Exit Interview Questions For Employees

Description

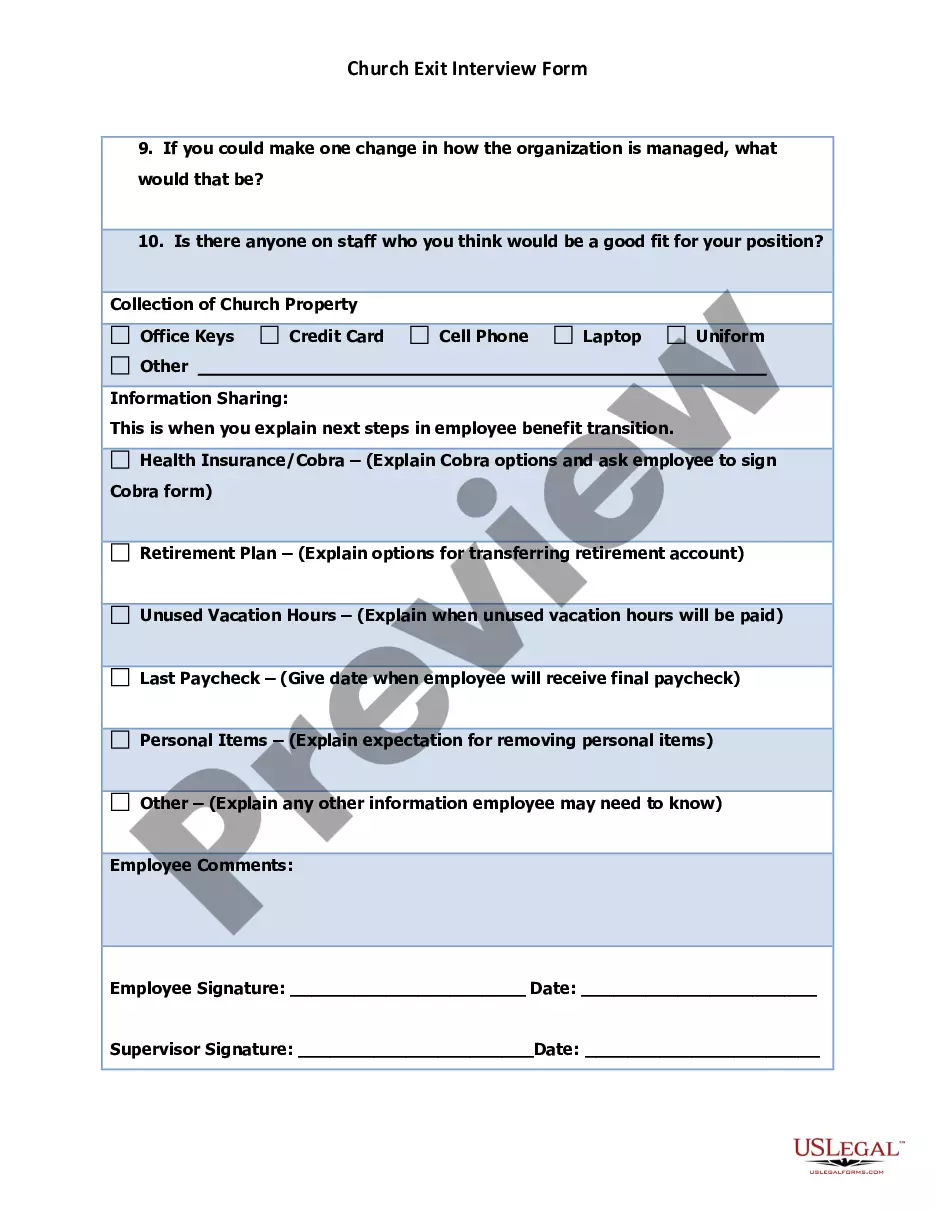

How to fill out Church Exit Interview Form?

Acquiring legal templates that comply with federal and local regulations is essential, and the internet presents numerous choices to select from.

However, why spend time hunting for the suitable Exit Interview Questions For Employees example online when the US Legal Forms online library already consolidates such templates in one location.

US Legal Forms is the largest digital legal repository featuring over 85,000 fillable templates created by attorneys for any professional and personal situation. They are easy to navigate, with all documents organized by state and intended use.

- Our experts stay abreast of legislative developments, ensuring your documents are current and compliant when obtaining Exit Interview Questions For Employees from our platform.

- Acquiring an Exit Interview Questions For Employees is quick and straightforward for both existing and new users.

- If you already possess an account with an active subscription, Log In and download the document sample you require in the desired format.

- If you are a newcomer to our site, adhere to the steps below.

- Review the template using the Preview option or through the text outline to confirm it fulfills your requirements.

Form popularity

FAQ

The annual franchise tax report is due May 15. If May 15 falls on a weekend or holiday, the due date will be the next business day.

You can file your franchise tax report, or request an extension of time to file, online.

Texas Tax Code Section 171.001 imposes franchise tax on each taxable entity that is formed in or doing business in this state. All taxable entities must file completed franchise tax and information reports each year.

How to File Your Texas Franchise Tax Report Determine your due date and filing fees. Complete the report online OR download a paper form. (Paper forms not allowed for No Tax Due Information Report.) Submit your report to the Texas Comptroller of Public Accounts.

How much does the Texas annual franchise tax report cost? There is no filing fee for your franchise tax report. The only payment due is any franchise tax owed for that filing year, plus a $1 service fee for online payments.

Each taxable entity formed in Texas or doing business in Texas must file and pay franchise tax.

How to File Your Texas Franchise Tax Report Determine your due date and filing fees. Complete the report online OR download a paper form. (Paper forms not allowed for No Tax Due Information Report.) Submit your report to the Texas Comptroller of Public Accounts.