Statement Financial Form Template With Solution

Description

How to fill out Statement Of Financial Affairs - Form 7?

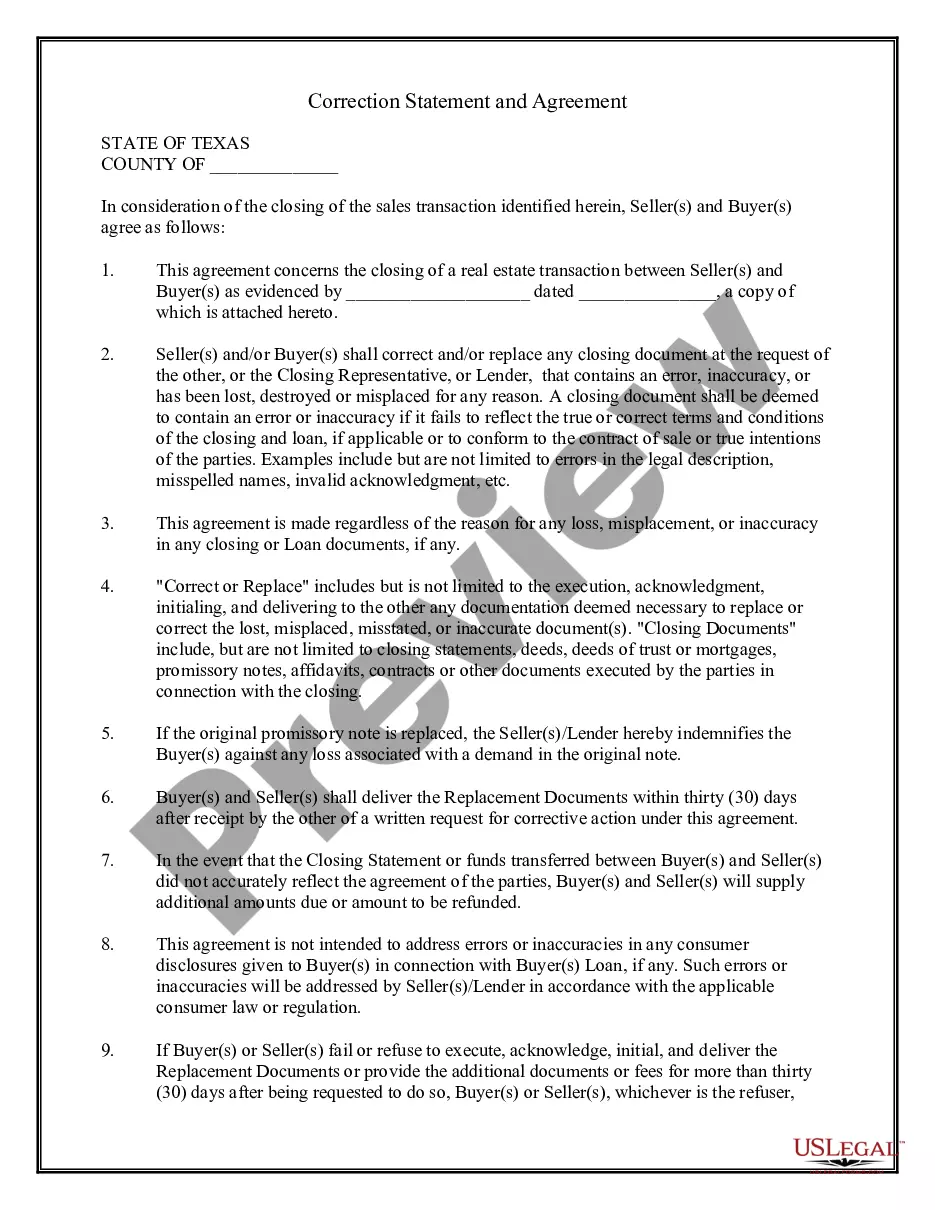

The Statement Financial Form Template With Solution presented on this page is a versatile legal template created by experienced attorneys in compliance with federal and state laws.

For over 25 years, US Legal Forms has supplied individuals, organizations, and legal practitioners with more than 85,000 authenticated, state-specific documents for any business and personal circumstances. It’s the quickest, easiest, and most dependable method to acquire the forms you require, as the service ensures the highest standard of data protection and anti-malware safeguards.

Register for US Legal Forms to access verified legal templates for all of life’s circumstances.

- Search for the document you need and review it.

- Sign up and Log In.

- Download the fillable template.

- Complete and sign the document.

- Download your papers again.

Form popularity

FAQ

How to fill out SBA Form 413 Gather required documents. ... Select the SBA loan type or program. ... Enter business and personal information. ... Add your assets and their value. ... Add your liabilities and their value. ... List income and any contingent liabilities. ... Add any additional details. ... Review the form, sign and date.

A statement of financial position is often formatted as a table with three columns. The first column lists the asset accounts, the second column lists liability or equity accounts and the final column contains totals for each section that are used to calculate net worth.

Follow these steps: Close the revenue accounts. Prepare one journal entry that debits all the revenue accounts. ... Close the expense accounts. Prepare one journal entry that credits all the expense accounts. ... Transfer the income summary balance to a capital account. ... Close the drawing account.

It will help you to get a clear idea of the cost to run your home. Filling in the Financial Statement template. ... Enter your personal details. ... Enter your income. ... Enter your expenditure totals. ... Calculate how much you have left for all debts. ... Enter your debt details. ... Calculate how much you have left for secondary debts.

Follow these steps: Close the revenue accounts. Prepare one journal entry that debits all the revenue accounts. ... Close the expense accounts. Prepare one journal entry that credits all the expense accounts. ... Transfer the income summary balance to a capital account. ... Close the drawing account.