Llc Business Owner For Application

Description

How to fill out Resolution Of Meeting Of LLC Members To Remove The Manager Of The Company And Appoint A New Manager?

Creating legal documents from the ground up can occasionally be daunting.

Certain situations may entail extensive research and significant financial expenditure.

If you're seeking a more straightforward and budget-friendly method of preparing Llc Business Owner For Application or other forms without the hassle, US Legal Forms is always here to assist.

Our online database of over 85,000 current legal documents covers nearly every facet of your financial, legal, and personal issues. With just a few clicks, you can promptly obtain state- and county-compliant templates carefully compiled for you by our legal experts.

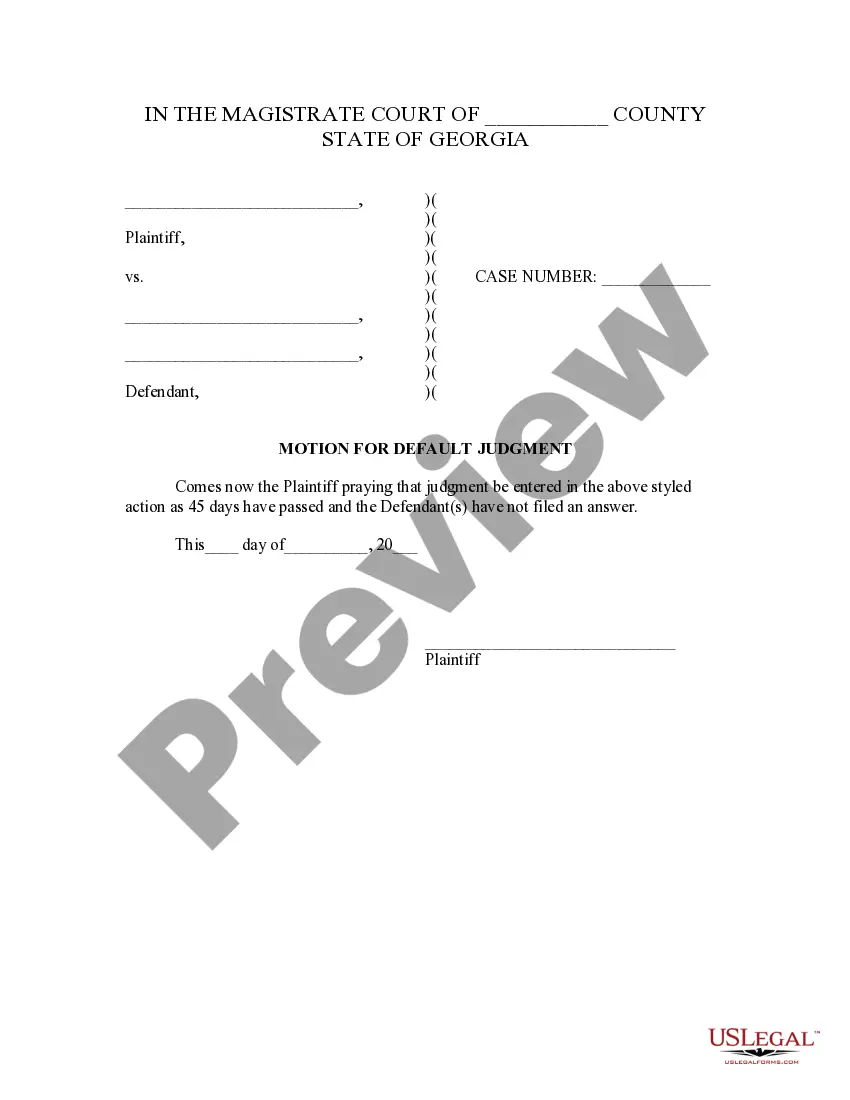

Review the form preview and descriptions to ensure you've located the document you're looking for.

- Access our website whenever you require a trustworthy and dependable service through which you can swiftly locate and download the Llc Business Owner For Application.

- If you are already familiar with our site and have previously created an account with us, simply Log In to your account, choose the template, and download it or re-download it anytime later from the My documents section.

- Not signed up yet? No problem. It takes minimal time to set it up and explore the library.

- However, before directly downloading the Llc Business Owner For Application, consider these suggestions.

Form popularity

FAQ

The best proof of ownership includes official business documents that detail your ownership stake, such as your operating agreement and stock certificates if applicable. For LLCs, having an updated operating agreement is crucial, as it is often the first reference for verifying ownership. As an LLC business owner for application, utilizing a platform like uslegalforms can simplify the creation and maintenance of these essential documents.

To show proof of ownership of a business, you can present your business enrollment documents, such as the LLC's formation papers and tax documents. Additionally, having a signed operating agreement can strongly affirm your status as an LLC business owner for application purposes. It's vital to maintain these documents in an accessible place to provide clarity and resolve any potential disputes.

To prove ownership in an LLC, you typically provide your operating agreement or articles of organization. These documents outline each member's ownership percentage and their roles within the LLC. As an LLC business owner for application, ensure these records are current and clearly indicate your ownership share to establish legal standing and credibility.

The owner of an LLC should be an individual or a group of individuals who want to start and run a business. It's important to select someone who is truly invested in the success of the business and can make informed decisions. As an LLC business owner for application, you gain flexibility in management and liability protection. If you need guidance, consider using the US Legal Forms platform to easily navigate ownership options and other legal requirements.

To demonstrate ownership in an LLC, present the Operating Agreement and any relevant amendments that outline ownership stakes. These documents confirm your status as a llc business owner for application. Remember, clear documentation can ease various processes, such as securing financing or entering contracts.

You can show ownership in an LLC through the Operating Agreement, which details each member's ownership percentage and role. Furthermore, providing documentation like the Articles of Organization adds authority to your claim as a llc business owner for application. When required, these documents serve as validated proof of your ownership.

As an owner of an LLC, you commonly refer to yourself as a 'member.' This term aligns with the structure of the LLC, emphasizing your participation in its affairs. When you are a llc business owner for application, using this specific title can simplify communications and ensure clarity in legal matters.

Yes, you can refer to yourself as the owner of your LLC; however, the official title is often 'member' in the context of an LLC. As a llc business owner for application, recognizing your role can clarify responsibilities and expectations. Additionally, this terminology is crucial when dealing with legal documents and contracts.

The primary document that reveals the owners of an LLC is the Operating Agreement. This document outlines the structure of the LLC, stipulating the ownership interests and roles of the members. When applying for licenses or permits as an LLC business owner for application, you may need to present this agreement to prove your ownership.

To file as a business owner, especially as an LLC business owner for application, start by determining your business structure and tax obligations. Gather all your financial documents; this includes income statements, expenses, and any applicable deductions. You may want to use tax software or consult tax professionals for assistance. Additionally, consider leveraging US Legal Forms for comprehensive tools that guide you through the filing process.