Position Is Exempt

Description

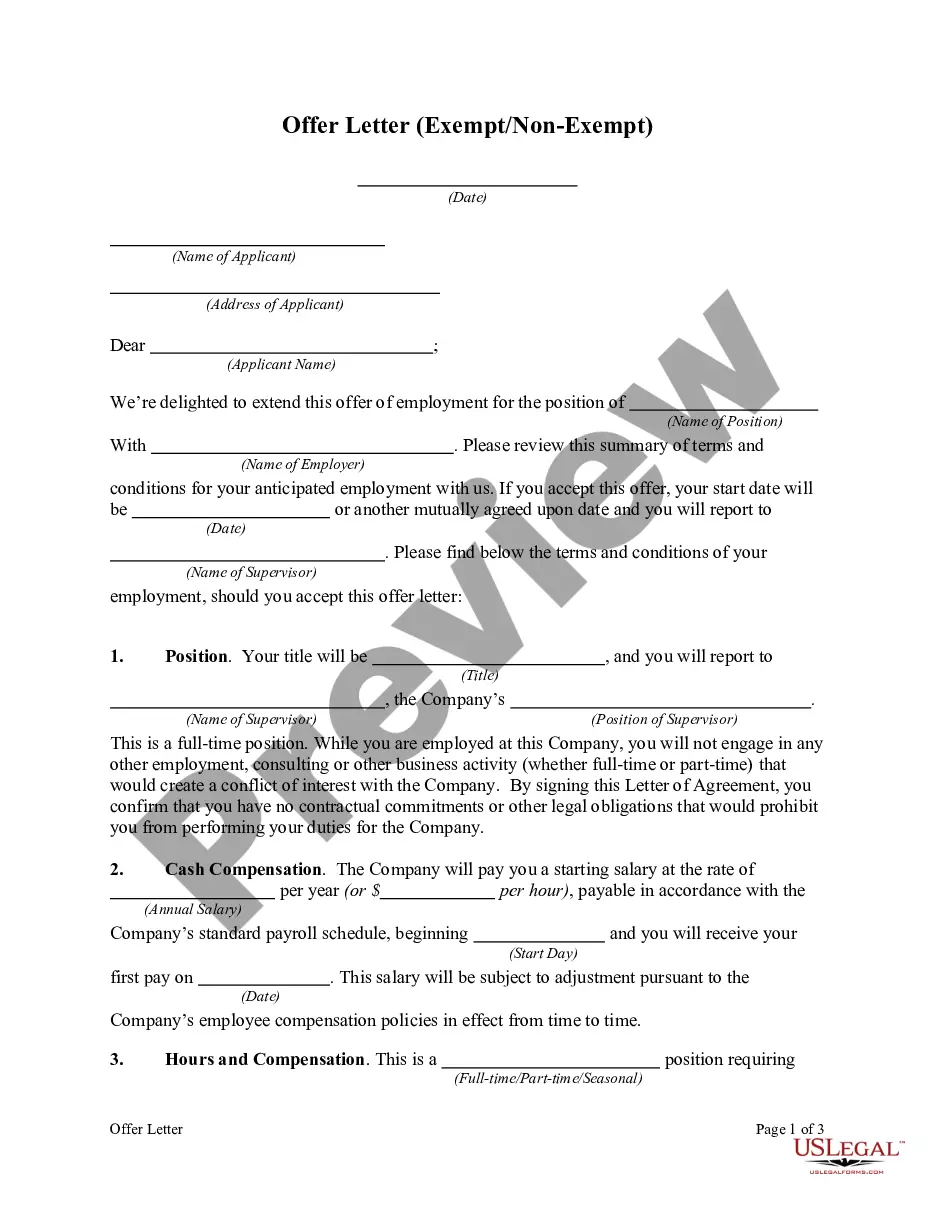

How to fill out Job Offer Letter - Exempt Position - Detailed?

- Log in to your US Legal Forms account if you're already a user. Make sure your subscription is active for seamless access.

- If you're new to our service, start by browsing the extensive online library to find the form that best fits your needs. Check the form description and preview mode to ensure compliance with local jurisdiction.

- Utilize the search feature if you can't find the perfect template. This will help you navigate through our robust collection effectively.

- Purchase your chosen document by clicking the Buy Now button. Select a subscription plan that meets your requirements and create an account to unlock additional resources.

- Complete your purchase by entering your payment details or using your PayPal account.

- Once your transaction is successful, download your form directly to your device. You'll also find it saved in the My Forms section of your account for future reference.

By following these steps, you can quickly access the necessary legal documents you need to ensure your position is exempt is properly managed. Not only do these forms save you time, but they also ensure that your documents are legally sound.

Start your journey with US Legal Forms today and take advantage of our extensive resources for all your legal needs!

Form popularity

FAQ

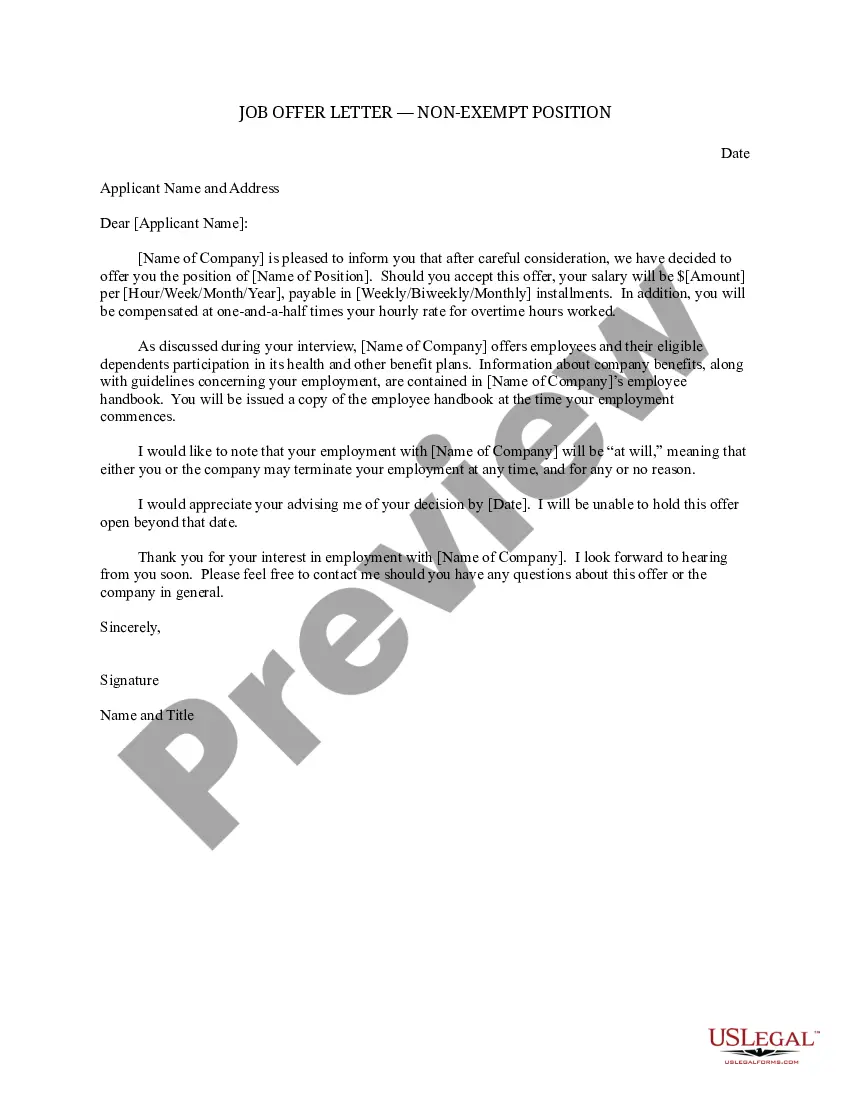

Deciding if a position is exempt requires careful consideration of both the job's functions and the compensation structure. Review the position against federal guidelines to understand which duties qualify for exemption. Always keep updated with any changes in legislation that might affect this classification. If you are uncertain, consider using services like US Legal Forms to assist with the classification process.

The IRS provides several guidelines to help determine if a position is exempt. Generally, it revolves around the employee's job duties, salary, and work hours. Exempt employees usually earn a salary that meets or exceeds a specified threshold and their job responsibilities include decision-making authority. Compliance with these guidelines is essential for maintaining legal and financial soundness.

Determining if a position should be exempt involves assessing the specific job duties and the compensation structure. The position must primarily perform exempt tasks such as management or specialized knowledge work. You should also review the current laws and regulations, as changes can impact classification. Utilizing resources like US Legal Forms can help clarify these distinctions and provide necessary documentation.

To classify a job as exempt or nonexempt, you must consider the job duties and the salary. The Fair Labor Standards Act defines exempt positions primarily based on their job functions and salary level. If a role involves executive, professional, or administrative tasks and meets the minimum salary requirements, the position is exempt. Ensuring accurate classification protects both the employee and employer.

Employers cannot arbitrarily classify a position as exempt. The classification must meet specific criteria under federal and state laws. Typically, it requires that the position meet certain duties tests and salary thresholds. Misclassifying a position can lead to legal issues and financial penalties.

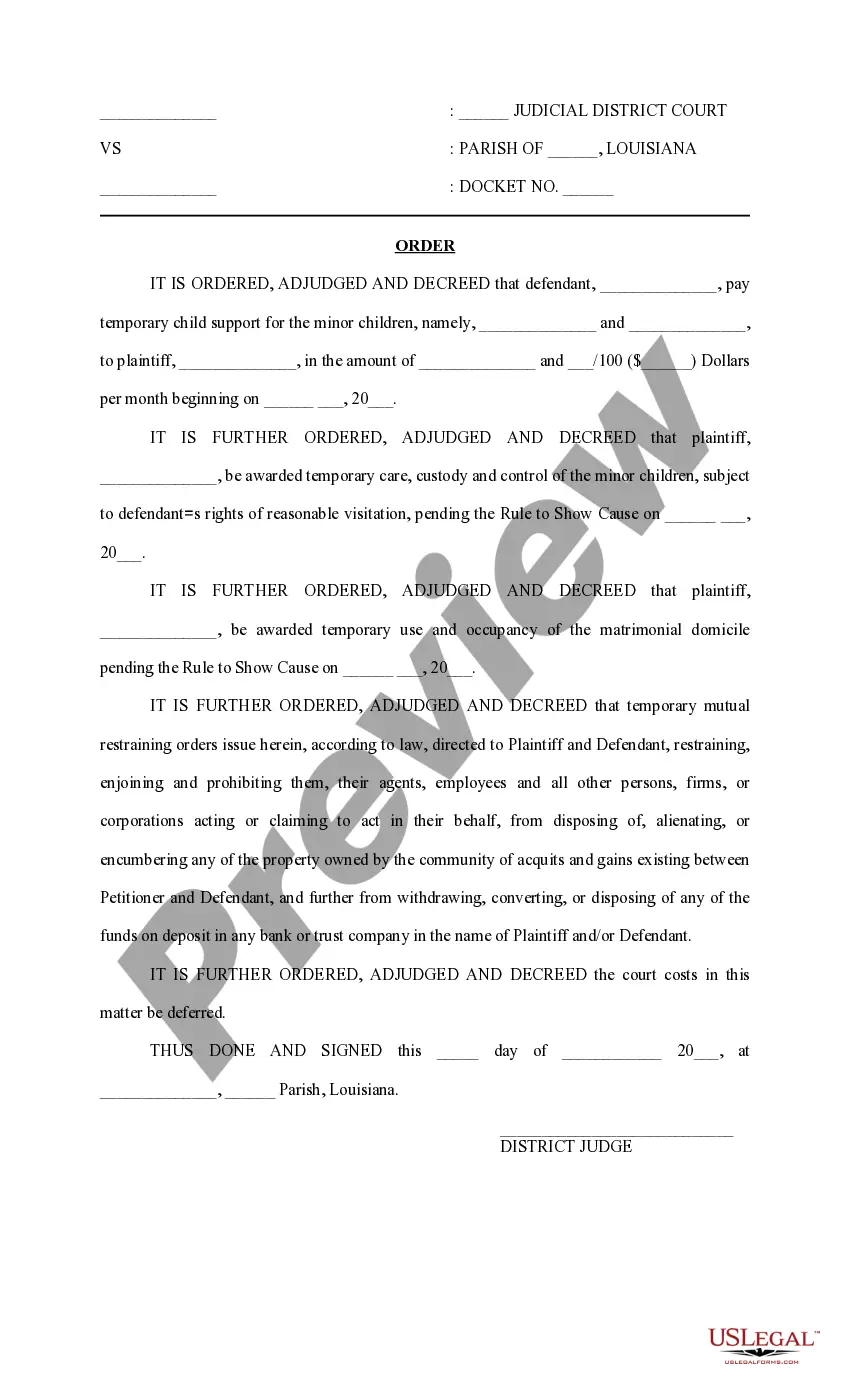

To determine if you qualify for exempt status, review your job duties, salary, and responsibilities against the FLSA criteria. Look for key indicators such as managerial tasks, advanced skills, or tasks requiring independent decision-making. If you still have questions about your status, the US Legal Forms platform can provide useful resources and templates to clarify your situation. Understanding your qualifications can empower you to negotiate your employment terms effectively.

Being an exempt employee can be a good thing, especially if you value autonomy and opportunities for professional growth. Exempt positions often come with leadership roles and the chance to work on significant projects that can enhance your resume. However, it’s essential to consider if the workload and responsibilities align with your career goals. Evaluating your role’s demands against the benefits will help clarify if being exempt suits your lifestyle.

Whether a position is exempt is determined by the Fair Labor Standards Act (FLSA) guidelines, which focus on job duties, salary, and responsibilities. Key factors include tasks that involve managerial duties, professional expertise, or administrative abilities. Positions requiring independent judgment are often exempt as well. Understanding these elements is essential when evaluating job offers and making career decisions.

An employer can be classified as exempt based on specific criteria, primarily rooted in the nature of the work and the type of employees they hire. Typically, employers of white-collar workers, like managers or professionals, are more likely to offer exempt positions. Additionally, the industry and job duties play a crucial role in determining whether a position is exempt. Familiarizing yourself with these factors can help you understand the employer's classification better.

Exempt and salaried are not synonymous, although there is often overlap. A position may be salaried and still fall under nonexempt categories if it does not meet the required criteria. Therefore, always consider both job responsibilities and salary structure when classifying a position.