Bad For Check

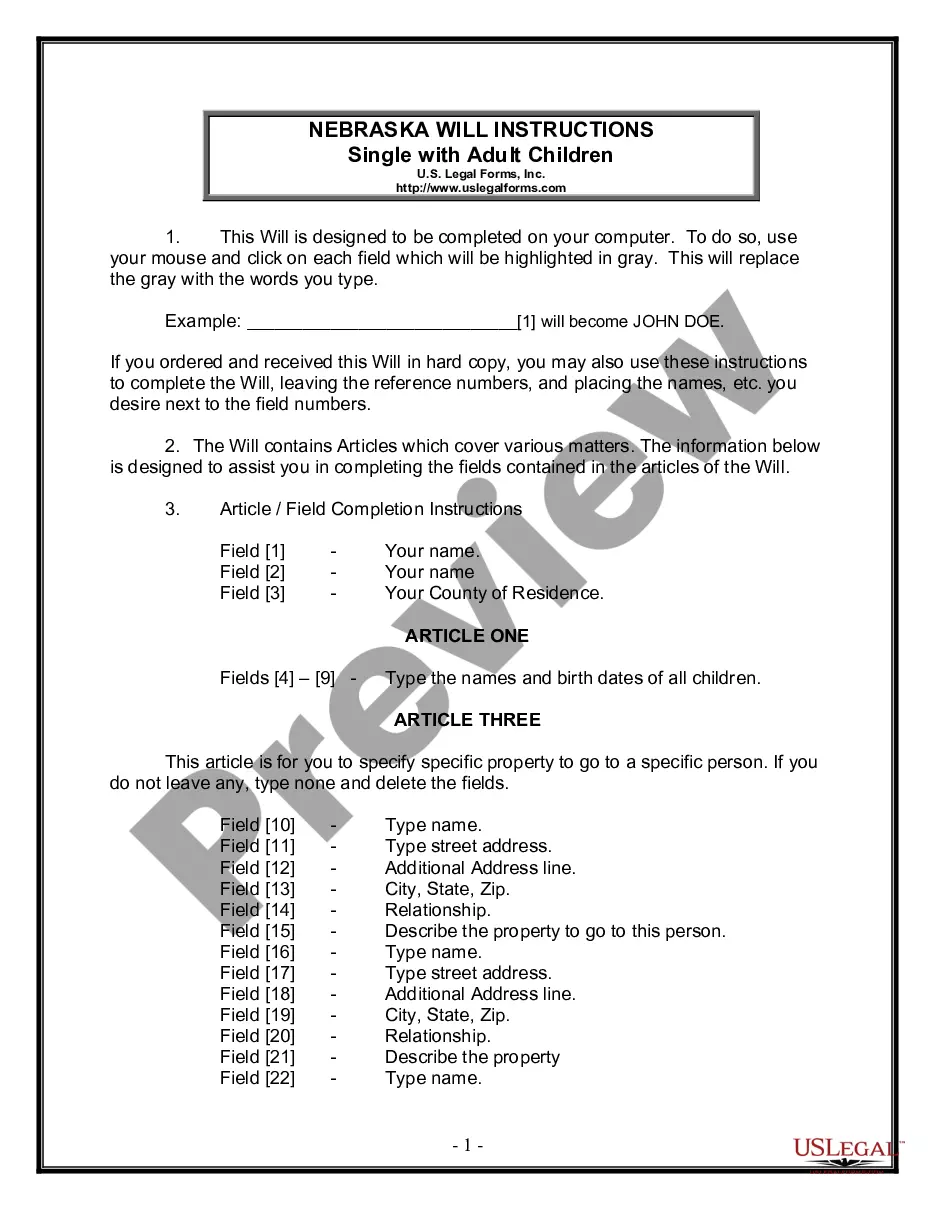

Description

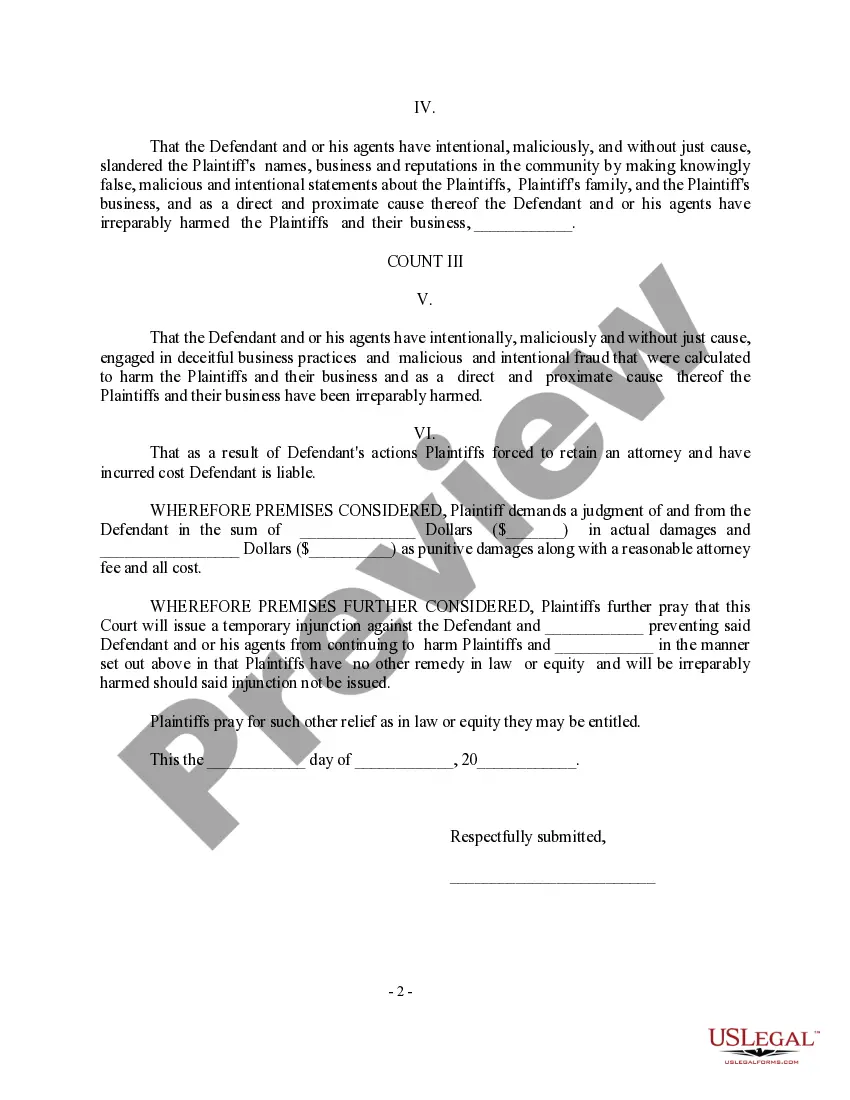

How to fill out Complaint Regarding Defamation, Fraud, Deceitful Business Practices?

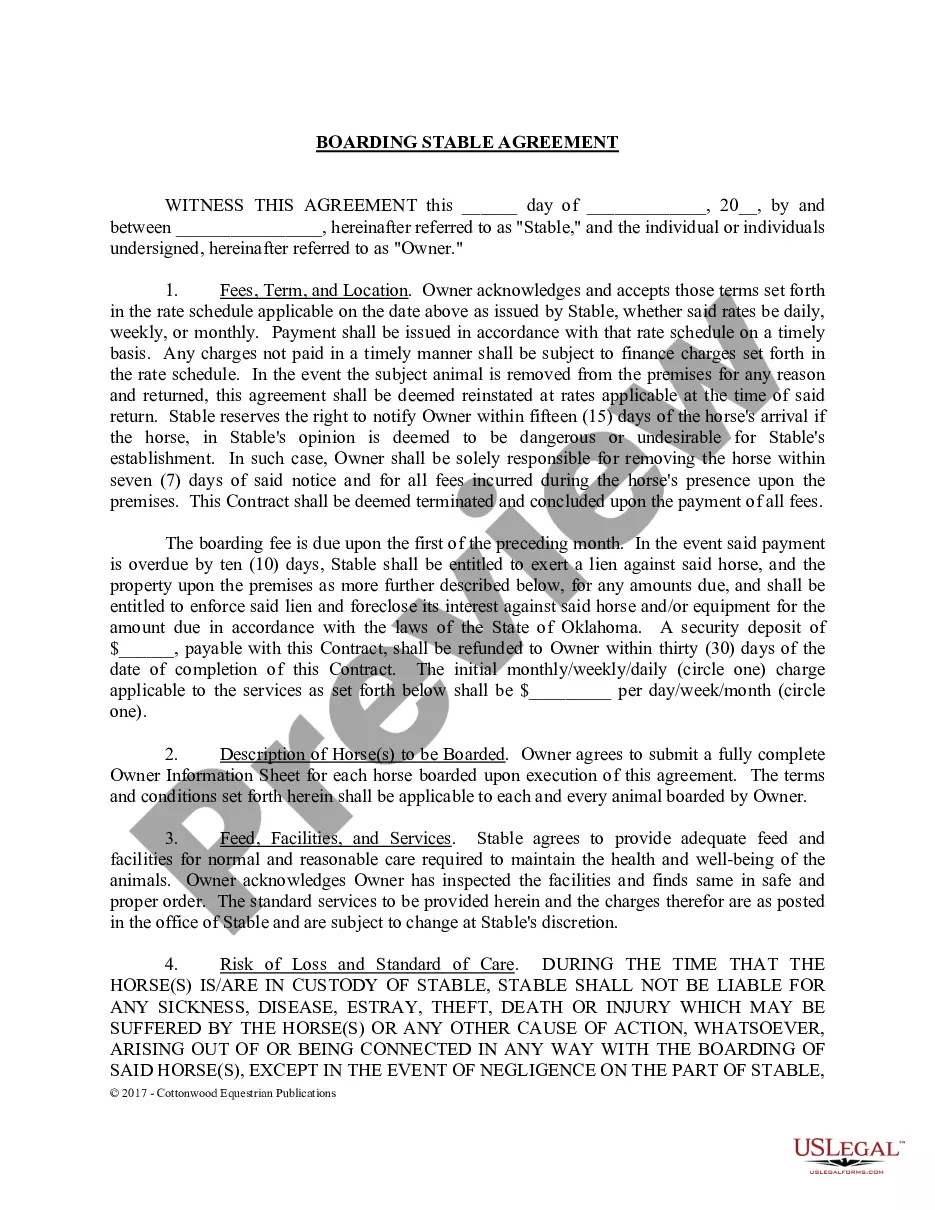

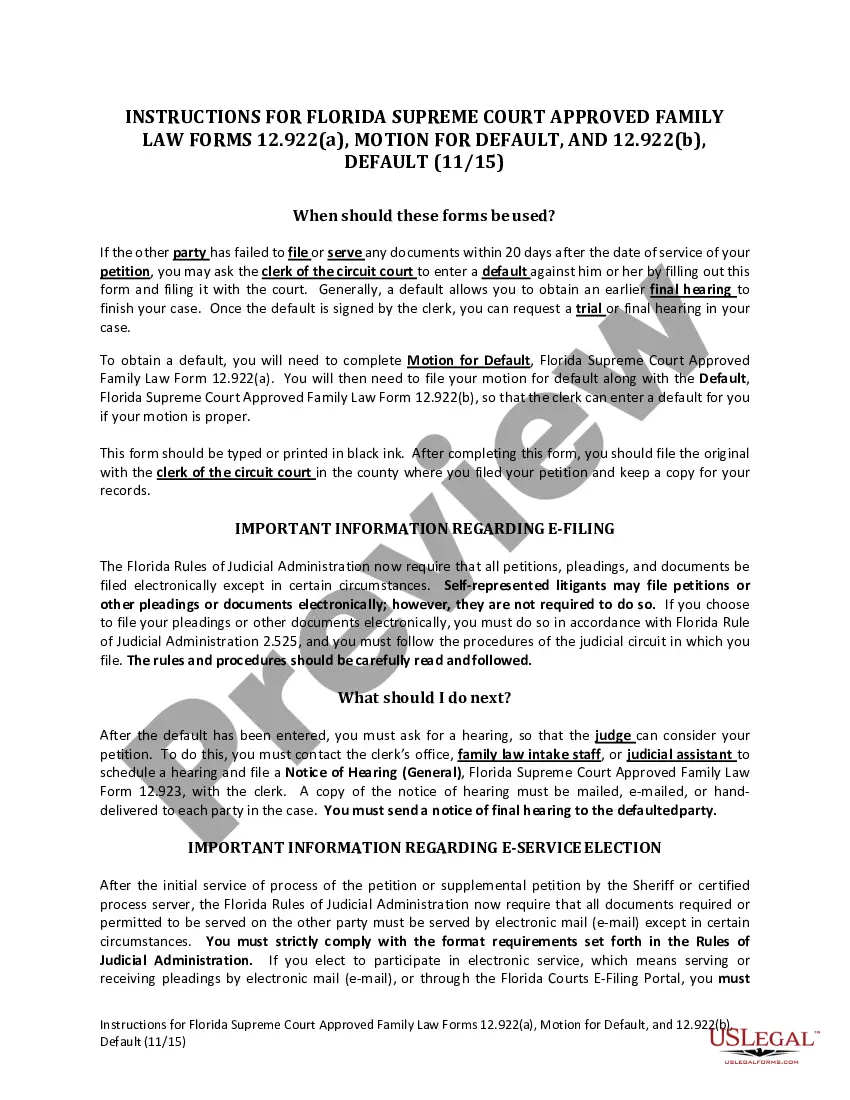

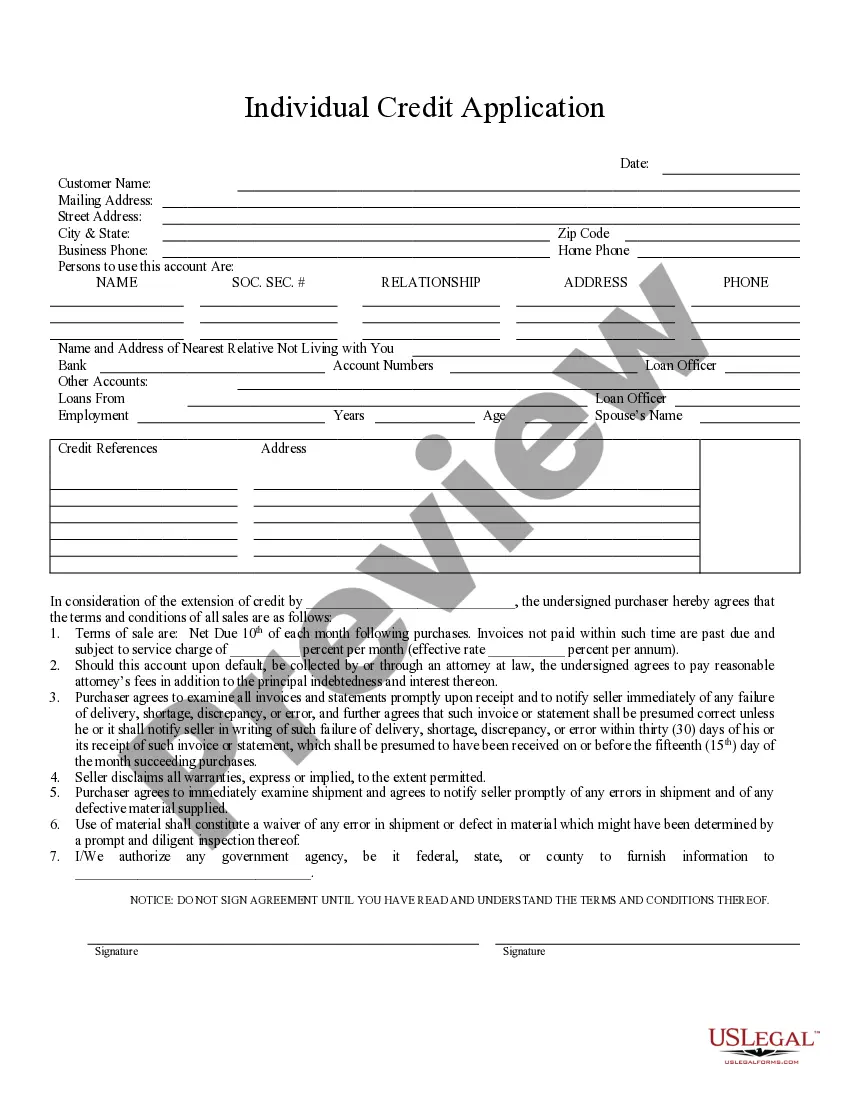

The Negative For Check you see on this page is a reusable legal blueprint crafted by expert attorneys in alignment with federal and local statutes and regulations.

For over 25 years, US Legal Forms has supplied individuals, businesses, and legal experts with more than 85,000 validated, state-specific documents for any commercial and personal situation. It’s the quickest, easiest, and most dependable way to acquire the paperwork you require, as the service ensures the utmost level of data protection and anti-malware safety.

Join US Legal Forms to have verified legal templates for all of life’s situations readily available.

- Search for the document you need and assess it.

- Browse through the file you searched and preview it or examine the form description to verify it meets your needs. If it does not, utilize the search bar to find the appropriate one. Click Buy Now once you have located the template you need.

- Register and Log In.

- Select the pricing plan that fits you and create an account. Use PayPal or a credit card to make an immediate payment. If you already possess an account, Log In and check your subscription to proceed.

- Acquire the editable template.

- Choose the format you desire for your Negative For Check (PDF, DOCX, RTF) and save the example on your device.

- Complete and endorse the documentation.

- Print out the template to fill it out manually. Alternatively, use an online versatile PDF editor to quickly and accurately complete and sign your form with an electronic signature.

- Retrieve your documents once more.

- Access the same document again whenever necessary. Open the My documents tab in your profile to redownload any previously saved forms.

Form popularity

FAQ

Writing a bad check is considered when you issue a check without enough funds in your bank account to cover it. It also includes checks written on closed accounts or those that have been flagged for fraud. If you find yourself dealing with issues related to bad for check, consider our services at US Legal Forms to find solutions that can help you manage this legal concern effectively. Understanding what constitutes a bad check can help you avoid serious financial and legal troubles.

A bad check is one that cannot be processed because the account lacks sufficient funds. For example, if you write a check for $500 but only have $200 in your account, that check would be considered bad for check. Such situations can cause trouble for both the payer and the payee, including fees and legal consequences. It’s important to manage your finances to avoid writing bad checks.

A bad check is essentially one that cannot be cashed due to a lack of funds, a frozen account, or an account that has been closed. This classification can lead to financial repercussions for the writer, such as fees or legal action. If you're unsure about your checks' validity, consider using resources on USLegalForms to understand check-writing requirements better.

A check might be deemed unacceptable for various reasons, such as insufficient funds, a mismatch with the checking account holder's name, or missing signatures. Additionally, checks that do not comply with banking regulations can be rejected. To avoid these issues, always verify your check details and utilize platforms like USLegalForms to guide you in properly formatting your checks.

Mistakes on a check can occur through simple errors, such as misspelling a name, calculating an incorrect amount, or recording the wrong date. These mistakes can complicate the transaction, potentially rendering it bad for check. To reduce errors, take your time when filling out checks and consider using templates or digital solutions, like USLegalForms.

A check becomes unreadable when information, such as the name, date, or amount, is unclear or smudged. This can happen due to poor printing, ink bleeding, or physical damage. An unreadable check is often rejected, making it bad for check transactions. Always double-check your writing for clarity to prevent this issue.

A bad check occurs when the account linked to the check does not have sufficient funds to cover the amount written. This can lead to fees for both the issuer and the recipient, making it detrimental to all parties involved. Ensuring proper funds before issuing a check is crucial to avoid being labeled as bad for check.

Depositing a bad check can result in various penalties, including fees from your bank and potential legal ramifications. The financial institution may hold you accountable for any losses incurred and could report the incident to credit agencies. It’s vital to understand these penalties and take preventive measures to avoid dealing with a bad check.

Banks may choose to pursue legal action for bad checks, especially if the amount is substantial. They typically take such matters seriously to protect their interests and discourage similar incidents. If you find yourself in a situation involving a bad check, consider reaching out to platforms like USLegalForms to understand your rights and obligations.

If you write a bad check for more than $500, you may face significant legal consequences. Writing a bad check of this amount can lead to criminal charges and potential fines, depending on your state's laws. It’s essential to recognize the seriousness of writing a bad check and to seek alternatives if you have concerns about covering the amount.