Special Needs Trust For Elderly

Description

How to fill out Special Needs Irrevocable Trust Agreement For Benefit Of Disabled Child Of Trustor?

It’s clear that you cannot become a legal expert in a day, nor can you easily learn how to swiftly create a Special Needs Trust For Elderly without possessing a specialized education.

Compiling legal documents is a lengthy process that demands particular training and expertise. Therefore, why not entrust the creation of the Special Needs Trust For Elderly to the professionals.

With US Legal Forms, one of the largest collections of legal templates, you can discover everything from court filings to templates for internal corporate communication.

If you need any other template, restart your search.

Create a free account and choose a subscription plan to acquire the template. Select Buy now. Once the transaction is completed, you can access the Special Needs Trust For Elderly, fill it out, print it, and send or mail it to the relevant individuals or organizations.

- We recognize how vital compliance and adherence to federal and local regulations are.

- That’s why, on our platform, all templates are tailored to specific locations and remain current.

- Here’s how to start with our website and obtain the document you need in just a few minutes.

- Find the form you require using the search bar at the top of the page.

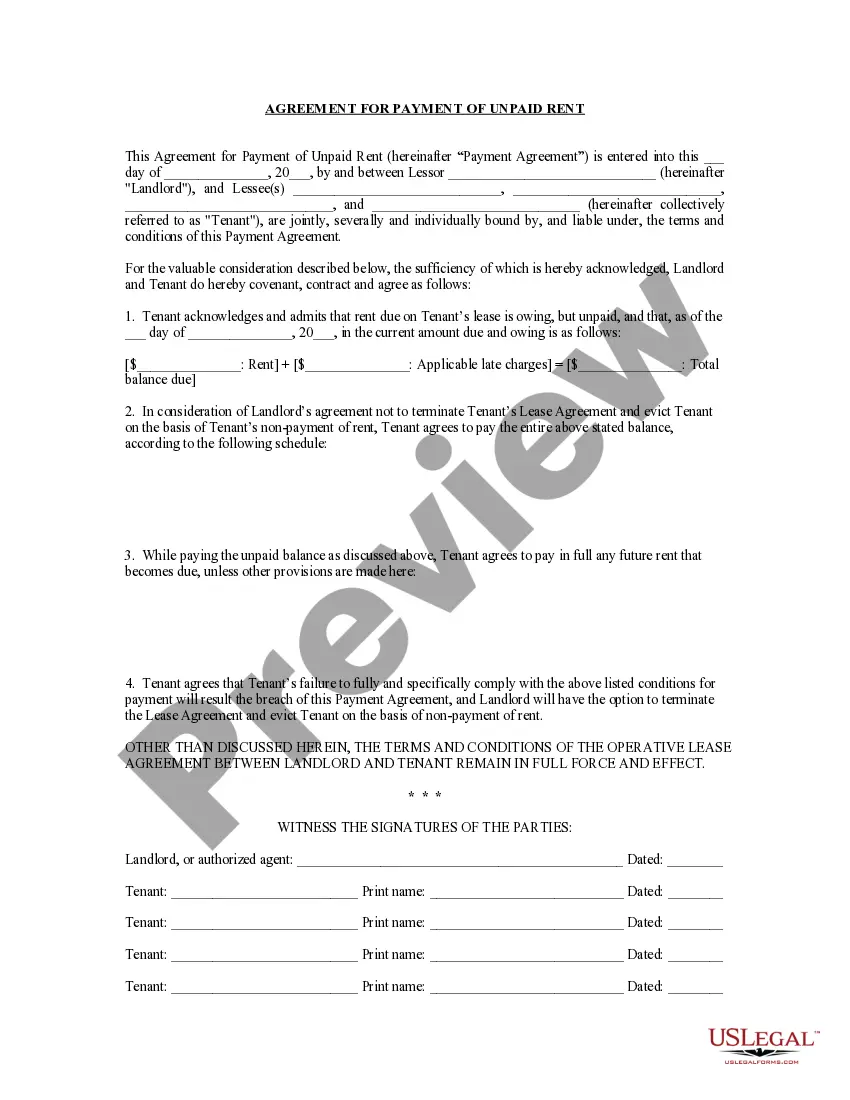

- Preview it (if this option is available) and review the accompanying description to verify if Special Needs Trust For Elderly is what you need.

Form popularity

FAQ

The 5 year rule for special needs trust pertains to the Medicaid eligibility of the beneficiary. Essentially, if the trust is funded within five years of applying for Medicaid, it may affect the eligibility for benefits. This rule emphasizes the importance of careful planning when considering a special needs trust for elderly individuals. Consulting with experts at US Legal Forms can provide clarity on this rule and help you navigate the complexities of trust management.

While a special needs trust for elderly individuals offers many advantages, there are some downsides to consider. One potential downside is the complexity of setting it up, which may require legal assistance and ongoing maintenance. Furthermore, the trust may limit the beneficiary's ability to access certain government benefits if not managed correctly. Understanding these challenges can help you make informed decisions about your estate planning.

When setting up a special needs trust for elderly individuals, it's crucial to avoid common pitfalls. One mistake is failing to properly fund the trust, which can lead to a lack of resources for the beneficiary. Additionally, neglecting to consult with a legal expert may result in non-compliance with government regulations, jeopardizing the trust's benefits. Ensuring accurate documentation and ongoing management is essential to prevent these issues.

Individuals who qualify for a disabled person's trust, often referred to as a special needs trust for elderly, typically include those with disabilities that limit their ability to earn income or care for themselves. This type of trust is designed to ensure that beneficiaries can receive necessary financial support without jeopardizing their eligibility for government assistance programs. If you are considering establishing a special needs trust for elderly family members, it is essential to consult with a legal expert to ensure compliance with federal and state regulations. Platforms like US Legal Forms can provide valuable resources and documentation to help you navigate this process effectively.

When a beneficiary of a special needs trust for elderly individuals turns 65, the trust can continue to provide financial support without jeopardizing their eligibility for government benefits. The special needs trust remains intact and can still cover expenses that government benefits do not. It's important to consult with a legal expert to ensure the trust is managed correctly and continues to meet the needs of the beneficiary. Utilizing the US Legal Forms platform can help you navigate these complexities and create a trust that aligns with your goals.

A qualified disability trust (QDisT) is a type of trust that qualifies for tax exemptions and applies to most trusts set up for someone with special needs. Normally, you must pay income tax on the income you receive from trusts, and that requirement formerly included special needs trusts.

Questions About Setting Up a Special Needs Trust ?How would you get started to make a special needs trust?? ... ?If your parents name you as the beneficiary of their insurance [and you are an individual with disabilities who receives public benefits] can that be put into a special needs trust??

What are the main benefits of an SDT? The asset value limit of $781,250 (indexed annually on 1 July) and income from the trust may be disregarded for the purposes of the principal beneficiary's income support payment. Assets above that limit are added to the assessable assets of the principal beneficiary.

Different names for first-party special needs trusts you may hear include: Payback special needs trust. Litigation special needs trust. Miller trust. (d)(4)(A) SNT. (d)(4)(C) SNT.

Cons of Special Needs Trusts The trust must be maintained, and yearly management costs can be high. Depending on who manages the fund, there may be a minimum amount required to set up the trust. It may be financially difficult for the settlor to actually establish the trust, depending upon their circumstances.