Assignment Of Limited Partnership Interest Form

Description

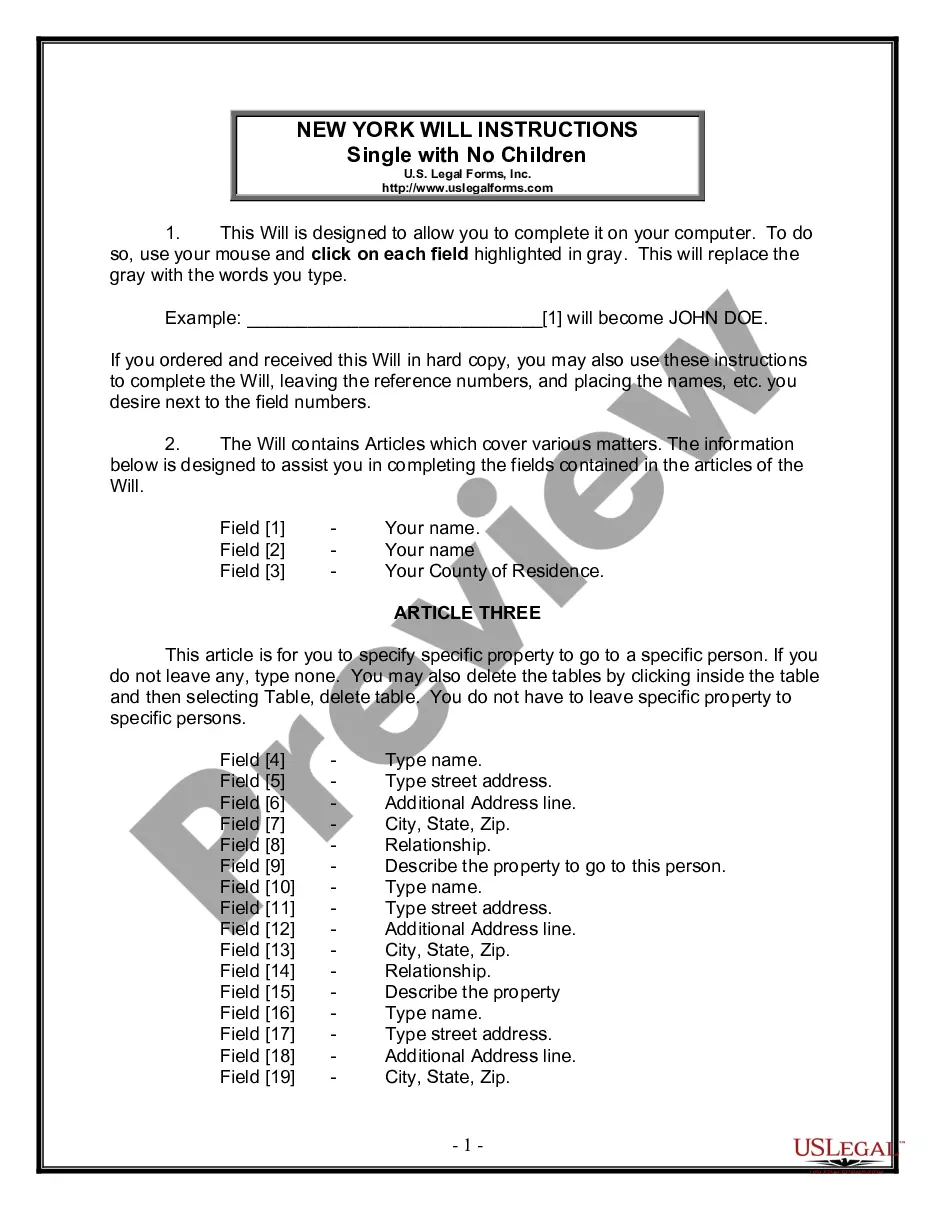

How to fill out Agreement For Assignment And Sale Of Partnership Interest And Reorganization With Purchaser As New Partner Including Assignment?

Bureaucracy requires exactness and correctness.

If you do not manage completing paperwork like the Assignment Of Limited Partnership Interest Form daily, it may lead to some confusions.

Selecting the right sample from the start will ensure that your document submission will proceed smoothly and avert any issues of resending a document or having to redo the same task from the beginning.

If you are not a subscribed user, finding the necessary sample will necessitate a few extra steps. Look for the template using the search field, confirm the Assignment Of Limited Partnership Interest Form you have found is suitable for your state or county, view the preview or examine the description that outlines the specifics of using the template. If the result aligns with your search, click the Buy Now button, select the appropriate option from the offered subscription plans, Log In to your account or create a new one, complete the purchase using a credit card or PayPal, and save the form in your desired format. Locating the appropriate and current samples for your documentation is a matter of a few moments with an account at US Legal Forms. Eliminate bureaucratic uncertainties and simplify your work with forms.

- Obtain the correct sample for your paperwork in US Legal Forms.

- US Legal Forms is the largest collection of online forms with over 85 thousand samples covering various topics.

- You can acquire the latest and most relevant version of the Assignment Of Limited Partnership Interest Form by simply searching on the website.

- Locate, store, and save templates in your profile or consult the description to ensure you have the correct one available.

- With an account at US Legal Forms, it is simple to gather, store in one place, and navigate the templates you save for easy access.

- When on the site, click the Log In button to authenticate.

- Then, go to the My documents page, which retains the history of your forms.

- Browse the descriptions of the forms and save the ones you need at any time.

Form popularity

FAQ

Whether an assignment of interest needs notarization depends on the specific requirements set out in your LLC's operating agreement or state laws. In many cases, notarizing the Assignment of Limited Partnership Interest Form adds an extra layer of authenticity to the document. To ensure compliance and to facilitate a smooth transfer, check your local regulations and consider getting the form notarized.

An assignment of interest may be viewed as a gift if the transfer occurs without receiving any compensation. This perspective hinges on the arrangement between the parties involved. To avoid any confusion or potential tax issues, it is beneficial to document such transfers using an Assignment of Limited Partnership Interest Form to clarify the intent behind the transfer.

Form 8308 is a tax form used to report the sale or exchange of a partnership interest. This form applies to transactions involving the transfer of ownership or interest in a partnership. It often requires accurate details; thus, utilizing an Assignment of Limited Partnership Interest Form can help document such assignments clearly and support your filing with Form 8308.

The assignment of interest refers to the legal process where one party transfers their stake in a partnership or LLC to another party. This transfer can involve not only the rights to profits but also any associated liabilities. Completing an Assignment of Limited Partnership Interest Form is crucial to formalize the agreement and protect the interests of all parties involved.

The tax consequences of assigning LLC interest can vary based on the situation and various factors. Generally, the transfer may trigger capital gains tax if the assignment results in a profit for the assignor. It's advisable to consult tax professionals to discuss implications specific to your circumstances and to ensure compliance using the Assignment of Limited Partnership Interest Form.

An assignment of LLC interest refers to the transfer of an owner's rights and obligations to another person within a limited liability company. This process often requires a specific document known as the Assignment of Limited Partnership Interest Form. By using this form, the current member can effectively assign their interest, ensuring that the new member assumes the rights to profits and losses associated with that interest.

Transferring ownership in a partnership is not necessarily easy, as it often depends on the terms outlined in the partnership agreement. While an Assignment of Limited Partnership Interest form can simplify the process, you must consider the rights and agreements of all partners. This complexity can lead to potential delays or disputes, underscoring the importance of clear communication and legal advice.

Transferring ownership in a partnership can be challenging due to the need for agreement from all parties involved. Often, partnership agreements have specific restrictions or require unanimous consent for any transfers. Using an Assignment of Limited Partnership Interest form can help clarify the process, ensuring that all legal requirements are met.

To assign partnership interest, you typically start by preparing an Assignment of Limited Partnership Interest form, which details the transfer conditions. Ensure that you get consent from the other partners as required by your partnership agreement. Once completed, the form should be signed by the transferring partner and the new partner to finalize the assignment.

Yes, ownership can be transferred in a partnership, but the process may be subject to specific rules outlined in the partnership agreement. A well-structured Assignment of Limited Partnership Interest form can facilitate this transfer, making the process smoother for all parties involved. Always review your agreement and, if needed, consult legal experts for guidance.