Irrevocable Trust Beneficiaries With A Will

Description

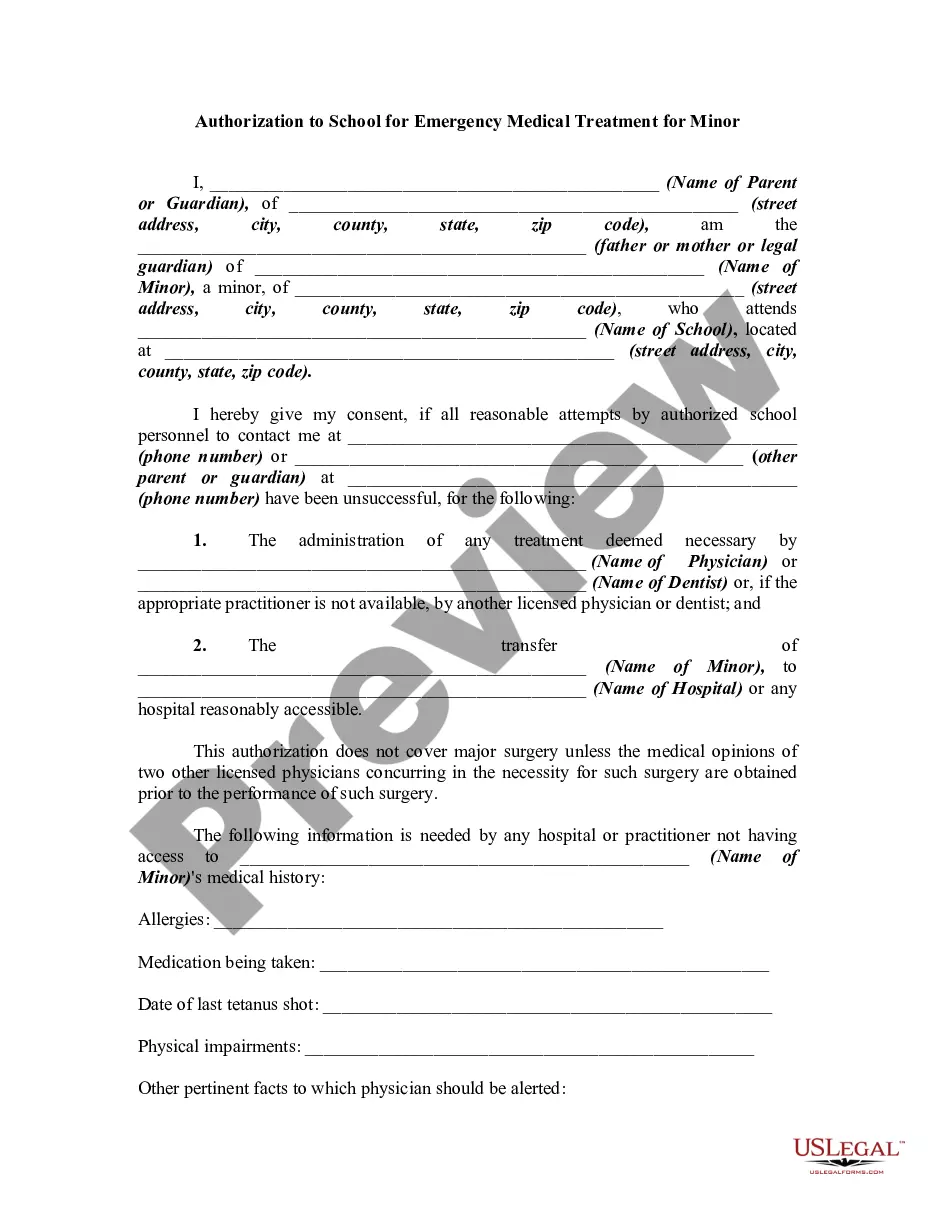

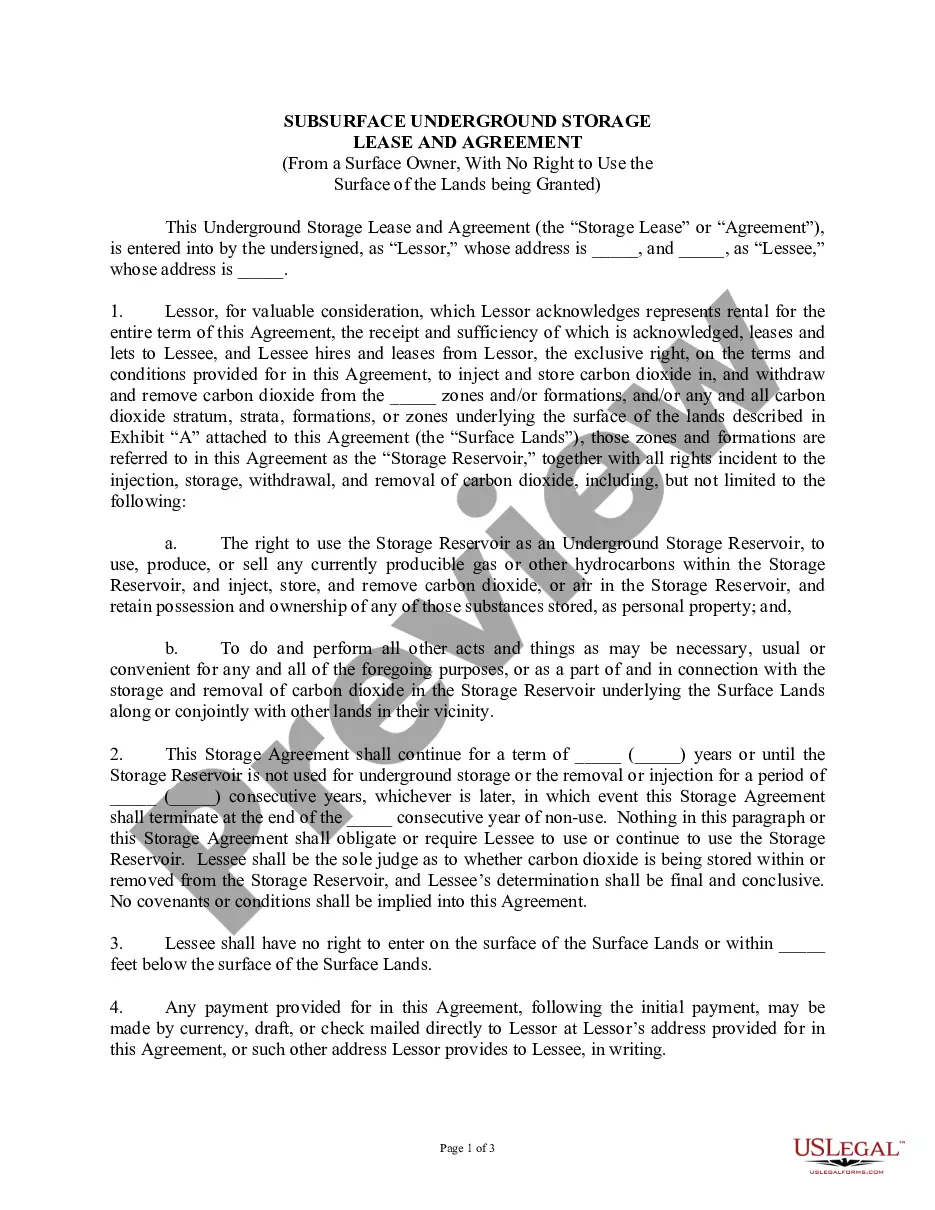

How to fill out Irrevocable Funded Life Insurance Trust Where Beneficiaries Have Crummey Right Of Withdrawal With First To Die Policy With Survivorship Rider?

- Log in to your US Legal Forms account if you're a returning user. Ensure your subscription is active for uninterrupted access.

- For new users, start by previewing the form descriptions to find the right template that suits your requirements and complies with your jurisdiction.

- If needed, use the search feature to locate additional templates that align with your needs.

- Select the 'Buy Now' option and choose your preferred subscription plan; account registration will be necessary.

- Complete your purchase by providing credit card details or using a PayPal account.

- Download your completed form and save it for easy access via the 'My documents' menu in your profile.

With US Legal Forms, you not only gain access to a robust library of over 85,000 editable forms, but you also benefit from expert assistance, ensuring your documents are precise and legally valid.

Don't hesitate any longer; start securing your legal documents today! Visit US Legal Forms for more details.

Form popularity

FAQ

An irrevocable trust continues to operate after the owner's death, effectively transferring control of the assets to the designated trustee. This trustee is responsible for managing the assets and ensuring distributions are made according to the established terms of the trust. For irrevocable trust beneficiaries with a will, this process simplifies asset transfer, avoiding probate, and allows for immediate access to inherited funds or property.

Generally, an irrevocable trust does not need to be filed with the court unless a dispute arises or a legal action is taken regarding the trust. The private nature of the trust offers a level of confidentiality for the irrevocable trust beneficiaries with a will. However, some states may require the trust to be registered if it holds property or if certain tax filings are necessary, so it’s wise to consult with a legal expert.

When the owner of an irrevocable trust passes away, the trust typically remains in effect, and the assets are distributed to the beneficiaries according to the terms specified in the trust document. The trust does not go through probate, which can streamline the transfer of assets. It's essential to understand that the irrevocable trust beneficiaries with a will will receive their shares directly from the trust, bypassing the lengthy probate process.

Irrevocable trust beneficiaries with a will generally have rights to distributions from the trust as specified by the trust document. They can also request accountings to understand how the trust is being managed and whether it is fulfilling its obligations. However, it's important to note that the trust creator typically retains control over the trust assets during their lifetime, limiting some beneficiary rights until the creator passes away.

One of the most significant mistakes parents make is neglecting to clearly outline the irrevocable trust beneficiaries with a will. Failing to do this can lead to confusion and disputes among family members. Additionally, many underestimate the importance of regularly updating the trust as circumstances change. Using services like USLegalForms can help ensure your trust fund aligns with your family’s needs and intentions.

You can write your own irrevocable trust, but it's important to ensure it meets all legal requirements. Many choose to use templates or resources from services like USLegalForms to avoid common pitfalls. Remember, addressing the irrevocable trust beneficiaries with a will correctly is crucial for effective management of the trust. Professional guidance can help tailor the document to your specific needs.

Filling out an irrevocable trust involves several key steps. First, you need to identify the trust’s purpose, including the irrevocable trust beneficiaries with a will. Next, clearly define the terms of the trust, including assets to include and the roles of trustees. Consider consulting with an estate planning attorney or using a platform like USLegalForms to help streamline the process.

Yes, an irrevocable trust does have beneficiaries. These beneficiaries are individuals or entities designated to receive assets from the trust. It's important to understand how irrevocable trust beneficiaries with a will can interact, as a will cannot change the terms of the irrevocable trust. By clearly outlining beneficiaries in both the trust and the will, you can ensure a smooth transfer of assets according to your wishes.

One downside of an irrevocable trust is the loss of control over the assets placed in the trust. Once established, you cannot change the terms or dissolve the trust without the consent of the beneficiaries. Additionally, it may not provide the same level of flexibility as a revocable trust, which might be a consideration for those planning their estate.

After the death of the person who created the irrevocable trust, the trustee becomes the responsible party for managing the trust. This individual ensures that the terms of the trust are followed and that the irrevocable trust beneficiaries with a will receive their designated assets. The trustee must act in the best interest of the beneficiaries by adhering to the trust’s guidelines.