Wrongful Foreclosure Settlement Amounts

Description

How to fill out Sample Letter For Employment Discrimination - Wrongful Discharge?

Obtaining legal document examples that adhere to federal and state regulations is essential, and the internet provides many alternatives to select from.

However, what's the purpose of expending time searching for the properly prepared Wrongful Foreclosure Settlement Amounts example online when the US Legal Forms digital library already has such templates organized in one location.

US Legal Forms is the largest online legal directory with more than 85,000 fillable templates created by lawyers for any professional and personal situation. They are straightforward to navigate, with all documents categorized by state and intended use.

Search for another example using the search tool at the top of the page if necessary. Once you've found the appropriate form, click Buy Now and choose a subscription plan. Register for an account or Log In, then complete your payment with PayPal or a credit card. Select the preferred format for your Wrongful Foreclosure Settlement Amounts and download it. All documents you find through US Legal Forms are reusable. To redownload and complete previously purchased forms, access the My documents section in your account. Take advantage of the most extensive and user-friendly legal document service!

- Our experts keep current with legal changes, ensuring your documents are always updated and compliant when obtaining a Wrongful Foreclosure Settlement Amounts from our site.

- Acquiring a Wrongful Foreclosure Settlement Amounts is quick and easy for both existing and new users.

- If you already possess an account with an active subscription, Log In and save the document template you require in the desired format.

- If you are a new visitor to our site, follow the steps below.

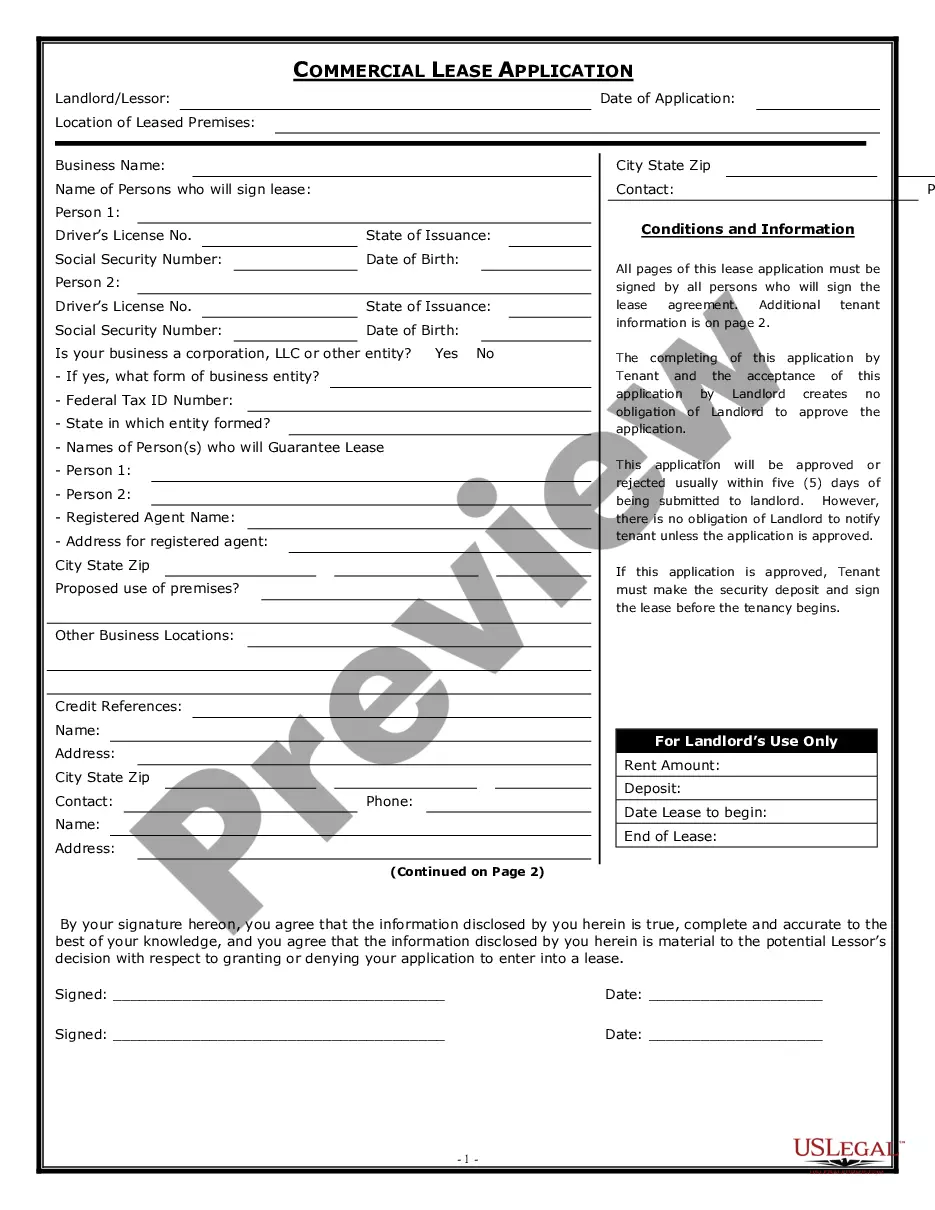

- Review the template using the Preview feature or through the text outline to ensure it meets your requirements.

Form popularity

FAQ

The 37 day foreclosure rule refers to the timeline that lenders must follow before completing a foreclosure. This rule ensures that homeowners receive proper notice and have the chance to respond. Understanding this timeline is crucial when considering wrongful foreclosure settlement amounts, as it can impact your rights and options. By using resources on platforms like US Legal Forms, you can gain clarity on this rule and better navigate your foreclosure situation.

Negotiating a foreclosure settlement involves understanding your situation and gathering relevant documents. Start by assessing your wrongful foreclosure settlement amounts and identifying your goals. Then, reach out to your lender to discuss your options and present your case clearly. Utilizing platforms like US Legal Forms can provide you with the necessary templates and resources to effectively communicate your position and negotiate a fair settlement.

The statute of limitations for wrongful foreclosure typically varies by state, but it often ranges from one to six years. This time frame begins when you first become aware of the wrongful action taken against you. It is essential to act promptly, as missing this deadline could bar you from seeking damages. To better understand your rights and the associated wrongful foreclosure settlement amounts, consider using resources from US Legal Forms to navigate your situation effectively.

The typical settlement percentage for wrongful foreclosure cases can vary widely, often ranging from 20% to 50% of the total amount lost. Factors influencing the settlement include the strength of your case, the lender's willingness to negotiate, and the specific circumstances surrounding your foreclosure. Engaging with legal professionals can help you determine a realistic expectation for wrongful foreclosure settlement amounts. US Legal Forms offers tools and information to assist you in understanding your options.

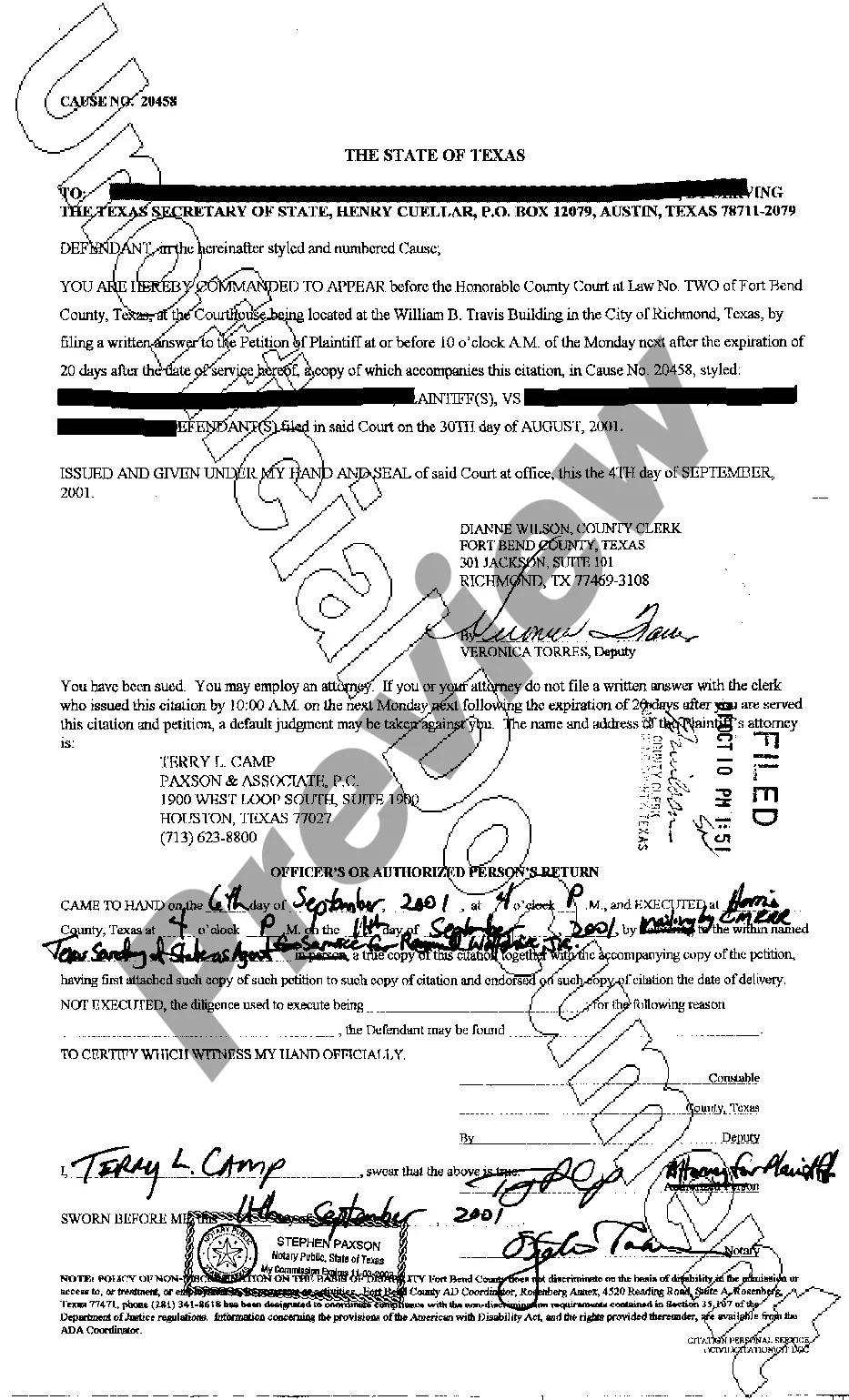

This can include homeowners, judgment holders, lienholders, or occupants of the property. The summons lets the defendants know that they must respond to the complaint by filing a formal answer with the court within either 20 or 30 days, depending on whether the service was in person or by mail.

Foreclosure Can Take Months or Years Notice of default: The lender typically issues a notice of default, indicating its intention to foreclose, when the loan becomes 90 days past due. Typically, the notice indicates legal foreclosure will begin in 90 days unless the borrower brings their payments up to date.

What Are the Steps of Foreclosure? Step 1: payment default. Step 2: notice of the default. Step 3: foreclosure process. Step 4: foreclosure sale. Step 5: real estate owned (REO), and. Step 6: eviction.

A foreclosure is simply the closing of a Home Loan by paying off the entire amount borrowed in one lump sum amount. It is part of the regular Home Loan process and allows you to pay off the borrowed amount before the EMI schedule. You can opt for a foreclosure even after having made a few EMI payments.

Notice of Default ? Foreclosure starts when your lender records a Notice of Default against your property with the Registrar Recorder's office. The Notice of Default tells you the total amount you owe including missed payments and foreclosure fees.