Co-founder Agreement For Startup

Description

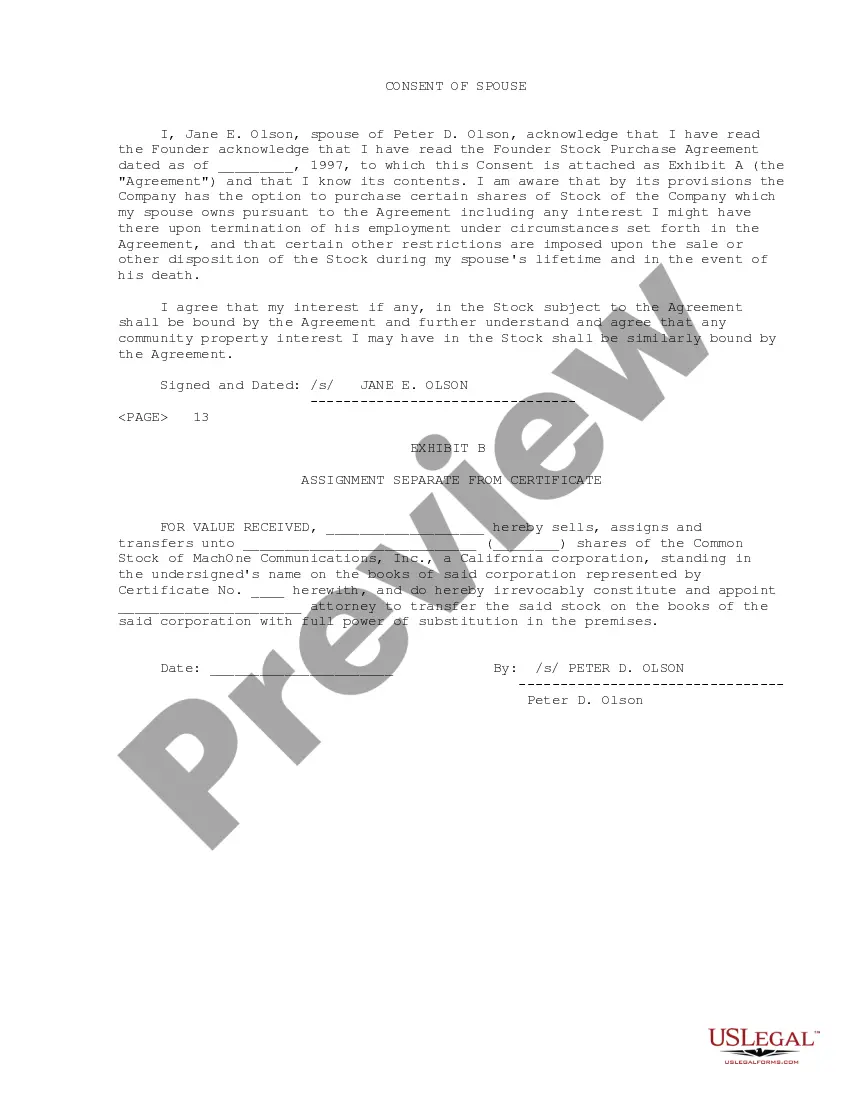

How to fill out Sample Founder Stock Purchase Agreement Between MachOne Communications, Inc. And Peter D. Olson?

There’s no longer a requirement to waste time searching for legal documents to meet your local state obligations.

US Legal Forms has gathered all of them in a single location and improved their accessibility.

Our platform provides over 85k templates for any commercial and personal legal situations organized by state and application area.

Utilize the form description and preview options if available. Use the Search field above to look for another template if the current one isn’t suitable. Click Buy Now beside the template title when you find the right one. Select the most appropriate pricing plan and either register for an account or Log In. Process payment for your subscription with a credit card or through PayPal to proceed. Choose the file format for your Co-founder Agreement For Startup and download it to your device. Print your form for manual completion or upload the template if you wish to edit it online. Creating legal documentation under federal and state laws and regulations is quick and straightforward with our platform. Try US Legal Forms now to maintain your paperwork organized!

- All forms are professionally created and validated for authenticity.

- You can rest assured in acquiring an up-to-date Co-founder Agreement For Startup.

- If you are acquainted with our platform and already possess an account, ensure your subscription is active before downloading any templates.

- Log In to your account, choose the document, and click Download.

- You can also revisit all obtained documents whenever necessary by accessing the My documents tab within your profile.

- If you haven't utilized our platform before, the procedure will require a few additional steps to finalize.

- Here's how new users can acquire the Co-founder Agreement For Startup in our collection.

- Review the page content thoroughly to confirm it holds the sample you need.

Form popularity

FAQ

For most companies, two to three people are sufficient as co-founders. Two co-founders is the most ideal from management perspective. Three, though okay in many cases, can become a crowd when new management is brought in and founders start taking sides.

SummaryRule 1) Try to split as equaly and fairly as possible.Rule 2) Don't take on more than 2 co-founders.Rule 3) Your co-founders should complement your competencies, not copy them.Rule 4) Use vesting.Rule 5) Keep 10% of the company for the most important employees.More items...?

The basic formula is simple: if your company needs to raise $100,000, and investors believe the company is worth $2 million, you will have to give the investors 5% of the company. The remainder of the investor category of equity can be reserved for future investors.

Investors claim 20-30% of startup shares, while founders should have over 60% in total. You may also leave some available pool (5%), but don't forget to allocate 10% to employees. Based on the most outstanding skills of co-founders, define your roles clearly within the company and assign job titles.

Investors, generally, tend to support companies which are run by a team than those who run solo. They trust companies with multiple founders and are likely to fund them more easily. So it is best to get a co-founder or co-founders by your side if you want to make the funding process smoother.