Obtaining Nonprofit With Ein Number

Description

How to fill out Bylaw Provision For Obtaining Federal Nonprofit Status Article Restatement Of Purpose?

Gaining access to legal documents that conform to federal and local laws is crucial, and the web provides numerous choices to choose from.

However, what’s the use of squandering time searching for the accurately crafted Obtaining Nonprofit With Ein Number template online when the US Legal Forms digital library has such resources compiled in one location.

US Legal Forms is the largest online legal repository with more than 85,000 fillable documents created by attorneys for any business and personal situation.

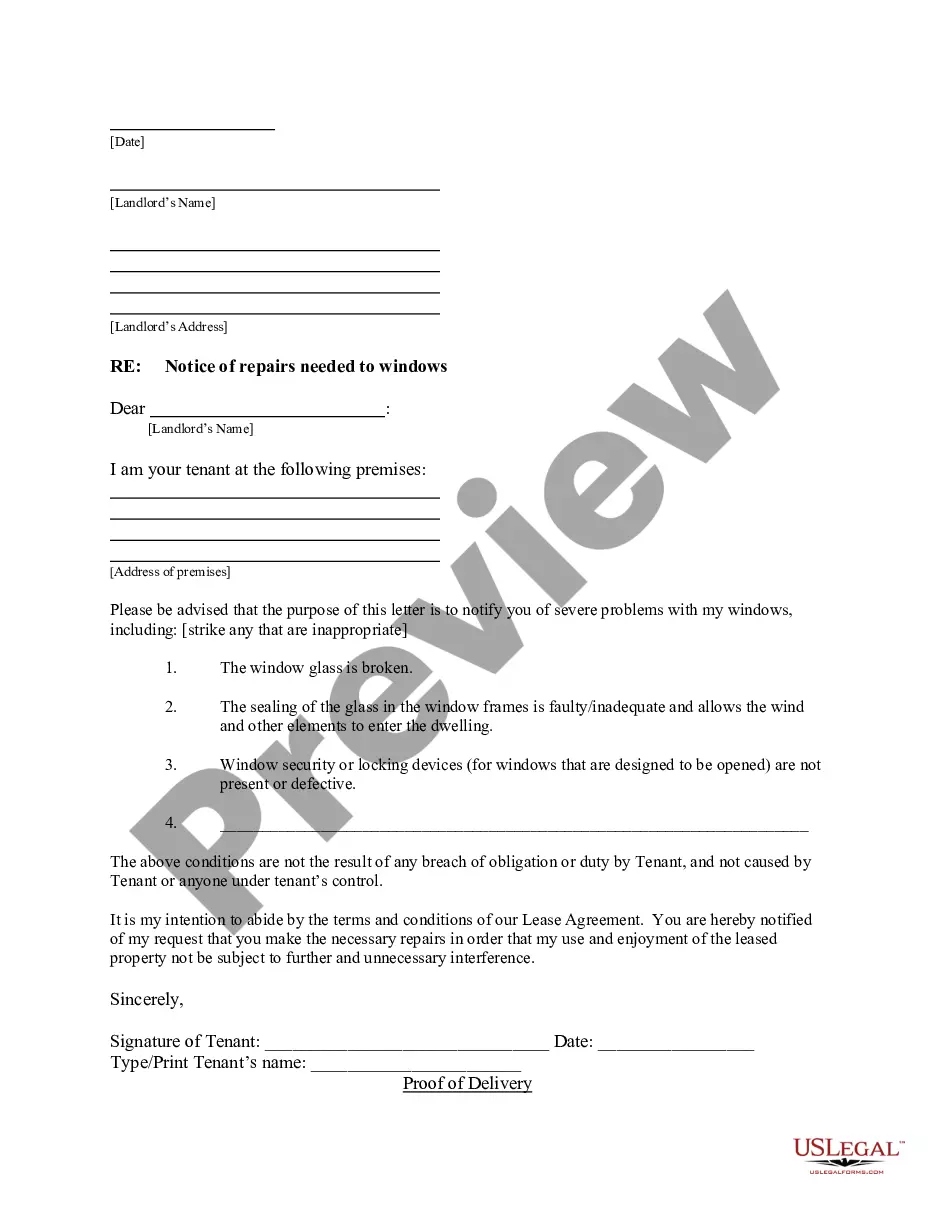

Review the template using the Preview feature or by looking through the text description to ensure it satisfies your needs.

- They are easy to navigate with all records categorized by state and intended use.

- Our experts keep up with legislative changes, ensuring that your form is always current and compliant when acquiring an Obtaining Nonprofit With Ein Number from our site.

- Securing an Obtaining Nonprofit With Ein Number is straightforward and quick for both existing and new clients.

- If you already possess an account with an active subscription, Log In and save the document you need in the desired format.

- If you are unfamiliar with our website, follow the instructions below.

Form popularity

FAQ

To find an EIN number in the USA, you can check various documents such as tax returns, bank statements, or official correspondence from the IRS. If it is a nonprofit you are looking for, consider using resources like the IRS website, which allows you to search for organizations by name. Alternatively, if you are obtaining nonprofit with EIN number, you can utilize platforms like US Legal Forms to simplify the application process and find necessary information quickly.

Nonprofit Employer Identification Number (EIN) is a Federal nine-digit tax ID number that IRS assigns to nonprofits, charities, organizations, and businesses in the following format: XX-X. EIN is used to identify the tax accounts of employers and certain others who have no employees.

Follow these steps to apply online for an EIN for your business. Determine eligibility. ... Apply at the IRS website. ... Select your business type. ... Provide a reason for requesting an EIN. ... Authenticate your personal information. ... Business location. ... Business information. ... Receive EIN.

How to Fill Out the Form W-9 for Nonprofits Step 1 ? Write your corporation name. ... Step 2 ? Enter your business name. ... Step 3 ? Know your entity type. ... Step 4 ? Your exempt payee code. ... Step 5 ? Give your street address. ... Step 6 ? Give your city, state, and zip code. ... Step 7 ? List account numbers.

Those two terms are referring to the same exact number. All businesses are required to have an Employer Identification Number (EIN) or Federal Employer Identification Number (FEIN). Even though nonprofit organizations don't conduct business in the traditional sense, they do employee staff.

Before donating monies to a charity, it is alwaysadvisable to verify its proper registration and IRS Form 990 tax-exempt status. An EIN is usually written in the form 00-0000000 whereas a Social Security Number is usually written in the form 000-00-0000 in order to differentiate between the two. EINs do not expire.