Company Internet Policy Format

Description

How to fill out Company Internet And Email Policy - Strict?

Legal administration can be perplexing, even for the most skilled professionals.

When searching for a Corporate Internet Policy Template and you cannot allocate time to find the suitable and current version, the process can be challenging.

With US Legal Forms, you can.

Access state- or county-specific legal and business documents. US Legal Forms addresses any needs you may have, from personal to corporate paperwork, all in one location.

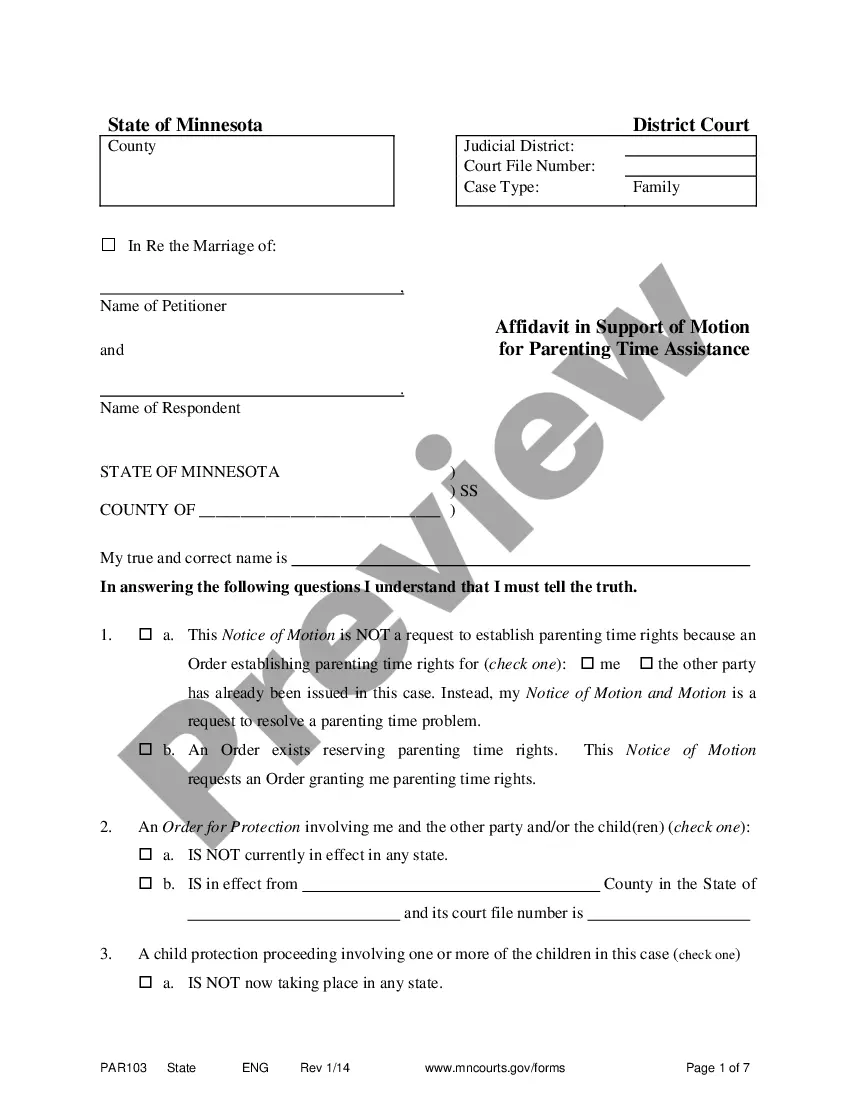

Verify it is the correct form by previewing it and reviewing its description.

If this is your first encounter with US Legal Forms, create a free account and gain unlimited access to the benefits of the library. Here are the steps to follow after you find the form you need.

Ensure the template is recognized in your state or county.

Click on Buy Now when you are prepared.

- Utilize sophisticated tools to complete and manage your Corporate Internet Policy Template.

- Browse a valuable resource hub of articles, guides, and manuals related to your context and requirements.

- Conserve time and effort searching for the documents you require, and employ US Legal Forms’ advanced search and Preview feature to locate the Corporate Internet Policy Template and obtain it.

- If you have a subscription, Log In to your US Legal Forms account, search for the form, and download it.

- Visit the My documents section to view the documents you've previously saved and to manage your folders as desired.

Select a monthly subscription option.

Choose the file format you desire, and Download, complete, eSign, print, and send your document.

Leverage the US Legal Forms online database, supported by 25 years of experience and reliability. Streamline your daily document management into a straightforward and user-friendly process today.

- A comprehensive online form database can be transformative for anyone aiming to navigate these situations effectively.

- US Legal Forms is a leading provider in online legal documents, featuring over 85,000 state-specific legal forms at your disposal anytime.

Form popularity

FAQ

To revive or reinstate your Idaho LLC, you'll need to submit the following to the Idaho Secretary of State: a completed Idaho Reinstatement Form. any missing annual reports. a $25 filing fee.

LLC ownership is personal property to its members. Therefore the operating agreement and Idaho state laws declare the necessary steps of membership removal. To remove a member from your LLC, a withdrawal notice, a unanimous vote, or a procedure depicted in the articles of organization may entail.

To form an Idaho S corp, you'll need to ensure your company has an Idaho formal business structure (LLC or corporation), and then you can elect S corp tax designation. If you've already formed an LLC or corporation, file Form 2553 with the Internal Revenue Service (IRS) to designate S corp taxation status.

In Idaho, you are allowed to register as many DBA names as you desire. You must follow the same process with each one and must be approved by the Idaho Secretary of State.

You may also reinstate your corporation by calling the Idaho Secretary of State's office; they will provide you with a Reinstatement Annual Report form and an Application for Reinstatement. You must complete and return them both in duplicate with the filing fee, by mail or in person.

While this is not an exhaustive list, it is a great place to start. File the Annual Report. The first thing you need to understand is that you have already gone to the effort in creating your LLC. ... Keep Good Written Records. ... Follow all Corporate Formalities. ... Enlist an Idaho Business Attorney to Help You.

Idaho LLC Formation Filing Fee: $100 The cost to start an Idaho LLC is $100 for online filings, and $120 for paper filings. Forming your LLC involves filing an Idaho Certificate of Organization with the Secretary of State.

Yes, you can file the Amendment to Certificate of Organization by mail to change your Idaho LLC name. There are two ways to file by mail: Download and complete the Amendment to Certificate of Organization form and mail it to the Secretary of State. Complete the online filing as described above.