Special Needs Trust Planning For Ssi

Description

How to fill out Special Needs Irrevocable Trust Agreement For Benefit Of Disabled Child Of Trustor?

Regardless of whether it’s for corporate needs or personal affairs, everyone must confront legal circumstances at some point in their lives.

Filling out legal documents requires meticulous consideration, starting from selecting the correct form template.

Once saved, you can complete the form using editing software or print it out and finish it manually. With a comprehensive US Legal Forms catalog available, you won’t need to waste time searching for the correct template online. Take advantage of the library’s simple navigation to locate the suitable document for any situation.

- For instance, if you choose an incorrect version of a Special Needs Trust Planning For Ssi, it will be denied upon submission.

- Thus, it is essential to secure a trustworthy source of legal documents like US Legal Forms.

- To acquire a Special Needs Trust Planning For Ssi template, follow these straightforward steps.

- Utilize the search bar or catalog browsing to find the template you require.

- Review the document’s description to ensure it aligns with your circumstances, state, and county.

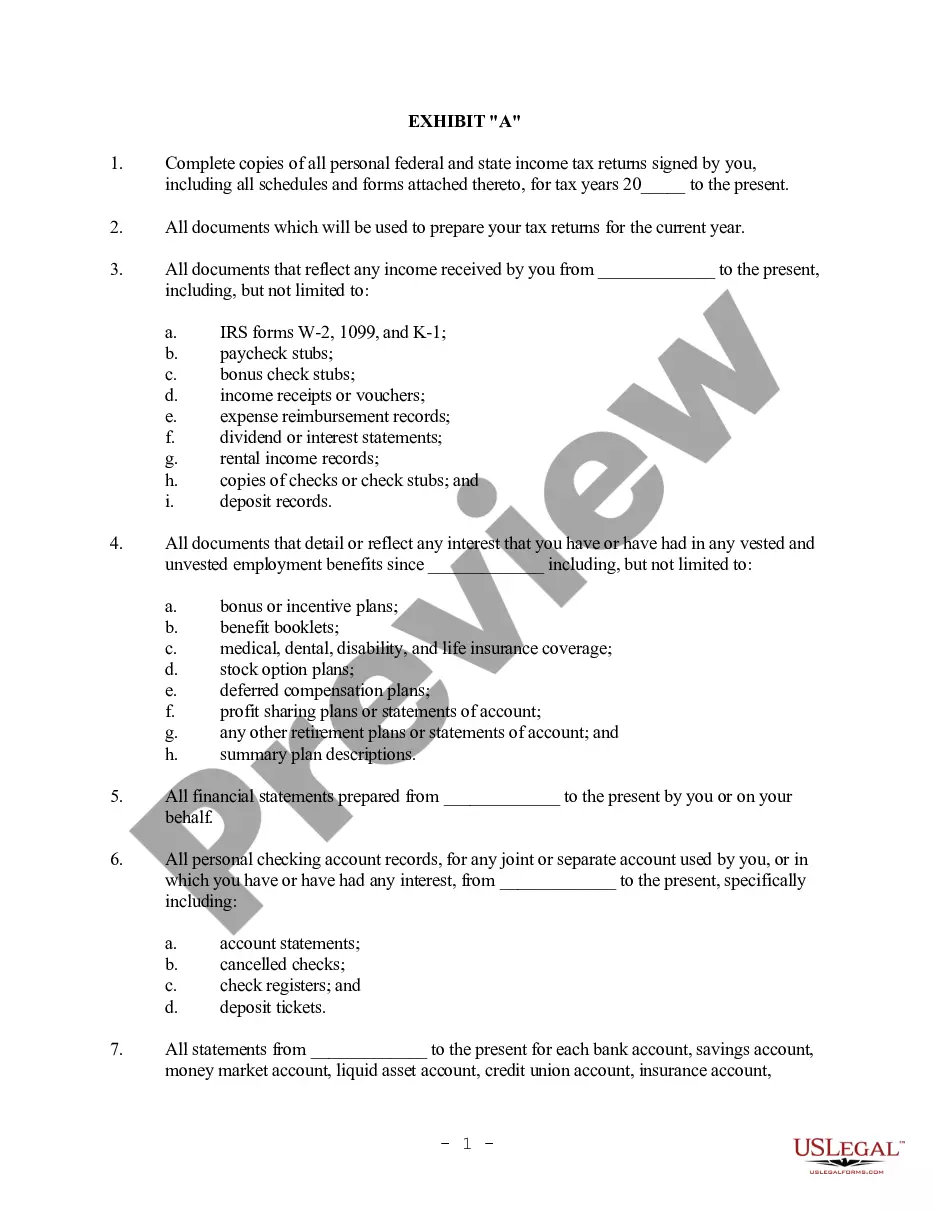

- Click on the form’s preview to examine it.

- If it is not the correct document, return to the search feature to locate the Special Needs Trust Planning For Ssi template you need.

- Download the form once it satisfies your requirements.

- If you possess a US Legal Forms account, simply click Log in to access previously saved templates in My documents.

- If you do not yet have an account, you can obtain the document by clicking Buy now.

- Select the appropriate pricing option.

- Complete the profile registration form.

- Choose your method of payment: utilize a credit card or PayPal account.

- Select the file format you prefer and download the Special Needs Trust Planning For Ssi.

Form popularity

FAQ

What are the main benefits of an SDT? The asset value limit of $781,250 (indexed annually on 1 July) and income from the trust may be disregarded for the purposes of the principal beneficiary's income support payment. Assets above that limit are added to the assessable assets of the principal beneficiary.

Anyone may contribute to a beneficiary's account, but only cash assets may be placed in an ABLE account. A special needs trust, on the other hand, may hold non-cash assets such as land or stock. ABLE account contributions are limited to a maximum annual contribution equal to the annual gift tax exclusion.

Cons of Special Needs Trusts The trust must be maintained, and yearly management costs can be high. Depending on who manages the fund, there may be a minimum amount required to set up the trust. It may be financially difficult for the settlor to actually establish the trust, depending upon their circumstances.

With an irrevocable trust, the transfer of assets is permanent. So once the trust is created and assets are transferred, they generally can't be taken out again. You can still act as the trustee but you'd be limited to withdrawing money only on an as-needed basis to cover necessary expenses.

Funds held in a properly drafted special needs trust (SNT) will not affect a Supplemental Security Income (SSI) or Medicaid recipient's benefits. However, funds disbursed in a manner that violates SSI or Medicaid rules can impact these benefits.