Share With Par Value

Description

How to fill out Amendment Of Common Stock Par Value?

The Share With Par Value displayed on this page is a versatile formal template created by expert lawyers in accordance with federal and state laws.

For over 25 years, US Legal Forms has supplied individuals, businesses, and lawyers with more than 85,000 validated, state-specific documents for any business and personal situation. It’s the quickest, simplest, and most reliable method to acquire the documents you require, as the service ensures the highest level of data protection and anti-malware measures.

Choose the format you prefer for your Share With Par Value (PDF, Word, RTF) and save the document on your device. Fill out and sign the paperwork. Print out the template to finish it by hand. Alternatively, use an online multi-functional PDF editor to swiftly and accurately complete and sign your form with a legally-binding electronic signature. Download your paperwork again whenever necessary. Access the My documents tab in your profile to redownload any previously saved forms. Sign up for US Legal Forms to have verified legal templates for all of life’s situations at your fingertips.

- Search for the document you require and examine it.

- Browse the sample you searched for and preview it or check the form description to confirm it meets your requirements. If it doesn’t, use the search bar to find the appropriate one. Click Buy Now when you have found the template you need.

- Subscribe and sign in.

- Select the pricing plan that fits you and create an account. Use PayPal or a credit card to make a quick payment. If you already possess an account, Log In and review your subscription to proceed.

- Obtain the fillable template.

Form popularity

FAQ

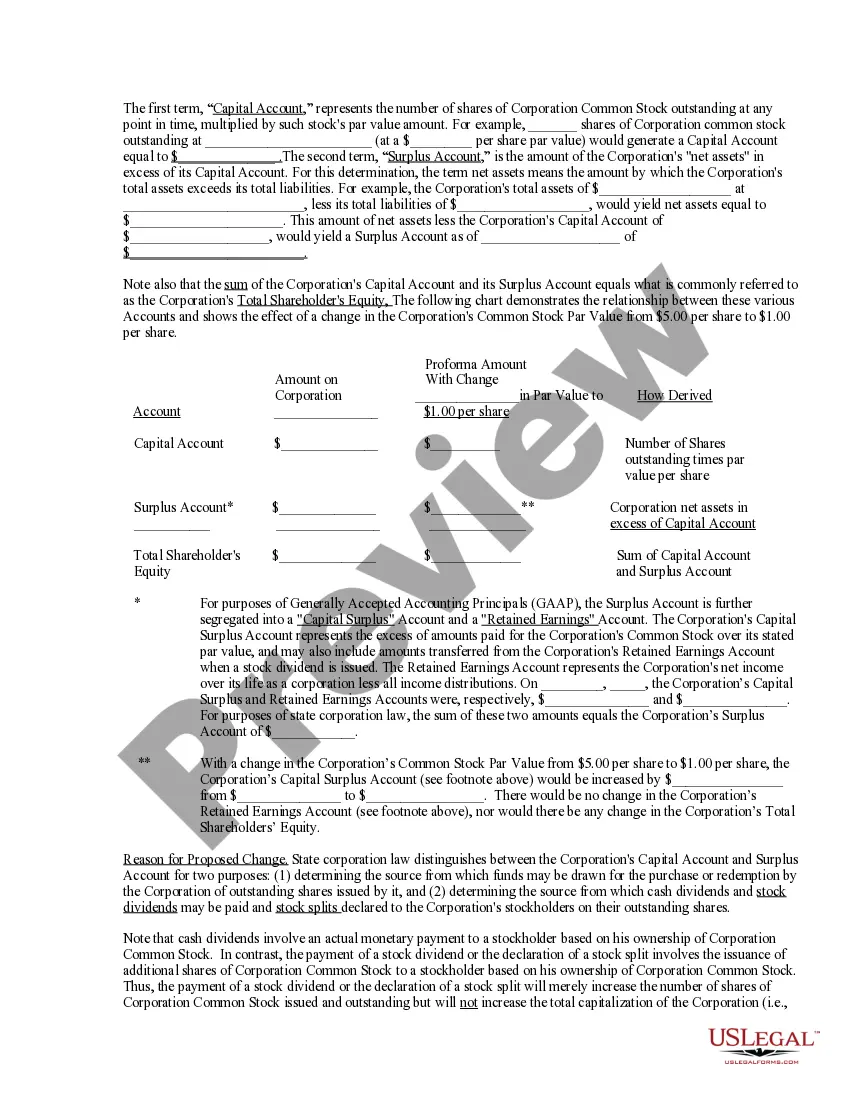

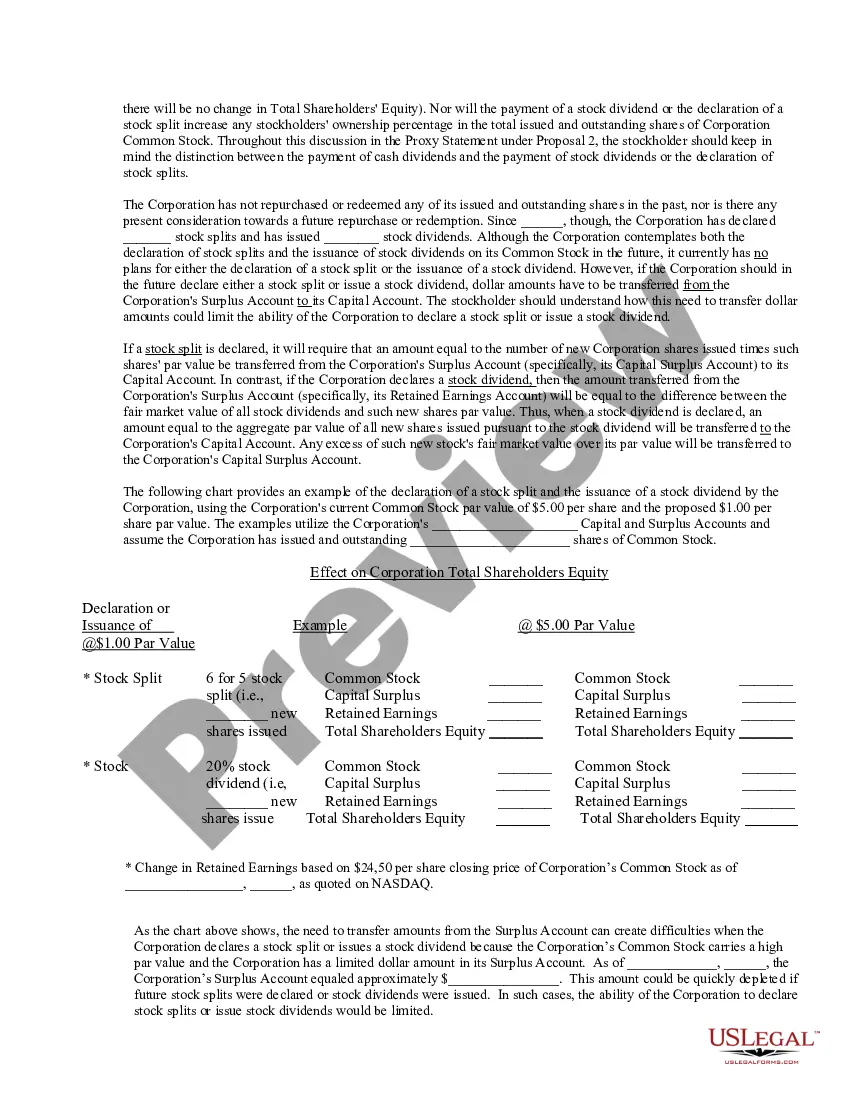

?Par value? or ?face value? is the lowest price for which a company can sell stock. ?Fair Market Value? is the notional value of stock on the market at the time of sale. A reasonable par value for an early stage company can be as low as $0.00001. Setting a par value low can avoid tax liabilities later.

The company's par value is calculated by multiplying the par value per share by the total number of shares issued. That means you'll just need to grab your calculator and key in the math.

The par value is the minimum price at which a corporation can legally sell its shares, and most are priced below $0.01. As a real-life example, Apple (NASDAQ: AAPL) has set its common stock's par value at $0.00001 per share.

A bond's par value is the face value of the bond plus coupon payments, annually or sem-annually, owed to the bondholders by the issuer of the debt. A bond with a par value of $1,000 and a coupon rate of 4% will have annual interest payments of 4% x $1,000 = $40.

For example, if company XYZ issues 1,000 shares of stock with a par value of $50, then the minimum amount of equity that should be generated by the sale of those shares is $50,000.