Salaried Employee Guidelines Form Number

Description

How to fill out Salaried Employee Appraisal Guidelines - General?

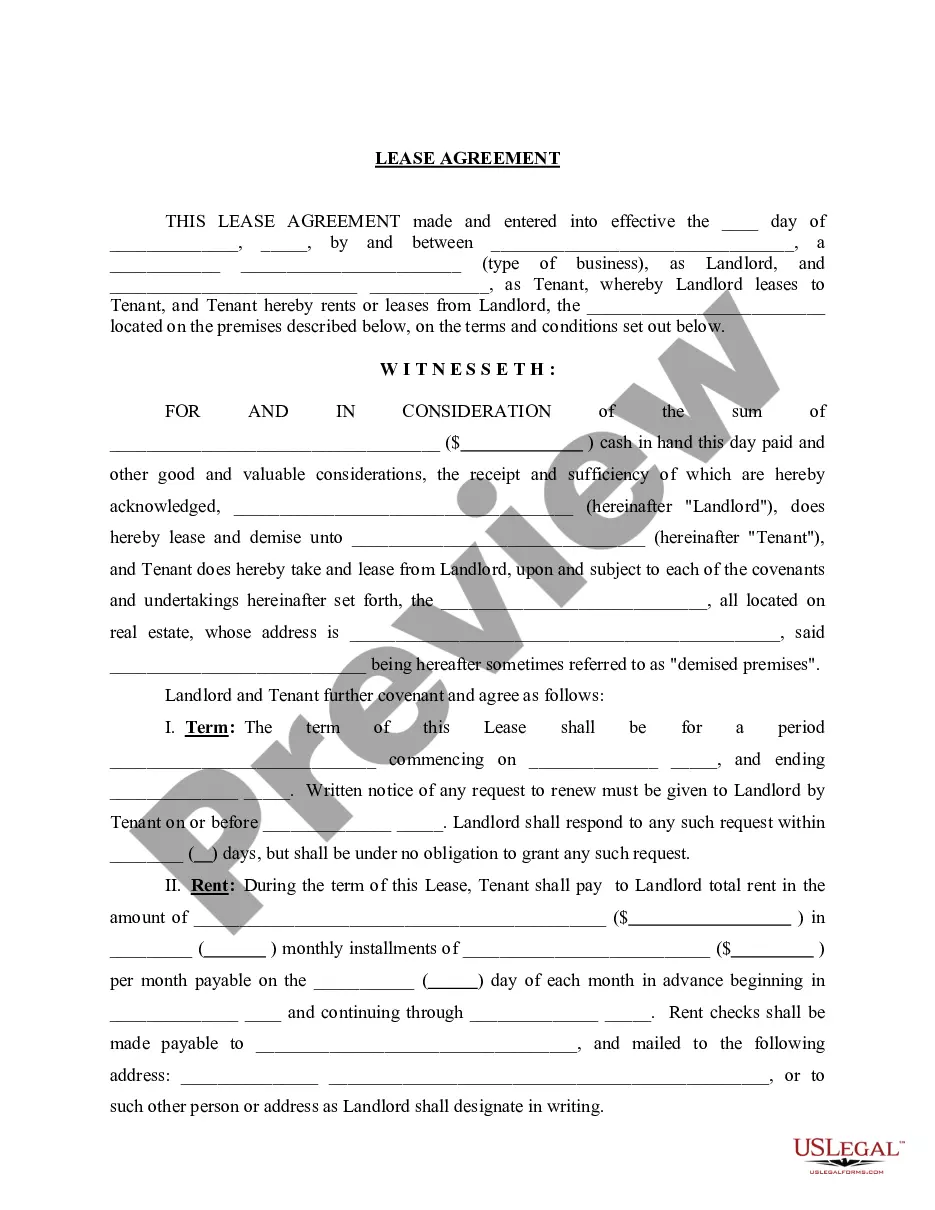

Using legal document samples that comply with federal and state laws is a matter of necessity, and the internet offers numerous options to choose from. But what’s the point in wasting time looking for the right Salaried Employee Guidelines Form Number sample on the web if the US Legal Forms online library already has such templates accumulated in one place?

US Legal Forms is the largest online legal catalog with over 85,000 fillable templates drafted by attorneys for any professional and personal case. They are easy to browse with all papers grouped by state and purpose of use. Our experts stay up with legislative updates, so you can always be confident your paperwork is up to date and compliant when getting a Salaried Employee Guidelines Form Number from our website.

Getting a Salaried Employee Guidelines Form Number is quick and easy for both current and new users. If you already have an account with a valid subscription, log in and save the document sample you need in the right format. If you are new to our website, adhere to the instructions below:

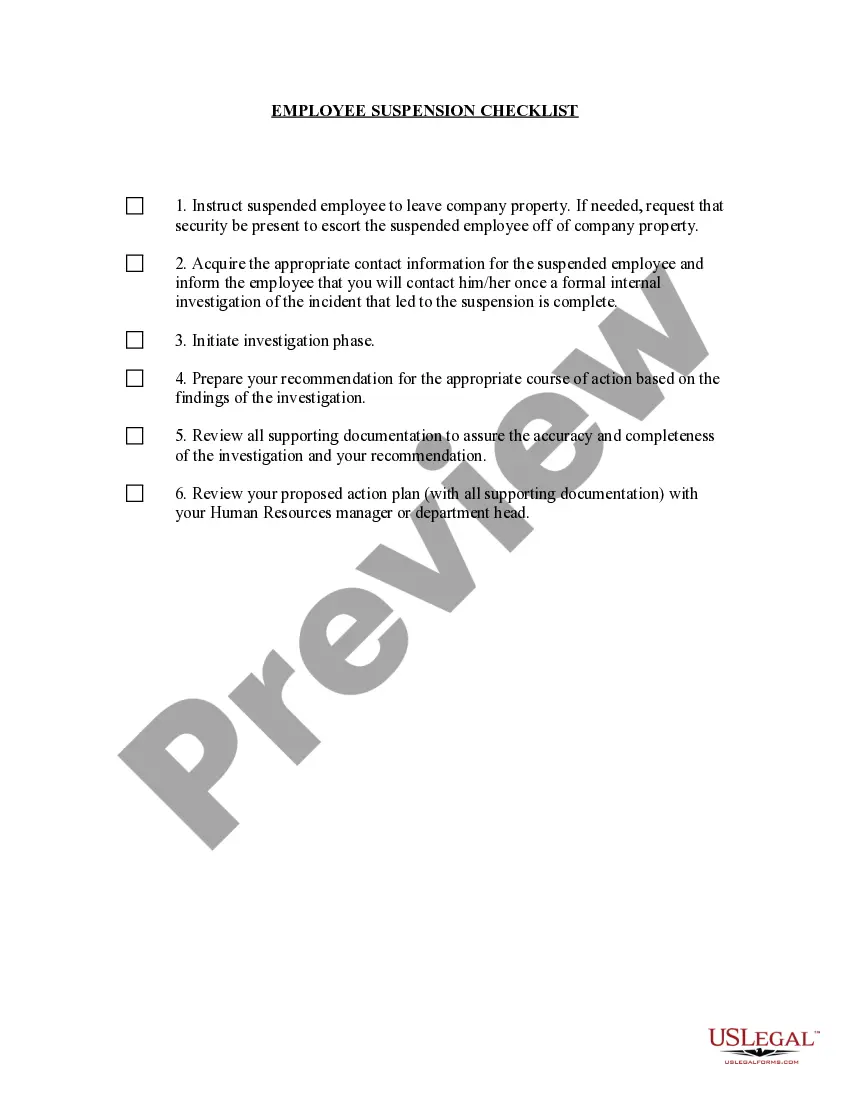

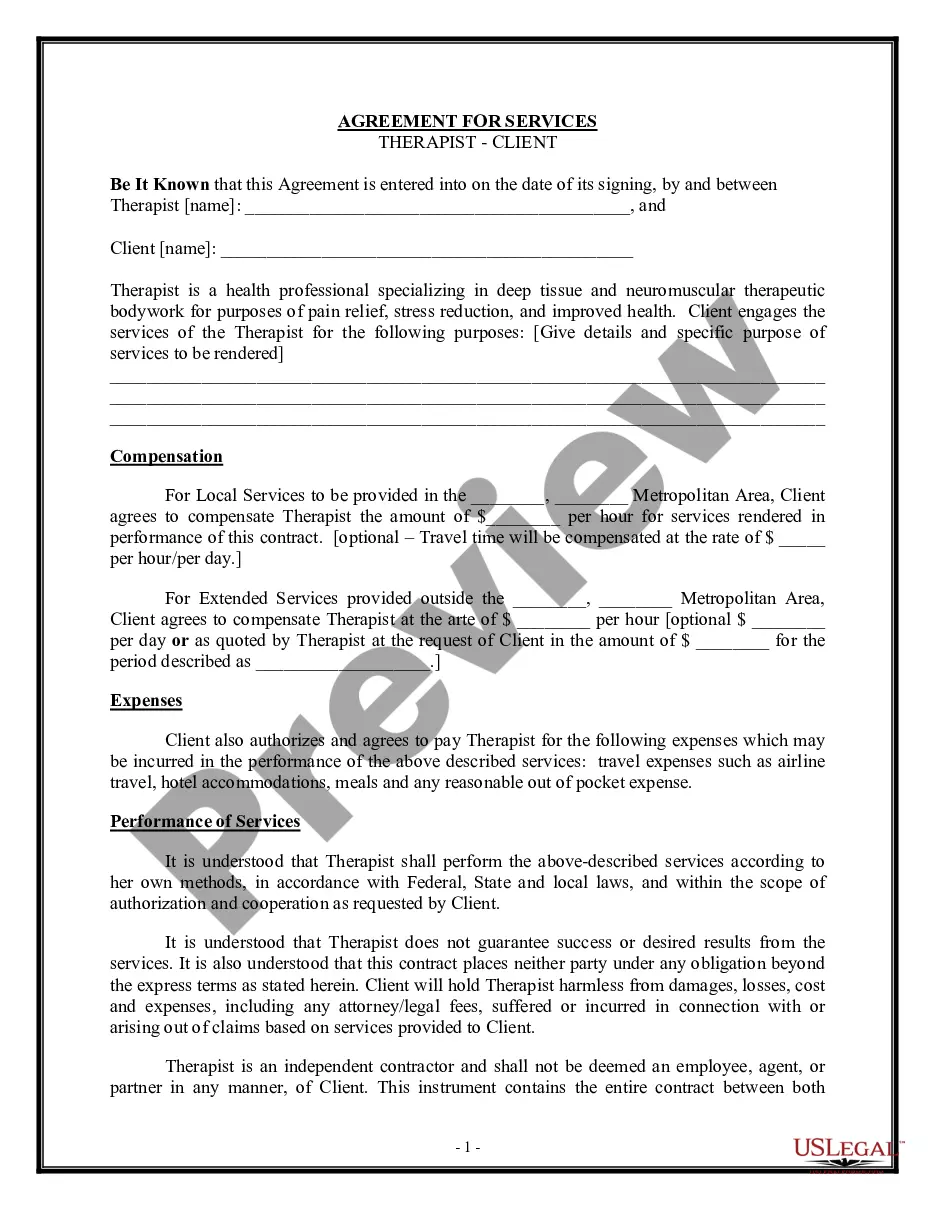

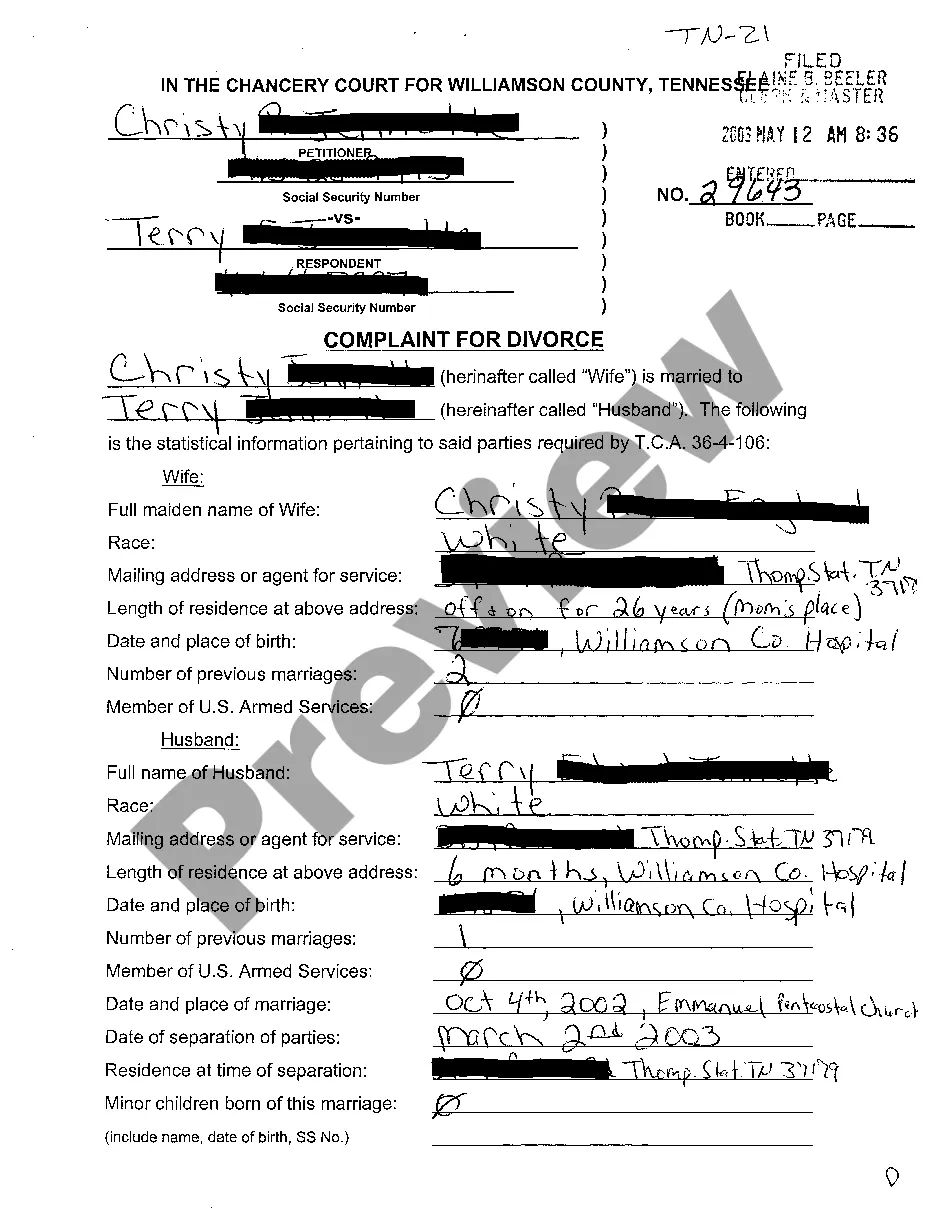

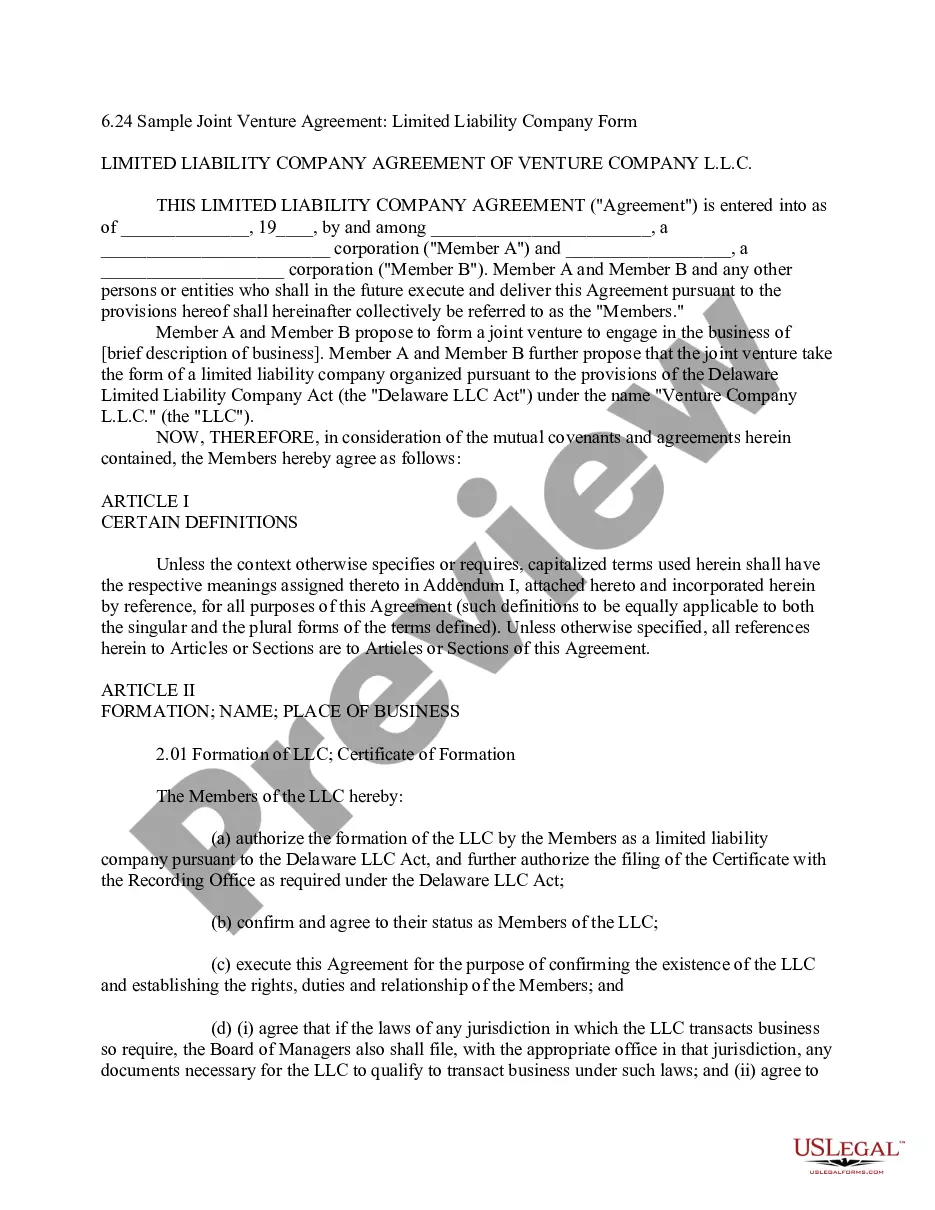

- Take a look at the template using the Preview feature or through the text outline to make certain it fits your needs.

- Browse for a different sample using the search function at the top of the page if needed.

- Click Buy Now when you’ve located the right form and opt for a subscription plan.

- Register for an account or log in and make a payment with PayPal or a credit card.

- Pick the format for your Salaried Employee Guidelines Form Number and download it.

All templates you find through US Legal Forms are multi-usable. To re-download and fill out earlier obtained forms, open the My Forms tab in your profile. Enjoy the most extensive and easy-to-use legal paperwork service!

Form popularity

FAQ

Under the FLSA, exempt salaried employees have virtually no rights at allwhen it comes to overtime, aside from their base salary as determined in their employment agreement. Employers can require any number of hours or any type of schedule from employees, including mandatory overtime or makeup time for absences.

In many situations, knowing how many hours an employee spent on a task defines how the work will be paid. As long as the employee doesn't deduct amounts from your paycheck based on hours you tracked, it is okay to require salaried employees to fill in timesheets.

California employers must pay salaried exempt employees at least twice the minimum hourly wage based on a 40-hour workweek. As of 2023, the California minimum wage is $15.50 an hour. Though many California cities and counties have higher minimum wage requirements than the state minimum.

So, how does one decide if an employee is exempt vs. non exempt? Pay rate, job duties and responsibilities are all key factors in determining if an employee is exempt or non-exempt, not the type of clothes they wear or their work environment.

Is It Legal to Work 60 Hours a Week on Salary? If an employee is exempt from FLSA and any state, local, or union overtime laws, then it is legal to work 60 hours a week on salary. Some employers do pay exempt employees for overtime work through time-and-a-half, bonuses, or extra time off.