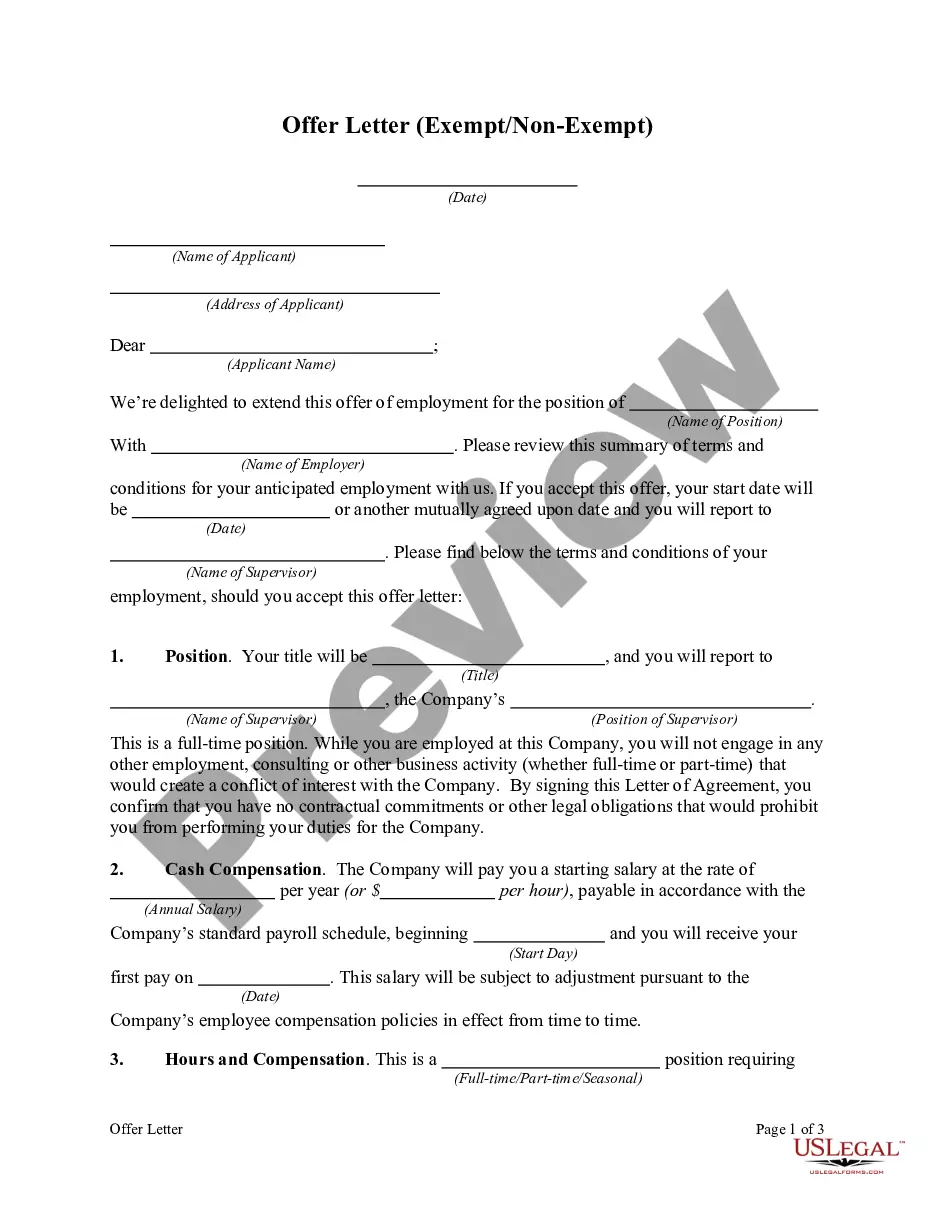

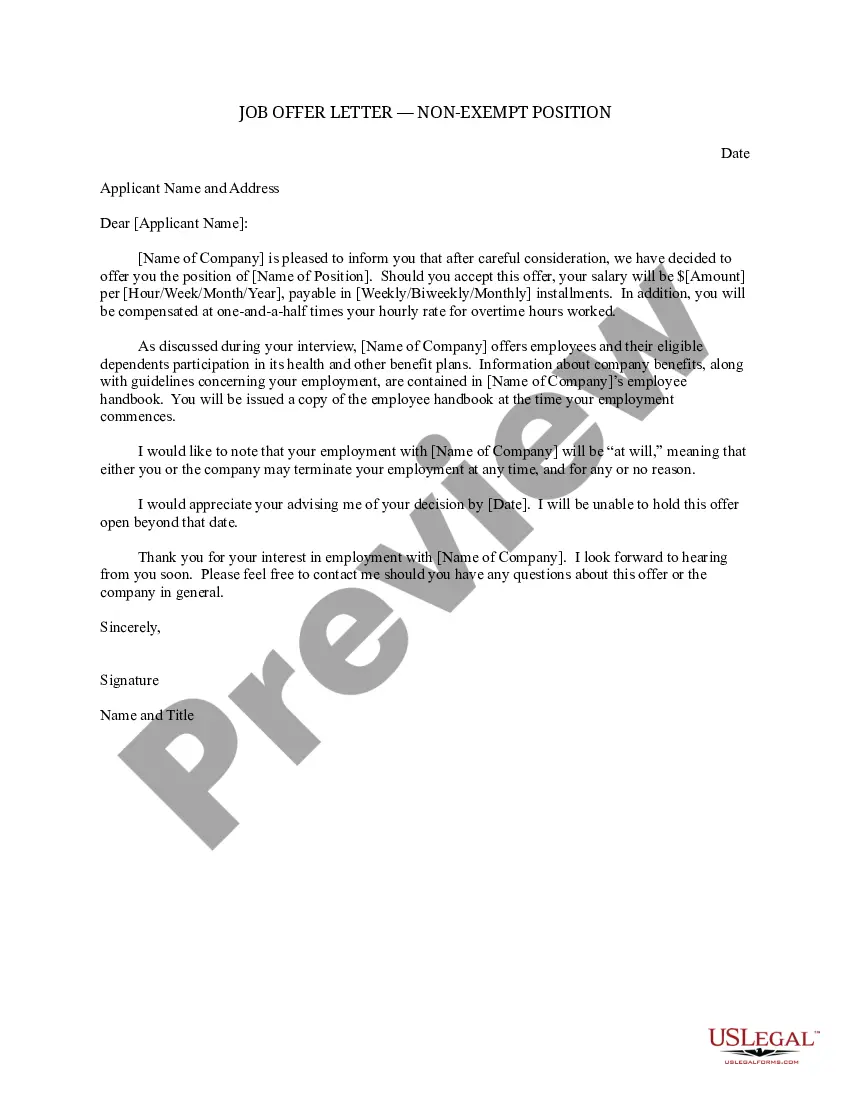

Employee Appointment Letter With Terms And Conditions

Description

How to fill out Employment Offer Letter Exempt Or Non-Exempt?

Regardless of whether for professional reasons or personal issues, everyone must handle legal matters at some stage in their life.

Completing legal paperwork requires meticulous attention, starting from selecting the correct form template.

With an extensive array of US Legal Forms at your disposal, you will not need to waste time searching for the appropriate template online. Utilize the library’s simple navigation to find the correct form for any situation.

- Obtain the template you require by using the search feature or browsing the catalog.

- Review the form’s details to confirm it aligns with your situation, state, and county.

- Click on the form’s preview to assess its content.

- If it is an incorrect document, return to the search tool to locate the Employee Appointment Letter With Terms And Conditions sample you require.

- Download the document once it satisfies your criteria.

- If you possess a US Legal Forms account, click Log in to access previously stored documents in My documents.

- If you have not created an account yet, you can download the document by selecting Buy now.

- Choose the appropriate pricing option.

- Fill in the profile registration form.

- Select your payment method: either a credit card or PayPal account.

- Choose the document format you wish to use and download the Employee Appointment Letter With Terms And Conditions.

- Once saved, you can complete the form using editing software or print it out and finalize it manually.

Form popularity

FAQ

The Senior Tax Credit is available to homeowners at least 65 for whom the property is their principal residence (see the HOTC page for details); Interested homeowners must submit the Homeowners Tax Credit Application to the Maryland State Department of Assessments and Taxation (SDAT).

How To Change From Sole Proprietorship to LLC in 6 Steps Step 1: Confirm Business Name. ... Step 2: File Articles of Organization. ... Step 3: Draft and Execute an LLC Operating Agreement. ... Step 4: File a Form SS-4 To Obtain an EIN. ... Step 5: Apply for a New Bank Account. ... Step 6: Apply for Business Licenses and Permits.

You can download tax forms using the links listed below. Request forms by e-mail. You can also e-mail your forms request to us at taxforms@marylandtaxes.gov. Visit our offices.

You can prepare and efile your full-year resident MD state tax return and your federal tax return for your convenience. The regular due date for filing your Maryland state taxes is April 15. Below, you will find information about Maryland state tax forms, state tax filing instructions, and government information.

All taxpayers may use Form 502. You must use this form if you itemize deductions, if you have any Maryland additions or subtractions, if you have made estimated payments or if you are claiming business or personal income tax credits.

The Maryland Form 510 A Pass-Through Entity Income Tax Return must be filed electronically if the pass-through entity has generated a business tax credit from Form 500CR or a Heritage Structure Rehabilitation Tax Credit from Form 502S to pass on to its members.

To amend your Maryland corporations charter, just file Articles of Amendment by mail or in person with the Maryland State Department of Assessments and Taxation (SDAT).

Note: If you are at least 65 years old or blind, you can claim an additional 2023 standard deduction of $1,850 (also $1,850 if using the single or head of household filing status). If you're both 65 and blind, the additional deduction amount is doubled.