Cobra Benefits For Terminated Employees

Description

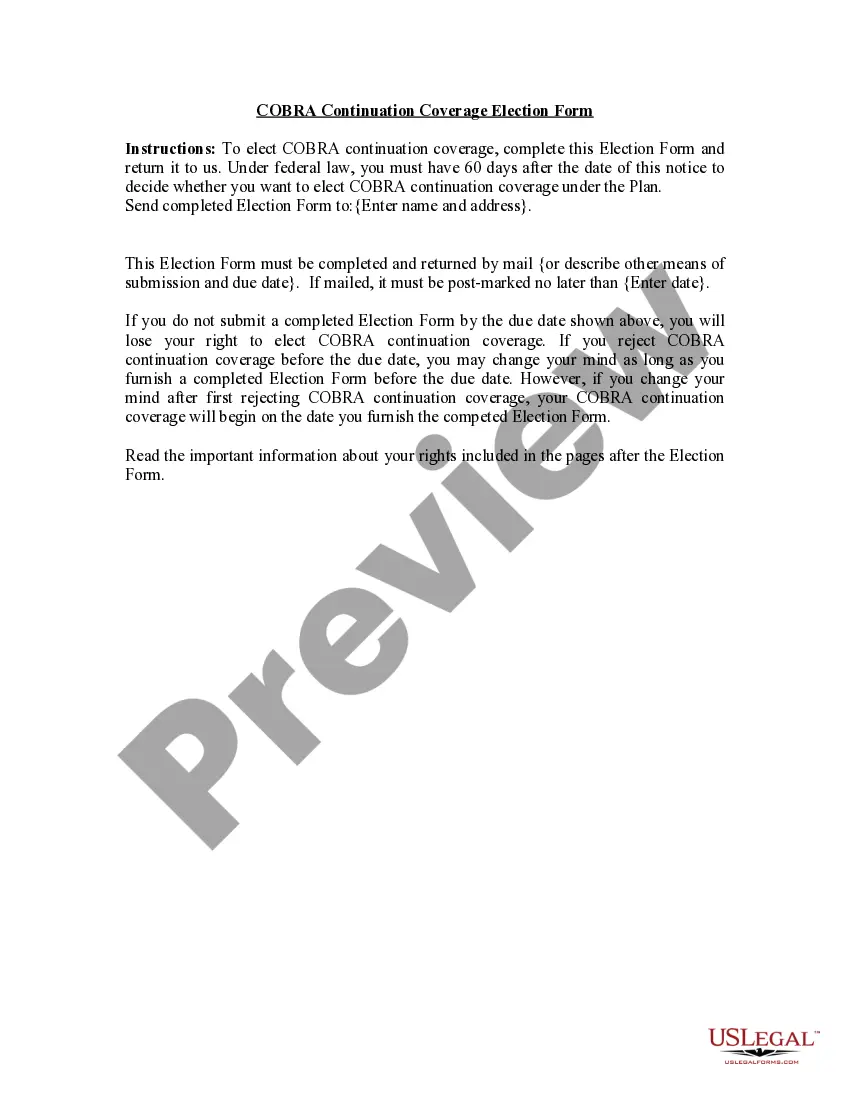

How to fill out COBRA Continuation Coverage Election Notice?

Legal documents management can be overwhelming, even for experienced professionals.

When searching for Cobra Benefits For Terminated Employees and lacking the time to spend finding the appropriate and current version, the tasks may be taxing.

US Legal Forms addresses any requirements you might have, from personal to business paperwork, all in one place.

Utilize advanced tools to complete and manage your Cobra Benefits For Terminated Employees.

Here are the steps to follow after accessing the document you desire: Verify it is the correct form by previewing it and reviewing its details. Ensure that the sample is authorized in your state or county. Select Buy Now when you are prepared. Choose a monthly subscription plan. Select the format you prefer, and Download, complete, eSign, print, and submit your documents. Enjoy the US Legal Forms online library, backed by 25 years of experience and trustworthiness. Transform your daily document management into a seamless and user-friendly process today.

- Access a resource pool of articles, tutorials, and guides related to your situation and needs.

- Save time and effort searching for the necessary documents, and use US Legal Forms’ advanced search and Review tool to find Cobra Benefits For Terminated Employees and obtain it.

- If you possess a subscription, Log In to the US Legal Forms account, search for the document, and acquire it.

- Check your My documents tab to see the documents you have previously saved and to manage your folders as needed.

- If it’s your first experience with US Legal Forms, create a free account and enjoy unlimited access to all the platform's benefits.

- A comprehensive web form library can be transformative for anyone aiming to handle these situations efficiently.

- US Legal Forms is a frontrunner in online legal documents, offering over 85,000 state-specific legal forms accessible to you anytime.

- With US Legal Forms, you have the ability to access state- or county-specific legal and business documents.

Form popularity

FAQ

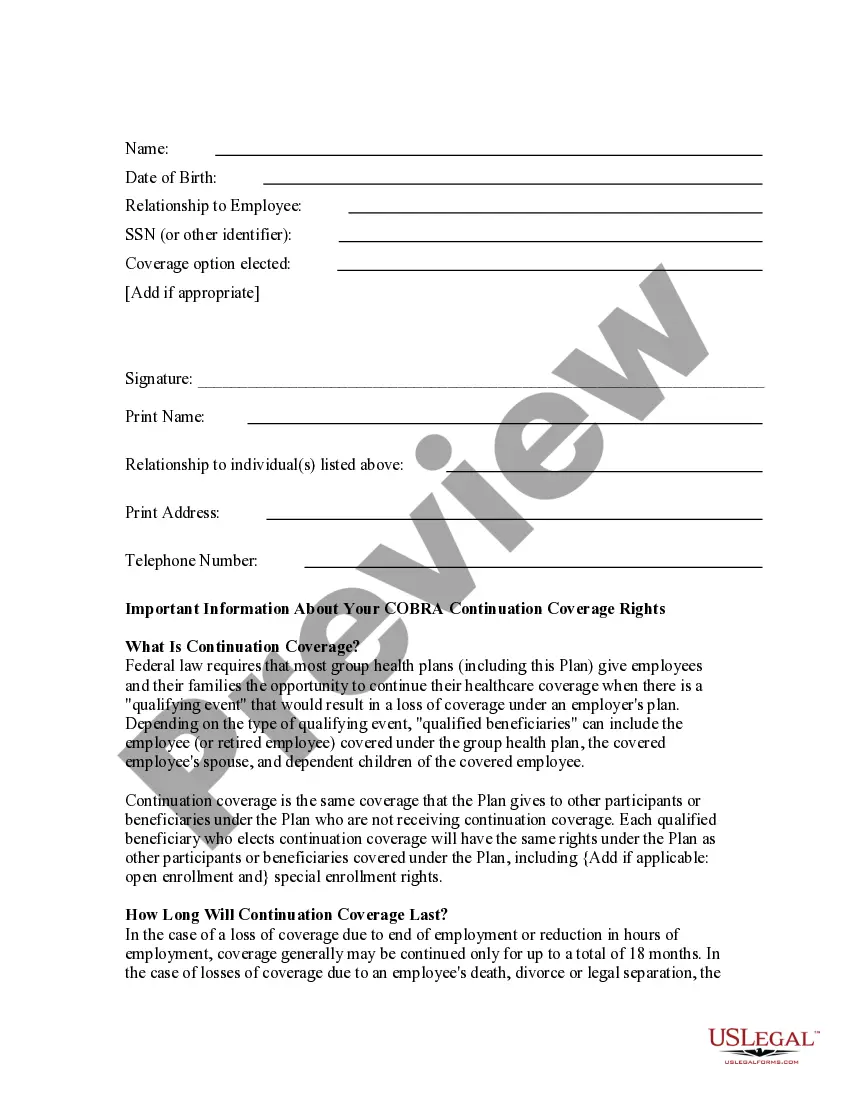

To get COBRA coverage after leaving a job, you should first receive a notice from your employer about your eligibility. This notice is crucial as it outlines your rights and the process to elect COBRA benefits for terminated employees. You must respond within the specified timeframe to secure your coverage. If you need assistance navigating this process, platforms like uslegalforms can provide valuable resources and guidance.

Many people wonder about the loophole for COBRA insurance, especially regarding its costs. A common misconception is that COBRA benefits for terminated employees are always unaffordable. However, if you qualify for a special enrollment period due to a job loss, you may access alternatives that are more budget-friendly. Understanding these options can help you find coverage that suits your needs.

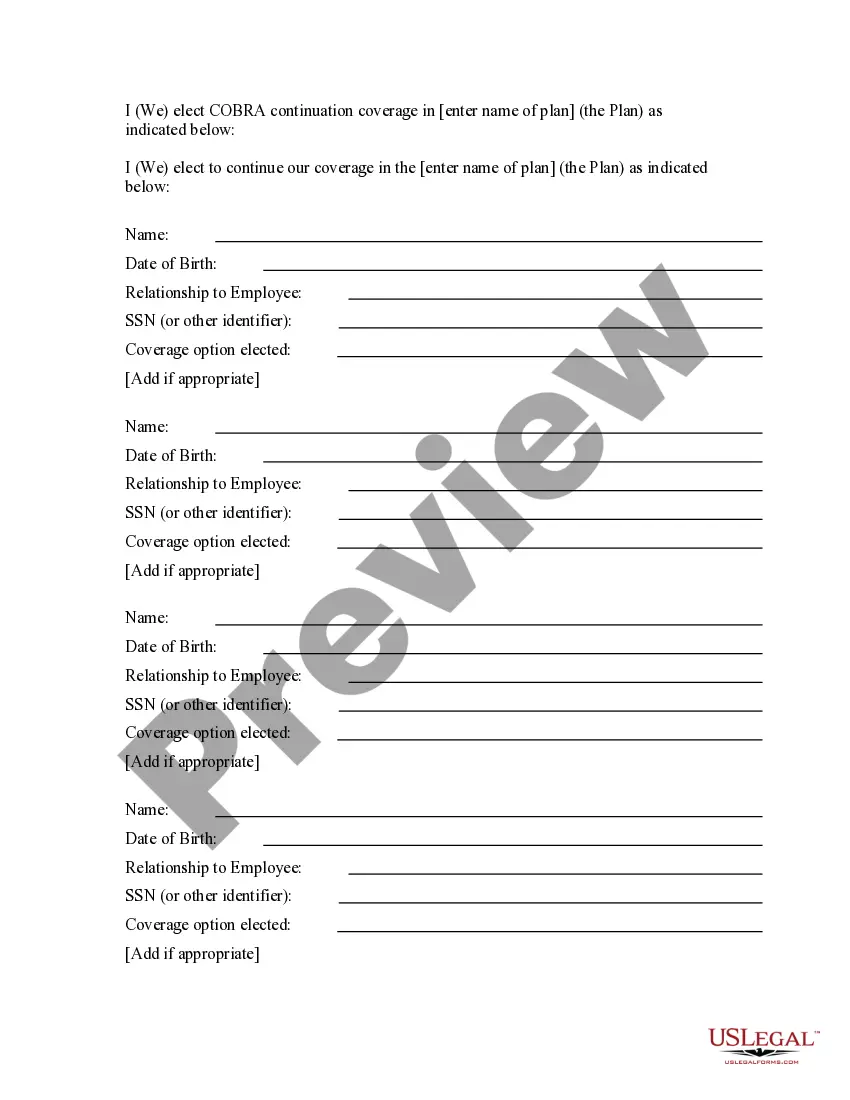

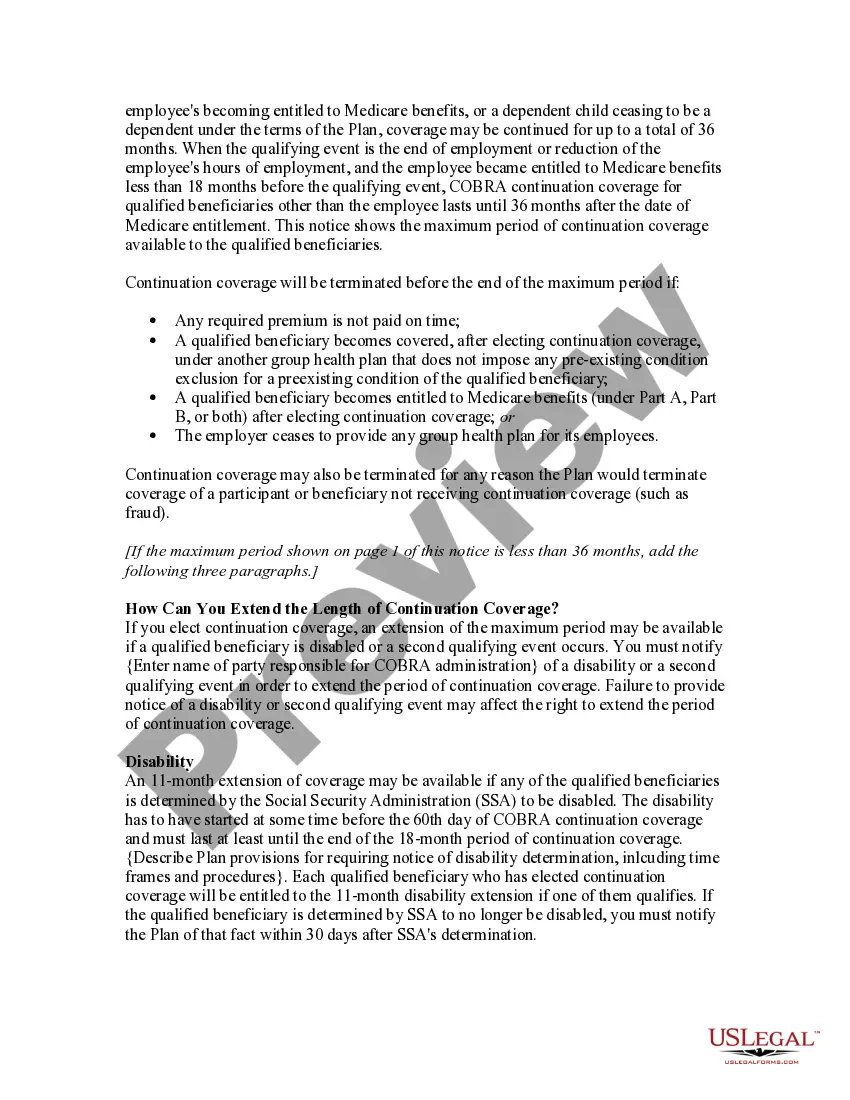

If you are terminated from your job, you may qualify for COBRA benefits for terminated employees. To be eligible, you must have been part of a group health plan and your employer must have 20 or more employees. Generally, you can continue your health coverage for up to 18 months under COBRA. It's important to act quickly, as you have a limited time to elect this coverage.

(California passed a similar law known as ?Cal-COBRA.?) Under COBRA, the group plan health insurance plan made available to terminated workers provides the exact same benefits as they would receive if they were still a member of the group, except that the employees have to pay the employer's cost of providing the ...

COBRA and Cal-COBRA COBRA stands for the Consolidated Omnibus Budget Reconciliation Act. COBRA allows former employees, retirees, and their dependents to temporarily keep their health coverage. If you get COBRA, you must pay for the entire premium, including any portion that your employer may have paid in the past.

For ?covered employees,? the only qualifying event is termination of employment (whether the termination is voluntary or involuntary) including by retirement, or reduction of employment hours. In that case, COBRA lasts for eighteen months.

You have 60 days to enroll in COBRA once your employer-sponsored benefits end. Even if your enrollment is delayed, you will be covered by COBRA starting the day your prior coverage ended. You will receive a notice from your employer with information about deadlines for enrollment.