Record Absence Form Template With Email

Description

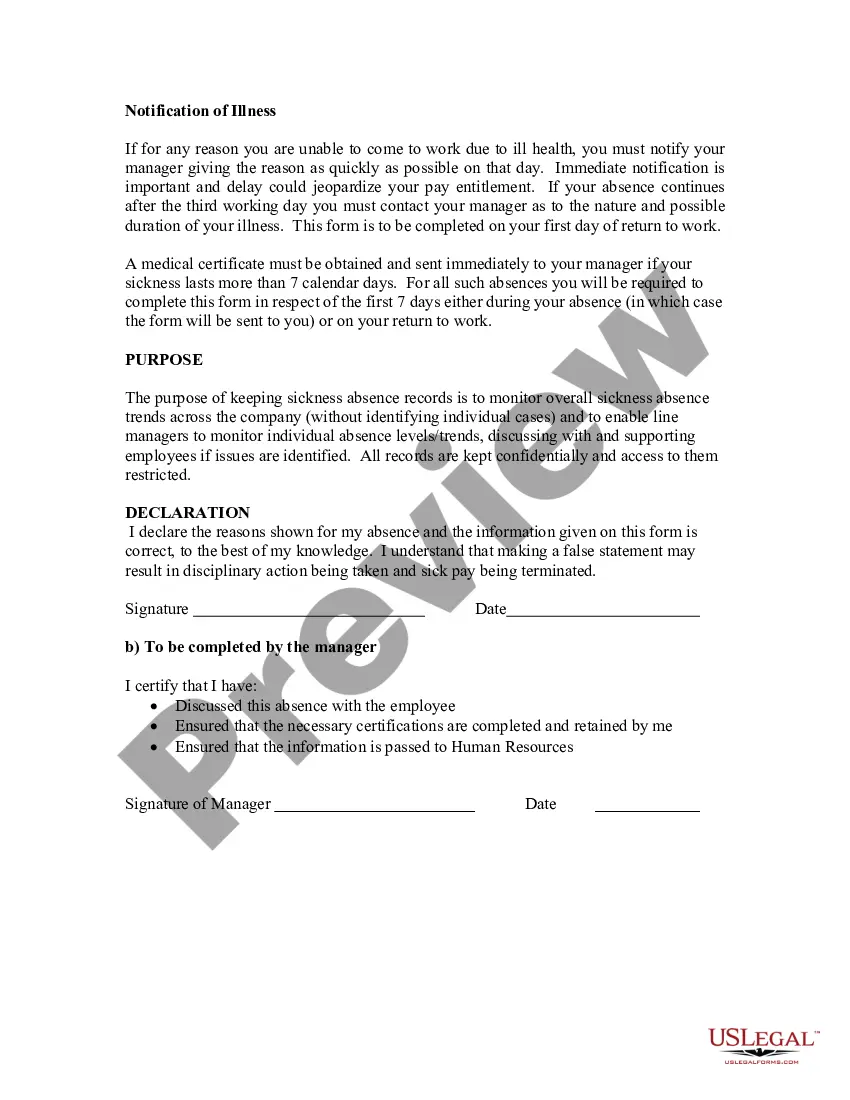

How to fill out Record Of Absence - Self-Certification Form?

The Absence Record Form Template With Email displayed on this webpage is a versatile legal document crafted by experienced attorneys in line with federal and municipal regulations.

For over 25 years, US Legal Forms has offered individuals, businesses, and legal practitioners access to more than 85,000 authenticated, state-specific templates for any commercial and personal requirement.

Register with US Legal Forms to have validated legal templates for every circumstance in life readily available.

- Search for the document you require and review it.

- Examine the file you searched for and preview it or check the form description to ensure it meets your requirements. If it does not, use the search feature to locate the correct one. Click Buy Now once you have identified the template you need.

- Register and Log Into your account.

- Select the pricing option that fits you and create an account. Use PayPal or a credit card for a swift payment. If you possess an existing account, Log In and verify your subscription to continue.

- Retrieve the editable template.

- Choose the format you prefer for your Absence Record Form Template With Email (PDF, Word, RTF) and download the file on your device.

- Complete and endorse the document.

- Print the template to fill it out manually. Alternatively, use an online multifunctional PDF editor to efficiently and accurately complete and sign your form with an eSignature.

- Download your documents again.

- Use the same document again whenever necessary. Go to the My documents section in your profile to redownload any forms you have purchased earlier.

Form popularity

FAQ

You may review the aircraft records on your own, or have this done by an attorney or aircraft title search company. Several firms that perform aircraft title searches and related services can be found on the internet. The AC does not perform title searches.

Why did I receive this letter? Our records show that you have an outstanding balance. Additional interest will accrue if the tax and/or fee is not paid in full. Details of the balance due are shown on your letter.

Every person, firm, partnership, corporation, etc., engaging in the business of selling or leasing tangible personal property of a kind the gross receipts from the retail sale of which are required to be included in the measure of the sales tax, must apply with the CDTFA for a permit on a form prescribed by the ...

If your clearance request is approved, you will receive a CDTFA -111, Certificate of Use Tax Clearance. Upon presentation of the CDTFA -111 at DMV or DHCD, you will be allowed to complete registration without payment of use tax.

The mission of the CDTFA is to make life better for Californians by fairly and efficiently collecting the revenue that supports our essential public services.

Also known as Form AC 8050-2, an aircraft bill of sale is required by the Federal Aviation Administration (FAA) when buying and/or selling an aircraft. This form includes important information about the buyer, seller, and transaction details.

To authorize the transmission of confidential information to you and/or your representative via unencrypted email or other unencrypted electronic transmission, please sign this CDTFA-82, Authorization for Electronic Transmission of Data, and provide it to a CDTFA representative.

Some customers are exempt from paying sales tax under California law. Examples include government agencies, some nonprofit organizations, and merchants purchasing goods for resale. Sellers are required to collect a valid exemption or resale certificate from buyers to validate each exempt transaction.