Exempt And Nonexempt Employees

Description

How to fill out FLSA Exempt / Nonexempt Compliance Form?

Accessing legal documents that adhere to national and local regulations is essential, and the web presents numerous choices to choose from.

However, why waste time searching for the suitable Exempt And Nonexempt Employees sample online when the US Legal Forms digital library already compiles such documents in one location.

US Legal Forms is the largest online legal repository featuring over 85,000 editable templates crafted by attorneys for various business and personal scenarios. They are simple to navigate with all documents categorized by state and intended use. Our specialists monitor legislative updates, ensuring your forms are always current and compliant when acquiring an Exempt And Nonexempt Employees from our site.

All documents you discover through US Legal Forms are reusable. To re-download and finalize previously purchased forms, access the My documents section in your account. Take advantage of the most comprehensive and user-friendly legal document service!

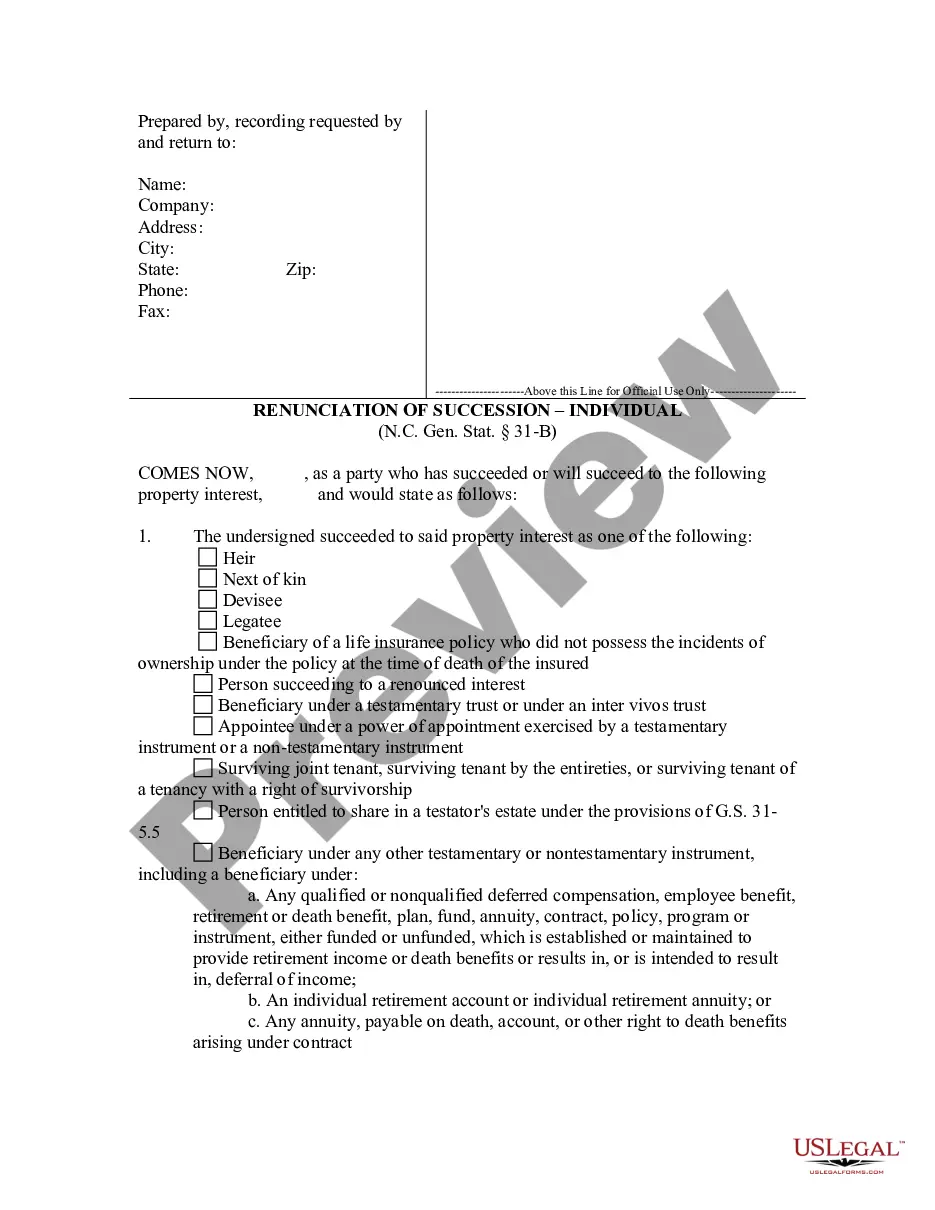

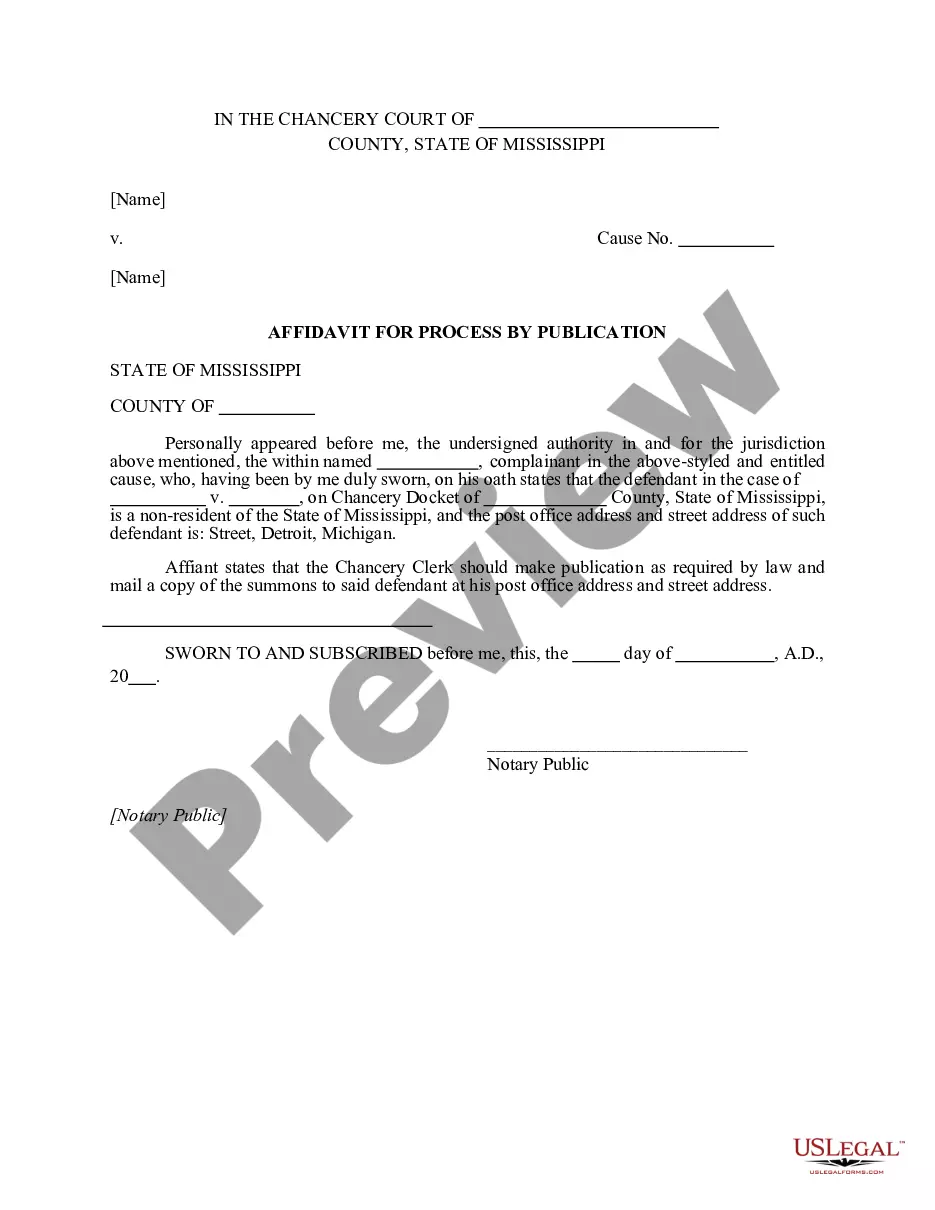

- Review the template using the Preview option or through the text description to ensure it fulfills your needs.

- Search for an alternative sample using the search feature at the top of the page if necessary.

- Click Buy Now once you've found the right form and choose a subscription plan.

- Create an account or Log In and complete the payment using PayPal or a credit card.

- Select the appropriate format for your Exempt And Nonexempt Employees and download it.

Form popularity

FAQ

To qualify for exempt status, you must meet specific conditions outlined by the IRS, such as having no federal tax liability for the previous year and anticipating none this year. This status generally applies to individuals with low income or specific financial situations. Understanding these qualifications is vital, and resources like uslegalforms can support you in navigating the complexities surrounding exemptions for exempt and nonexempt employees.

To change your tax status to exempt, you need to fill out Form W-4 and indicate your exemption status. Ensure you meet the criteria for being classified as exempt; this typically includes having no tax liability in the previous year and expecting none in the current year. Once you complete the form, submit it to your employer to update your payroll withholding status efficiently and accurately.

Claiming 0 means no exemptions, resulting in maximum tax withholding and a potential refund during tax season. Filing exempt may be beneficial for those who consistently earn below the tax threshold but can lead to owing taxes if your situation changes. It's crucial to assess your income throughout the year to determine which option suits your financial strategy best, especially between exempt and nonexempt employees.

If you are classified as an exempt employee, you are not responsible for federal withholding taxes. However, this doesn't mean you can go indefinitely without any tax obligations. Typically, if you remain exempt and earn income throughout the year without withholding, you may still end up owing taxes at the end of the year based on your total earnings. It's essential to monitor your income and tax situation closely.

Classifying employees as exempt or nonexempt involves understanding their job functions, salaries, and applicable labor laws. Begin by analyzing the specific duties of each employee and comparing them with the criteria for both status types. Use resources and tools available on platforms like USLegalForms to ensure correct classification, which ultimately protects your business and your employees' rights.

Filling out exempt status requires attention to detail, as you'll need to document the employee's role and responsibilities accurately. Start by determining if the employee meets the criteria for exempt classification, taking into account their duties and salary. Then, complete the necessary forms, ensuring that all information aligns with the definitions of exempt and nonexempt employees established by labor regulations.

Exempt employees usually fall into specific categories defined by federal and state laws, such as executive, administrative, and professional roles. These individuals typically have significant decision-making authority, perform specialized tasks, or manage teams. For example, a marketing manager who supervises a team and sets budgets is often classified as an exempt employee. Understanding these categories can streamline your classification process.

To determine if an employee is exempt or nonexempt, review their job functions and compensation details. Exempt employees often engage in managerial, professional, or administrative tasks and earn a predetermined salary. On the other hand, nonexempt employees typically have hourly positions and may earn overtime. Assessing these criteria will help you classify your employees accurately.

Yes, an employee can hold two positions within the same company, potentially with one being exempt and the other being nonexempt. Each role's classification will depend on the tasks associated with it and the employee's compensation. Properly tracking these classifications is essential, and using platforms like US Legal Forms can assist companies in managing this complexity.

A specific position itself cannot be both exempt and nonexempt, as these classifications dictate the rules governing job functions. However, the responsibilities of that position could change, leading to a reclassification. Effectively managing these distinctions is crucial for compliance and employee satisfaction.