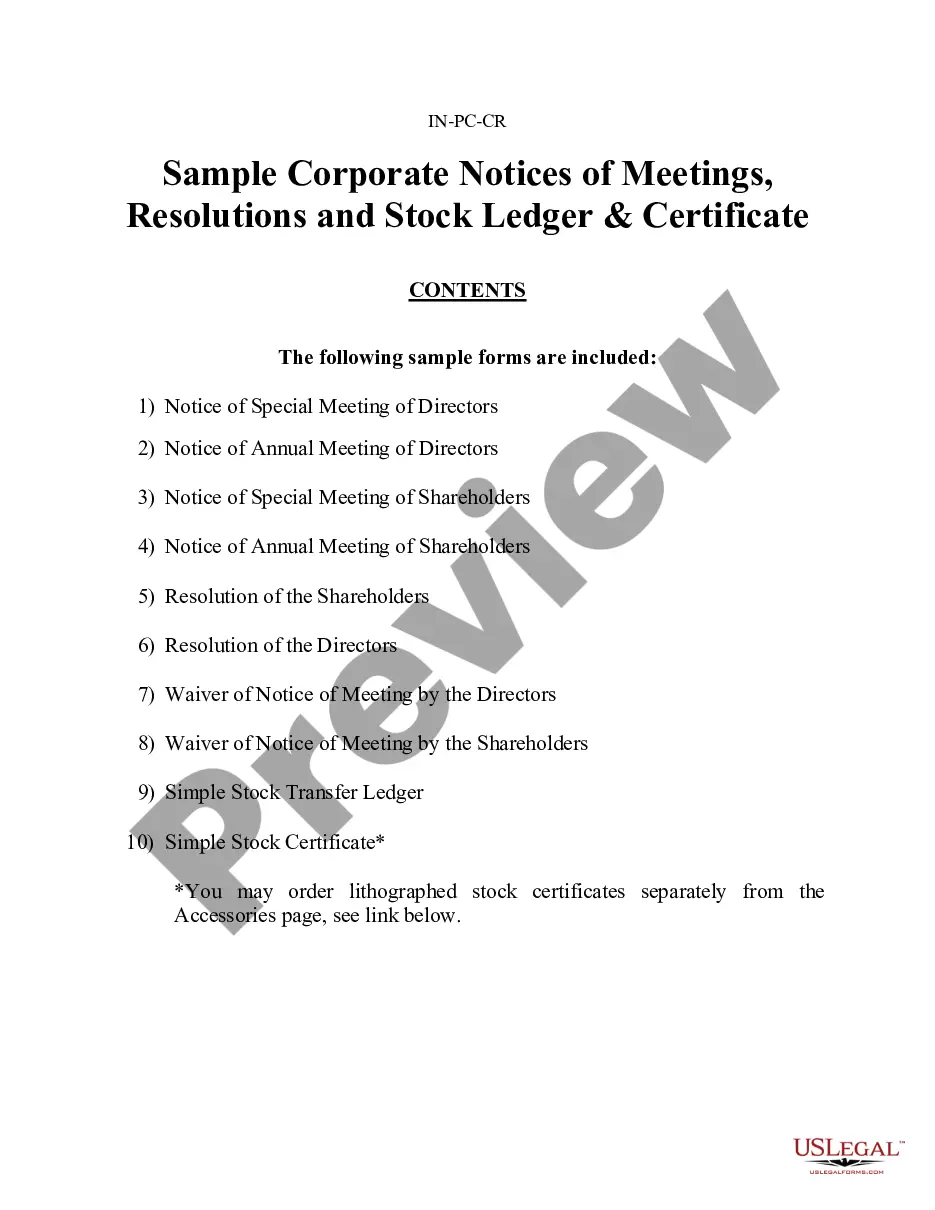

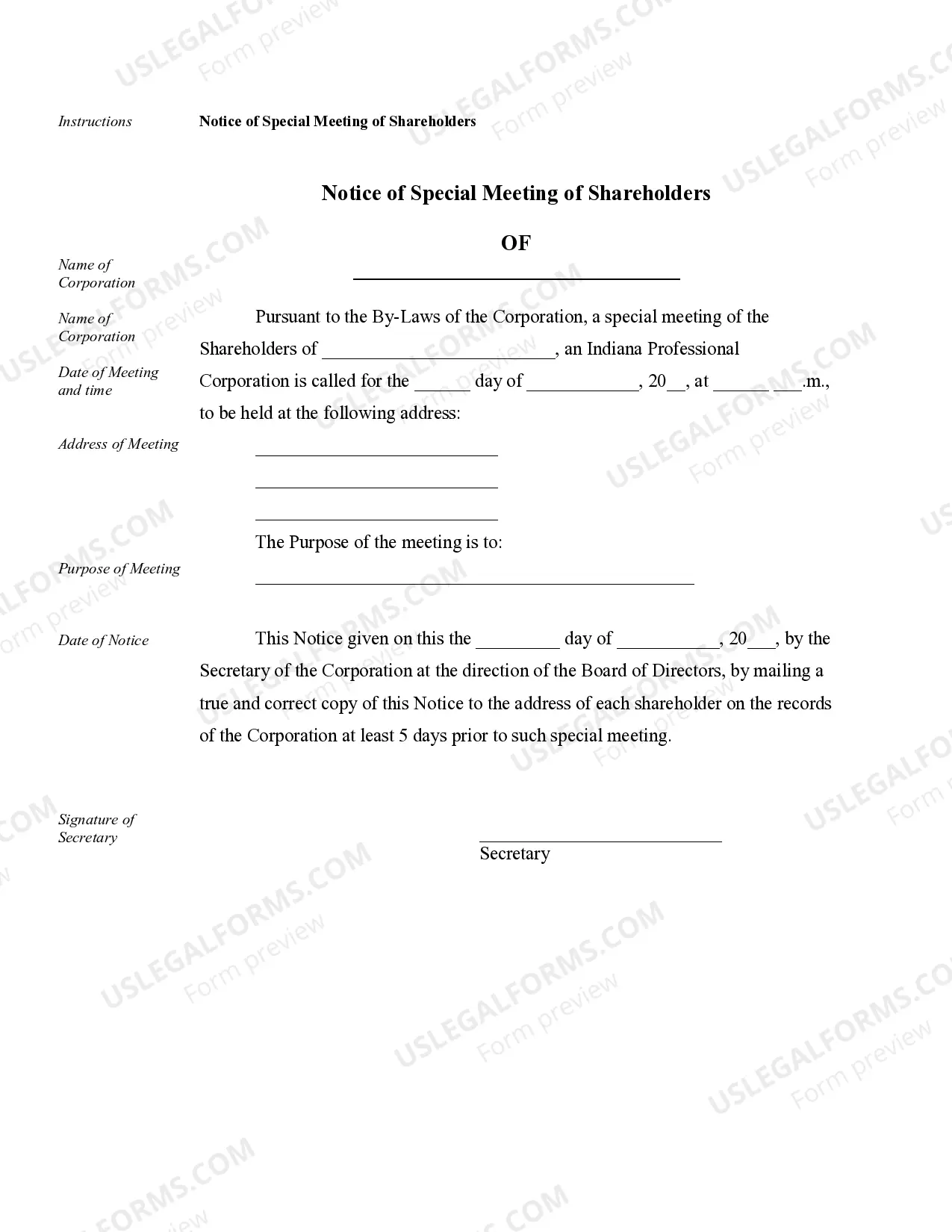

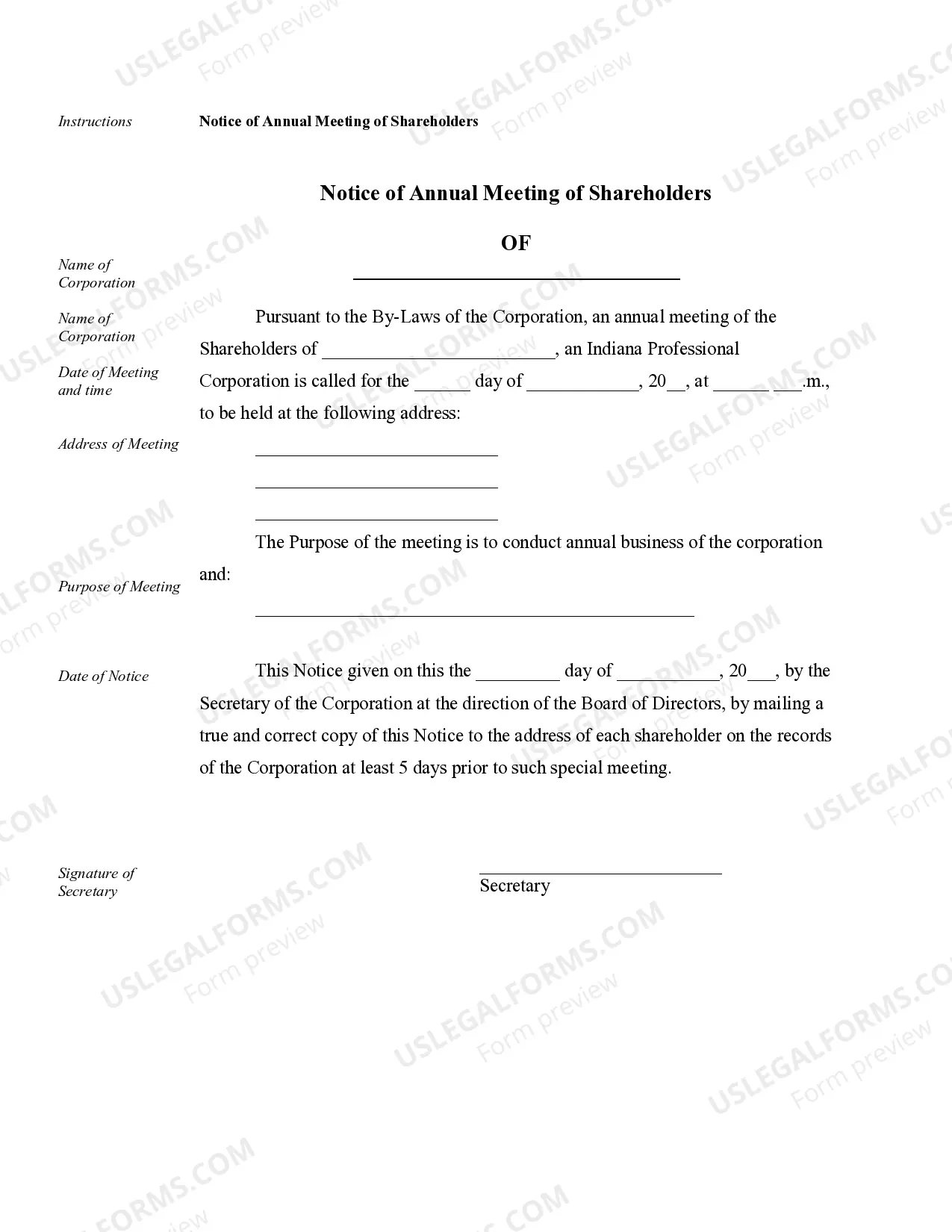

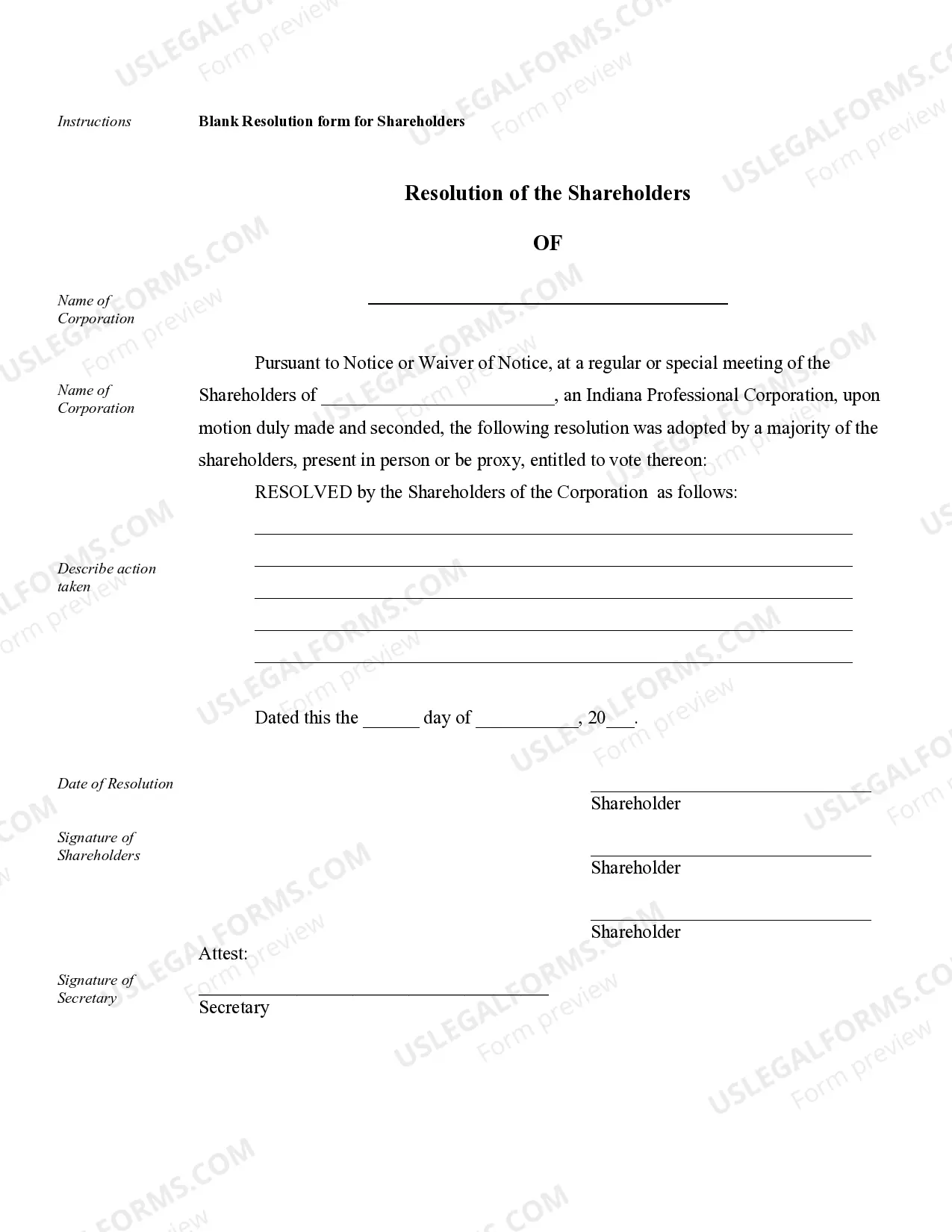

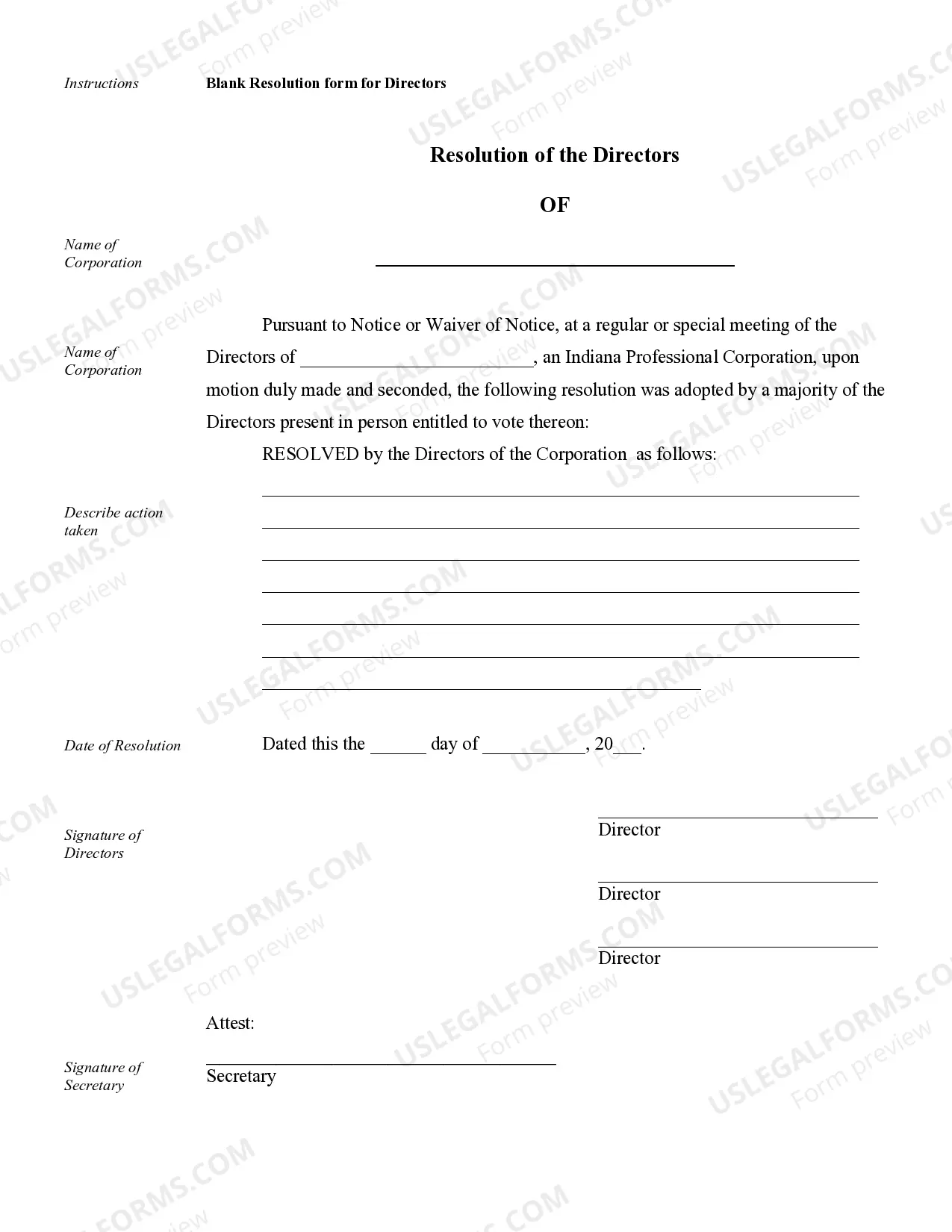

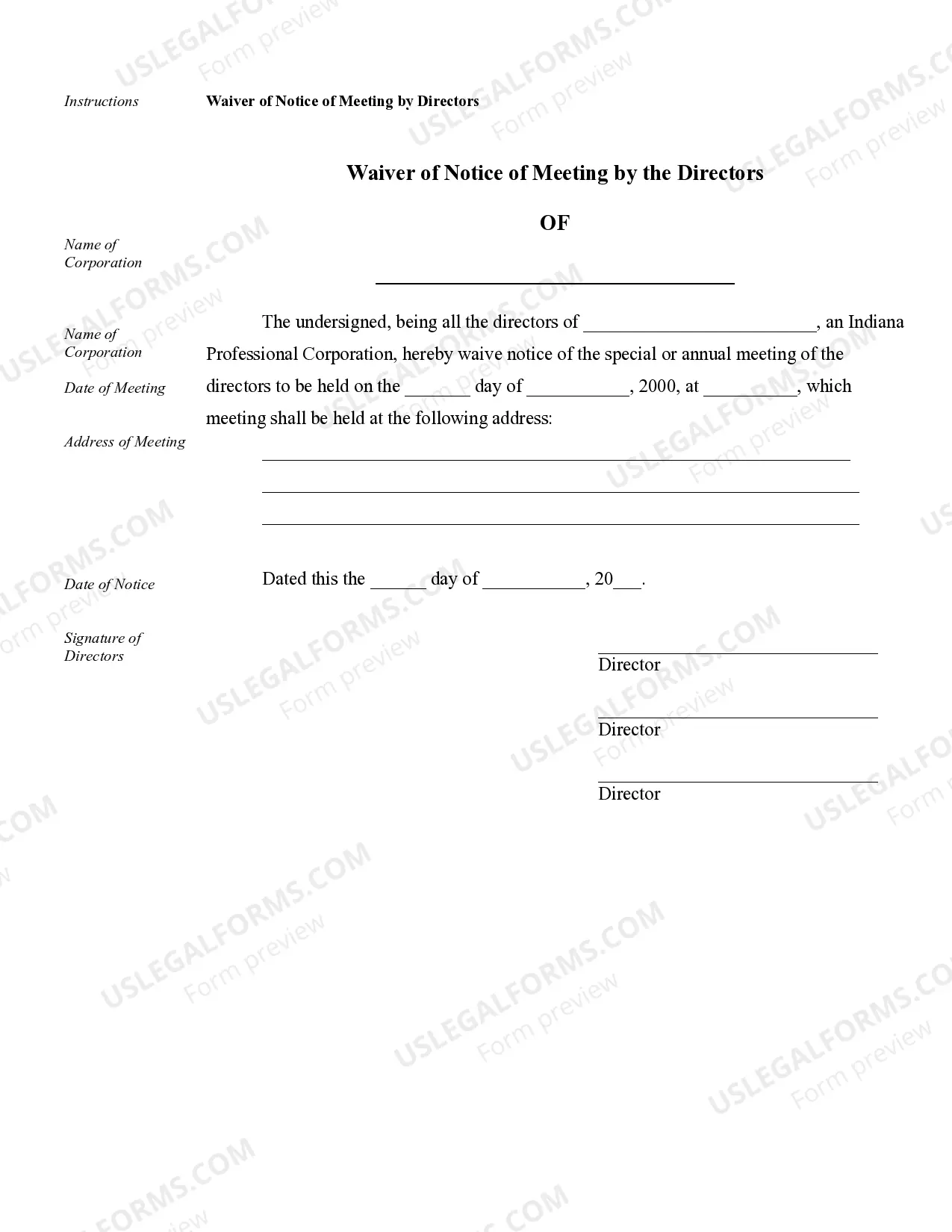

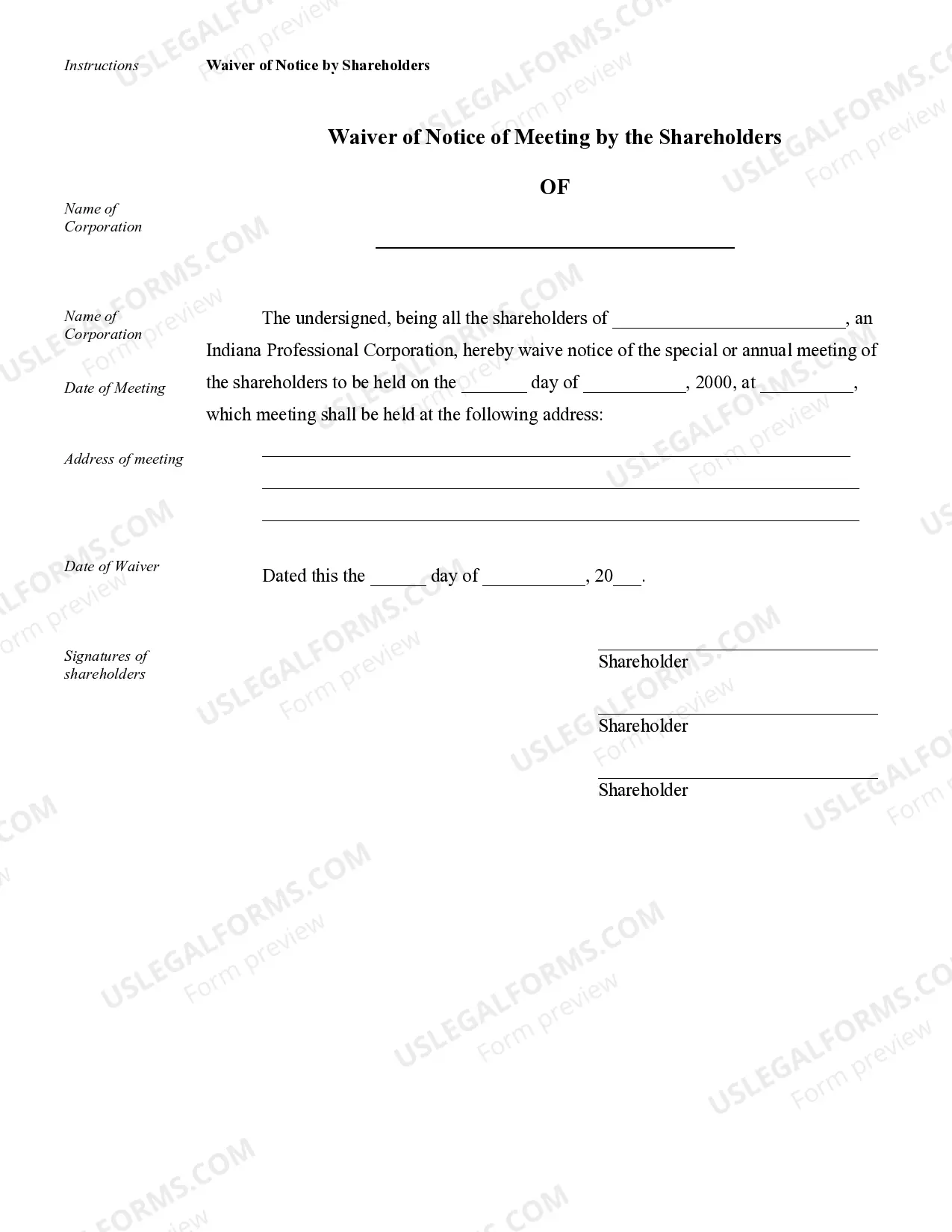

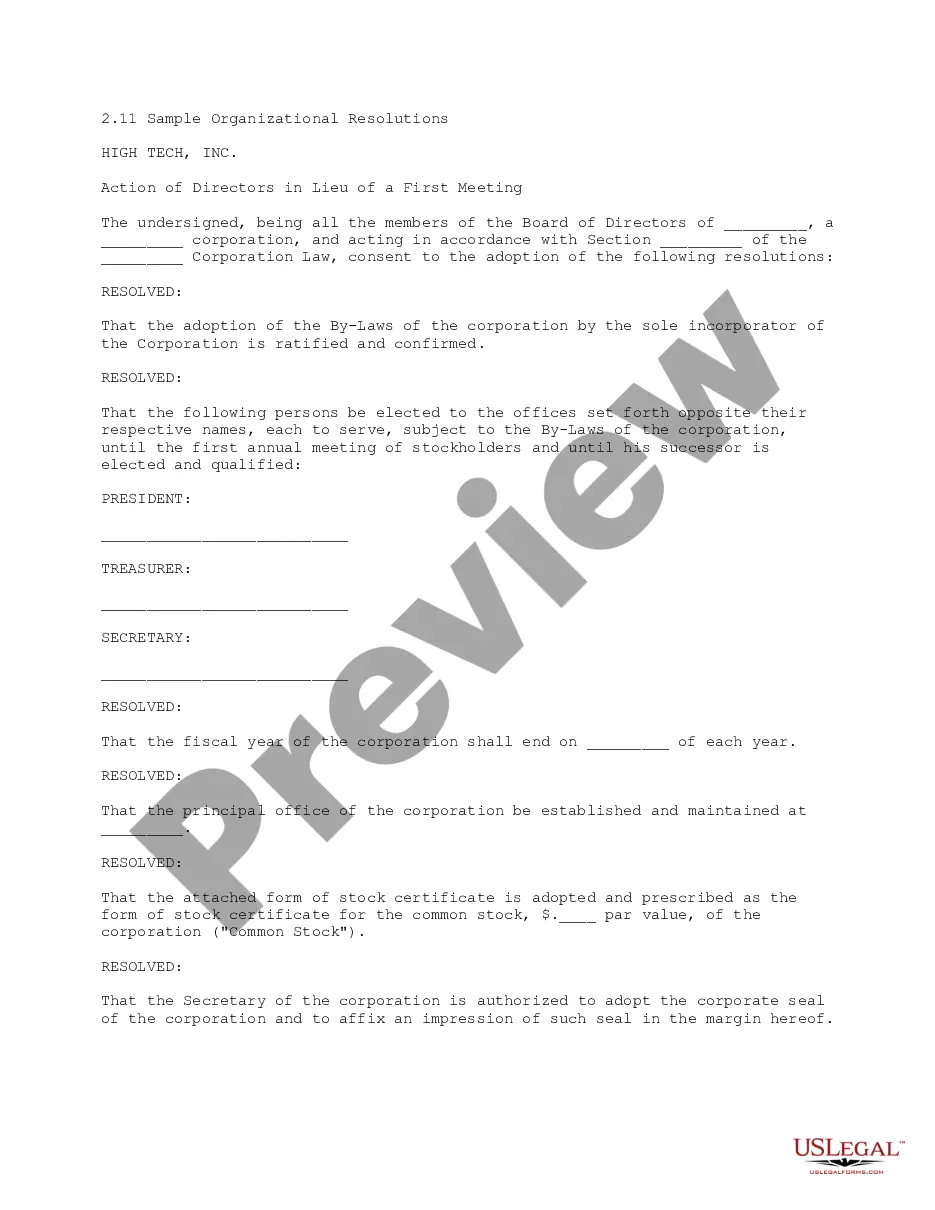

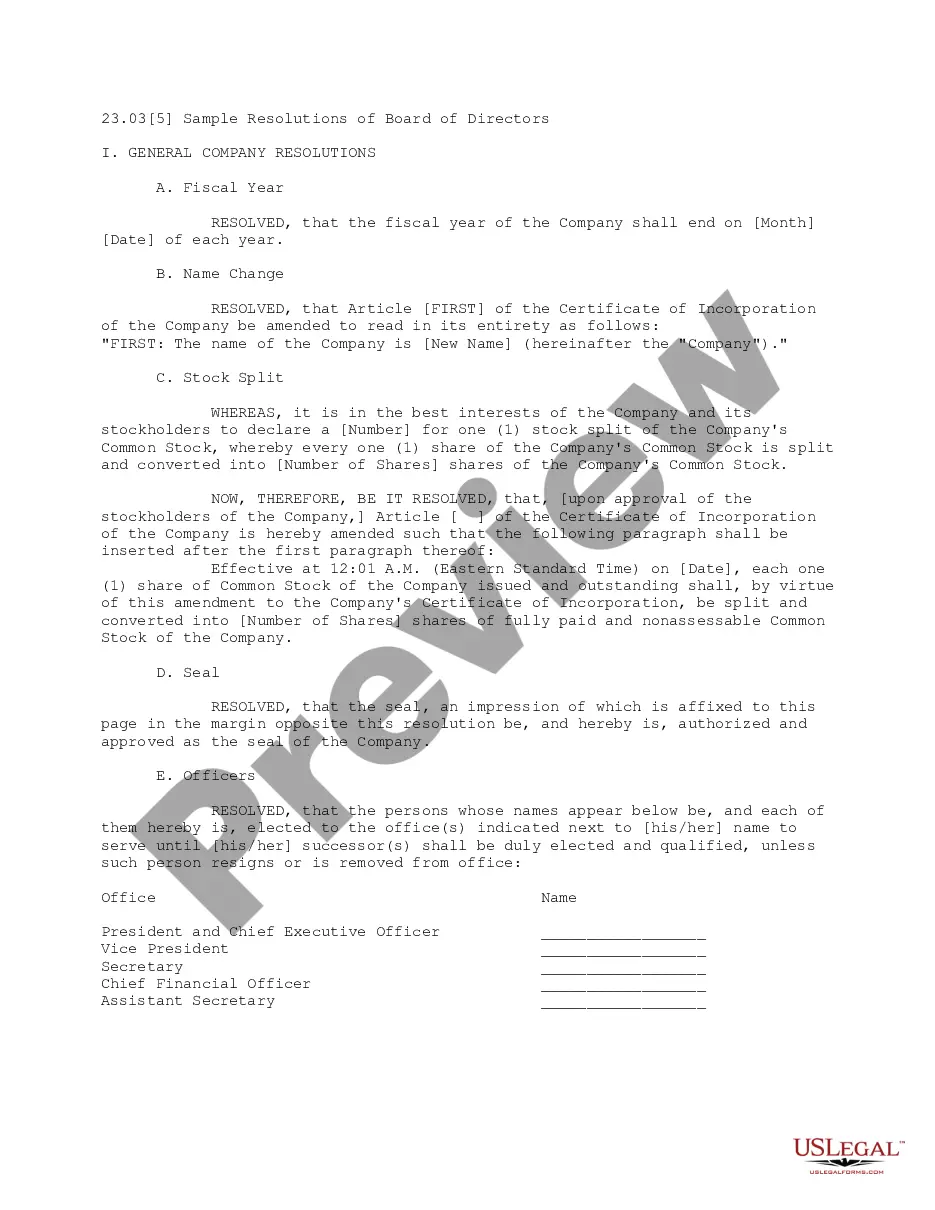

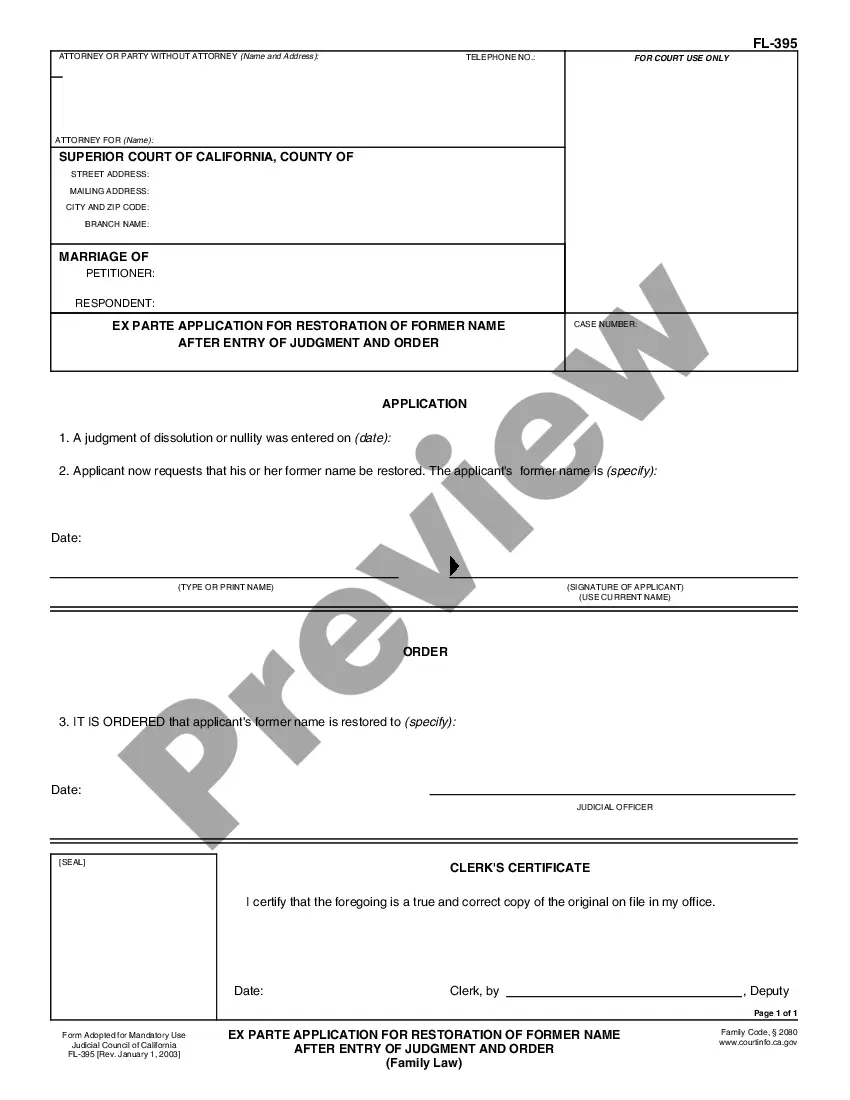

Sample Corporate Notices of Meetings, Resolutions, Simple Stock Ledger & Certificate.

Sample Corporate Records for an Indiana Professional Corporation

Description

How to fill out Sample Corporate Records For An Indiana Professional Corporation?

Searching for sample corporate records for an Indiana professional corporation forms and completing them could be challenging.

To conserve time, expenses, and effort, utilize US Legal Forms to discover the appropriate template specifically for your state with just a few clicks.

Our attorneys prepare every document, so you only need to complete them. It's remarkably straightforward.

Select your plan on the pricing page and create an account. Decide whether you wish to pay with a credit card or via PayPal. Save the document in your desired file format. You can print the sample corporate records for an Indiana professional corporation form or complete it using any online editor. Don’t worry about making errors since your form can be used, submitted, and printed as many times as necessary. Try US Legal Forms to access over 85,000 state-specific legal and tax documents.

- Log in to your account and return to the form’s webpage to download the sample.

- Your saved templates are stored in My documents and can be accessed anytime for future use.

- If you haven't registered yet, you need to enroll.

- Refer to our comprehensive instructions on how to acquire your sample corporate records for an Indiana professional corporation in just a few minutes.

- To obtain a valid sample, verify its applicability for your state.

- Review the sample using the Preview option (if available).

- If there’s a description, read it to grasp the details.

- Click the Buy Now button if you found what you are looking for.

Form popularity

FAQ

You can form your Indiana LLC by filing Articles of Organization online or by mail. Form an Indiana LLC online: The state filing fee is $95 and the processing time is 24 hours.

A professional corporation is a variation of the corporate form available to entrepreneurs who provide professional servicessuch as doctors, lawyers, accountants, consultants, and architects.In a professional corporation, the owners perform services for the business as employees.

A professional corporation is one that only performs services in one, single profession. It is a specific type of corporation for professionals like doctors, lawyers, accountants, etc. The professional is able to form a corporation, but the professional remains liable for his or her own actions.

The IRS categorizes professional corporations as C corporations. They are considered taxpayers and must pay income taxes at the corporate rate. In some states, physicians are not allowed to form professional corporations and must instead establish professional associations.

Professional corporations or professional service corporation (abbreviated as PC or PSC) are those corporate entities for which many corporation statutes make special provision, regulating the use of the corporate form by licensed professionals such as attorneys, architects, engineers, public accountants and physicians

An Indiana Professional Corporation may render Professional Services in the state of Indiana only through individuals licensed or otherwise authorized in Indiana to render the specific Professional Service.

Step 1: File the Articles of Incorporation with the California Secretary of State (required) Step 2: Register with the Appropriate Government Agency (required) Step 3: Prepare Corporate Bylaws. Step 4: Appoint the Professional Corporation's Directors (required)

Search your LLC. Email Address. Principal Office Address. Registered Agent. Principal Information. Review. Signature. Checkout.

A professional corporation is a variation of the corporate form available to entrepreneurs who provide professional servicessuch as doctors, lawyers, accountants, consultants, and architects.In a professional corporation, the owners perform services for the business as employees.