Spouse Vs Common Law

Description

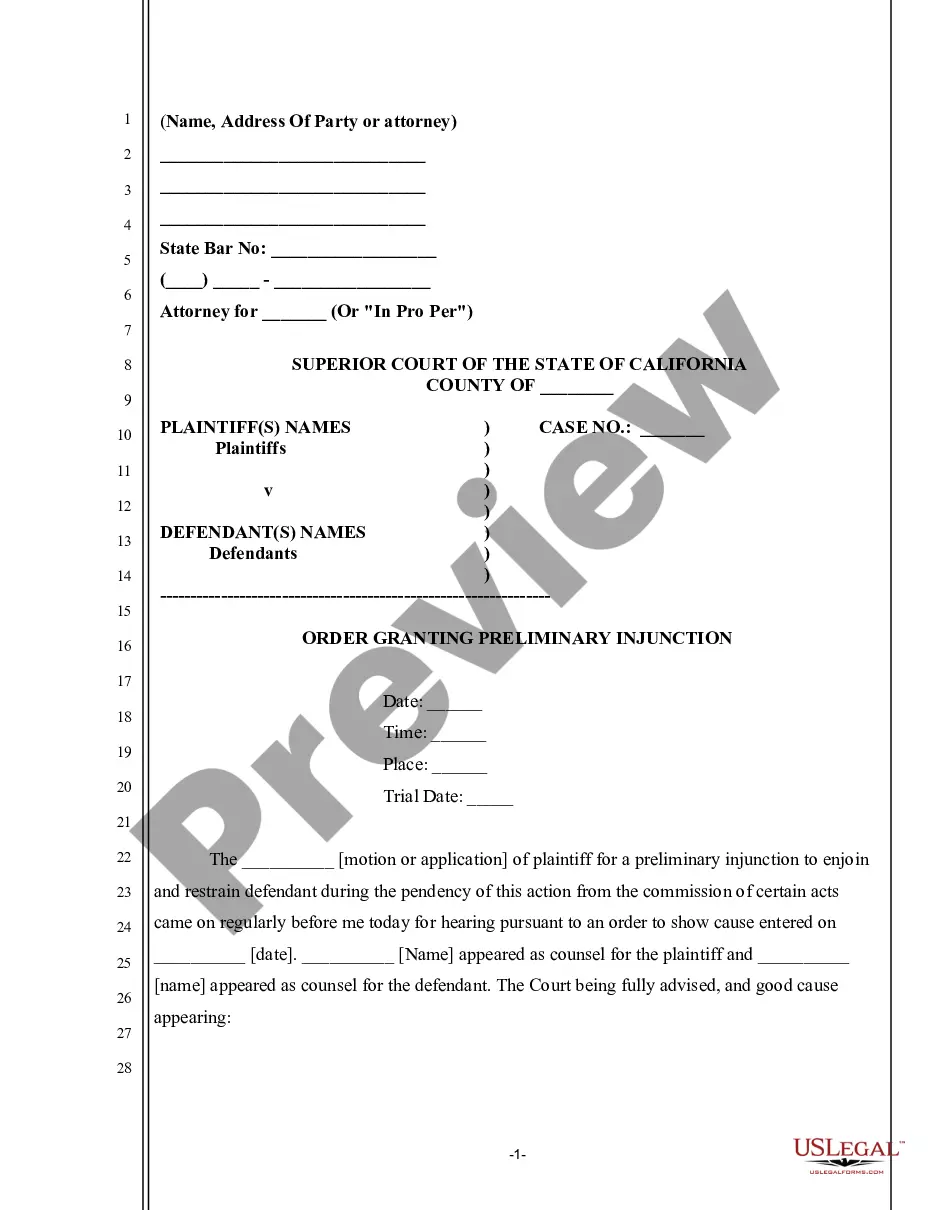

How to fill out Common Law Spouse Or Marriage Declaration Or Affidavit?

It’s obvious that you can’t become a legal expert overnight, nor can you grasp how to quickly draft Spouse Vs Common Law without having a specialized background. Putting together legal forms is a time-consuming process requiring a certain education and skills. So why not leave the preparation of the Spouse Vs Common Law to the pros?

With US Legal Forms, one of the most comprehensive legal template libraries, you can access anything from court papers to templates for in-office communication. We understand how crucial compliance and adherence to federal and local laws are. That’s why, on our platform, all templates are location specific and up to date.

Here’s how you can get started with our platform and obtain the document you require in mere minutes:

- Find the document you need by using the search bar at the top of the page.

- Preview it (if this option provided) and read the supporting description to determine whether Spouse Vs Common Law is what you’re looking for.

- Start your search again if you need any other form.

- Set up a free account and select a subscription option to purchase the form.

- Choose Buy now. As soon as the transaction is through, you can download the Spouse Vs Common Law, complete it, print it, and send or mail it to the designated individuals or entities.

You can re-gain access to your forms from the My Forms tab at any time. If you’re an existing customer, you can simply log in, and find and download the template from the same tab.

Regardless of the purpose of your documents-be it financial and legal, or personal-our platform has you covered. Try US Legal Forms now!

Form popularity

FAQ

There are more requirements than just living together to be considered common-law, but they are different depending on the state. A domestic partnership is an unmarried couple who live together and are interested in receiving many of same benefits that a married couple enjoys, such as health benefits.

If you are common-law, you must have lived together for a minimum period of time to qualify as a spouse. In order to be considered a spouse for the purposes of dividing property or debt you must have lived together in a marriage-like relationship for at least two years.

Marital status is the legally defined marital state. There are several types of marital status: single, married, widowed, divorced, separated and, in certain cases, registered partnership.

If you are common-law, you must have lived together for a minimum period of time to qualify as a spouse. In order to be considered a spouse for the purposes of dividing property or debt you must have lived together in a marriage-like relationship for at least two years.

Both of the common law partners must file their own tax returns with Internal Revenue Service (IRS). Apart from their personal information, they need to mention the name of their common-law partner, their net income, and social insurance number on their tax return.