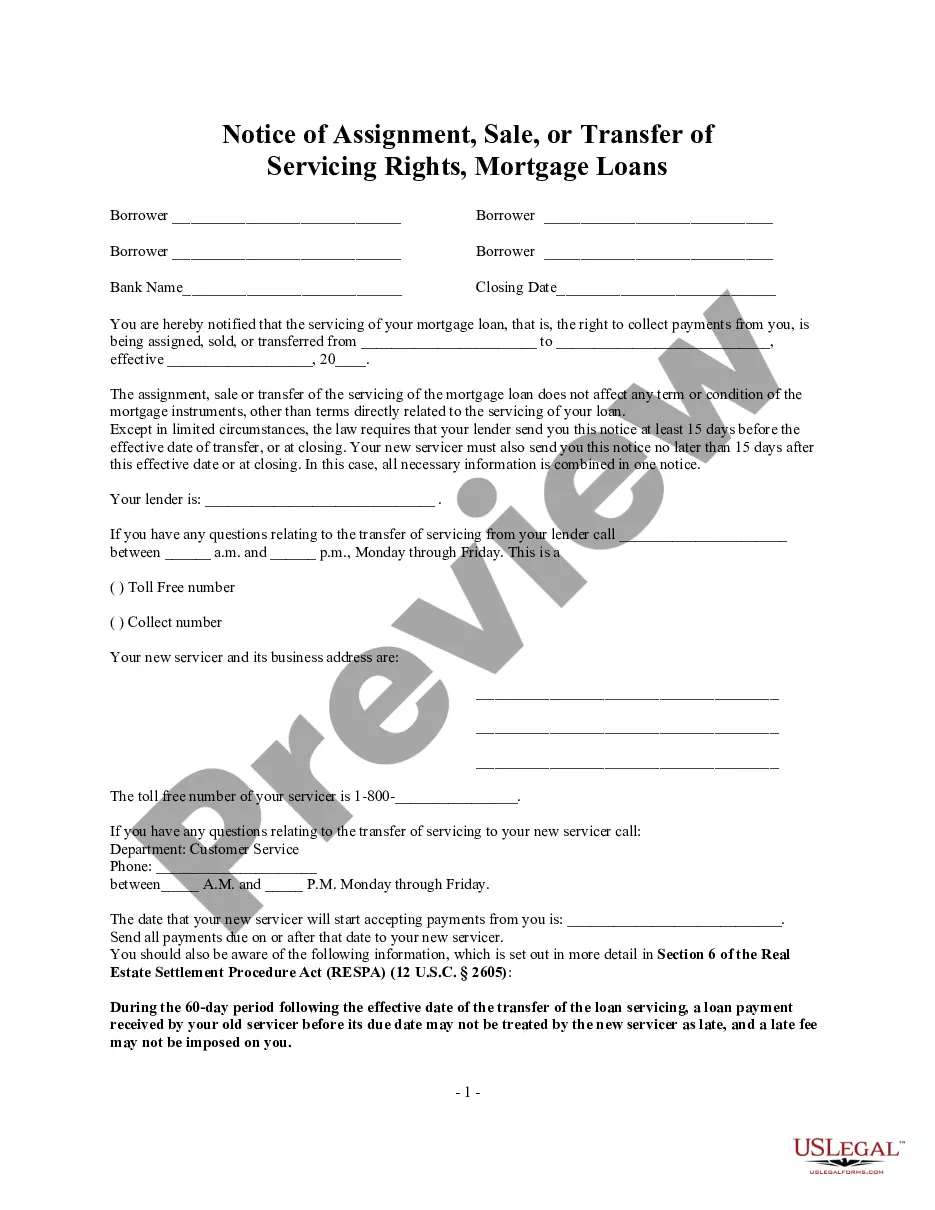

How to fill out Notice Of Assignment - Sale Or Transfer Of Servicing Rights - Mortgage Loans?

Engaging with legal documents and processes can be an arduous addition to your schedule.

Transfer Mortgage Lender Revoke Offer and similar documents frequently necessitate you to search for them and find the most effective approach to fill them out accurately.

Consequently, whether you are managing financial, legal, or personal affairs, having an extensive and accessible online library of documents at your disposal will greatly assist you.

US Legal Forms is the premier online platform of legal templates, showcasing over 85,000 state-specific documents and various resources that will aid you in completing your paperwork with ease.

Is it your initial time using US Legal Forms? Register and create an account in a matter of minutes, and you'll gain access to the form library and Transfer Mortgage Lender Revoke Offer. Then, follow the steps outlined below to complete your document: Ensure you possess the correct form using the Preview feature and reviewing the form details. Select Buy Now when ready, and choose the subscription plan that suits you best. Click Download, then fill out, sign, and print the form. US Legal Forms boasts twenty-five years of expertise assisting individuals in managing their legal documents. Acquire the form you require today and simplify any process without exerting undue effort.

- Browse the assortment of pertinent documents accessible to you with merely a click.

- US Legal Forms delivers state- and county-specific documents available for downloading at any time.

- Secure your document management processes with a superior service that enables you to prepare any form within minutes without any additional or concealed fees.

- Simply Log In to your account, locate Transfer Mortgage Lender Revoke Offer and obtain it instantly in the My documents section.

- You can also retrieve previously saved documents.

Form popularity

FAQ

This can be done, but it will possibly mean amending your mortgage offer. The bank or lender you use will organise for another valuation to take place on the new property. If the new property is cheaper than the first one, some lenders may only let you move your mortgage if you keep the same loan-to-value (LTV) ratio.

If your lender informs you that its mortgage offer is being withdrawn and will be replaced with another offer with a higher interest rate, get advice from your mortgage broker. It may be able to advise you on what your options are and the next best deal.

In most cases once you secure a rate you can cancel it without charge, however some lenders won't allow you to cancel the rate you have secured once you have accepted it. This means that if a better rate becomes available, you won't be able to cancel the product switch.

Any contract in Canada is subject to the approval of both parties, and a real estate transaction is no different. Therefore, there are typically significant financial or legal consequences if the buyer or seller simply changes their mind and backs out of an offer after it has been accepted.

If you need to terminate a mortgage agreement and state laws allow for you do so, you should follow these steps: Review the agreement. ... Contact the lender. ... Negotiate with the lender. ... Pay any applicable fees. ... Obtain a release.