Cobra Insurance For Dummies

Description

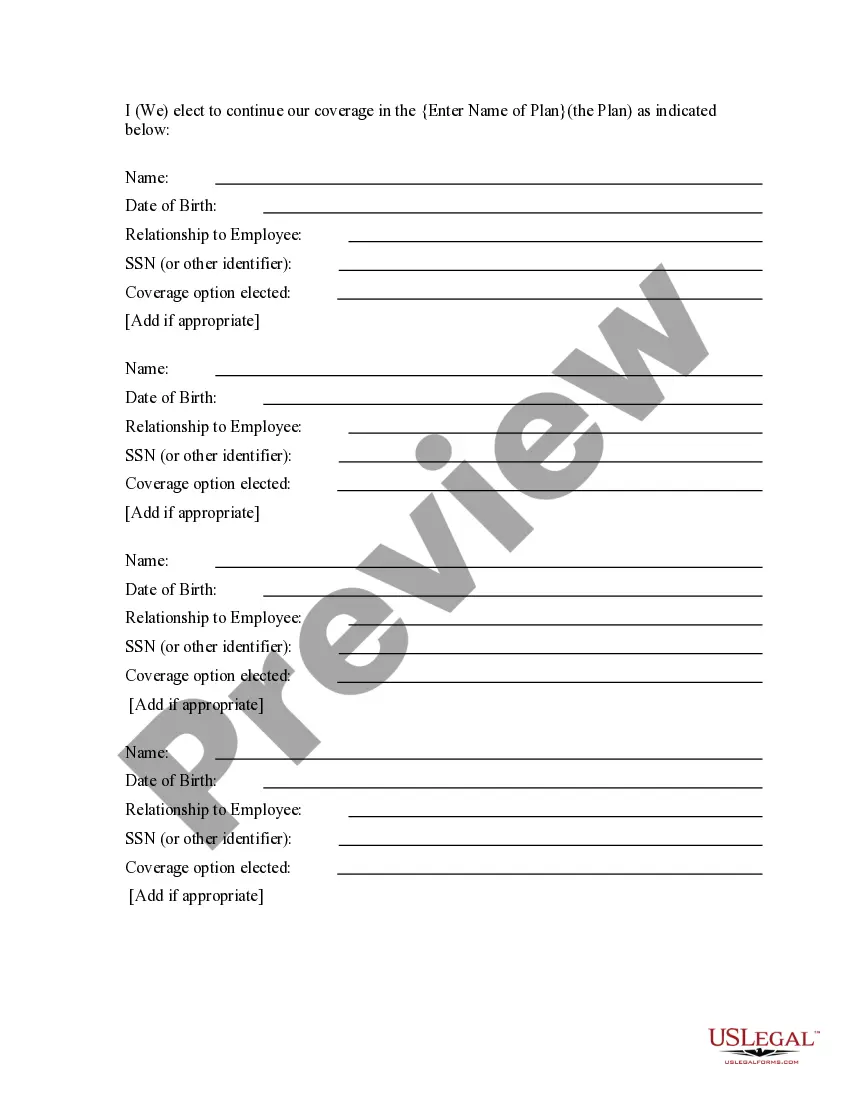

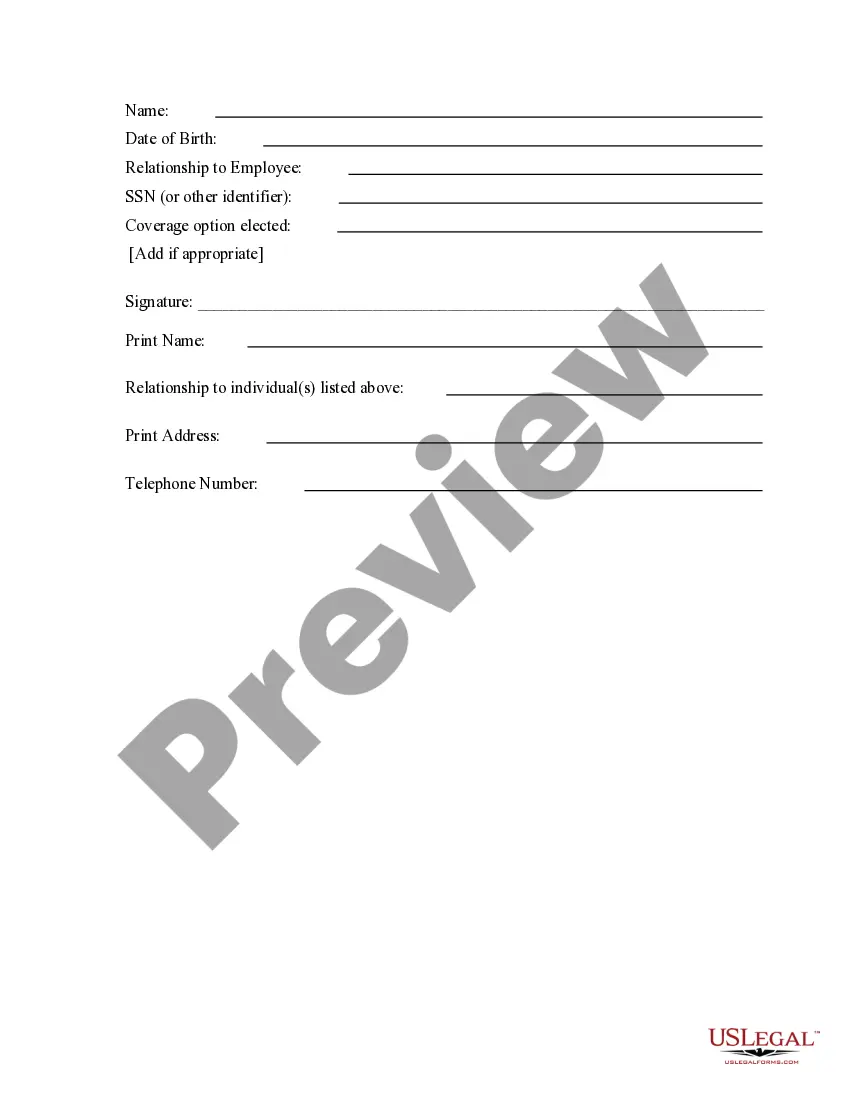

How to fill out COBRA Continuation Coverage Election Form?

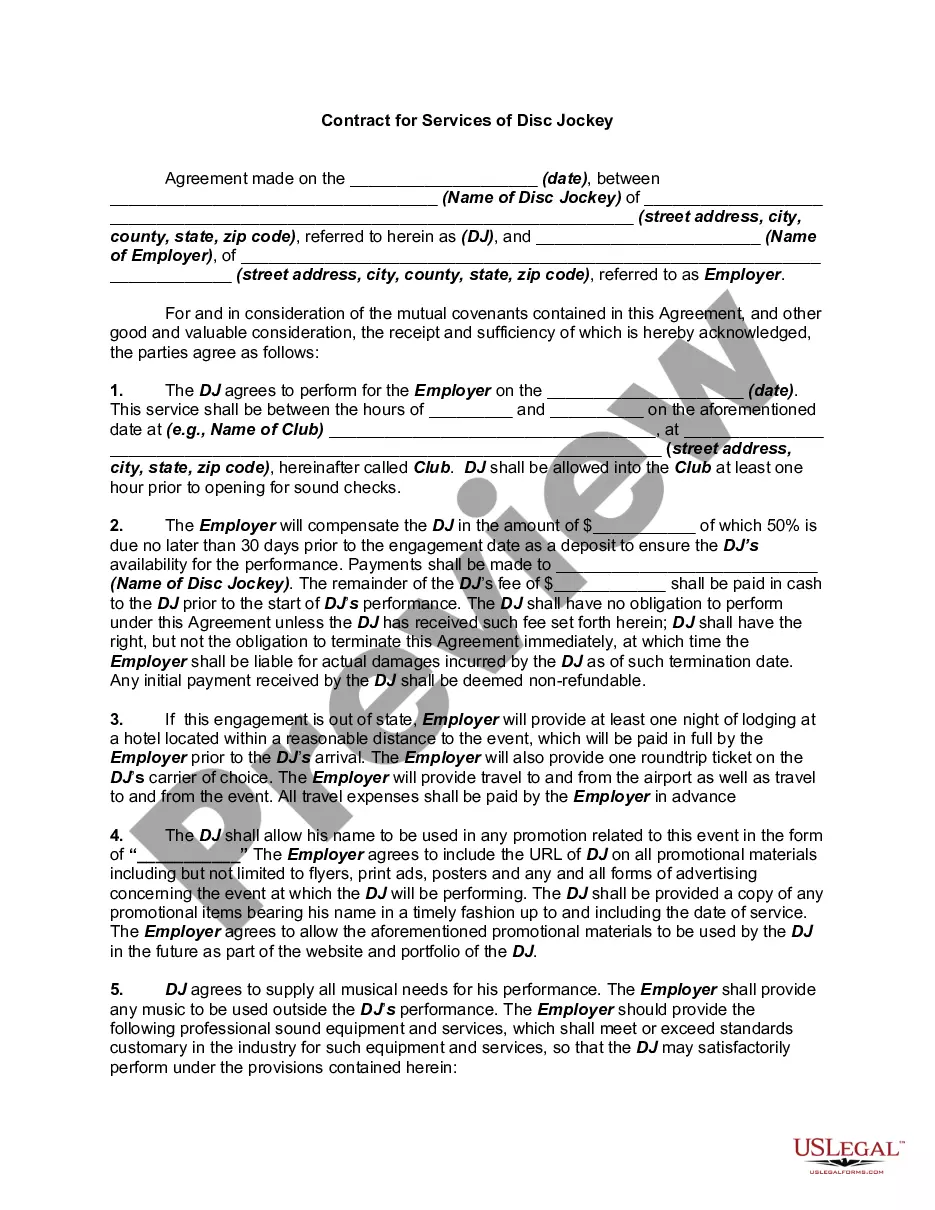

Regardless of whether it is for corporate needs or personal affairs, everyone encounters legal matters at some point during their lifetime.

Completing legal documents requires meticulous care, starting from the selection of the correct form template.

After downloading, you can fill out the form using editing software or print it out and complete it by hand. With an extensive catalog from US Legal Forms at your disposal, you won’t have to waste time searching for the correct template online. Utilize the library’s straightforward navigation to discover the right template for any circumstance.

- Acquire the form you require by using the search box or browsing through the directory.

- Review the description of the form to confirm it corresponds with your scenario, jurisdiction, and area.

- Click on the preview of the form to inspect it.

- If it is the incorrect document, return to the search feature to find the Cobra Insurance For Dummies template you need.

- Obtain the template if it satisfies your requirements.

- If you have an existing US Legal Forms profile, simply click Log in to access previously saved templates in My documents.

- Should you not possess an account yet, you can download the form by clicking Buy now.

- Select the appropriate pricing plan.

- Complete the profile registration form.

- Choose your payment method: you can opt for a credit card or a PayPal account.

- Select the document format you prefer and download the Cobra Insurance For Dummies.

Form popularity

FAQ

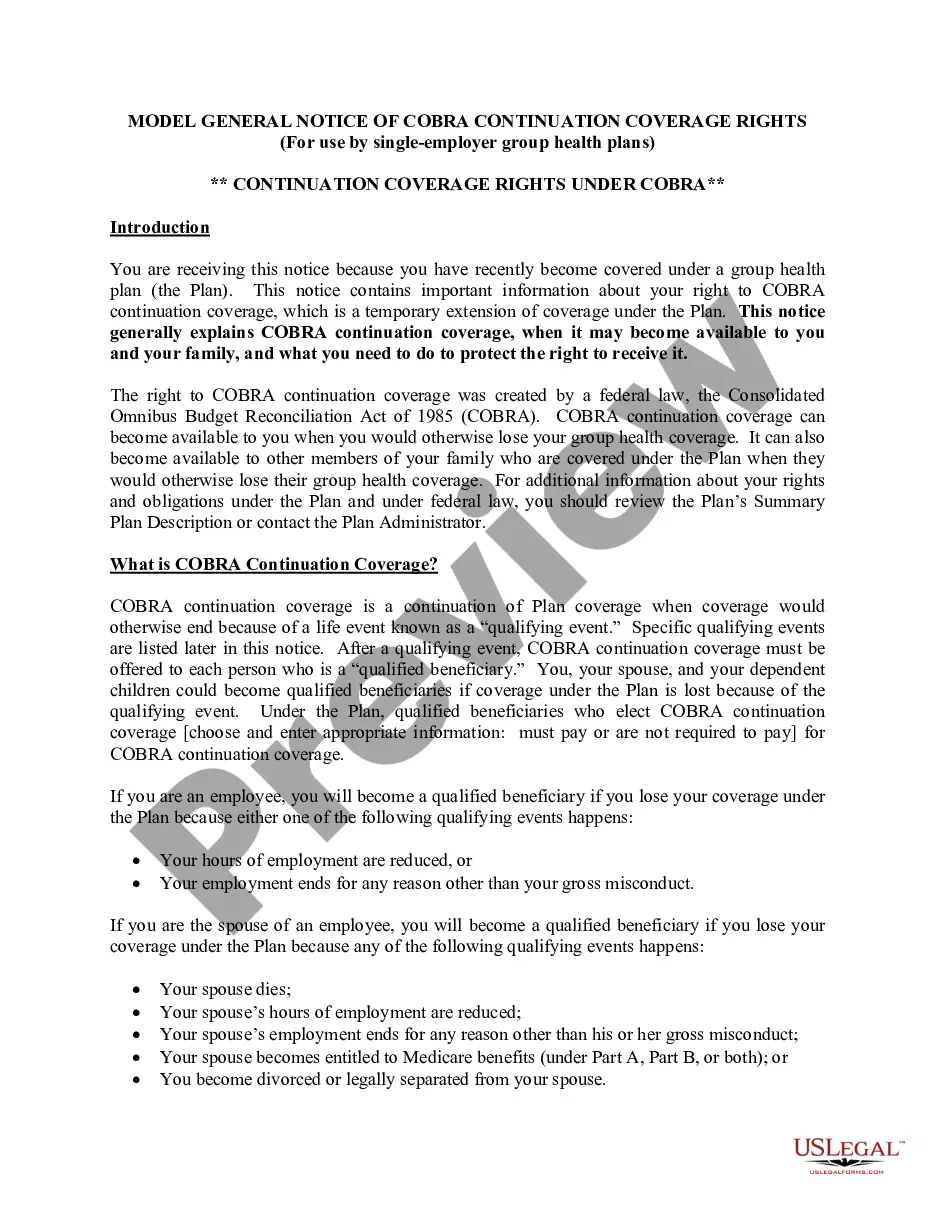

COBRA paperwork is typically sent by your employer or your employer's benefits administrator. Following a qualifying event, such as job loss or reduced hours, you should receive a notification regarding your eligibility for COBRA coverage. This paperwork includes essential details about your rights and responsibilities related to COBRA insurance. If you find yourself confused by the process, don't worry; resources like US Legal Forms can guide you through the necessary steps in simple terms, making the concept of COBRA insurance for dummies much easier to grasp.

Getting started with COBRA involves receiving your election notice from your employer, which details your rights and options. After reviewing this information, you should make your election decision within 60 days. Enrolling requires submitting a completed election form and the first premium payment. If you need assistance, US Legal Forms can provide straightforward explanations and tools regarding COBRA insurance for dummies.

To start COBRA coverage, you first need to receive the COBRA election notice from your employer. This notice should arrive within 14 days of your qualifying event, such as job loss or reduction in hours. After you receive the notice, you have 60 days to choose whether to enroll in COBRA insurance. It's advisable to compare your options, and if you need help understanding it better, resources like US Legal Forms can guide you through the details of COBRA insurance for dummies.

To initiate COBRA coverage, you should contact your former employer's health plan administrator as soon as possible. They will provide you with detailed instructions and necessary forms to complete. It’s vital to act within the given timeframe, typically 60 days after your job ends, to ensure that you secure this important benefit. For additional assistance, platforms like uslegalforms can guide you through the process smoothly.

If COBRA seems too costly or limited, consider options like enrolling in a spouse's health plan, seeking insurance through the Affordable Care Act (ACA) marketplace, or exploring short-term health insurance plans. Each alternative offers its own benefits and drawbacks, so weighing your choices can provide a better fit for your situation. Remember, being informed about your options is crucial, especially when learning about COBRA insurance for dummies.

COBRA coverage rules dictate that you must be a participant in an employer-sponsored group health plan and experience a qualifying event. You and your dependents must also elect coverage within 60 days of the event. Keeping these rules in mind can provide a clearer path through the complex world of COBRA insurance for dummies.

One significant loophole in Cobra insurance is that you can still qualify for coverage if you elect it within 60 days after your qualifying event. Additionally, some states have laws that provide extended benefits beyond federal requirements. Familiarizing yourself with these loopholes helps you maximize your options, making it easier to understand COBRA insurance for dummies.

The 60-day loophole refers to the timeframe for electing COBRA coverage. After you experience a qualifying event, you have 60 days to decide whether you want to enroll in COBRA. Knowing about this loophole helps you avoid rushing a decision, thus, understanding COBRA insurance for dummies becomes essential to navigate these timeframes.

COBRA, or the Consolidated Omnibus Budget Reconciliation Act, allows you to continue your health insurance after leaving a job. Usually, it applies for 18 months following events like job loss or reduced work hours. For dummies, think of COBRA as a safety net that retains your existing health plan, but you’re responsible for paying the full premium.