Who Is The Beneficiary Of An Irrevocable Trust

Description

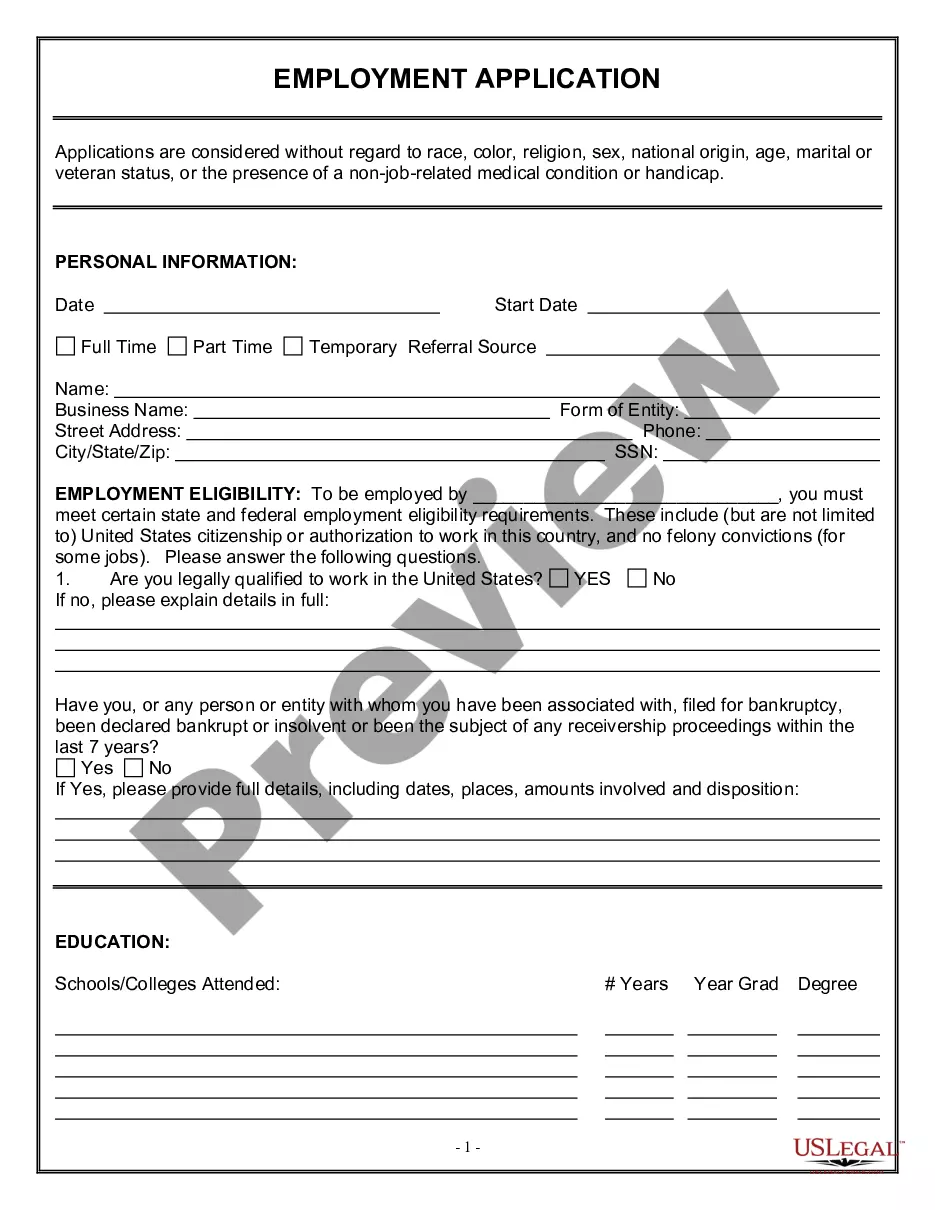

How to fill out Irrevocable Funded Life Insurance Trust Where Beneficiaries Have Crummey Right Of Withdrawal With First To Die Policy With Survivorship Rider?

- If you're a returning user, log in to your account and click Download next to your desired form template. Confirm your subscription is active; renew it if necessary.

- For first-time users, start by checking the Preview mode and form description to ensure you've selected the right document that aligns with your local jurisdiction requirements.

- If you need a different template, utilize the Search tab to find the most suitable form tailored for your situation.

- Once you locate the correct form, click on the Buy Now button and select your preferred subscription plan. You will need to create an account to access the full library.

- Complete your purchase by entering your credit card details or choosing your PayPal account for payment.

- Finally, download your form and save it on your device. You can access it anytime from the My Forms section in your profile.

US Legal Forms empowers both individuals and legal professionals, offering a vast collection of over 85,000 legal documents that are easy to fill out and edit.

Start your journey in legal documentation with US Legal Forms today and ensure your forms are precise and legally sound. Don't hesitate; get started now!

Form popularity

FAQ

In an irrevocable trust, the beneficiary is the person or entity designated to receive benefits from the trust's assets. This trust generally cannot be modified after its establishment, which secures the beneficiary’s rights. Understanding who is the beneficiary of an irrevocable trust is crucial for effective estate planning. If you need assistance defining or managing your trust, US Legal Forms offers valuable resources to help you navigate this process.

Beneficiaries are typically listed in the trust document itself. This document should clearly define who the beneficiaries are, alongside their respective shares. By detailing this information, the trust ensures that everyone understands their stake in the assets. Properly listing beneficiaries helps avoid confusion or disputes down the line.

Yes, you can find out if you are a beneficiary of a trust by directly asking the trustee or reviewing the trust documents. In many cases, beneficiaries have the right to access information regarding the trust. If you are uncertain about your status, platforms like US Legal Forms can guide you in obtaining this information and understanding who is the beneficiary of an irrevocable trust.

Yes, notifying a beneficiary of a trust is a legal requirement in many jurisdictions. The trustee must inform beneficiaries about their interest and any actions involving the trust. Knowing who is the beneficiary of an irrevocable trust helps clarify expectations and responsibilities for all parties involved.

A beneficiary gets notified through formal communication from the trustee, usually via mail or email. This notification often includes information about the trust assets, the trust terms, and the beneficiary's rights. Understanding how notifications are delivered is essential for grasping who is the beneficiary of an irrevocable trust.

Beneficiaries of a trust typically receive notifications in writing to ensure clear and documented communication. The trustee will outline the specifics regarding the trust, including details about the assets, any distributions, and crucial timelines. Establishing who is the beneficiary of an irrevocable trust is an important process, and written notifications facilitate transparency and understanding.

Yes, a trustee has a duty to communicate with beneficiaries about the administration of the trust. This includes providing updates on the trust's activities and informing them of their rights and interests. A key aspect of understanding who is the beneficiary of an irrevocable trust involves clear communication, ensuring that all parties are aware of potential distributions and the trust's status.

You cannot name yourself as a beneficiary of an irrevocable trust in the same way you can with a revocable trust. In an irrevocable trust, once you transfer assets, you relinquish control and ownership. Thus, you cannot benefit from the trust as a beneficiary, which is crucial to its design—protecting assets from creditors and reducing tax burdens. If you need clarity on this topic and others like it, consider exploring US Legal Forms for reliable solutions and resources.

The beneficiary of an irrevocable trust is the individual or group that stands to receive benefits from the trust assets. This designation is made during the trust’s creation and cannot be easily changed. A clear understanding of who the beneficiary of an irrevocable trust is can help manage expectations and clarify the intentions of the trust creator.

The beneficial owner of an irrevocable trust is essentially the beneficiary who currently holds the right to enjoy the benefits of the trust's assets. These rights may include receiving distributions or other benefits outlined in the trust agreement. It's important to note that while the beneficiaries gain access, control over the assets typically remains with the trustee.