Avgo Stock Split For Long Term

Description

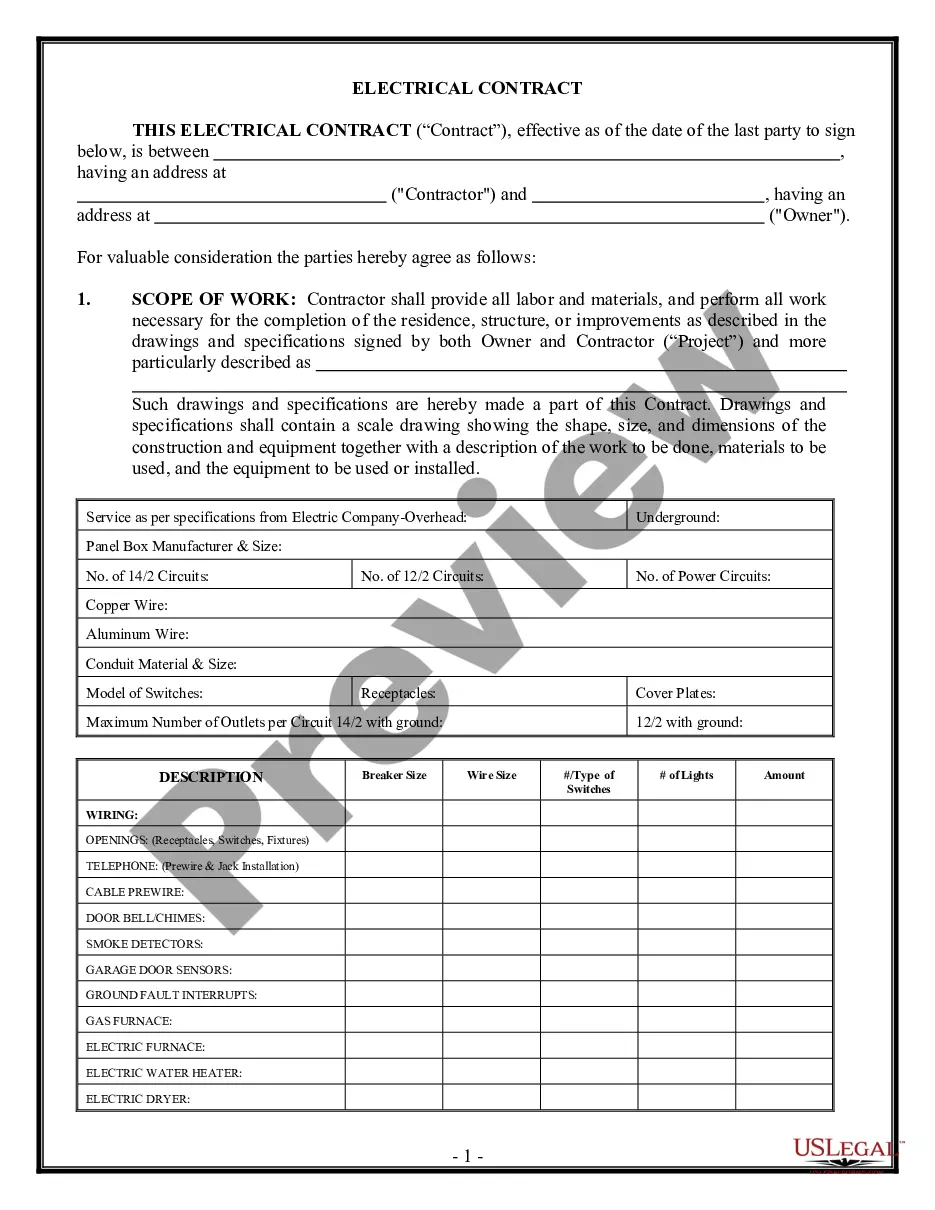

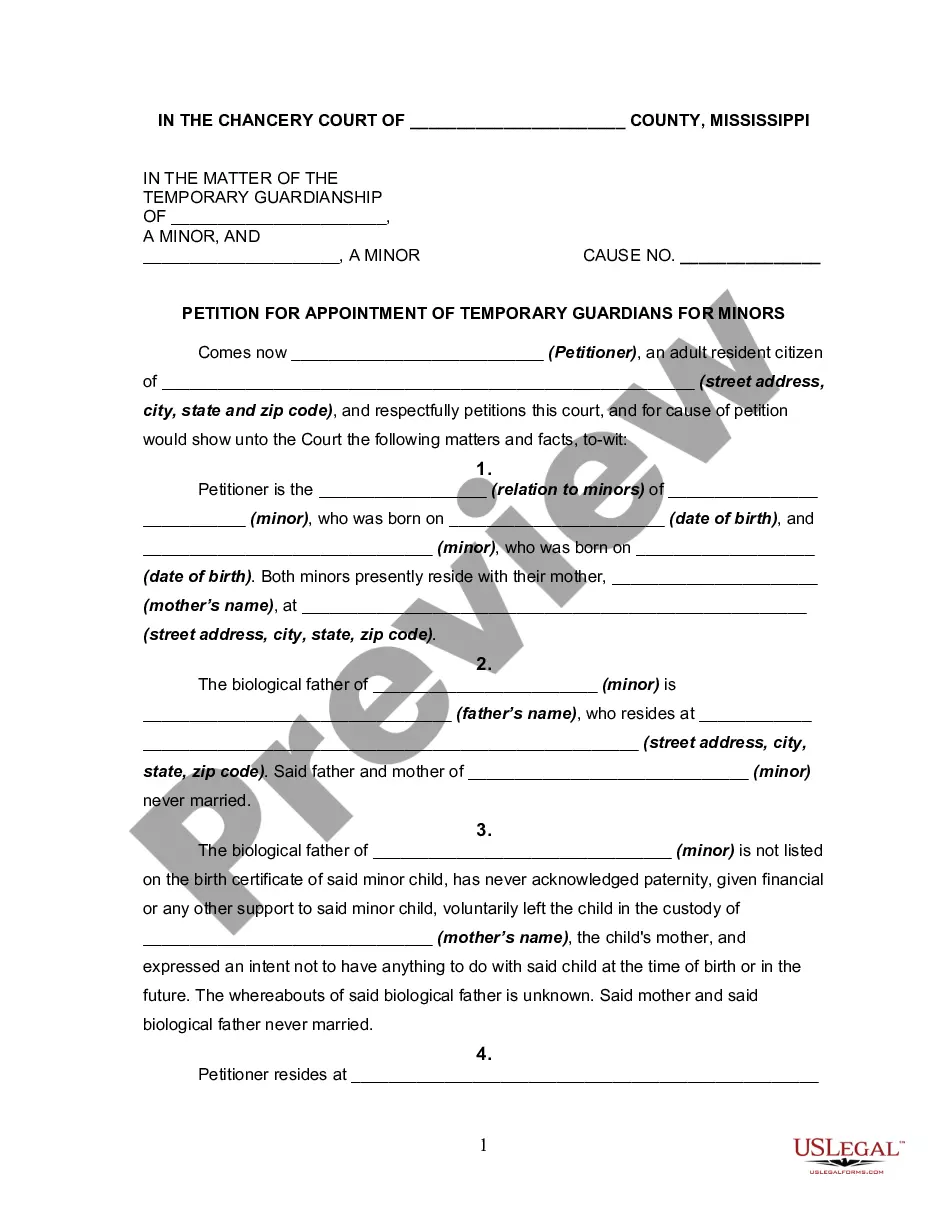

How to fill out Proposal To Amend Certificate To Reduce Par Value, Increase Authorized Common Stock And Reverse Stock Split With Exhibit?

- If you're a returning user, log in to your account and click the Download button for your required form, ensuring your subscription is active. Renew as necessary.

- For first-time users, begin by previewing the form to ensure it aligns with your needs and meets local jurisdictional requirements.

- Should you need a different template, utilize the Search tab to find the correct form. Confirm its relevance before proceeding.

- Purchase the document by clicking the Buy Now button and selecting your desired subscription plan. Create an account for access to the library resources.

- Complete your purchase using your credit card or PayPal account to secure your subscription.

- Download your chosen form, saving it to your device. You can access it at any time from the My Forms section of your profile.

Using US Legal Forms, individuals and attorneys can conveniently execute essential legal documents. With over 85,000 fillable forms, you have unparalleled access to a vast online legal library that is user-friendly and efficient.

In conclusion, understanding the documentation required for investment opportunities is vital. Utilize US Legal Forms to empower your investment journey today!

Form popularity

FAQ

Broadcom has established a strong track record of growth, buoyed by strategic acquisitions and expanding market opportunities. Industry analysts project that as technology evolves, Broadcom will likely capture further market share. This growth trajectory can be reassuring for investors looking at the Avgo stock split for long term gains, as it suggests that the company's fundamentals are solid.

Predicting how high AVGO stock will rise is challenging, yet analysts remain optimistic. Many believe that Broadcom's robust business model and innovative offerings will drive significant growth over time. As you consider investing for the long term, keep an eye on the Avgo stock split for long term potential that could elevate your investment portfolio.

The average gain after a stock split can vary, but many studies suggest that stocks tend to rise between 10% to 30% within the first year following the split. Investors often view stock splits as a positive indicator, signaling potential growth. For those considering the Avgo stock split for long term investment, such gains can be a compelling reason to enter the market.

When considering an investment in AVGO stock, many experts highlight its strong fundamentals and growth potential. The company’s consistent revenue growth and innovative technology position it well in the market. Additionally, as you think about the Avgo stock split for long term gains, keep in mind that such splits often enhance liquidity and attract new investors, potentially boosting long-term value.

The decision to buy before or after a stock split often depends on individual investment strategies. Some investors prefer purchasing before, anticipating increased demand post-split, while others wait for the split to occur. For a focused approach, considering the Avgo stock split for long term, it's essential to assess your investment goals and market conditions before making a decision.

Broadcom has established itself as a leader in the technology sector, making it a favorable choice for long-term investors. The company’s consistent revenue growth and commitment to returning value to shareholders through dividends add to its appeal. By focusing on the Avgo stock split for long term, you can position yourself to benefit from a robust investment in a strong company.

In the next five years, analysts predict that AVGO stock may exhibit considerable growth due to its strong market position and ongoing innovation. With regular updates and advancements in technology, particularly in semiconductors, the outlook remains optimistic. Considering the Avgo stock split for long term, many investors are encouraged to hold onto their shares as better performance may be on the horizon.

Stock splits, like the anticipated Avgo stock split for long term, can be beneficial for investors in various ways. They can increase the stock's liquidity and make shares more affordable for a broader audience. While splits do not inherently change a company's value, they can positively influence market perception and stock performance. Understanding the implications of such changes will help you make informed decisions.

AVGO is frequently viewed as a solid long-term investment opportunity, particularly in light of the Avgo stock split for long term. The stock has shown resilience in various market conditions, making it a trusted choice among investors. Additionally, Broadcom's commitment to innovation and expansion supports its potential for steady growth. Investing in AVGO can lead to strong returns if approached thoughtfully.

Many financial experts recommend considering Broadcom as a buy in 2025, especially with the Avgo stock split for long term in mind. As the tech sector continues to grow, Broadcom's strategic initiatives likely position it well for long-term success. Regularly evaluating financial reports and forecasts is essential for determining the best time to invest. This approach allows you to make well-informed decisions.