Termination Trust Trustee Without Notice

Description

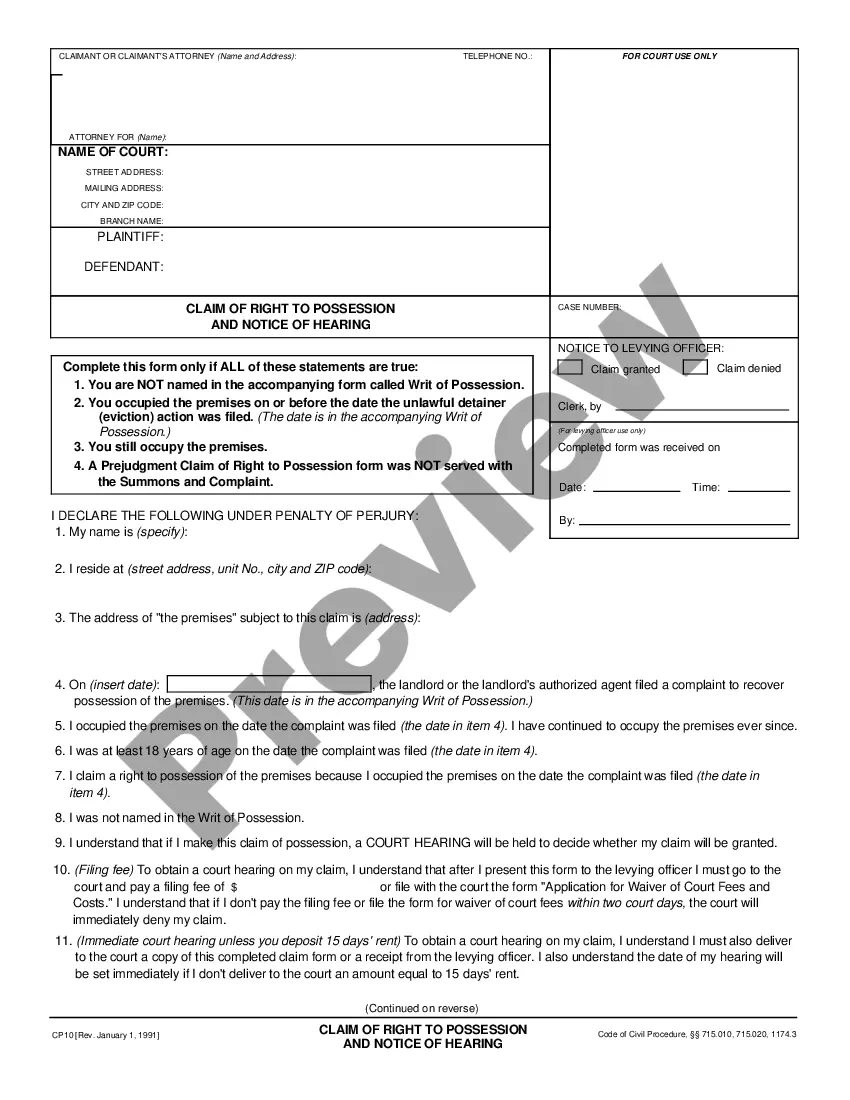

How to fill out Termination Of Trust By Trustee?

It’s well-known that you cannot become a legal expert overnight, nor can you swiftly learn to draft Termination Trust Trustee Without Notice without possessing a specialized skill set.

Drafting legal documents is an extensive undertaking that demands specific training and abilities. So why not entrust the creation of the Termination Trust Trustee Without Notice to the experts.

With US Legal Forms, one of the most comprehensive legal template collections, you can discover everything from court documents to templates for intra-office communication.

You can regain access to your forms from the My documents tab anytime. If you’re a current client, you can simply Log In and locate and download the template from the same tab.

No matter the intention behind your documents—be it financial and legal, or personal—our platform has you covered. Give US Legal Forms a try today!

- Locate the document you require using the search bar at the top of the webpage.

- Preview it (if this option is available) and review the accompanying description to ascertain whether Termination Trust Trustee Without Notice is what you seek.

- If you need another form, start your search anew.

- Create a free account and select a subscription plan to purchase the form.

- Click Buy now. After the payment is processed, you can download the Termination Trust Trustee Without Notice, complete it, print it, and send or mail it to the relevant parties or organizations.

Form popularity

FAQ

A trust can be terminated through various methods, including reaching the trust's expiration date, fulfilling its purpose, or through the consent of all beneficiaries. Additionally, a termination trust trustee without notice can lead to an unexpected closure if the trustee decides to act unilaterally. Understanding these methods is essential for anyone involved in trust management. Utilizing platforms like uslegalforms can assist you in navigating the complexities of trust termination.

Removing a trustee without their consent is typically dependent on the trust’s terms and state laws. In many cases, beneficiaries can petition a court for removal if there is evidence of misconduct or failure to fulfill duties. If you face a situation involving a termination trust trustee without notice, consider seeking legal advice to navigate the process effectively. This approach can help ensure a smooth transition.

Yes, it is possible to be removed from a trust without your knowledge, especially if the trust document allows for such actions. A termination trust trustee without notice can occur if the trustee decides to make changes without informing all beneficiaries. To protect your interests, regularly review trust documents and maintain open communication with the trustee. This awareness can help mitigate surprises.

Closing a trust involves several key steps to ensure compliance with legal requirements. First, the trustee must settle any outstanding debts and distribute assets to the beneficiaries as outlined in the trust. Once all responsibilities are fulfilled, the trustee should prepare a final accounting. If a termination trust trustee without notice is involved, ensure all parties are informed to prevent misunderstandings.

A trustee can terminate a trust by following the trust document's instructions or through state laws. Typically, this involves notifying beneficiaries and ensuring all trust assets are distributed according to the terms. If a termination trust trustee without notice occurs, it is crucial for the trustee to document the process to avoid potential disputes. Consulting legal resources can provide clarity on the necessary steps.

You may use Form 56 to: Provide notification to the IRS of the creation or termination of a fiduciary relationship under section 6903.

In that case, the trustee may resign either by obtaining consent from the appropriate parties or by filing a petition to resign with the probate court. California Probate Code §17200 allows a trustee to petition the court to accept their resignation as trustee.

If a trustee does not uphold these responsibilities and breaches their duty, the beneficiaries can take legal action. They may petition the court to terminate the trust and distribute its assets. The court then decides whether the trustee has indeed acted improperly and if so, may order the dissolution of the trust.

A noncharitable irrevocable trust (which are most trusts after the death of a settlor) may be terminated upon the consent of all of the beneficiaries if the court concludes that modification is not inconsistent with a material purpose of the trust.

Most trusts include a provision that outlines how a trustee may resign. Usually, this procedure includes signing a Resignation to Serve as Trustee and also sending written notice and a report and account of their actions as Trustee to the trust beneficiaries.