Sample Guarantor Letter For Bank Loan

Description

How to fill out Sample Letter For Demand On Guarantor?

There’s no longer any justification for wasting time searching for legal documents to comply with your local state standards.

US Legal Forms has compiled all of them in one location and enhanced their availability.

Our site offers over 85,000 templates for any business and personal legal instances categorized by state and area of application.

Utilize the Search bar above to find another template if the previous one didn’t meet your needs. Click Buy Now next to the template name when you locate the appropriate one. Choose your preferred pricing plan and either register for an account or Log In. Complete your subscription payment with a card or through PayPal to proceed. Select the file format for your Sample Guarantor Letter For Bank Loan and download it to your device. Print your form to fill it out manually or upload the sample if you wish to use an online editor. Organizing formal documentation according to federal and state regulations is quick and easy with our platform. Experience US Legal Forms now to maintain your paperwork systematically!

- All forms are properly constructed and validated for authenticity, so you can trust in acquiring a current Sample Guarantor Letter For Bank Loan.

- If you are acquainted with our service and already possess an account, ensure your subscription is active before accessing any templates.

- Log In to your account, select the document, and click Download.

- You can also revisit all obtained documents at any time by accessing the My documents section in your profile.

- If you have never utilized our service before, the procedure will require a few additional steps to finalize.

- Here’s how new users can locate the Sample Guarantor Letter For Bank Loan in our library.

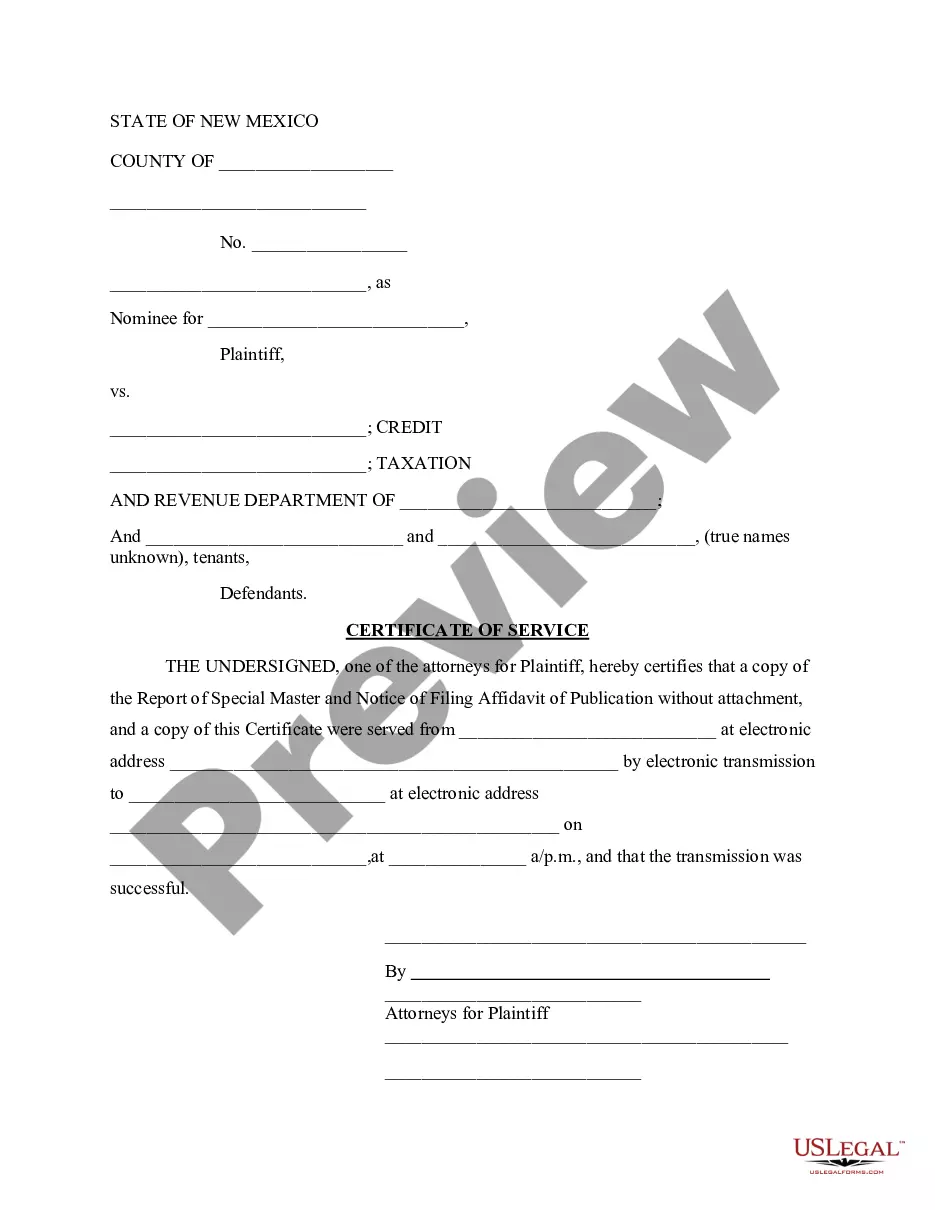

- Examine the page content closely to ensure it contains the sample you require.

- To do so, utilize the form description and preview options if available.

Form popularity

FAQ

Write out your qualifications as a guarantor -- your income, assets and other personal details supporting why you would be able to take responsibility should the tenant or borrower fail to do so. You can also list your accountant to testify to your financial state, as well as other character references.

A guarantor is a financial term describing an individual who promises to pay a borrower's debt in the event that the borrower defaults on their loan obligation.

One example of a guarantor could occur when someone who is under 21 applies for a credit card but is unable to provide proof that they are capable of making minimum payments on the card. The card company may require a guarantor, who becomes liable for repaying any charges on the credit card.

To write a guarantor letter, start by writing the date at the top of the paper, followed by your full name and address. Below your information, address the letter to the company you're dealing with and begin the letter by identifying yourself and the person you're guaranteeing.

To write a guarantor letter, start by writing the date at the top of the paper, followed by your full name and address. Below your information, address the letter to the company you're dealing with and begin the letter by identifying yourself and the person you're guaranteeing.