Activity 6.3 Employee Withholding Sheet

Description

How to fill out Employee Time Sheet?

Finding a go-to place to access the most current and relevant legal templates is half the struggle of dealing with bureaucracy. Discovering the right legal documents needs precision and attention to detail, which is why it is very important to take samples of Activity 6.3 Employee Withholding Sheet only from reputable sources, like US Legal Forms. An improper template will waste your time and hold off the situation you are in. With US Legal Forms, you have very little to worry about. You can access and view all the details about the document’s use and relevance for your circumstances and in your state or county.

Take the listed steps to finish your Activity 6.3 Employee Withholding Sheet:

- Utilize the library navigation or search field to locate your sample.

- View the form’s description to check if it fits the requirements of your state and region.

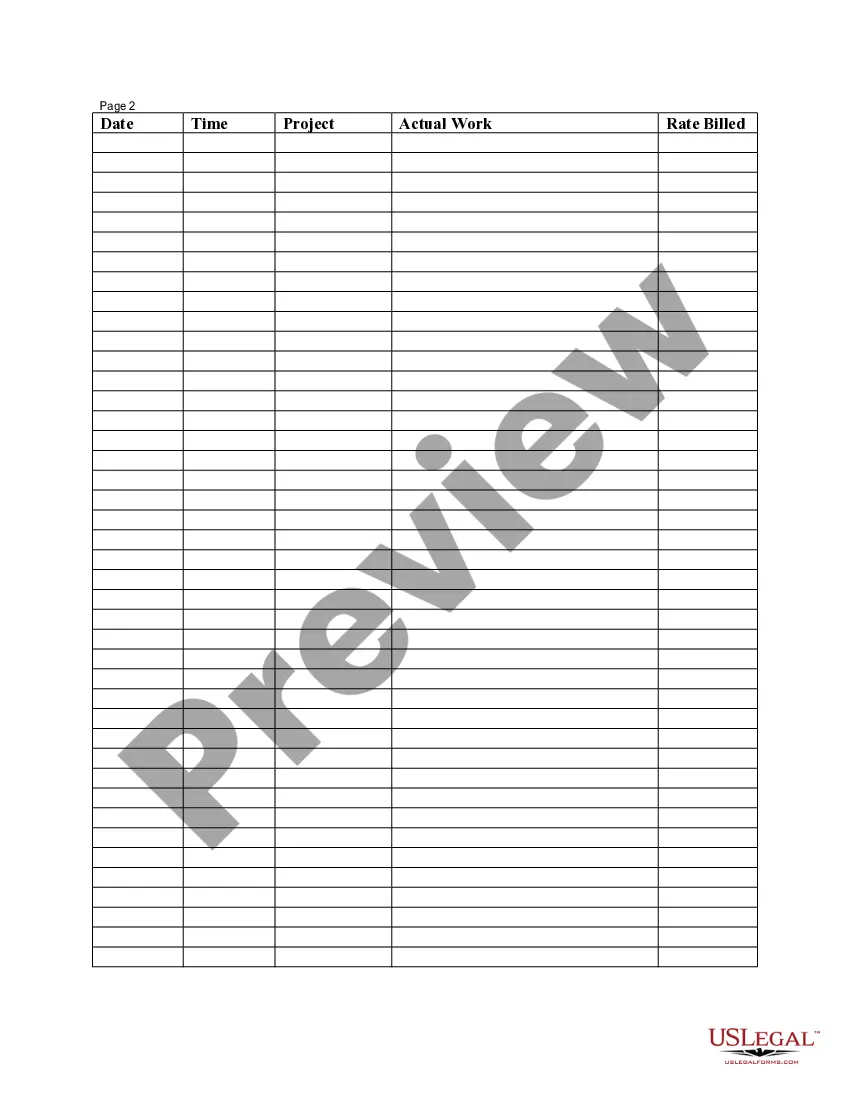

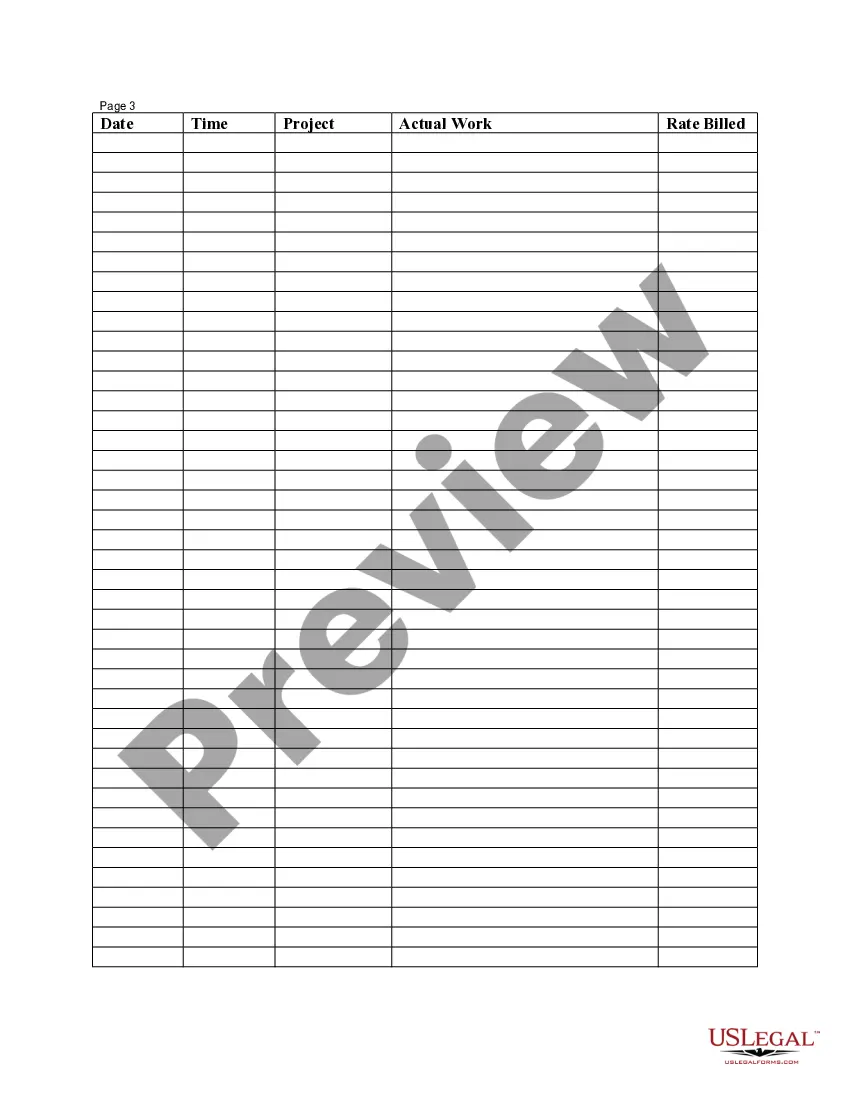

- View the form preview, if available, to ensure the form is the one you are searching for.

- Return to the search and find the right template if the Activity 6.3 Employee Withholding Sheet does not suit your requirements.

- When you are positive regarding the form’s relevance, download it.

- If you are an authorized customer, click Log in to authenticate and gain access to your picked templates in My Forms.

- If you do not have a profile yet, click Buy now to get the form.

- Select the pricing plan that suits your needs.

- Proceed to the registration to complete your purchase.

- Finalize your purchase by choosing a transaction method (credit card or PayPal).

- Select the file format for downloading Activity 6.3 Employee Withholding Sheet.

- Once you have the form on your device, you may alter it with the editor or print it and finish it manually.

Get rid of the hassle that accompanies your legal paperwork. Explore the comprehensive US Legal Forms collection where you can find legal templates, examine their relevance to your circumstances, and download them immediately.

Form popularity

FAQ

You can claim anywhere between 0 and 3 allowances on the W4 IRS form, depending on what you're eligible for. Generally, the more allowances you claim, the less tax will be withheld from each paycheck. The fewer allowances claimed, the larger withholding amount, which may result in a refund.

Claiming 1 reduces the amount of taxes that are withheld from weekly paychecks, so you get more money now with a smaller refund. Claiming 0 allowances may be a better option if you'd rather receive a larger lump sum of money in the form of your tax refund.

A withholding allowance is an exemption that reduces how much income tax an employer deducts from an employee's paycheck. Internal Revenue Service (IRS) Form W-4 is used to calculate and claim withholding allowances.

If you are single and have one job, or married and filing jointly then claiming one allowance makes the most sense. An individual can claim two allowances if they are single and have more than one job, or are married and are filing taxes separately.

A withholding allowance is an exemption that lowers the amount of income tax you must deduct from an employee's paycheck. A larger number of withholding allowances means smaller income tax deductions, and a smaller number of allowances means larger income tax deductions.