Employee Final Pay Within 72 Hours

Description

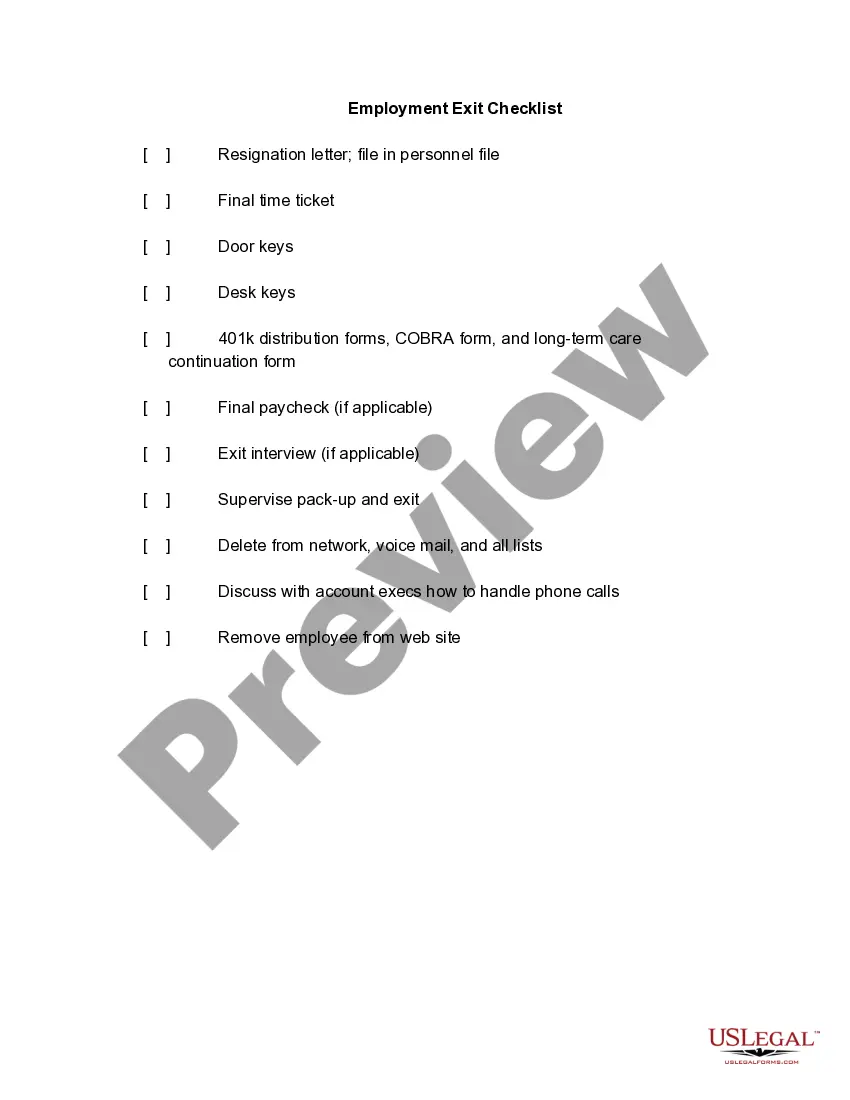

How to fill out Termination Meeting Checklist?

Managing legal papers and processes can be a lengthy addition to your entire day.

Documents like Employee Final Pay Within 72 Hours often require you to locate them and comprehend the most effective way to complete them correctly.

Thus, whether you are handling financial, legal, or personal issues, having a comprehensive and efficient online collection of forms readily available will be immensely beneficial.

US Legal Forms is the premier online platform for legal templates, providing over 85,000 state-specific forms and various tools to assist you in completing your documents effortlessly.

Is this your first instance using US Legal Forms? Create and set up your account in a few minutes, and you'll gain access to the form library and Employee Final Pay Within 72 Hours. Then, follow the steps below to fill out your form: Ensure you have found the appropriate form using the Review feature and examining the form details. Select Buy Now when prepared, and choose the subscription option that suits your requirements. Click Download, then complete, eSign, and print the form. US Legal Forms possesses 25 years of experience assisting users with their legal documents. Discover the form you need now and simplify any process with ease.

- Explore the collection of pertinent documents accessible to you with just a click.

- US Legal Forms provides state- and county-specific forms that can be downloaded anytime.

- Safeguard your document management processes by utilizing a high-quality service that allows you to prepare any form in minutes without incurring additional or hidden fees.

- Simply Log In to your account, locate Employee Final Pay Within 72 Hours and obtain it immediately in the My documents section.

- You can also access previously saved forms.

Form popularity

FAQ

The final pay is basically the sum of all the wages that companies have to give their outgoing employees, regardless of whether the employees resigned or were terminated. It generally includes: The last salary due (i.e. payment for the hours the employees clocked in since their last pay)

In California, an employer is required to pay a final paycheck on an employee's last day of work or within 72 hours of that last shift. This final payment shall include all accrued and unused vacation time and any paid time off.

How is an Employee's Last Check Calculated? Calculating how much you owe to hourly employees on their final paycheck is quite simple. You just multiply their hourly rate by the number of hours they worked before leaving your company, plus overtime pay.

The final paycheck should contain the employee's regular wages from the most recent pay period, along with other types of compensation, such as accrued vacation, bonus, and commission pay.

You can either file a wage claim with the Division of Labor Standards Enforcement (the Labor Commissioner's Office), or bring an action in court against your former employer to recover the wages if they are still due you, and to claim the waiting time penalty.