Right Death Spouse For A Former

Description

How to fill out Irrevocable Life Insurance Trust - Beneficiaries Have Crummey Right Of Withdrawal?

Creating legal documents from the ground up can frequently feel a bit daunting.

Certain situations may require extensive research and significant financial investment.

If you're seeking a more direct and economical method of preparing Right Death Spouse For A Former or any other paperwork without unnecessary complications, US Legal Forms is always available to assist you.

Our online repository of over 85,000 current legal documents encompasses nearly every facet of your financial, legal, and personal affairs.

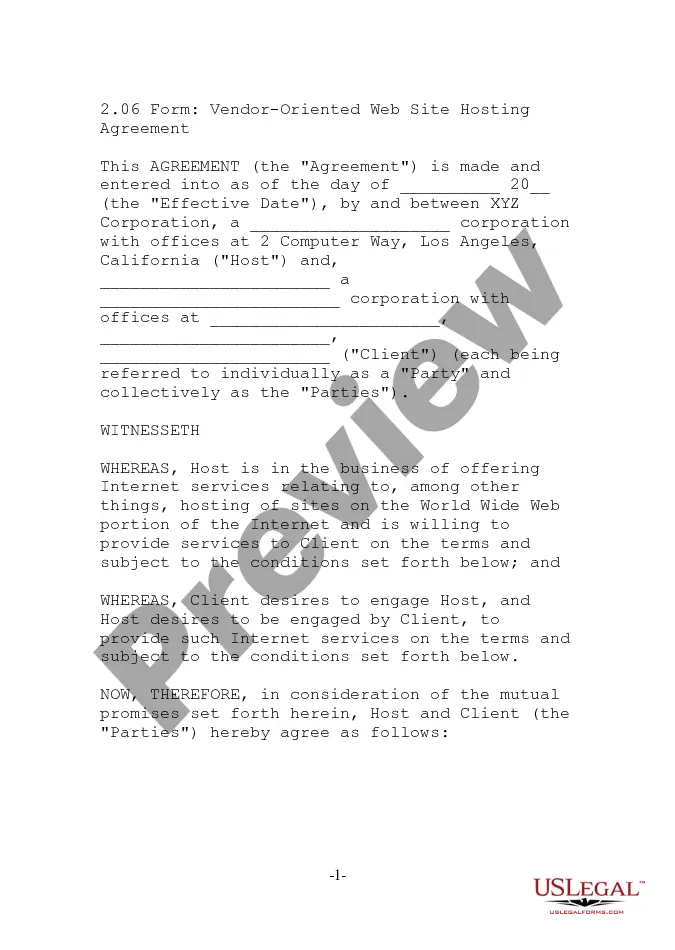

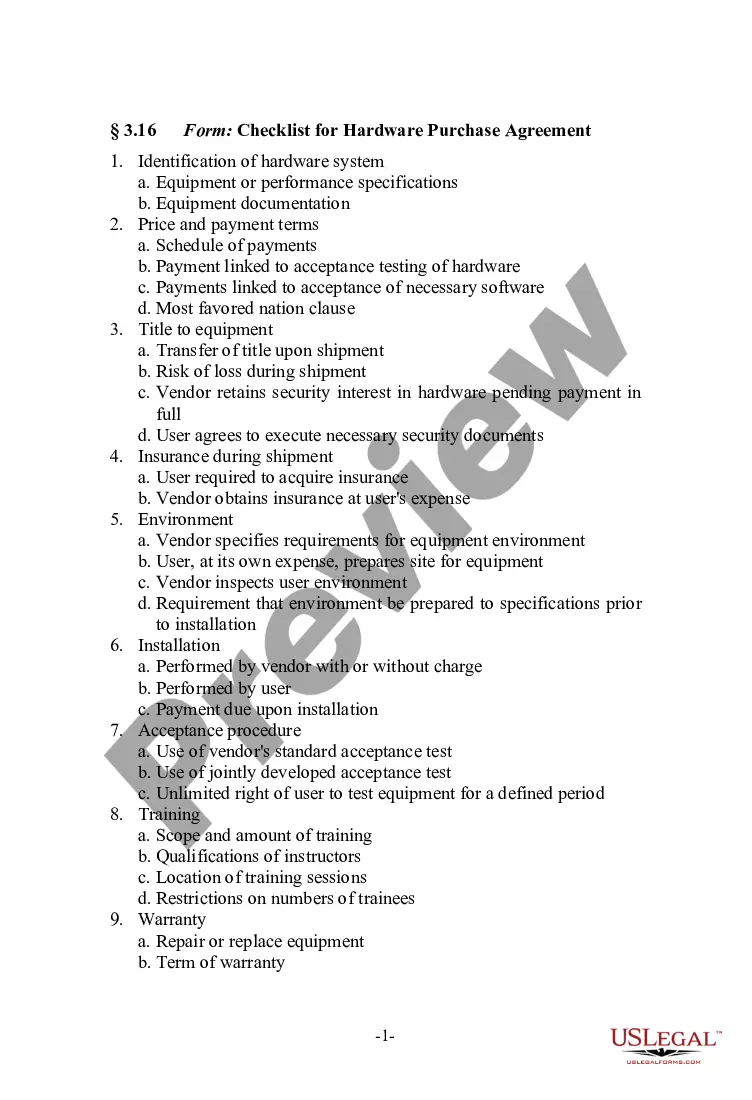

Examine the document preview and descriptions to confirm that you are looking at the document you need. Ensure the form you choose adheres to the regulations of your state and county. Select the most appropriate subscription plan to acquire the Right Death Spouse For A Former. Download the file, then fill it out, validate it, and print it. US Legal Forms has a solid reputation and over 25 years of expertise. Join us today and simplify document preparation into a seamless process!

- With just a few clicks, you can swiftly obtain state- and county-specific forms meticulously prepared for you by our legal experts.

- Utilize our platform whenever you require dependable services to quickly find and download the Right Death Spouse For A Former.

- If you’re familiar with our services and have already created an account with us, simply Log In to your account, find the form, and download it immediately or access it again later in the My documents section.

- Not registered yet? No problem. It only takes a few minutes to sign up and browse the catalog.

- However, before proceeding to download Right Death Spouse For A Former, consider these suggestions.

Form popularity

FAQ

If your spouse died this year, you should file your taxes just as if your spouse were still alive. If he had income, enter it as you would in any other year. In the year of a spouse's death, the surviving spouse usually is considered married for the entire year, for tax purposes.

Here is what you should do within about 10 days after your spouse dies: Locate their will. ... Get at least 10 copies of the death certificate. ... Consult an estate attorney. ... Contact the executor of your spouse's estate. ... Contact your certified public accountant (CPA).

Top 10 Things Not to Do When Someone Dies 1 ? DO NOT tell their bank. ... 2 ? DO NOT wait to call Social Security. ... 3 ? DO NOT wait to call their Pension. ... 4 ? DO NOT tell the utility companies. ... 5 ? DO NOT give away or promise any items to loved ones. ... 6 ? DO NOT sell any of their personal assets. ... 7 ? DO NOT drive their vehicles.

For two tax years after the year your spouse died, you can file as a qualifying widow(er), which gets you a higher standard deduction and lower tax rate than filing as a single person. You must meet these requirements: You haven't remarried.

Taxpayers who do not remarry in the year their spouse dies can file jointly with the deceased spouse. For the two years following the year of death, the surviving spouse may be able to use the Qualifying Widow(er) filing status.