Assignment Of Partnership Interest Tax Consequences

Description

How to fill out Assignment Of Partnership Interest To A Corporation With Consent Of Remaining Partners?

Legal management can be frustrating, even for experienced experts. When you are searching for a Assignment Of Partnership Interest Tax Consequences and don’t have the time to commit trying to find the right and updated version, the procedures may be stress filled. A robust online form catalogue might be a gamechanger for everyone who wants to manage these situations effectively. US Legal Forms is a industry leader in online legal forms, with over 85,000 state-specific legal forms accessible to you at any moment.

With US Legal Forms, you are able to:

- Gain access to state- or county-specific legal and organization forms. US Legal Forms handles any requirements you might have, from individual to organization paperwork, in one place.

- Make use of advanced tools to finish and manage your Assignment Of Partnership Interest Tax Consequences

- Gain access to a resource base of articles, guides and handbooks and resources connected to your situation and requirements

Save time and effort trying to find the paperwork you need, and use US Legal Forms’ advanced search and Review feature to find Assignment Of Partnership Interest Tax Consequences and get it. If you have a subscription, log in to your US Legal Forms account, look for the form, and get it. Review your My Forms tab to see the paperwork you previously downloaded and to manage your folders as you see fit.

If it is your first time with US Legal Forms, create a free account and acquire unlimited use of all benefits of the platform. Listed below are the steps for taking after accessing the form you need:

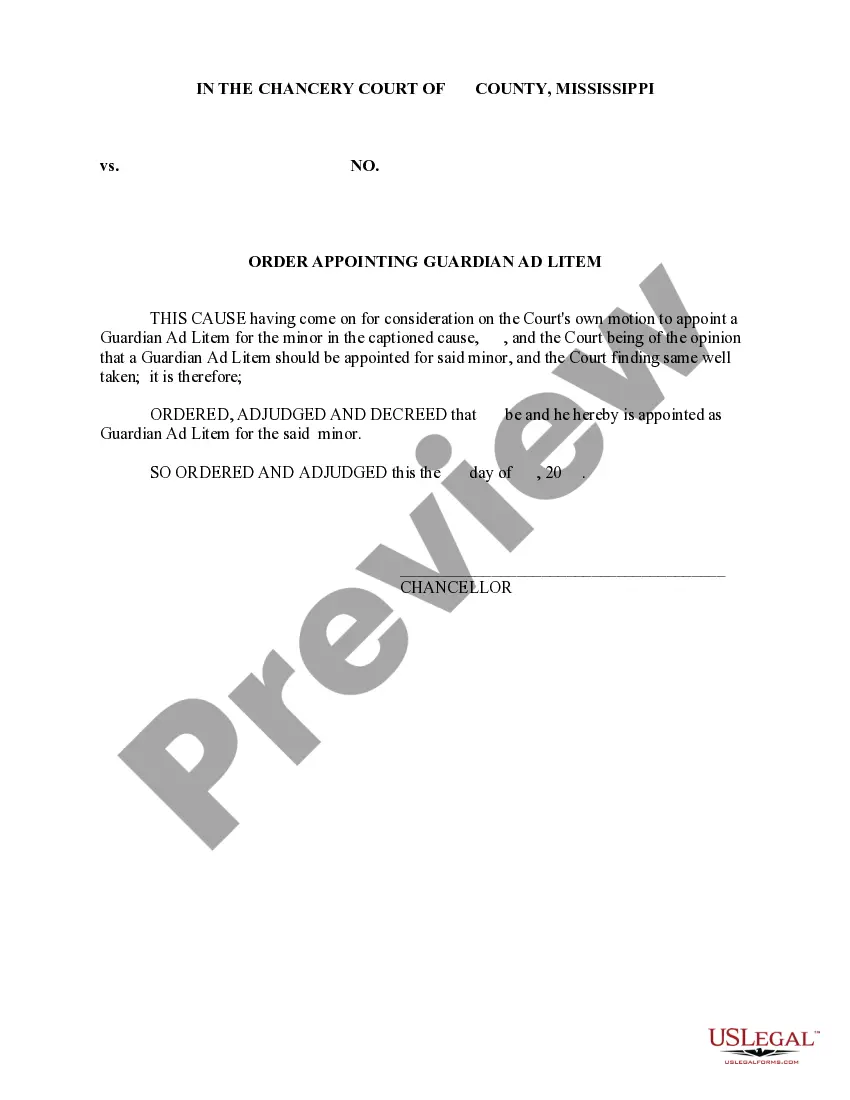

- Validate this is the right form by previewing it and reading its description.

- Be sure that the sample is approved in your state or county.

- Select Buy Now when you are all set.

- Select a monthly subscription plan.

- Find the file format you need, and Download, complete, eSign, print and send your document.

Benefit from the US Legal Forms online catalogue, backed with 25 years of experience and stability. Transform your day-to-day document managing into a smooth and user-friendly process today.

Form popularity

FAQ

Answer and Explanation: In partnership, the assignment of interests is generally transferable to the assignor interest in the partnership of profits and surplus. Without the approval of other partners, the assignee does not become a partner. The assignee has received only the rights to share profits.

The tax consequences of the sale are straightforward. Pursuant to Section 741,[1] gain or loss from the sale of a partnership interest is treated as gain or loss from the sale or exchange of a capital asset, except as otherwise provided in section 751.

Form 8308, Report of a Sale or Exchange of Certain Partnership Interests is completed only if there was a sale or exchange of partnership interest when any money or other property received in exchange for that interest is attributable to unrealized receivables or inventory items (also known as a Section 751(a) exchange ...

Section 27 of UPA declares that assignment of an interest in the partnership neither dissolves the partnership nor entitles the assignee ?to interfere in the management or administration of the partnership business or affairs, or to require any information or account of partnership transactions, or to inspect the ...

General Rule. Since the interest of a partner in the partnership is treated as a capital asset, the sale or exchange of a partner's interest will result in capital gain or loss to the transferor partner. I.R.C. § 741(a).