15 U S C 1681b Permissible Purpose Letter Format

Description

provided to inform users of consumer reports of their legal obligations. The first section of this summary sets forth the responsibilities imposed by the FCRA on all users of consumer reports. The subsequent sections discuss the duties of users of reports that contain specific types of information, or that are used for certain purposes, and the legal consequences of violations.

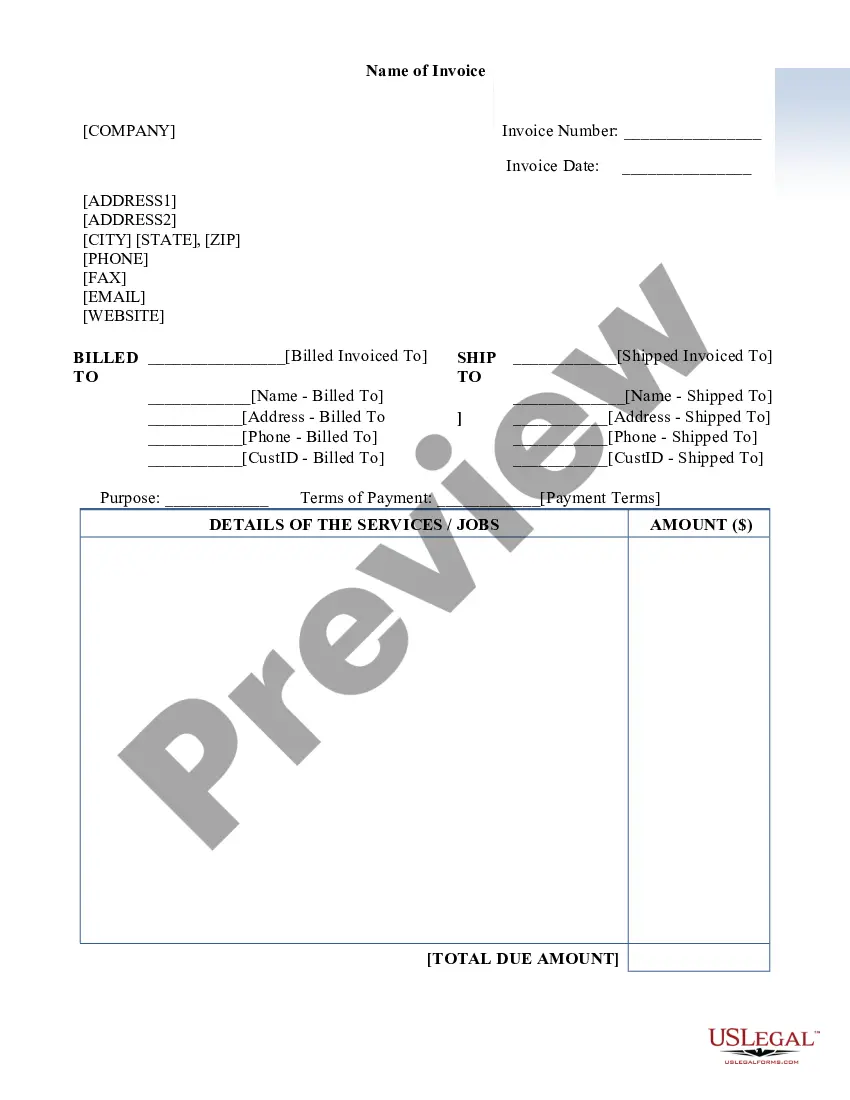

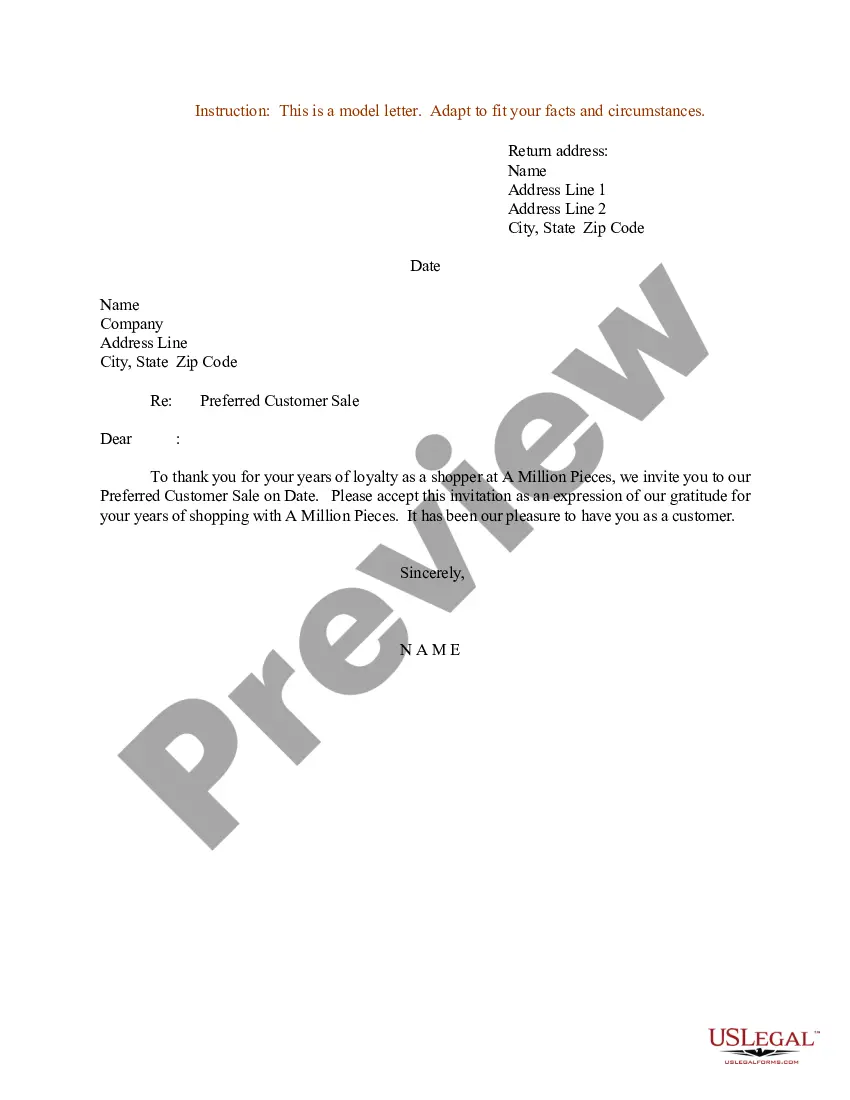

How to fill out Notice To Users Of Consumer Reports - Obligations Of Users Under The FCRA?

Managing legal documents can be daunting, even for seasoned professionals.

If you are seeking a 15 U S C 1681b Permissible Purpose Letter Format and lack the time to search for the accurate and latest version, the process can be stressful.

Tap into a library of articles, guides, manuals, and resources tailored to your circumstances and requirements.

Conserve time and energy searching for the documents you need, utilizing US Legal Forms’ advanced search and Preview feature to obtain the 15 U S C 1681b Permissible Purpose Letter Format.

Make sure that the template is accepted in your state or county. Click Buy Now when you are prepared. Select a subscription option, choose the desired file format, and Download, complete, sign, print, and send your document. Enjoy the US Legal Forms web library, backed by 25 years of expertise and reliability. Transform your daily document management into a simple and user-friendly experience today.

- If you have a subscription, Log In to your US Legal Forms account, search for the form, and obtain it.

- Check your My documents section to view previously saved documents and manage your folders as needed.

- If this is your first experience with US Legal Forms, create an account and gain unrestricted access to all the platform's features.

- Here are the steps to follow after downloading the desired form.

- Ensure this is the right document by previewing it and reviewing its details.

- Access regional or local legal and business documents.

- US Legal Forms meets all your requirements, from personal to corporate paperwork, all in one location.

- Employ sophisticated tools to complete and manage your 15 U S C 1681b Permissible Purpose Letter Format.

Form popularity

FAQ

A permissible purpose includes legitimate reasons defined by law to obtain a consumer report, such as employment screening, credit applications, or legal proceedings. These purposes ensure the protection of personal privacy while allowing access to necessary information. It is important to articulate these reasons using the 15 U.S.C. 1681b permissible purpose letter format to remain compliant and respectful of individual rights.

A 15 US code 1681 letter is a formal request for a consumer report as outlined in Section 1681 of the Fair Credit Reporting Act. This letter must specify the permissible purpose for which the report is being requested. To comply with the law, ensure that it follows the 15 U.S.C. 1681b permissible purpose letter format, protecting the rights of the individuals involved.

Permissible uses refer to the specific scenarios in which you can legally obtain and use consumer reports. Common examples include hiring decisions, rental applications, or credit evaluations. By understanding permissible uses, you can effectively implement the 15 U.S.C. 1681b permissible purpose letter format in your requests, ensuring adherence to regulatory standards.

The statement of purpose for a background check summarizes the intent behind the request for an individual's consumer report. It clearly defines the permissible purpose, such as employment or tenancy decisions. This statement should align with the requirements of the 15 U.S.C. 1681b permissible purpose letter format to maintain legal compliance and safeguard personal information.

The 15 USC 1681b permissible purpose letter is a document that outlines the specific reasons a consumer report is being requested. It is essential for legal compliance, serving as proof that the requester has a legitimate reason under the Fair Credit Reporting Act. Using the correct 15 U.S.C. 1681b permissible purpose letter format helps ensure transparency and builds trust with the report subjects.

A permissible purpose background check is an investigation conducted based on the legal reasons defined under the Fair Credit Reporting Act. This kind of check allows employers, landlords, and lenders to gather necessary information about a person while respecting their rights. To ensure compliance, utilize the 15 U.S.C. 1681b permissible purpose letter format when requesting such information.

A permissible purpose for a background check refers to the valid reasons allowed by law to obtain someone’s consumer report. Under the Fair Credit Reporting Act, these reasons include employment verification, tenant screening, or even to assess creditworthiness. Understanding permissible purposes is crucial for compliance, ensuring that you use the 15 U.S.C. 1681b permissible purpose letter format correctly.

Section 604 of the FCRA outlines specific permissible purposes for accessing consumer credit reports. These purposes include transactions initiated by the consumer, employment purposes, and other specific business needs. Compliance with these criteria is essential for businesses. By utilizing the 15 U.S.C. 1681b permissible purpose letter format, organizations can effectively communicate their reasons for access and uphold ethical standards.

An example of an FCRA permissible purpose includes a credit application where a lender needs to assess an applicant's creditworthiness. This legal framework protects consumers from unauthorized access to their reports. For businesses, adhering to the 15 U.S.C. 1681b permissible purpose letter format helps establish a clear, documented reason for obtaining this sensitive information. This approach supports compliance while fostering a responsible lending environment.

Permissible purpose on a credit report signifies the lawful reasons for which a credit report can be obtained. According to the FCRA, it includes needs for credit transactions, employment decisions, or rental agreements. Understanding this term is crucial for consumers and businesses alike. Adopting the 15 U.S.C. 1681b permissible purpose letter format can simplify the documentation process and demonstrate compliance.