Patent With Schedule With Balloon Payment

Description

How to fill out Exclusive License Agreement For Patent With Schedule Of Royalties?

Managing legal documents can be challenging, even for experienced professionals.

When you are looking for a Patent With Schedule With Balloon Payment and lack the time to search for the correct and current version, the process can be overwhelming.

US Legal Forms addresses any needs you might have, from personal to business documentation, all in one location.

Utilize advanced tools to complete and handle your Patent With Schedule With Balloon Payment.

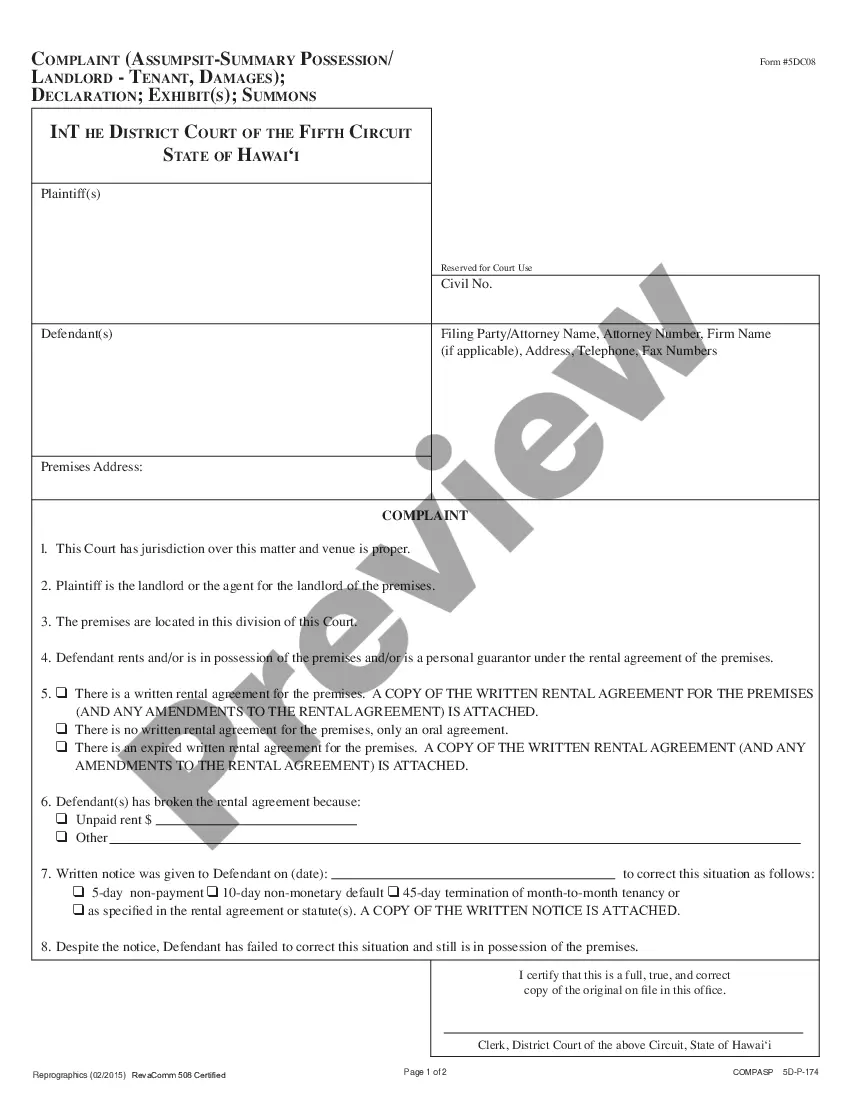

Here are the steps to follow after finding the form you need: Validate that it is the correct form by previewing it and reviewing its details.

- Access a valuable repository of articles, guides, and resources pertinent to your circumstances and needs.

- Save time searching for the documents you require, and leverage US Legal Forms’ enhanced search and Review tool to locate Patent With Schedule With Balloon Payment and obtain it.

- If you possess a monthly membership, Log Into your US Legal Forms account, search for the form, and download it.

- Check your My documents tab to access the documents you have already saved and to organize your folders as needed.

- If this is your first experience with US Legal Forms, create an account to gain unlimited access to all the benefits of the platform.

- A powerful online form repository could revolutionize the way anyone handles these circumstances efficiently.

- US Legal Forms stands as a frontrunner in online legal documentation, featuring over 85,000 state-specific legal templates accessible at all times.

- With US Legal Forms, you can access legal and business forms tailored to specific states or counties.

Form popularity

FAQ

A balloon mortgage, by comparison, might have a five-year term and a 30-year amortization. You'll make the same payment every month for five years (60 months) that you would have made on the loan with the 30-year term. But after that, you'll owe all of the remaining principal.

Selling the vehicle is usually the most popular option for when your balloon payment is due. Selling the car will typically cover the cost of the balloon payment, at which point you can then buy a new car and apply for another loan. Trading in the vehicle works much like selling it.

A balloon payment is the final amount due on a loan that is structured as a series of small monthly payments followed by a single much larger sum at the end of the loan period. The early payments may be all or almost all payments of interest owed on the loan, with the balloon payment being the principal of the loan.

There are several options available to you when your balloon payment is due: Make the final car loan repayment. Arguably the most obvious option is paying off the the final loan balance owed using your own cash, giving you complete ownership of the vehicle. ... Sell the car. ... Trade in the car. ... Refinance.

This large amount is called a balloon payment, which pays down the remaining balance when the term ends. A balloon mortgage has a short term that does not fully amortize, but the payment is usually based on a 30-year amortization schedule. Balloon mortgages are usually associated with commercial real estate loans.