Irs Payment Plan Agreement Form

Description

How to fill out Fast Packet Services Payment Plan Agreement?

Individuals commonly relate legal documentation with complexity that only an expert can manage.

In a sense, this is accurate, as creating an Irs Payment Plan Agreement Form requires considerable knowledge of subject criteria, including state and county laws.

Nevertheless, with US Legal Forms, everything has become simpler: ready-made legal templates for various life and business situations specific to state legislation are compiled in a single online library and are now accessible to everyone.

Select the format for your document and click Download. Print your document or export it to an online editor for quicker completion. All templates in our library are reusable: once acquired, they remain stored in your profile. You can access them anytime via the My documents tab. Discover all the benefits of using the US Legal Forms platform. Register today!

- US Legal Forms offers over 85k current forms categorized by state and area of use, making it easy to find the Irs Payment Plan Agreement Form or any other specific template in just minutes.

- Users who have previously registered with an active subscription must Log In to their account and click Download to obtain the form.

- New users need to create an account and subscribe prior to downloading any documents.

- Here are the step-by-step instructions to obtain the Irs Payment Plan Agreement Form.

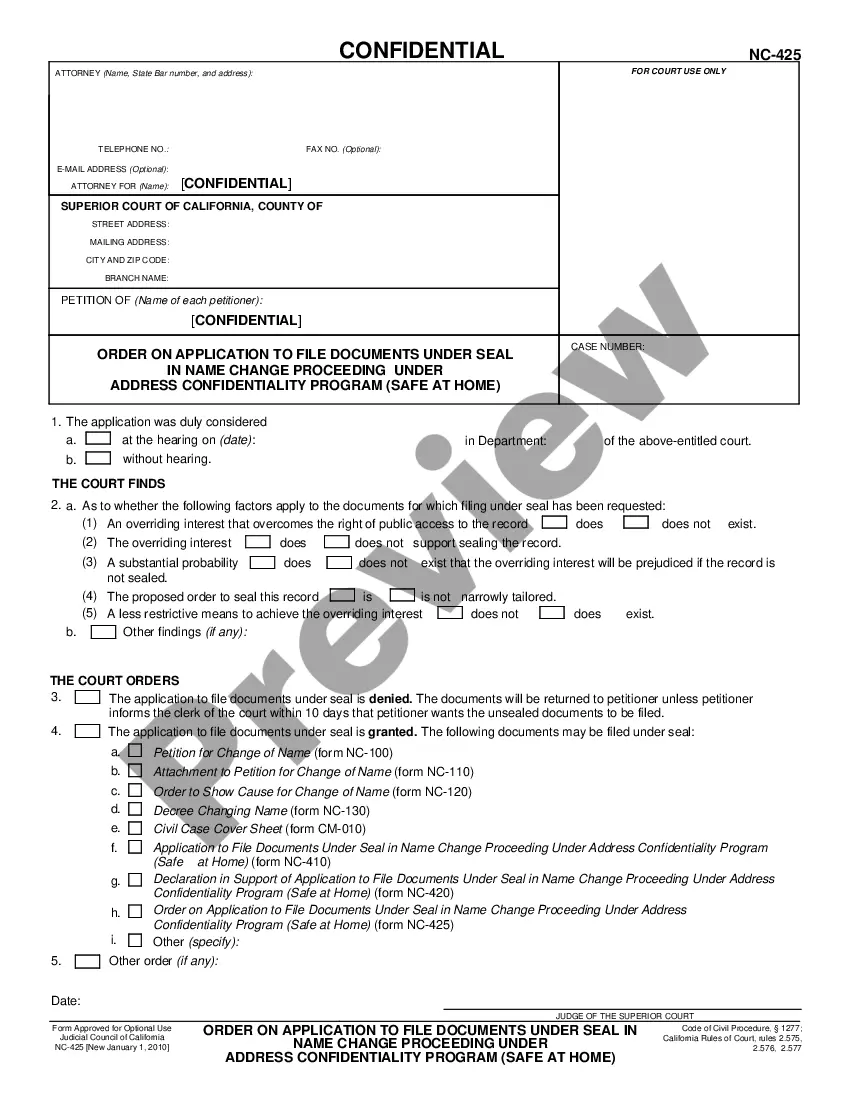

- Review the page content carefully to ensure it meets your requirements.

- Read the form description or view it using the Preview feature.

- If the previous sample does not fit your needs, find another using the Search field above.

- Click Buy Now when you locate the appropriate Irs Payment Plan Agreement Form.

- Select a subscription plan that aligns with your requirements and budget.

- Create an account or Log In to proceed to the payment section.

- Complete the payment for your subscription via PayPal or with your credit card.

Form popularity

FAQ

Make sure your check or money order includes the following information:Your name and address.Daytime phone number.Social Security number (the SSN shown first if it's a joint return) or employer identification number.Tax year.Related tax form or notice number.25-Mar-2022

Your minimum payment will be your balance due divided by 72, as with balances between $10,000 and $25,000.

Call the IRS at 1-800-829-1040 weekdays from 7am to 7pm local time. At the first prompt press 1 for English. At the next menu press 2 for questions about your personal income taxes. At the next menu press 1 for questions about a form you have already submitted, your tax history, or payment.

Short-Term Payment Plans (up to 180 days) Individuals may be able to set up a short-term payment plan using the Online Payment Agreement (OPA) application or by calling us at 800-829-1040 (individuals).