Accounting For Patent License Agreement

Description

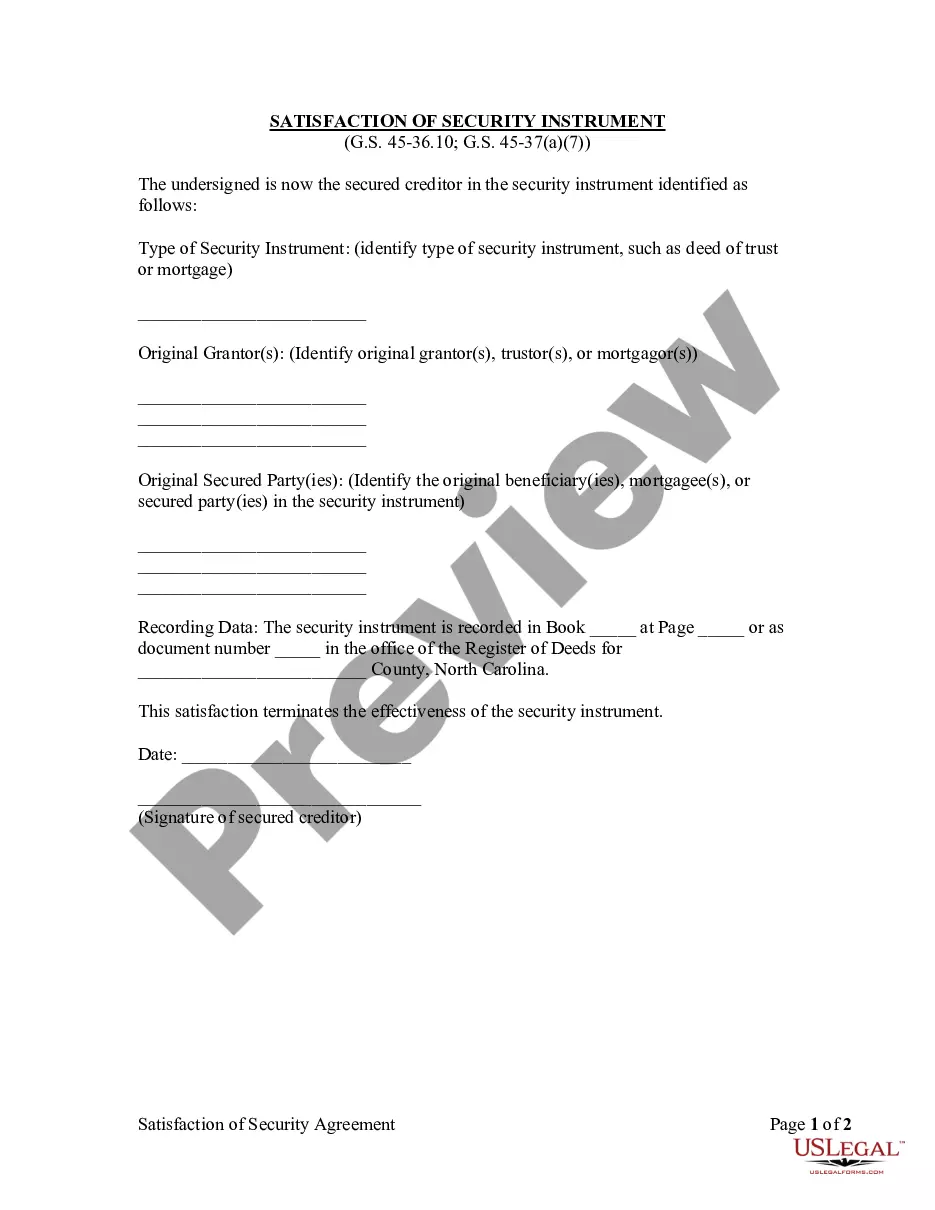

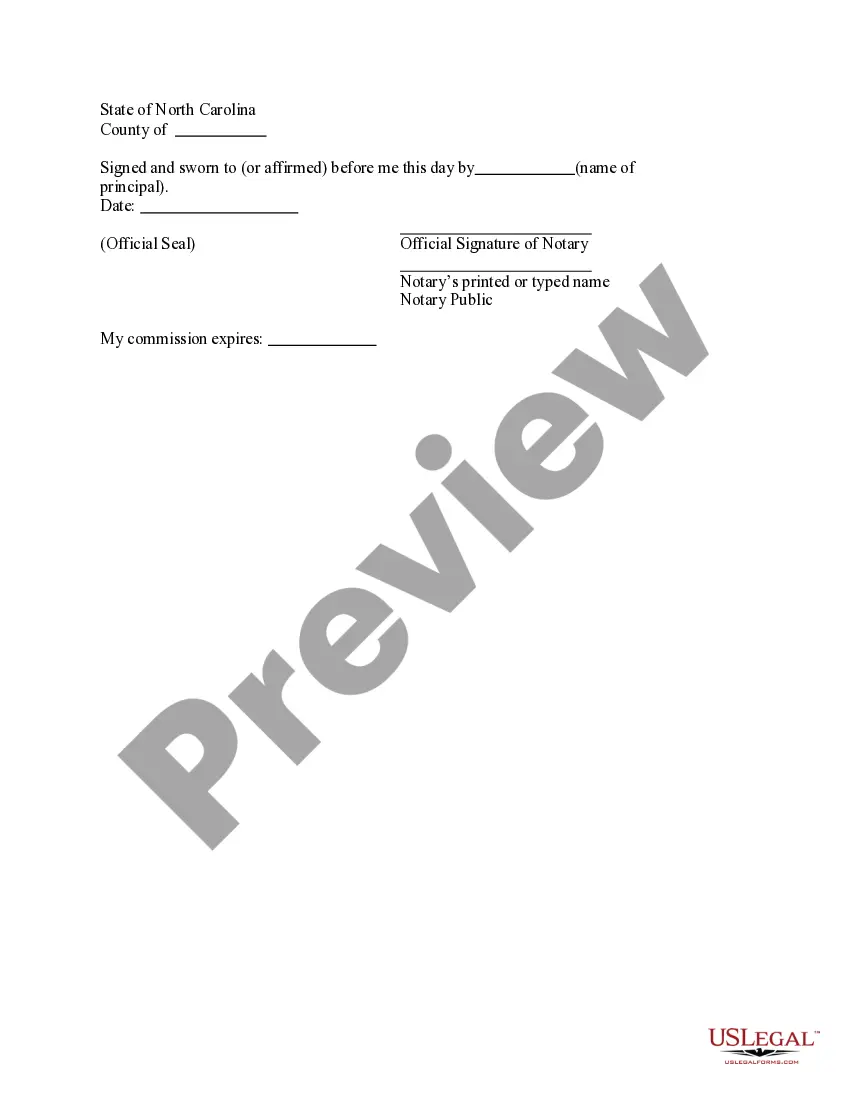

How to fill out Patent License Agreement?

What is the most reliable service to acquire the Accounting For Patent License Agreement and other recent versions of legal documents.

US Legal Forms is the answer! It's the largest assortment of legal forms for any purpose.

If you don't yet have an account with our library, here are the steps you need to follow to create one.

- Each template is skillfully drafted and verified for adherence to federal and local laws.

- They are organized by area and state of application, making it easy to find the one you require.

- Experienced users of the site simply need to Log In to the platform, verify if their subscription is active, and click the Download button next to the Accounting For Patent License Agreement to receive it.

- Once downloaded, the template can be accessed for further use under the My documents section of your account.

Form popularity

FAQ

Account for stepped royalty agreements.It is recorded in the ledger as a debit to royalty expense and a credit to accrued royalties (assuming the royalties are to be paid at the end of the period). For example, an author might receive $1 per book for the first 10,000 sold, then $1.50 per book for any sales after that.

The fees that the business paid for those licenses are included as an expense. If the license is for multiple years or accounting periods and is acquired by paying an initial fee, the license is recorded as an asset on the balance sheet and its value equals what it cost to acquire the license.

Debit the patent's total cost to the patent account in a journal entry in your accounting records when you acquire the patent. A debit increases the patent account, which is an asset on the balance sheet. The cost includes the purchase price plus any legal or other fees necessary to use the patent.

A patent is an intangible asset to a company. Patents are similar to goodwill or natural resource rights. They are not expensed when bought; instead they are amortized of the useful life, which is 20 years.

When a patent is acquired, Generally Accepted Accounting Procedures requires that it be included on the business's balance sheet at its fair value. Fair value is the cost to acquire the patent. If the business purchased the patent, it should be valued at the cost to acquire the patent from the former owner.