Attorney Lien Form For Ny

Description

How to fill out Patient - Attorney Medical Lien Agreement?

It’s no secret that you can’t become a law expert overnight, nor can you learn how to quickly draft Attorney Lien Form For Ny without the need of a specialized background. Putting together legal documents is a time-consuming venture requiring a particular training and skills. So why not leave the preparation of the Attorney Lien Form For Ny to the specialists?

With US Legal Forms, one of the most extensive legal template libraries, you can access anything from court paperwork to templates for in-office communication. We know how important compliance and adherence to federal and state laws are. That’s why, on our website, all forms are location specific and up to date.

Here’s how you can get started with our platform and obtain the document you require in mere minutes:

- Discover the form you need with the search bar at the top of the page.

- Preview it (if this option available) and check the supporting description to determine whether Attorney Lien Form For Ny is what you’re searching for.

- Begin your search over if you need a different form.

- Register for a free account and choose a subscription option to purchase the template.

- Pick Buy now. As soon as the transaction is complete, you can download the Attorney Lien Form For Ny, fill it out, print it, and send or send it by post to the necessary individuals or entities.

You can re-access your documents from the My Forms tab at any time. If you’re an existing client, you can simply log in, and find and download the template from the same tab.

No matter the purpose of your forms-whether it’s financial and legal, or personal-our platform has you covered. Try US Legal Forms now!

Form popularity

FAQ

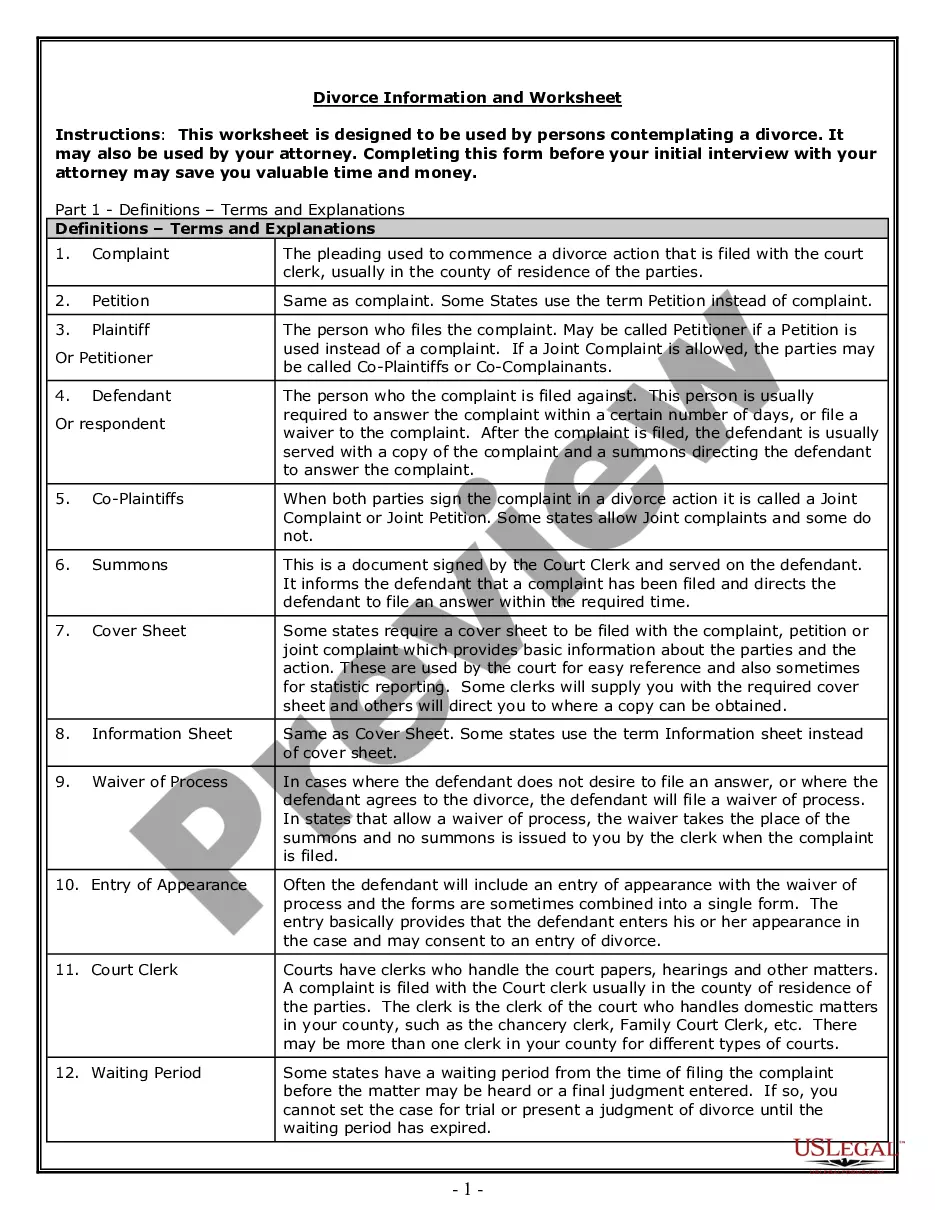

About New York Notice of Intent to Lien Form No one wants to be forced to file a mechanics lien, and this document gives all of the parties involved one final chance to take care of the payment issues on a project. This form advises the party that a lien will be filed if payment is not received within 10 days.

The executor, administrator, or heir-at-law of the estate must file an Inheritance Tax return (if required) within eight (8) months of the date of the decedent's death.

How does a creditor go about getting a judgment lien in New York? To attach the lien, the creditor files the judgment transcript with the county clerk in the New York county where the debtor's property is located.

Use Form ET-85 when. ? The estate is not required to file a New York State estate tax return (see filing requirements below), and either an executor or administrator has not been appointed, or if appointed, nine months has passed since the date of death. ? The estate is required to file a New York State estate tax.

The New York City Department of Social Services, Division of Liens and Recovery is the unit that figures out how much DSS is owed. DSS, along with the New York State Office of the Medicaid Inspector General (OMIG), work to collect Medicaid and Cash Assistance liens.