Exempt Property Simple Definition

Description

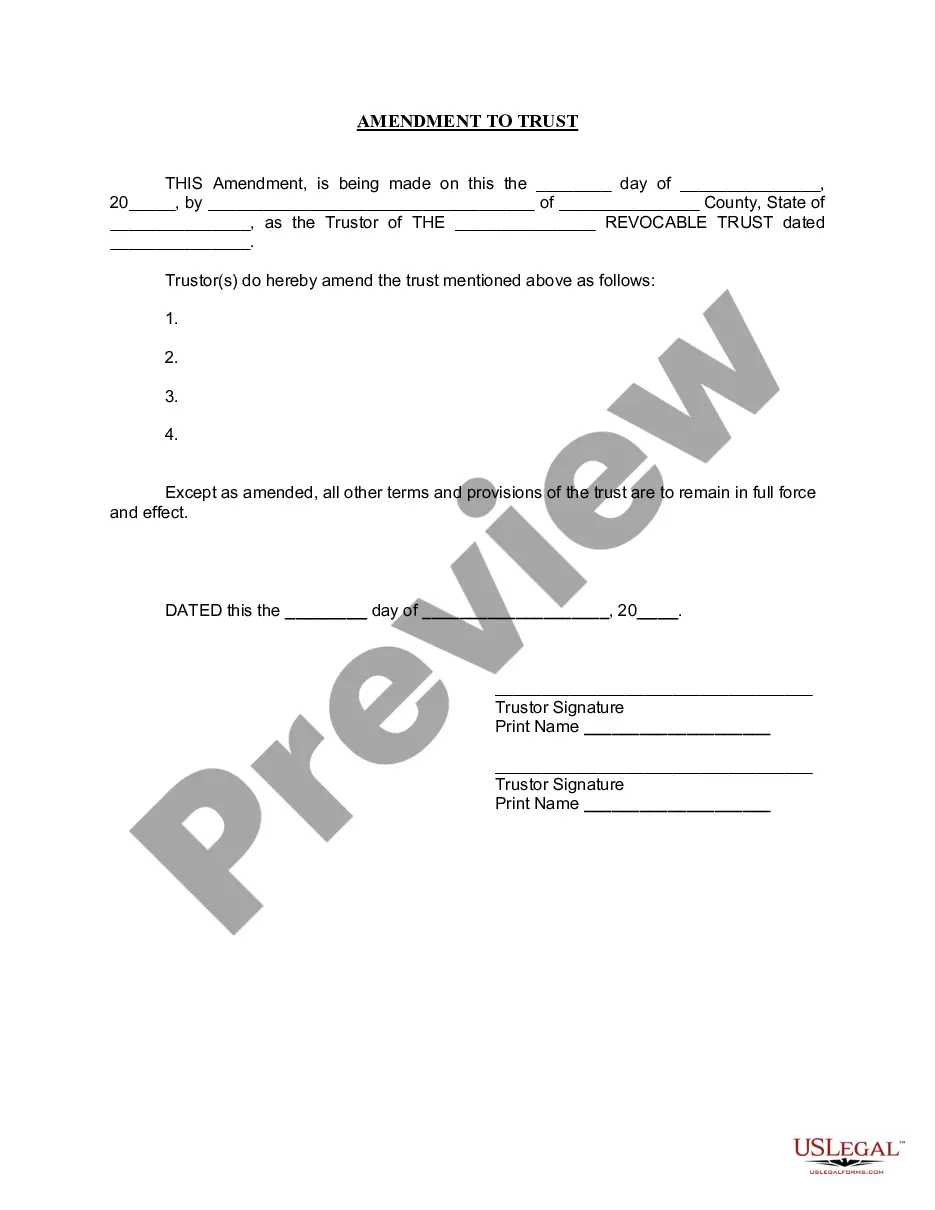

How to fill out Property Claimed As Exempt - Schedule C - Form 6C - Post 2005?

Whether for business purposes or for personal affairs, everybody has to handle legal situations at some point in their life. Completing legal papers demands careful attention, starting with choosing the correct form template. For instance, when you choose a wrong edition of a Exempt Property Simple Definition, it will be rejected when you submit it. It is therefore crucial to have a reliable source of legal documents like US Legal Forms.

If you need to obtain a Exempt Property Simple Definition template, follow these easy steps:

- Find the template you need by utilizing the search field or catalog navigation.

- Look through the form’s description to ensure it suits your situation, state, and county.

- Click on the form’s preview to view it.

- If it is the incorrect document, go back to the search function to find the Exempt Property Simple Definition sample you need.

- Get the template if it meets your requirements.

- If you have a US Legal Forms account, click Log in to gain access to previously saved templates in My Forms.

- If you do not have an account yet, you may download the form by clicking Buy now.

- Choose the proper pricing option.

- Complete the account registration form.

- Choose your transaction method: you can use a bank card or PayPal account.

- Choose the document format you want and download the Exempt Property Simple Definition.

- After it is saved, you are able to complete the form with the help of editing software or print it and finish it manually.

With a substantial US Legal Forms catalog at hand, you never need to spend time searching for the appropriate template across the internet. Use the library’s straightforward navigation to find the right form for any occasion.

Form popularity

FAQ

But if you live in more than one home, the IRS determines your primary residence by: Where you spend the most time. Your legal address listed for tax returns, with the USPS, on your driver's license and on your voter registration card.

To claim this tax exemption, you must complete form TP-274-V, Designation of Property as a Principal Residence, and include it with your income tax return for the year of sale. If you do not send us this form, you are liable to a penalty of $100 per month, to a maximum of $5,000.

You are an excluded owner of a residential property if you are any of the following: the government of Canada or a province, or an agent of the government of Canada or a province. an owner of the residential property as a trustee of any of the following trusts: a mutual fund trust for Canadian income tax purposes.

Failure to comply with these administrative rules entails penalties, which is the lesser of $100/month of late designation or $8,000 for the year.

Excluded owner An individual who is a Canadian citizen or permanent resident (unless included in the list of affected owners) Any person that owns a residential property as a trustee of a mutual fund trust, real estate investment trust, or specified investment flow-through (SIFT) trust for Canadian income tax purposes.