Stars Management Interview Questions For Freshers

Description

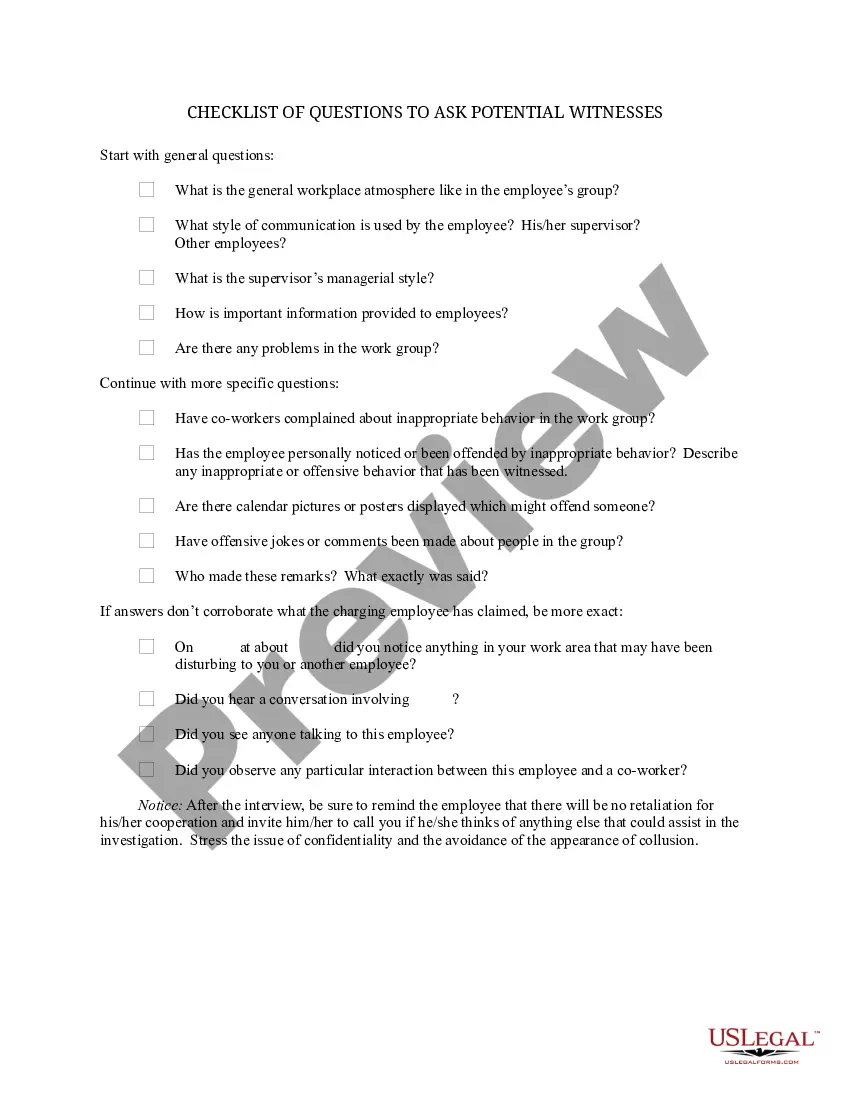

How to fill out Checklist Of Standard Hiring Interview Questions With Listening Tips And Suggested Follow-up Questions?

Accessing legal document samples that comply with federal and state regulations is essential, and the internet provides numerous options to select from.

But what’s the purpose of squandering time searching for the suitable Stars Management Interview Questions For Freshers sample online when the US Legal Forms digital library already has such templates organized in one location.

US Legal Forms is the largest online legal repository with over 85,000 editable templates created by attorneys for any professional and personal situation.

Examine the template using the Preview function or through the text outline to confirm it meets your needs.

- They are easy to navigate with all documents categorized by state and intended use.

- Our experts keep up with legal updates, ensuring your paperwork is current and compliant when acquiring a Stars Management Interview Questions For Freshers from our site.

- Obtaining a Stars Management Interview Questions For Freshers is straightforward and fast for both existing and new users.

- If you already possess an account with an active subscription, Log In and store the document sample you need in your desired format.

- If you are a new visitor to our website, follow the steps below.

Form popularity

FAQ

Anyone may purchase a certificate of ?existence or authorization online or by mail/fax for a $10.00 fee. Copies of documents on file with the Secretary of State may be purchased for $5.00 for up to five pages and $0.50 per additional page. The Secretary of State can certify a copy of any document filed of record.

To register for a Kentucky Sales Tax Permit, you can apply at the Department of Commerce's online Kentucky Business One Stop portal, or with Form 10A100, the Kentucky Tax Registration Application.

Charitable or other Nonprofit Organizations Depending on the state, nonprofit organizations may be exempt from paying sales tax.

Tax-exempt customers Some customers are exempt from paying sales tax under Kentucky law. Examples include government agencies, some nonprofit organizations, and merchants purchasing goods for resale. Sellers are required to collect a valid exemption or resale certificate from buyers to validate each exempt transaction.

Sales tax is a tax on tangible personal property and digital property that is sold, leased or rented in Kentucky and selected services. It is the seller's responsibility to collect the sales tax from the customers and to remit the sales tax to the Department of Revenue.

To qualify for sales and use tax exemption in Kentucky, first, your nonprofit corporation must have been granted 501c3 status by the IRS. The next distinction is that your KY nonprofit corporation must meet to qualify is that it has to be a resident educational, charitable, or religious entity.

Kentucky doesn't have local sales tax rates, only a statewide tax rate of 6%. So you would simply charge 6% sales tax to buyers in Kentucky. This is true whether you are based in Kentucky or whether you are based in another state and have sales tax nexus in Kentucky.

How to Fill Out TC 96-182 or Kentucky Vehicle Registration | PDFRun YouTube Start of suggested clip End of suggested clip Application. Then enter both the less seas and lion holders full legal. Name address and signatureMoreApplication. Then enter both the less seas and lion holders full legal. Name address and signature and enter the lessee's date of transfer.