Contractor Payment Schedule With Irs

Description

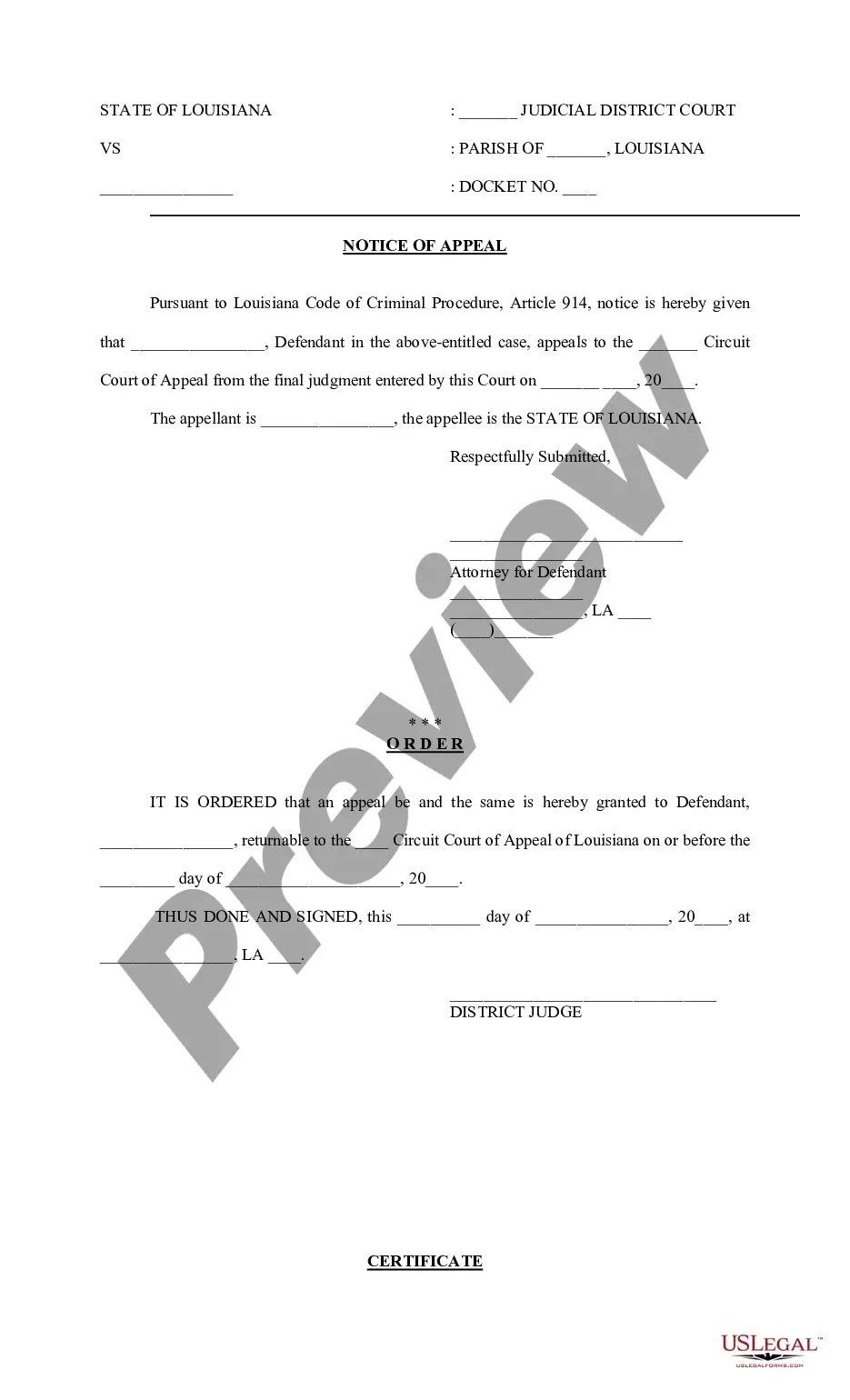

How to fill out Self-Employed Independent Contractor Payment Schedule?

It's clear that you cannot become a legal authority instantly, nor can you determine how to swiftly create Contractor Payment Schedule With Irs without possessing a specialized background.

Drafting legal documents is an extensive endeavor that demands specific education and expertise. So why not entrust the creation of the Contractor Payment Schedule With Irs to the experts.

With US Legal Forms, one of the largest legal document collections, you can discover everything from court filings to templates for internal corporate correspondence.

You can revisit your documents from the My documents tab at any time. If you’re an existing customer, you can simply Log In, and find and download the template from the same tab.

Regardless of the purpose of your paperwork—whether financial, legal, or personal—our platform has you covered. Try US Legal Forms now!

- Locate the document you require by utilizing the search bar at the top of the page.

- Preview it (if this option is available) and read the accompanying description to determine if Contractor Payment Schedule With Irs is what you seek.

- Restart your search if you need a different document.

- Sign up for a free account and select a subscription plan to acquire the template.

- Click Buy now. Once the payment is processed, you can obtain the Contractor Payment Schedule With Irs, fill it out, print it, and send or mail it to the necessary parties or organizations.

Form popularity

FAQ

If you're a sole-proprietor, self-employed or a certain type of partnership*, you must fill out your T1 General, that's your standard personal income tax return. You must also complete a separate T2125 ?Statement of Business or Professional Activities?. This is where you specify: business and professional income earned.

Answer: Independent contractors report their income on Schedule C (Form 1040), Profit or Loss from Business (Sole Proprietorship). Also file Schedule SE (Form 1040), Self-Employment Tax if net earnings from self-employment are $400 or more.

The T5018 Statement of Contract Payments reports to CRA the income you made as a subcontractor. It is taxable income. The slip is for informational purposes only on payments over $500 to a subcontractor that provided construction services. Unlike the T4A, the total in box 22 might include GST/HST/PST amounts.

As an independent contractor, you control your fees, your work hours, and how you work. Because you're self-employed, you're responsible for managing your own taxes. The T2125 tax form is a must for reporting your income and expenses as an independent contractor.

Nevertheless, independent contractors are usually responsible for paying the Self-Employment Tax and income tax. With that in mind, it's best practice to save about 25?30% of your self-employed income to pay for taxes. And, remember, the more deductions you find, the less you'll have to pay.