Property Schedule B Form 1040

Description

How to fill out Personal Property - Schedule B - Form 6B - Post 2005?

Legal document management might be overwhelming, even for the most skilled professionals. When you are searching for a Property Schedule B Form 1040 and don’t get the a chance to commit in search of the appropriate and updated version, the procedures can be demanding. A strong online form catalogue might be a gamechanger for everyone who wants to manage these situations successfully. US Legal Forms is a industry leader in web legal forms, with over 85,000 state-specific legal forms available to you whenever you want.

With US Legal Forms, you may:

- Gain access to state- or county-specific legal and business forms. US Legal Forms covers any requirements you might have, from individual to enterprise papers, all-in-one location.

- Utilize advanced resources to accomplish and handle your Property Schedule B Form 1040

- Gain access to a useful resource base of articles, guides and handbooks and resources connected to your situation and needs

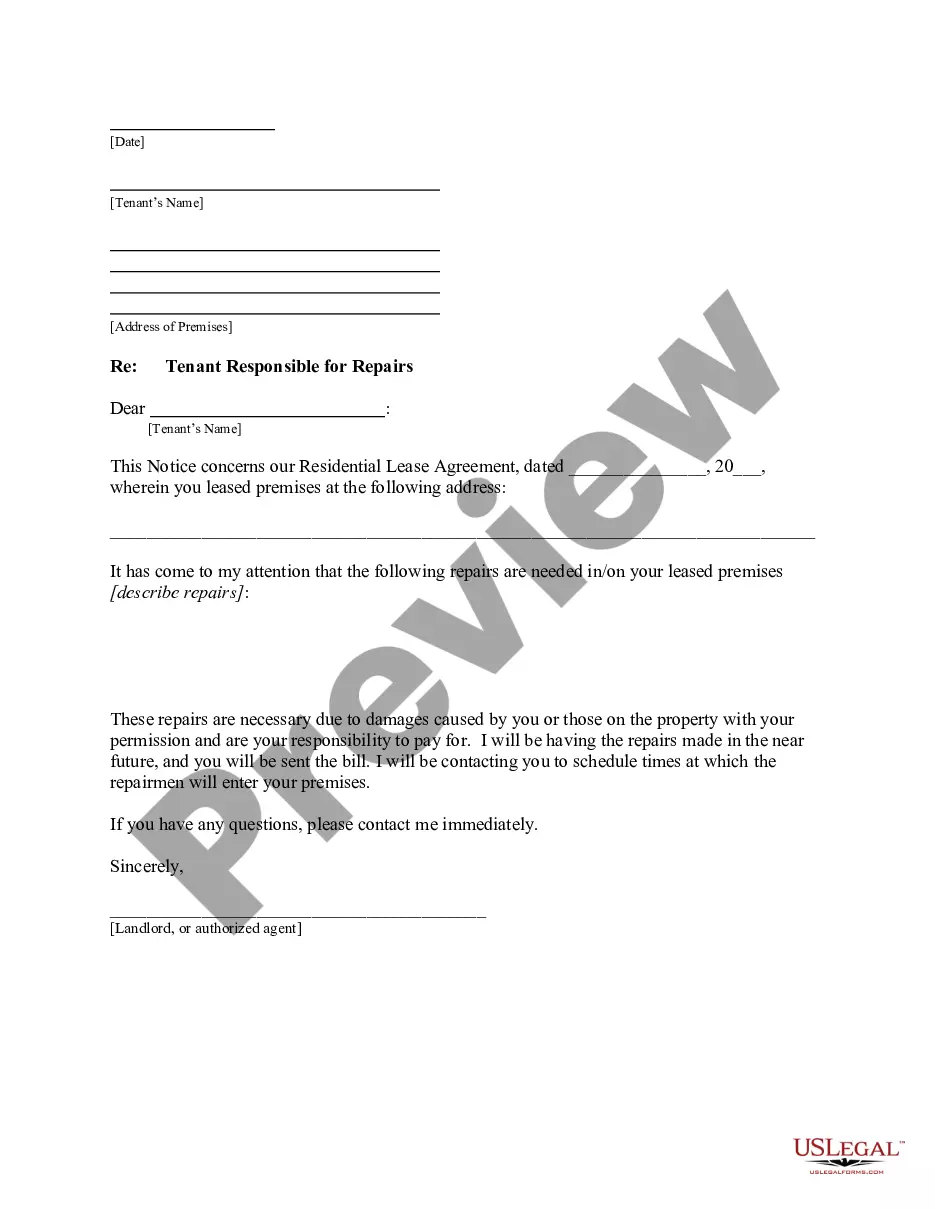

Save time and effort in search of the papers you will need, and use US Legal Forms’ advanced search and Review feature to get Property Schedule B Form 1040 and download it. If you have a membership, log in to your US Legal Forms account, search for the form, and download it. Take a look at My Forms tab to see the papers you previously downloaded as well as handle your folders as you see fit.

Should it be your first time with US Legal Forms, make an account and acquire unlimited use of all advantages of the library. Listed below are the steps for taking after downloading the form you want:

- Confirm it is the proper form by previewing it and reading through its information.

- Be sure that the sample is acknowledged in your state or county.

- Pick Buy Now when you are ready.

- Select a subscription plan.

- Pick the format you want, and Download, complete, eSign, print and send your papers.

Enjoy the US Legal Forms online catalogue, supported with 25 years of expertise and trustworthiness. Enhance your everyday papers managing in to a smooth and intuitive process today.

Form popularity

FAQ

Schedule B reports the interest and dividend income you receive during the tax year.

More In Forms and Instructions Use Schedule B (Form 1040) if any of the following applies: You had over $1,500 of taxable interest or ordinary dividends. You received interest from a seller-financed mortgage and the buyer used the property as a personal residence. You have accrued interest from a bond.

The IRS Form 941 Schedule B for 2023 is used by semiweekly schedule depositors that report more than $50,000 in employment taxes. Businesses that acquire more than $100,000 in liabilities during a single day in the tax year are also required to begin filing this Schedule.

Schedule B reports the interest and dividend income you receive during the tax year. However, you don't need to attach a Schedule B every year you earn interest or dividends. It is only required when the total exceeds certain thresholds.

Line 8. If you received a distribution from a foreign trust, you must provide additional information. For this purpose, a loan of cash or marketable securities is generally considered to be a distribution. See the Instructions for Form 3520 at IRS.gov/Form3520 for details.