Contractor Payment Schedule With Extra Payments

Description

How to fill out Self-Employed Independent Contractor Payment Schedule?

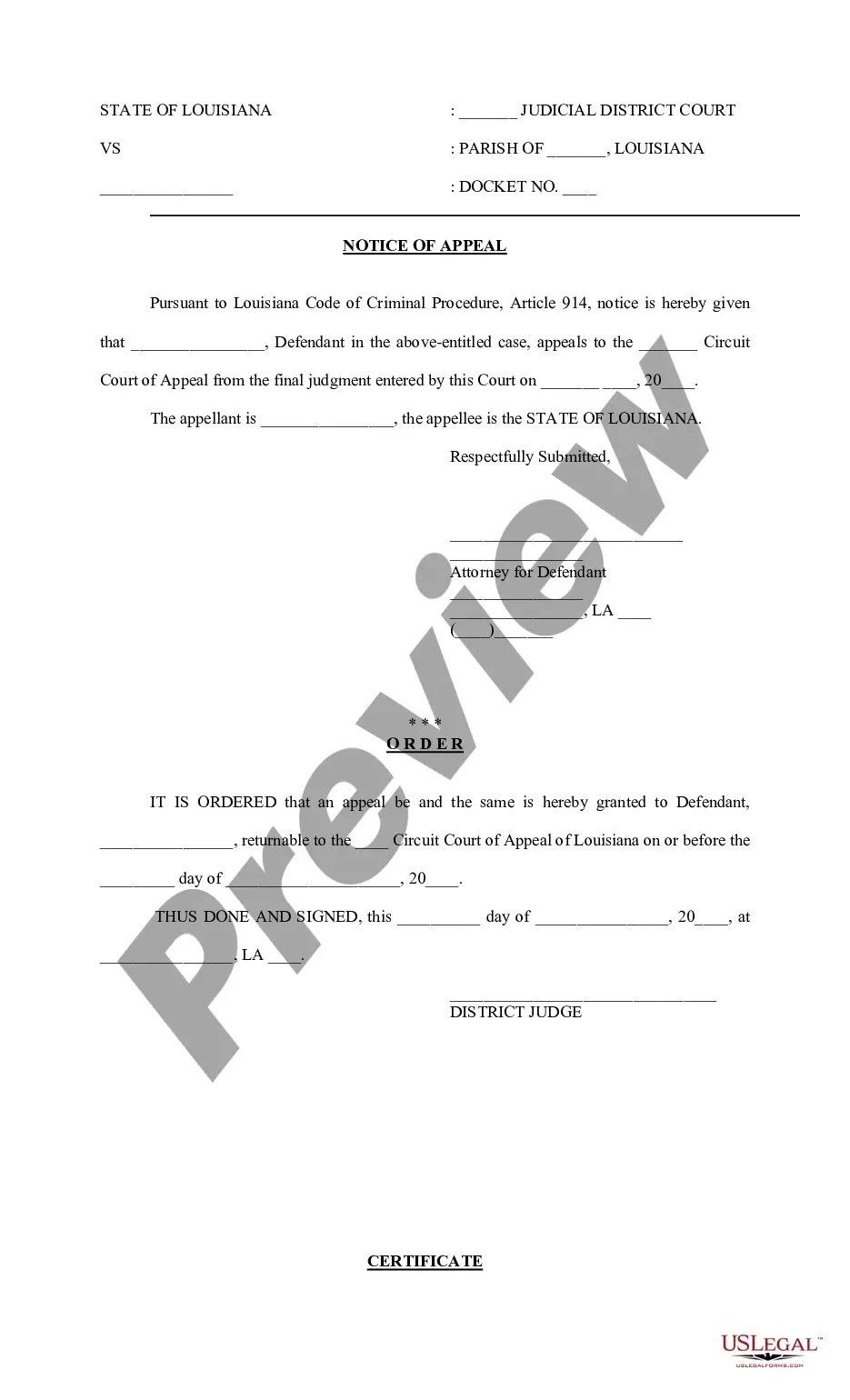

The Contractor Payment Schedule With Extra Payments displayed on this page is a reusable legal template created by qualified attorneys in accordance with federal and state regulations.

For over 25 years, US Legal Forms has offered individuals, businesses, and lawyers more than 85,000 authenticated, state-specific documents for any business and personal situation. It’s the fastest, simplest, and most dependable method to acquire the documents you require, as the service ensures the utmost level of data security and anti-malware safeguards.

Choose the format you prefer for your Contractor Payment Schedule With Extra Payments (PDF, Word, RTF) and download the sample to your device.

- Search for the document you require and examine it.

- Browse through the file you searched and preview it or review the form description to confirm it meets your requirements. If it does not, use the search bar to find the suitable one. Click Buy Now when you have located the template you need.

- Subscribe and Log In.

- Select the pricing plan that fits you and create an account. Use PayPal or a credit card for a swift payment. If you already possess an account, Log In and check your subscription to proceed.

- Obtain the fillable template.

Form popularity

FAQ

Net 10, 30, and 60. Net payment is the most common payment schedule for medium-sized construction companies. This payment term refers to the number of days ? 10, 30, or 60 days ? within which an owner should pay an invoice after it has been received.

A payment schedule template typically includes the following information: Name of your contractors or vendors. Descriptions of the services or products being provided. Total amount agreed upon with the vendor or contractor. Total amount due date. First payment. Last payment.

What Is a Conditional Payment Clause? A conditional payment clause is a clause that conditions payment on some other event. For example, contractors often include a clause in their subcontracts that conditions payment to the subcontractor on the contractor first receiving payment from the owner.

The most common type of construction payment is a net payment, meaning the invoice is due a set amount of days from the issue date. For longer projects, it's typical to pay an upfront deposit and then to pay the contractor monthly until the job is finished.

A payment schedule must[2]: Identify the payment claim to which it relates; Indicate the amount of the payment that the respondent proposes to make; and. State the respondent's reasons for withholding payment.